We hear financially uneducated "financial advisors" tell their audience to “cut our expenses” or “live below our means.” Such wrong advice it’s insulting to the financial educated, and it should be to you too now, if a financial “expert” thinks we are so unconscious and ignorant that the only way we could possibly reach financial security was by cutting back, reducing what we spend, and living a life less than what we really want. Why building wealth requires to spend money wisely?

That is incredibly LAZY advice. It’s safe advice for the so-called “advisor” because it sounds logical and it won’t cause any flack for the advisor. It’s lazy because the advisor doesn’t have to think. Plus, who wants to live below their means? It does not inspire anyone only those without financial education. That kind of thinking and advice it kills the spirit and keeps people poor.

Cut vs. spend

Not only is “cut expenses” lazy advice, it is also incorrect advice if we truly want financial security for life. Consider this: we own a duplex that we rent out to two families. In any rental property, as in any business, our three key financial components are:

income

expenses

debt

In terms of income, expenses, and debt, what are the first questions we ought to ask?

Income. It's very straightforward: "How do we boost our passive income?" Whether the issue is with our personal household, our business, or our rental property, raising our cash flow is frequently the answer to a money issue. Lowering our vacancies, adding other revenue sources (like laundry), and raising rents are all real estate strategies for achieving this. Expenses. How do we reduce our expenses is a question that most individuals instantly ask, an erroneous question. What should we do to spend our money more wisely so that we can raise the value of our property? is a better question to ask. The question of "How can we use our money or debt more wisely to raise the worth of our company?" is another possibility.

(And yes, we should pose this question regarding our own financial situation as well.) For instance, we might determine that the water cost for the rental duplex we own is too high and try to reduce that expense by using less water overall. Our plants and shrubs begin to wither as a result of the water restriction. Our tenants are now dissatisfied because of the unsightly, brown landscape. Spending money may be a better option than reducing expenses. Similar to a property we owned, we spent more money on more trees and plants rather than making cuts. This investment improved the property's curb appeal and increased its allure to inhabitants.

It does not take money to make passive income. Because with knowledge, money will find us. However, money spend wisely will create more wealth. That is why the rule #1 of our company and community is: to work to build passive income and make money work hard for us.

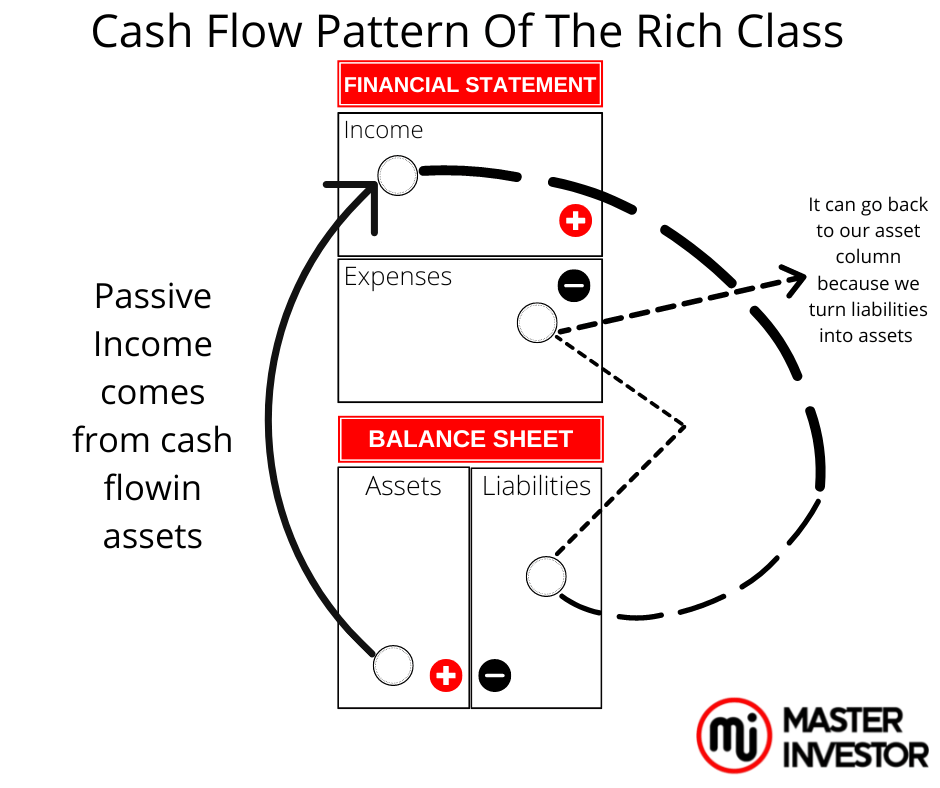

When we receive cash flow from an asset then we most move the cashflow into a new asset to make it work hard and multiple into more cash flow.

More and more individuals wanted to reside on this land because it now had such a beautiful appearance and atmosphere. We were able to raise the rents as a result. Increased rentals result in an increase in the property's value. The same question you should be asking of your own finances is, "How can we spend money more wisely to improve the value or income?" How can we spend or use my money in a way that will help me earn more cash flow?

More and more individuals wanted to reside on this land because it now had such a beautiful appearance and atmosphere. We were able to raise the rents as a result. Increased rentals result in an increase in the property's value.

The same question you should be asking of your own finances is, "How can you spend money more wisely to improve the value or income?" How can we spend or use our money in a way that will help us earn more cash flow?

When we say "don't live below our means," what we really mean is "increase our means."

Focus on raising our income rather than lowering our spending (a scarcity mindset that keeps you impoverished). Increase your revenue by making purchases that make money work harder for you rather than by working harder yourself. Cutting costs is simple and easy. Anyone can complete that. To decide how to spend our money in order to create money, we need creativity and a little bit of bravery. Financial intelligence is that.

Debt. How do we acquire the finest financing conditions is the question to ask. When the deal may be found in the terms, such as the interest rate, loan term, interest-only versus 30-year fixed, recourse versus non-recourse, etc., rather than the investment's price, too many individuals focus on the investment's price. (By the way, one of the nine suggestions to becoming a master real estate investor is to grasp the terminology. If we don't know what any of those terms mean, just look them up.)

We have paid full price more than once in exchange for conditions that increased my cash flow, gave me more time to make repairs, or gave me more freedom to use the property in the future. More than the price, the financing conditions have the power to make or break a transaction. Today, debt (good debt) is attractive since it is affordable. Our first rental property had an 18% interest rate when I bought it in 1989. And yet, we succeeded in cash flow. Remind oursleves that debt isn't always a four-letter term. Two categories of debt exist: Good debt is debt that is used to purchase, build, and acquire assets that produce passive income (positive cash flow - assets are things that put money in our pocket whether we work or not). Bad debt is money borrowed to purchase liabilities (liabilities are things that take money from our pocket).

You are reading: Why building wealth requires to spend money wisely?

Look at how it would flow back into our asset column by turning liabilities into an asset:

The impact of a healthy cash flow

Since we just brought it up and some of you might not be familiar with the idea, a brief word on cash flow.

Cash flow is my first and foremost concern when investing. Simply said, cash flow is the revenue we receive from an asset each month, quarter, or year minus the costs associated with keeping the asset in good condition.

For instance, our cash flow would be $400 per month if we invested $25,000 in a new gourmet food company and made that much money after expenses, interest, and taxes. If we put $20,000 down to buy a $100,000 rental property and make $100 per month in rental revenue after paying the mortgage and maintenance costs, that $100 is cash flow.

We can immediately put the money in our pocket.

Money flow results in freedom.

Cash flow ultimately results in financial independence or freedom.

We will be free to do whatever we choose when we are financially independent, whether that's to live a leisurely life or embark on a new business venture. We are free to associate with anyone we want. We can create any timetable we desire. Our time is really just ours.

Our freedom gives us more options. And we value options.

Which would we pick if we had the option between first class and coach travel? The majority of people lack such option. Because it's the only option they can afford, they fly coach.

Which would we pick if we have the option to select between a taco stand and a five-star restaurant? Depending on our mood, obviously. The key is that we have options when we have financial freedom. We are also not free as long as we have to work at a job. We may want to work, but having to work is something else different. We are not free if we have to work every day to make money to pay bills - that type of income is called earned income. Money that comes in every month, whether or not we work, is referred to as positive cash flow (passive income). Whether or not I'm working, our assets generate a positive cash flow each month. And we immediately put the money in our pocket.

Our main objective was to increase the amount of money coming in relative to the amount going toward living expenditures. We achieved financial independence once we done that. Instead of me working for money, our assets work for me. It's the best way to live, we assure you.

You are reading: Why building wealth requires to spend money wisely?

How can you tell whether you are financially independent?

How long could we subsist if we quit working right now? Over three months, the ordinary human cannot survive.

The key is not to be ordinary and average at investing.

Having millions of dollars to live off of is not necessary to achieve financial freedom. Simply put, it means that our monthly cash flow from investments or our business is greater than what we spend on living expenditures.

For instance, I didn't have much money when we retired from a job back in 2008. I was receiving $10,000 each month from my investments, which at the time were mostly real estate, businesses and online assets. We had $10,000 coming in every month after all expenses were paid, but our living expenses were only $3,000.00 so at that point, we were financially-free. Then me and my team continued to grow it, and grow it, and grow it.

The only option isn't real estate

It's not necessary for real estate to be our preferred asset class. There are many ways to generate cash flow, so be inventive.

For instance, a woman who loves to spend money on luxury handbags. To conserve money, she did not stop purchasing these purses. She instead opted to rent out her purses after realizing that many of her friends wanted to borrow them. Now, she has cash flow coming in each month from her rental-handbag business. It takes an idea, team, systems and courage to raise capital from sales and banks (OPM - other people money/debt).

They also turned a 20-page manual on how to accomplish this into an eBook when some of our friends wanted to self-publish an eBook online. They currently earn between $100 and $200 a month selling this eBook online.

Think about your area of expertise if you want to be debt-free. What services can you provide to boost your resources and cash flow?

Spend some time considering your future. Even though you are now having financial difficulties, you can achieve financial freedom in the future by being resourceful, learning about money, and taking action.

Spend some money now!

The real secret to happiness then? Spending is the secret to living a safe and financially sound existence! Spend! Spend!

Just make sure to spend the money wisely to make it work hard to create passive income by acquiring assets. Knowing how to spend our money on assets that generate passive income for we as opposed to liabilities that drain our bank account is the definition of financial intelligence. The distinction that our community here is aware of is that.

GET OUR CASH FLOW EBOOK TO LEARN HOW TO CREATE CASH FLOW ONLINE:

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

You are reading: Why building wealth requires to spend money wisely?

Comment, like, share and follow for more High Quality Financial Education Made Simple.