Summary:

No company is too large to collapse.

The essential 8 integrities and elements of a thriving business: the requirement for speed is key.

Looking back may provide clear vision, but there’s no necessity to be oblivious today.

At the end of today’s article is “How To Unlock Financial Freedom Using Real Estate Cash Flow Strategies? Don’t miss out on the domino effect that could lead to our financial freedom.

If we have ever organized a party, it’s likely we depended on Party City as the ideal “one-stop shop. ” Loaded with seasonal decorations (who could forget those Halloween costumes? ), it is difficult to conceive that the chain retailer could ever collapse.

Nonetheless, in early 2024, Party City declared bankruptcy just a day after revealing significant layoffs at its headquarters. Here is a passage from CBS news:

“The filing was submitted in bankruptcy court in the Southern District of Texas, as per court records acquired by CBS News. The company faced liabilities ranging from $1 billion to $10 billion, according to the filing. ”

Many young individuals who have not experienced Party City as such an emblem will find it challenging to grasp the significance of witnessing such a large corporation fall so rapidly, but they will undoubtedly have the chance in their lives to observe similar events occur. It is the nature of major entities to decline when fast startups pursue them.

So, what happened to Party City?

Amazon

When it comes to the fall of big giants, it often comes swift and fast, seemingly without warning to those who aren’t paying attention.

The history of Party City's income is shown in this chart from Seeking Alpha. As we can see, their price had been continuously falling ever since 2018—six years prior to their application.

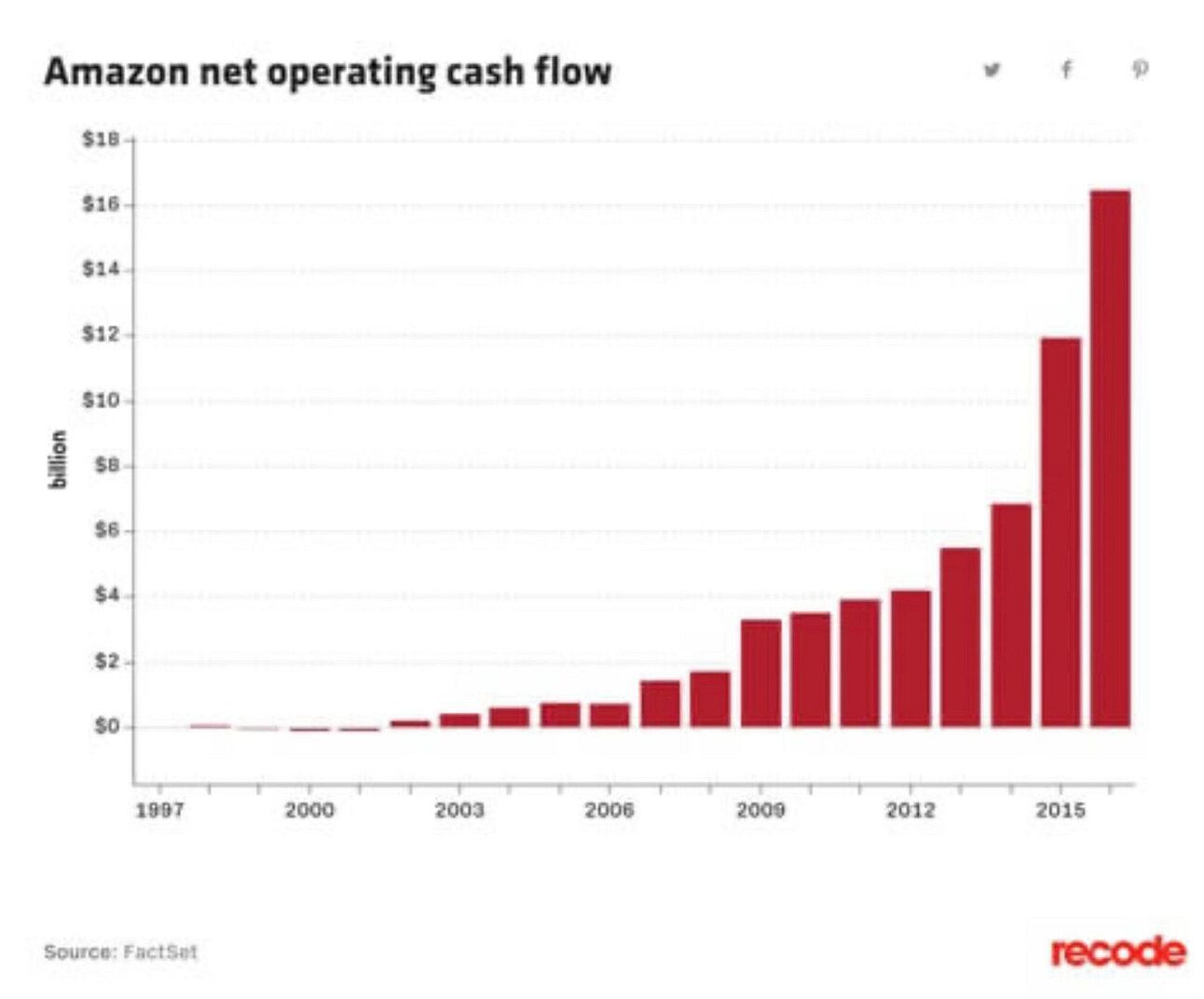

Amazon's historical net operating cash flow is shown in the following graph.

Their firm began to grow significantly in the early 2000s, and so did their market share in the e-commerce industry, as we can see. The inability of Party City to remain competitive was likely caused by a combination of pandemic difficulties and the fact that it was now easier to buy party supplies and costumes online (probably at a lower price, we must add).

Looking back, it's clear

This is likely to seem like a no-brainer examination of what transpired to Party City nowadays. However, things didn't seem that way when Amazon went public 20 years ago. Nobody at the time could have imagined that a newcomer online retailer could have taken down a retail behemoth like Party City, and certainly no one would have believed that Party City would be filing for bankruptcy in just 20 years.

This is not, however, a novel occurrence. Consider Kodak, for example. In our content here at masterinvestor from a few years ago:

Kodak declared bankruptcy in 2012. They had held the reins of the photography business for many years, but they were now losing their grip. For what reason? Kodak did not treat the development of digital photography as a threat. They believed they were too large to fail.

Sadly, they weren't. In fact, the worst thing is that Kodak had invented digital photography years earlier and might have easily been the first to market. They chose to sit on the technology out of fear that it may cannibalize their main business of physical photography.

Kodak comprehended the necessity for digital technologies (the what), but they didn't grasp how individuals would utilize them (the why). They chose to rely on digital technologies that encouraged users to print images, which is a mindset from the Industrial Age.

Kodak was so preoccupied with the photos they produced that they forgot that their purpose was to be shared. Instead of concentrating on technologies that facilitated sharing, they chose to concentrate on those that made picture creation easier while maintaining the obstacles to sharing.

Instagram, naturally, took center stage. With just 13 workers, Facebook paid $1 billion to acquire them in 2012. Over half of Meta's US ad sales are expected to come from the US alone, with $32.03 billion being generated there now.

Party City, like Kodak before them and several other companies, just grew too large and sluggish to compete. They believed they were taking the appropriate steps at the time to preserve their market share and maintain the status quo, but when it comes to the markets, there is never a status quo. The only option is to move quickly and adjust to change. He or she will perish if they do not. GE, a 125-year-old business, is experiencing it right now.

The 8 integrities of a thriving business

Knowing that the product is not the most important aspect of a business is key. As we can see the 8 integrities of a successful business are shown on the diagram below form the Cash Flow Triangle.

Mission

Team

Leadership

Cash-Flow

Communications

Systems

Product

Knowing how to establish these integrates requires planning and due diligence into our investment and business. We have seen many people make the mistake of focusing on only one integrity and then the business collapses because it never had a solid structure or infrastructure to persevere thriving through time. Eventually regardless of how big the business is if it does not have one of the 8 integrates, the business and investment will fail.

The foundation of true wealth is in the ability of reading and improving financial statements starting with our personal financial statement. Every person alike to every business and investment has financial statement that discloses the financial health of the entity or person.

The necessity for speed

Here at masterinvestor, we have discussed the new rules of money in our eBook and digital course “How to build cash flow with the internet? And other articles we have wrote here before. One of the 10 new rules of money is “The Need for Speed.”

It is crucial to recognize that we are living in an age where knowledge is wealth and information is currency since technology is advancing at such a breakneck pace. We must adjust and evolve at the pace of information in order to stay alive.

The positive aspect is that this indicates that anybody can become incredibly wealthy if they act quickly enough and can comprehend the data they are processing more effectively than their rivals. This was noticed by Instagram. Amazon understood this. A lot of other people did the same.

The collapse of the Party Cities and Kodaks of the world is not an intriguing tale because huge giants were brought down. Because quick start ups did it, it's intriguing. Additionally, anybody may establish a business like this, even you.

But one thing is certain: everyone who doesn't learn and adapt at the necessary rate will experience financial hardship in the years to come, whether they are individuals or businesses. They are, after all, workers of those enormous, sluggish behemoths.

Therefore, begin thinking at the speed of information today if we want to be financially successful in the future.

Formula For The Velocity for Cash-Flow

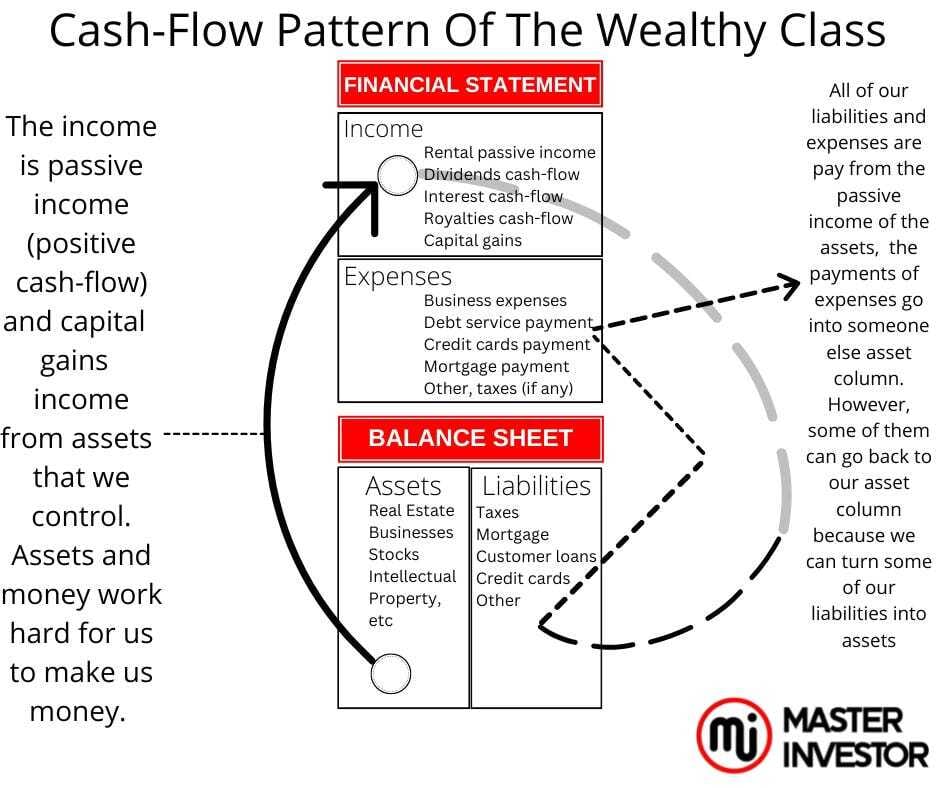

As we have covered previously our formal to build passive income (positive cash flow) from real assets and maintaining the gains working sound assets.

Acquire a cash flowing asset with a winning plan

Recoup the initial capital invested back

Keep control over the asset

Move the cash flow into a new cash flowing asset in a different asset class

Repeat the steps

That is literally how anyone can obtain IROI (infinite return on investment) which is the holy grail of investing. When we achieve IROI that means that we are making money for nothing. Yes, money from thin air as we have no money of our own in the deal. It all be run with good debt and OPM (other people’s money). As we use the cash flow to acquire more sound assets.

Financial literacy fundamentals

Finally, the wealthy make certain that their children understand the four cornerstones of financial literacy. When it comes to money, this is by far the most crucial lesson we shall learn. By internalizing these principles and dedicating our life to acquiring more and more knowledge about them, we will prepare ourselves and our closest to us for financial success.

The four foundations are as follows:

Knowing the distinction between an asset and a liability;

Capital gains as opposed to cash flow;

Becoming wealthy through the use of favorable debt and taxes, and

Choosing our own financial path

Here is diagram where it shows at what age parents talk about money to their kids. The lack of discussing about money and building true wealth within our households is the main reason families do not reach their highest potential. Money is something we should master as it is a game that we will be participating in for the rest of our natural lives. In this word, money is the most important medium to get what we want done on this earth.

Success is something we attract by the type of people we are becoming. We must strive to understand and operate with the wealthy context. Departing from any old and obsolete lesson about money and replacing it with the new rules of money.

Money is always evolving, and we have to adapt to the changes as they become real. Today, we must work to build passive income and multiply money in sound investing.

Bonus Question: “How To Unlock Financial Freedom Using Real Estate Cash Flow Strategies?

Before embarking on our real estate journey, ensure we understand the distinction between capital gains and cash flow; only one can lead to wealth.

Cease flipping for capital gains income and begin working to build passive income; here are the keys to create passive income in real estate wealth.

Do not hesitate to begin with small steps - each prudent investment is crucial to our journey towards financial freedom.

The accomplished husband and wife team featured on HGTV’s “Flip or Flop” show keeps audiences engaged as they acquire dilapidated properties with cash, sometimes without inspecting them, and subsequently renovate and resell them. And wow, do they manage to make it seem effortless, consistently coming out ahead financially regardless of the obstacles they face! And their profits only come if they sell for a higher price than they purchased for, they are not in the business for positive cash flow or passive income.

They are focus on budding capital gains income, in order to become an inside investor, they would need to upgrade their financial education and put together a winning business plan with a lucrative exit strategy. Then they should begin using their capital gains income to raise addition capital and invest in assets that produce positive cash flow (passive income) in all the assets classes that exist today. That is how to protect ourselves from any type of economy and hedge for inflation.

In reality, actual flippers may not achieve the same degree of success. Numerous issues can arise throughout the process—from selecting the wrong property and overpaying for it to facing unforeseen and costly repairs or struggling to find a buyer quickly enough. This is where investing for capital gains instead of cash flow carries inherent risks.

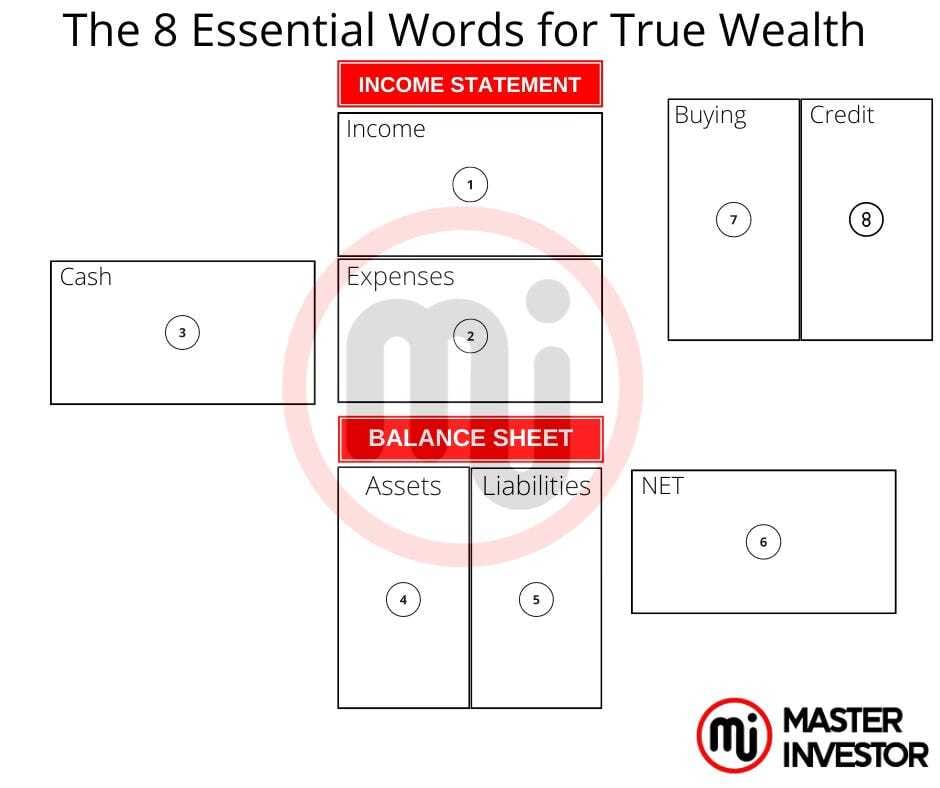

The 8 Essential Words For True Wealth

Learn these 8 words which are essential to building wealth. We are seeing a simplify financial statement on our diagram below. As we can see there 8 words are essential to understanding financial statements.

Income

Expenses

Cash Flow

Assets

Liabilities

Net

Buying Power

Credit

The truth about real estate investing that no one discusses is flipping versus holding

People invest for two main reasons: cash flow (passive income) and capital appreciation.

The one-time gain we realize when we sell an investment is referred to as capital gains income. Capital gains are based on the idea of purchasing at bargain price and selling it for more. To realize capital gains income, the asset must be sold. Capital-gains investors gain as long as market values rise. However, capital gains investors lose when the markets decline and prices drop. Also, in many instances when we obtain capital gains income we must pay taxes on those gains except when we use advance strategies to legally defer the taxes because we would be investing the gains into a bigger or more valuable cash flowing asset.

A continuous stream of income from an investment is referred to as cash flow (passive income). The investment determines whether we will be paid this money monthly, quarterly, or yearly. Buying and keeping is the underlying premise of positive cash flow.

If everything goes well, we could certainly make a killing by flipping one property, but how replicable is that approach? Because every time a person begins a new flip job, he or she is up against a lot of unknown factors that need to be overcome in order to sell the property, experts would disagree. He or she might be fortunate enough to turn it around and make a profit. However, he or she could just as easily fail. There are just too many dangers.

In investing if the number works, then the deal is sound. However, if the numbers do not work, then the investment is toxic. Reading financial statements of the business will give us an unfair advantage as to making the right the choice to either acquire the asset or simply decline the offer.

Due diligence are the second most important words in the business language. The most important words are cash flow. When we focus on our cash flow and doing due diligence by inspecting the financial statements then we can have the answers we are looking for to get.

The mechanism of cash flow

When you buy an investment and keep it, we get cash flow. After that, we get money back from that investment every month (or quarter or year). Cash-flow investors typically don't want to sell their investments because they want to keep earning the consistent cash flow income.

For example, if we buy a dividend-paying stock, then you will get cash flow in the form of a dividend as long as we own that stock. Imagine that we buy a single-family home in real estate and opt to rent it out rather than renovate and sell it. We pay the bills, including the mortgage, and collect the rent every month. We will earn a profit (positive cash flow) if we purchased it at a reasonable price and handle the property well.

The chain reaction of real estate

One of the greatest aspects of cash flow is that you don't have to accumulate hundreds of thousands of dollars in savings to achieve financial independence. The reason is that cash flow generates further cash flow.

By what means?

Here is another illustration. Even if the initial cash-flow of our investment is not a big amount yet it is something to be proud of achieving as many never get to experience what is like to have cash flow or passive income coming into our accounts even when we are sleeping.

Let’s say the average monthly cash flow is an astounding $50 from our first investment. Although is not much, it is a beginning for true wealth as it comes from passive income. Indeed, that $50 monthly payment in passive income is the initial step in the direction of the cash flow we currently continue to build. The point is that we must get stared and compound the assets column with assets from all the assets classes that exist today.

Real Estate

Business

Crypto

Paper Assets

Commodities

At some time throughout our investment journey, the money flow from our assets covers both our living costs and future investments. New assets are produced by our cash flow, which in turn generates more cash flow. Isn't it amazing? Money for nothing. We successfully understand how to create money from thin air.

Repeat this mantra: Cash flow is our best friend; it can help anyone break out of a scarcity mindset and keep increasing our wealth.

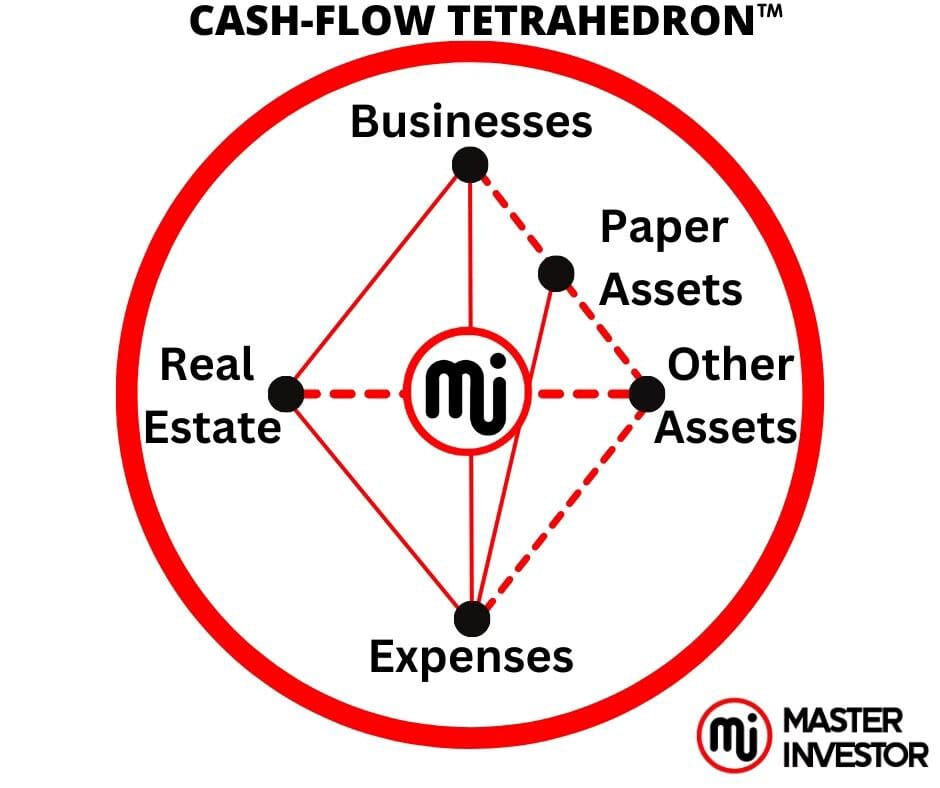

When we invest with the wealth context, then we can better understand the cash-flow tetrahedron’s diagram below, where it clearly shows that our businesses’ cash flow pays for our expenses and investments. We use our businesses to leverage our wealth by investing in all the assets classes that exist.

Additional advantages of increased cash flow

We are free to do anything we want once we are financially independent, as seen by the fact that cash flow equals freedom. We have the option of starting a new business endeavor or living a life of leisure. We may pursue more interests, travel more, and plan our own schedule.

The goal of cash flow is to alleviate the anxiety of running out of funds during retirement. Our cash will continue to flow like clockwork as long as we retain ownership of the asset.

Additionally, it has the lowest tax rate (this is not always the case for capital gains taxes, which we will get if we sell a property).

Last but not least, we don't have to wait; we may start earning money as soon as we find a tenant for the home.

Our objective should be to have more income than we spend on our everyday needs. The pinnacle of financial independence is when our assets work for us rather than the other way around.

Insights from a partner: A case study

This might naturally appear to be either excessively simplistic or a little bit frightening. The fact is that the only way to gain confidence in our real estate investment pursuits is to improve our financial knowledge.

As a masterinvestor’s partner, Maria, whose name we changed for privacy, offered her insights. “About a year ago, she was in the same position as many of we are now—figuring out how to plan for retirement and manage our finances in the current economic climate. With the help of the Master Investor’s knowledge and the support of the appropriate team members, her and her family are currently on the correct route to a financially stable future, despite the fact that they don't have much money or wealthy relatives.”

As we know it doesn’t take money to make money. First and foremost, it takes financial education to multiply money. Then, once the person has the wealthy context, he or she can make money make money through sound investing. However, someone without financial education and with money it is not guarantee that the person can make the money multiply.

It takes time, effort, and a good mindset to become a real estate investor, but the thrill of learning new things that can truly improve one's life is unparalleled. Masterinvestor concepts are completely correct. After all the research we can do, we have to put it into practice. So we are at last on our way.

With the help of our MASTERINVESTOR’s Coach and Team, we established our legitimate, real estate investing enterprise over the course of several months by bringing together our team of lawyers, CPAs, bookkeepers, and real estate brokers but not limited to these professionals. We began looking at properties, crunching the figures for positive cash flow, and making offers since it was time to act on what we had been learning.

Although it can be occasionally annoying, we got to be supported of each other in persevering. As a result of our patience and perseverance, we will have find that our bids for properties will be accepted. We will be overjoyed to get the keys to the house that we are using to create passive income (positive cash flow) when receive the first tenants for our properties (freedom units).

What about our strategy? What are the obstacles preventing us from realizing our financial aspirations today? For more information, check out Master Investor's financial education community here and get access to all the wealth tools we have available for our members.

What are we waiting for? Today might be the beginning of the rest of our life. What problems do we want to solve with a sound business? Becoming wealthy is all about becoming more generous not more greedy. It is truly about solving problems for humanity which require us to think for others not just ourselves. Using today’s AI and technology available to all of us, we can create true wealth with speed.

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Subscribe to our Youtube.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: Why The Need For Speed Is Key In Wealth?

Masterinvestor’s mission is to be the global authentic brand of money, business, and investing that elevates the financial well-being of humanity through high-quality financial education made simple with lucrative opportunities to build passive income, win-win partnerships, and true wealth.

Comment, like, share and follow for more High Quality Financial Education Made Simple.