Summary:

At the top of the corporate ladder isn't where true wealth lies.

Having a high-paying job won't make anyone wealthy.

No matter how far a person goes in corporate, there is no job security.

At the end of today’s article, we will cover what are 3 ways to start investing in today’s economy? Find why becoming a partner to the government is key to becoming wealthy. Becoming a true capitalist is what we must become in order to succeed in business and investing.

Many entrepreneurs dream of building a company that is worth acquiring . The reason is pretty simple , by selling a high-growth company, founders ' lives are forever changed .

This was the case for the two founders of Instagram, the massively popular photo sharing app used by pretty much everyone.

Facebook acquired Instagram for $1 billion in 2012. The mobile app had 27 million users, no revenue, and thirteen employees at the time.

One of the most coveted goals for entrepreneurs is to build a company that becomes a prime target for acquisition. The allure is clear: selling a high-growth business can transform a founder’s financial future, creating life-changing wealth.

This dream became a reality for the founders of Instagram, the globally dominant photo-sharing app used by billions worldwide. In 2012, Facebook acquired Instagram for an impressive 1 billion.

At the time of the acquisition, the app had just 27 million users, no revenue stream, and a modest team of 13 employees. Fast forward to today, Instagram boasts approximately 2 billion monthly active users and, according to The Whop Blog, was projected to generate a staggering 59 billion in revenue by 2024.

Despite this monumental success, many were surprised when Instagram’s co-founders stepped down in 2018 to “reconnect with their curiosity and creativity.” For seasoned entrepreneurs, however, this move was far from shocking. It underscored the importance of passion and innovation, reminding us that even after achieving extraordinary success, the entrepreneurial journey is often about pursuing new challenges and personal growth.

Always keep in mind the type of income that we work for daily. There are three types of income in the world. Choose wisely because they require different mindset and core values about money.

The three types of income that exist are:

Earned Income

Capital Gains Income

Passive Income (Positive Cash-Flow)

The True Definition of Wealth

What It Really Means to Be Financially Free? Many people believe that wealth is synonymous with having a large bank account or a high income. However, true wealth isn’t just about the amount of money we have—it’s about financial freedom. The real measure of wealth is whether we can stop working today and still comfortably cover all our expenses without shrinking or living below our means. This is the ultimate test of financial independence.

For entrepreneurs, the beauty lies in the ability to make money work for us, rather than being tied to a paycheck. This is why climbing the corporate ladder rarely leads to true wealth. Instead, building systems and assets that generate passive income is the key to achieving lasting financial freedom. If we are ready to redefine wealth and take control of our financial future, it’s time to think beyond the traditional 9-to-5 grind.

Wealth is measure in time not only with money. Majority of people got some sort of money but does not mean that they have a lot of wealth because they don’t have the freedom to do whatever they want perhaps. They work for someone else and earned income instead of having assets and money working hard for them.

Figure out how long can we go without working. That is our wealth number. The time that we can go without working and yet still be able to pay our lifestyle monthly and always living above our means.

We also understand the cash-flow circle. We are all playing the game of money in real life. Some people grow up to always work for someone else, as an employee. Others become self-employed by profession like lawyers, doctors, accountants, etc. They still working for earned income instead of passive income. They have to show up to work to handle their clients. Then, we have the ones that launches the idea into the market, business owners and inside investors.

These individuals are the ones that create total freedom. On the right side of the cash flow circle is where we create true wealth. On the left side of the cash flow circle is where people work for earned income, and due to that type of income then they get taxed the highest compare to the right side of the cash flow circle people.

Take a look at the diagram below to remind ourselves about the importance of the cash flow circle. Four types of people. Two of them are on the left side of the cash flow circle and the other two are on the right side of the cash flow circle. Choose wisely because it will determine the rest of our lives. The people on the left side of the cash flow circle have their own beliefs and values about money which are opposite as to the ones on the people on the right side of the cash flow circle. Adopting the proper context from the correct side of the cash flow circle is important if we wish to create financial independence.

Corporate Ladder Climbers vs. Founders: The Hidden Trade-Offs of High-Paid Employees

For founders, the allure of an acquisition often lies in the life-changing financial rewards it brings. However, the trade-off is significant: they relinquish control and transition from being entrepreneurs to high-paid employees. While this shift comes with decision-making authority, it also means answering to someone else—a reality that can stifle the independence and vision that drove them to build their companies in the first place.

This dynamic isn’t unique to small-scale founders. Even high-profile entrepreneurs like Kevin Systrom and Mike Krieger, the co-founders of Instagram, and Jan Koum, the founder of WhatsApp, experienced this shift. WhatsApp’s 19 billion acquisition by Facebook in 2014 (yes, 19 billion acquisition by Facebook in 2014 (yes,19 billion!) marked a monumental payday for Koum, but it also meant surrendering control. Both sets of founders had lofty ideals for their platforms, including protecting user data and resisting Facebook’s data-driven business model. Yet, despite their intentions, they found themselves unable to maintain their original vision under the new ownership.

This reality highlights a critical lesson for aspiring entrepreneurs: while acquisitions can bring immense wealth, they often come at the cost of autonomy. For high-paid employees, even those at the top, the ultimate authority still lies elsewhere—a reminder that true freedom often requires staying in the driver’s seat.

The Harsh Reality of Acquisitions: Why Founders Lose Control?

The experiences of Instagram and WhatsApp founders shouldn’t come as a surprise to anyone. Facebook, often described as a “data vampire,” thrives on harvesting user data to fuel its advertising empire. Its lofty rhetoric about “building a global community” is little more than corporate spin, masking its true priorities.

For startup founders considering an acquisition by Zuckerberg’s empire—or any similar conglomerate—it’s worth recalling Winston Churchill’s sharp analogy: appeasement is like “feeding a crocodile in the hope that he will eat you last.” Sooner or later, the crocodile will strike.

These stark truths align with a long-standing principle echoed in the Master Investor’s community: no matter how much we earn, if we don’t own our company, we are essentially a high-paid employee. Without control, our job security is always at risk, and our vision can be overridden at any moment. For entrepreneurs, this serves as a powerful reminder that true financial freedom and autonomy come from being a business owner and inside investor, not just an employee and self-employed with a hefty paycheck.

Business owners and inside investors thrive with the passive income from our investments and not a paycheck or salary.

True wealth must be maintain through discipline and re investing back into our assets column. Converting liabilities into assets as much as possible. Acquiring assets in different assets classes. Always moving money whether is debt or cash into cash flowing assets.

The Entrepreneurial Spirit: Why Founders Can’t Be Tamed?

When Jan Koum, Kevin Systrom, and Mike Krieger sold their companies to Facebook, they likely envisioned a future where they could still influence the direction of the platforms they built. However, the harsh reality of corporate acquisitions soon became clear: they had traded control for a paycheck. Despite this, it’s commendable that all three eventually walked away when their values clashed with their new roles.

This scenario is all too familiar for high-paid, high-position employees. Many enter with the hope of driving change from within, only to realize that their influence is limited. For former founders, this loss of autonomy is particularly jarring. It’s no surprise when they eventually leave cushy corporate jobs—it’s simply not in their DNA to follow someone else’s vision.

When Koum stated, “I’m taking some time off to do things I enjoy outside of technology, like collecting rare air-cooled Porsches, working on my cars, and playing ultimate frisbee. And I’ll still be cheering WhatsApp on—just from the outside,” and when Systrom and Krieger shared, “We’re planning on taking some time off to explore our curiosity and creativity again. Building new things requires that we step back, understand what inspires us, and match that with what the world needs,” what they were really saying was, “We’re done being told what to do.”

This is the entrepreneurial spirit in action—restless, independent, and driven by the desire to create. It’s a reminder that true innovators thrive on freedom, not corporate constraints. And honestly, isn’t that what makes entrepreneurship so inspiring?

Why Entrepreneurship Beats Climbing the Corporate Ladder?

While the future endeavors of successful founders like Koum, Systrom, and Krieger remain uncertain, one thing is clear: they’re unlikely to trade their independence for the role of high-paid employees again, no matter how lucrative the offer. Their stories serve as powerful inspiration for anyone, regardless of where they stand on the corporate ladder.

Their journeys should prompt us to pause and reflect: “Each day, when I come into work, am I truly contributing to what matters to me and living by my values? Or am I just an employee with the illusion of independence, ultimately bound by someone else’s decisions?”

The next question we need to ask ourselves is, “What am I going to do about it?”

Instead of chasing a high-paying job or a senior corporate title, it’s time to rethink our dreams—and if people have children, encourage them to dream differently too. Shift our focus from climbing the ladder to building our own. Dream of entrepreneurship.

What steps can we take today to start moving toward launching our own business and owning our financial future? It could be the most transformative decision we ever make. Remember, money isn’t everything—but financial freedom is. Start planning, take action, and embrace the entrepreneurial journey. Our future self will thank us.

The ultimate message of today’s talk is to turn earned income into passive income. We do that by creating a winning plan first. Then, we execute such plan and invest earned income into sound asset. It takes an ongoing devotion towards learning from financial education. Investing is having a plan and we need to have the tools to succeed in the game of money.

Make sure to adopt the ultra wealthy context in order to create passive income. Which is the best type of income because it brings true wealth. Passive income or also known as positive cash flow is the type of income that comes from our investments that we control. That could be a simple online website selling a product that is in high demand and such business is creating passive income daily on autopilot.

Passive income is supposed come in from autopilot sales from our systems and investments that we control. The passive income needs to come from real assets. Once we reach the three Es of an inside investor then we know we have made it on the fast track.

The three Es are:

Financial Education

Financial Experience

Excess of Passive Income (Positive Cash-Flow)

What problems do we want to solve in the world. Once we figure our problem then we begin drafting the winning business plan. We always invest with a plan that has a lucrative exit strategy for us. Make sure to measure the ROI (return on investment) with facts instead of opinion by simply doing our due diligence. Reading the financial statement of the business or investment. We have to understand everything about the investment before we take action. Business and investing both are teams sports. Having an inner circle and mentors that we can count on it is critical as we grow our wealth and navigate the entrepreneurship journey.

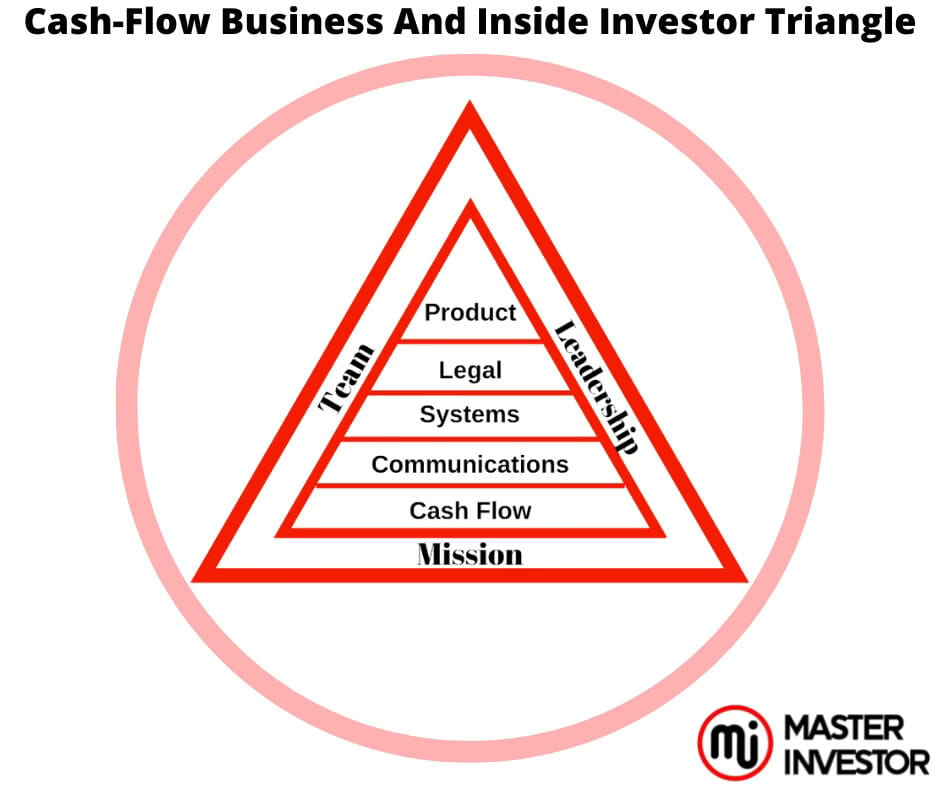

Use the cash flow triangle to build a successful business and manage our assets. The cats-flow triangle allow us to ensure that all integrities of a successful business are in place. The cash flow triangle has 8 integrities which are: Mission, Team, Leadership, Cash-Flow, Systems, Legal, and Product. See the following diagram to remember the cash-flow triangle as it will be our best friend when investing.

Bonus: What are 3 Ways to Invest in the Economy?

The government is urging individuals and businesses to invest in the economy to stimulate job creation, expand affordable housing, advance clean energy solutions, and promote environmental sustainability for long-term growth and a greener future.

When it comes to taxes, settling for average can cost us. To build substantial wealth, it’s essential to strategically and permanently reduce our tax burden. Discover three proven ways to invest in the economy while avoiding the pitfalls of being a super taxpayer. Learn how to optimize our finances, maximize savings, and grow our wealth efficiently.

Let’s be honest: the tax system often feels unfair to the average taxpayer. But who exactly is the average taxpayer? They’re someone with a job, a family, and a mortgage or rent to pay. Those people found on the left side of the cash flow circle, the employee and self employed. They typically have limited financial education and rely on mainstream media or services like H&R Block for advice. Their tax benefits are usually limited to personal exemptions, itemized deductions (like property taxes or charitable contributions), and retirement accounts such as a 401(k), IRA in the U.S., or RRSP in Canada—tools that only delay their tax burden until retirement.

But why settle for average when we can become a “super taxpayer”? By actively contributing to the economy, we can unlock tax advantages that reward us for investing in growth. Here are 3 powerful ways to invest in the economy, reduce our tax burden, and rise above the average taxpayer:

Invest in Real Estate: Take advantage of tax deductions like mortgage interest, property depreciation, and rental income benefits.

Start or Expand a Business: Leverage business expenses, deductions, and incentives designed to support economic growth.

Explore Tax-Advantaged Investments: Invest in opportunities like Opportunity Zones, green energy projects, or other government-backed initiatives that offer tax breaks.

By taking these steps, we can lower our taxes, build wealth, and contribute to the economy—all while avoiding the pitfalls of being an average taxpayer. Start today and transform our financial future!

Real Estate

Investing in Real estate is one of the most tax-advantaged investments available, offering significant benefits to investors in virtually every country. Governments actively incentivize real estate investments to stimulate economic growth and development. Here’s how it works: by investing in property, we can unlock a range of tax benefits, including deductions for mortgage interest, property depreciation, and rental income expenses. Additionally, many countries offer incentives such as capital gains tax reductions, tax-deferred exchanges, and credits for investing in affordable housing or green energy projects. These perks not only help us minimize on taxes but also boost our overall returns, making real estate a powerful wealth-building strategy. Start leveraging these opportunities today to maximize our financial growth!

Oil & Gas

The United States has consistently pursued an energy policy focused on reducing reliance on foreign oil by promoting domestic oil and gas drilling operations. To support this goal, the government has implemented tax laws that offer substantial benefits for investors in U.S.-based oil and gas projects. These incentives make oil and gas investments one of the most powerful tax shelters available.

Unlike other investments, oil and gas ventures are uniquely exempt from passive income and passive loss rules. This means that if we invest strategically, we can deduct losses from oil and gas operations against our ordinary income—even if our involvement is entirely passive. This exceptional tax advantage not only helps offset risks but also enhances the potential for significant returns. By investing in domestic oil and gas, we can contribute to energy independence while enjoying unparalleled tax benefits. Explore this opportunity to grow our wealth and support the U.S. energy sector today!

Agriculture

Most countries offer substantial tax incentives to encourage investment in agriculture businesses, and for good reason: governments aim to boost economic growth and promote local agricultural development. These tax breaks make agriculture an attractive and rewarding investment opportunity.

Key benefits include generous tax deductions for expenses related to agricultural operations, such as equipment, supplies, and labor. Additionally, many countries allow livestock trading to be conducted tax-free, providing further financial advantages.

By investing in agriculture, we not only contribute to the local economy but also enjoy significant tax savings. Explore these opportunities today to grow our wealth while supporting sustainable and profitable agricultural practices!

Remember to create a winning business plan with a lucrative exit strategy before investing in anything, and utilize facts to understand the return on investment. Ensure the investment will or is producing positive cash flow today. Master the ability to turn earned income into passive income by knowing how to invest like the ultra wealthy do. We also use debt to invest because debt is money.

Today money is created with debt. We can say that today’s money is an idea backed up by confidence and it is fake as gold no longer backs the dollar. We must treat debt like money because it is how money is created. Money today is full currency instead of real money. We have to embrace debt to invest for passive income because is leverage for our wealth and a tool to become a super taxpayer which means having tax free wealth legally.

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Subscribe to our Youtube.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: Why Earned Income Alone Doesn't Make Wealth?

Masterinvestor’s mission is to be the global authentic brand of money, business, and investing that elevates the financial well-being of humanity through high-quality financial education made simple with lucrative opportunities to build passive income, win-win partnerships, and true wealth.

Comment, like, share and follow for more High Quality Financial Education Made Simple.