Summary:

Are we making money (passive income) using our current approach to investing? To determine what kind of investor we are, consider this question.

Although many individuals identify as investors, the kind or type of investor has a significant impact on long-term outcomes.

Financial literacy is the key to true financial success.

Keep in mind that the most dangerous strategy is average investing. Begin by identifying our investor profile in order to develop or acquire a successful system of systems.

At the end of today’s article we will cover or bonus question: “What are the pros and cons of real estate investing?” Real estate is on of the 5 asset classes that exist today. Mastering investing in Real estate investing is essential to grow our wealth. This asset class of Real Estate allows us to use good debt, leverage, control, taxes, appreciation, depreciation and other strategies to increase passive income.

It is easy to call ourselves investors. People across the world have claimed that they invest and are investors, but that does not actually mean much. Investing is a complex subject and it means different things to different types of people. That is why understanding this knowledge is essential for our wealth building journey.

We must ensure that we are investing like the ultra wealthy and not like the average people tend to invest. Typically, we have to go through a series of inquiries to really understand the type of investor we are.

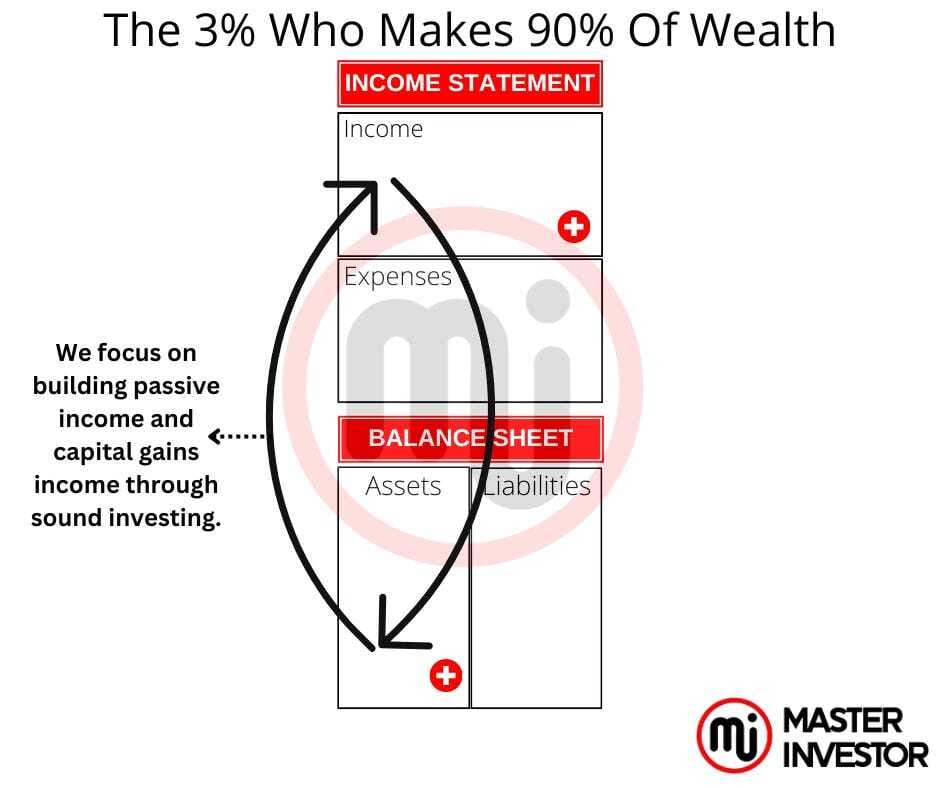

The diagram below show how around the 3% of the population, the inside investors, who have financial education control 90% of the world’s wealth. It shows that our priory is inviting and becoming wealthy by acquiring assets that produce cash flow. The way we operate and how we manage our cash flow is different as to the average investor or around 98% of the population.

Three types of investors

This is because there are investors, and then there are people who dabble in investing. Have we ever wondered why some investors make more money with a lot less risk than others?

Those individuals are a different sort of investors with a distinct outlook.

The investors have been classified into three types of investors here at masterinvestor.

Investor Type-C

Type-C investors are financially uneducated and look for people to tell them what to invest in. They invest with opinions instead of facts. They are not particularly interested in making investments in their education in order to improve their investment skills. Since they are ignorant about finance, they must depend on the counsel of other so-called professionals.

The likelihood of a Type-C investor achieving financial independence is about the same as winning the lottery.

Investor Type-B

Investors in type B want solutions. They frequently ask queries such as:

What should I put my money into, in your opinion?

Do you believe I should invest in real estate?

Which equities would be a good fit for me?

My broker advised me to diversify when I spoke with him. What are your thoughts?

I received a few shares of stock from my parents. Should I sell them?

It is recommended that type-B investors meet with a number of tax counselors, lawyers, stockbrokers, and real estate brokers. They should seek out counselors who live by their words and avoid anybody who offers investment advice and makes a fortune only through fees and commissions. Type-B investors should look for investment advisors who make money investing in the same investments they are selling.

Due to their busy schedules and lack of time to seek out investment opportunities, several high-income workers and self-employed people may fall under the Type-B investor category.

Investor Type-A

Type-A investors, we seek out financial problems. Specifically, we search for issues that arise from individuals who are experiencing financial difficulties. Investors with strong problem-solving skills anticipate earning between 30% and an infinite return on our investments. Money for nothing. Free money from thin air.

We have a solid financial base and the abilities necessary to be successful as a business owner and inside investor operating on the right side of the cash flow circle with the wealthy context. Our context is more important than the content. We must possess the wealthy context to become wealthy. We apply those abilities to address challenges brought on by individuals who lack them.

When we began investing with zero of our capital by using good debt from credit cards, and other loans, for instance, we concentrated on little flats and houses that were in foreclosure due to issues brought about by investors who failed to manage their cash flow and ran out of funds. We rent them for tourists and short rentals. Bringing enough cash-flow at the end of month to cover all the expenses including the debt service costs. And it leave us with positive cash flow (passive income), and that is how we know we have an asset because it makes us passive income and wealthier today.

When an asset makes us money on autopilot because we have systems in place doing the selling and telling for us then we assure that we have a real asset. There are people who only invests in fake assets, something that appears to be a good investment but it nothing more than a liability. The financial uneducated calls a liability an asset by not understanding that such liability is making the poorer not wealthier.

We continued to search for problems, but now the numbers are greater. We may begin to aim for bigger deals, such as acquiring a $30 million mine investment. The approach is the same, even though the issue and figures were larger.

The typical or average investor

“He or she paid $500,000 for a home, and now it's worth $750,000. The average investor most valuable asset is a house. However, we know that such house and is a liability unless it is rent it out for passive income.

“Today, the retirement account is worth $1 million. It will be worth $3 million by the time he or she retires.” All this language and approach to investing is coming from someone who has the poor context and operates with it.

Another example, the average investor would say "Real estate has averaged over 4% annually for the previous 20 years, while the stock market has averaged an 8% annual increase since 1974."

Have we ever heard someone say something like this? These claims demonstrate that investors are counting their chickens before they are hatched. This investor does not know how to invest with the wealthy context. He or she lacks the 3 Es’ of a Master Investor.

The following are the Es’ of a masterinvestor:

Financial Education,

Financial Experience, and

Excess of Cash Flow.

Facts are not the basis of any of the assertions made above; rather, they are based on the word of others (opinions) and the hope that the future will turn out as we want it to.

Master Investor’s wealthy partners also explained that the typical investor does not make a lot of money in the market. “The average investor has a count-your-chickens-before-they-hatch mentality. They call items that cost them money every month assets based on their opinions. They anticipate that the value of their house and stock holdings will increase in the future. The buy, hold, and pray. That is a risky strategy. This causes them to lose control of their own finances. In our opinion here at masterinvestor, that is dangerous.

Simply put, the average investor does not have the basics of money, business and investing to create true wealth. Their language is not that one from a wealthy context.

Make more money by working less

After that, there are people who "work" to earn a living. We offer this insight: the paradox of hard labor.

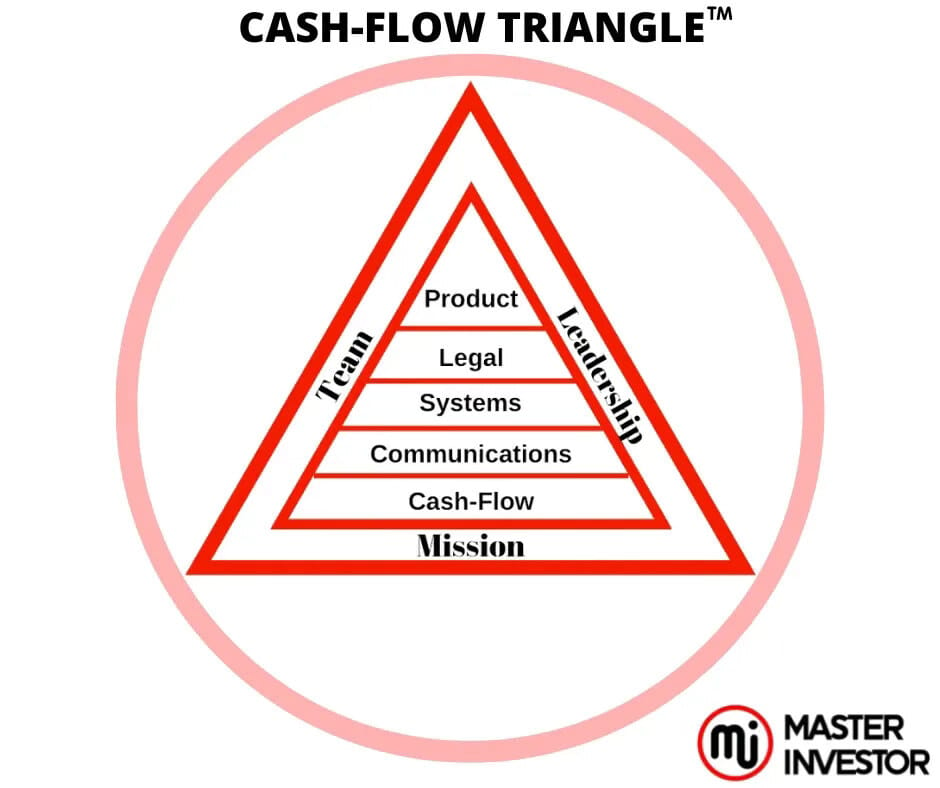

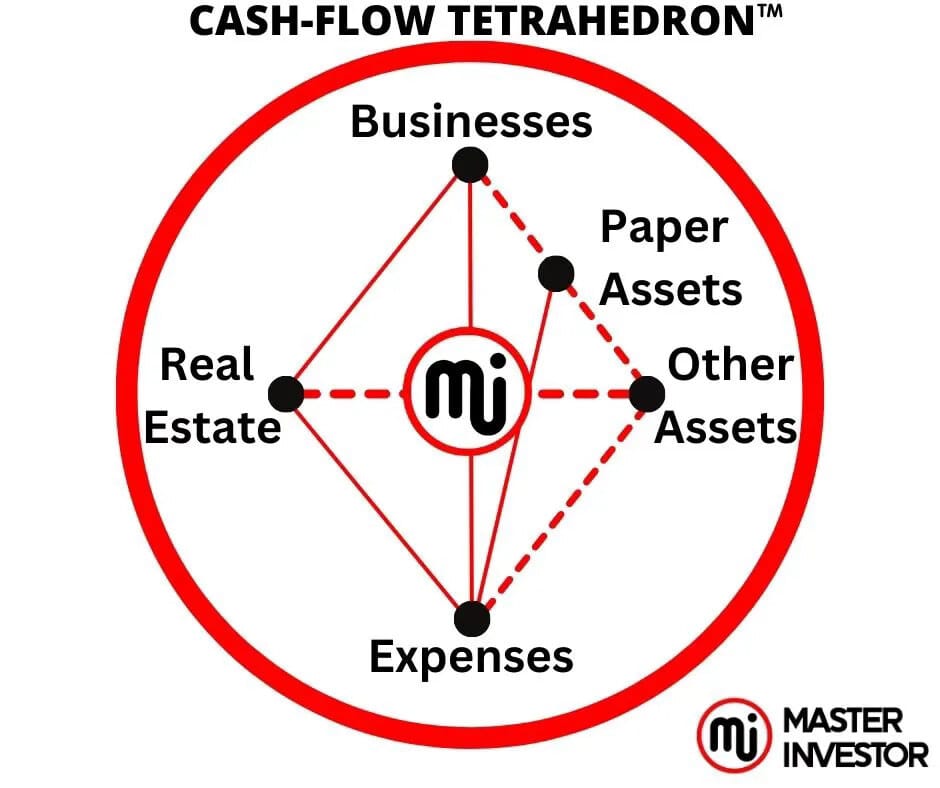

Many people believe in hard work as the means of making money. The ability to construct and follow the Cash-Flow Triangle and invest with the tetrahedron diagram. Then this approach will eventually lead to the realization that the less effort we put in, the more tax free positive cash flow we make and the more valuable our creation (business or investments) becomes.

The most important words in business and investing are cash flow, and the second most important words are due diligence. They complement each other and protects the investor from bad investments. Take a look at the cash flow triangle below and use the 8 integrities shown of a successful business. This way we will ensure that we are controlling sound assets with our companies.

Some may need to retrain their minds, and let go of old money habits. After many years of training, it all becomes clear that investing and business are both a team sport. Our team matters and makes all the difference in how successful we will be at building wealth. Our habit is to study the greats, and become greater by applying the knowledge we gain into our lives.

We have to learn to create, acquire, and combine systems that could function in our absence in order for us to create true wealthy. We came to understand what meant by "the less we work, the more money we will make" after we constructed and marketed our first Cash Flow Triangle. We referred to that line of thought as "Solving the Cash Flow Triangle riddle."

After all, a sound asset is a business or investment that is composed of a system of systems which is doing the telling and selling for us on autopilot. Because a business is created to solve a problem in the marketplace and it does it without the need of us being present to make the sales.

After that, we started mentioning the CASH-FLOW circle.

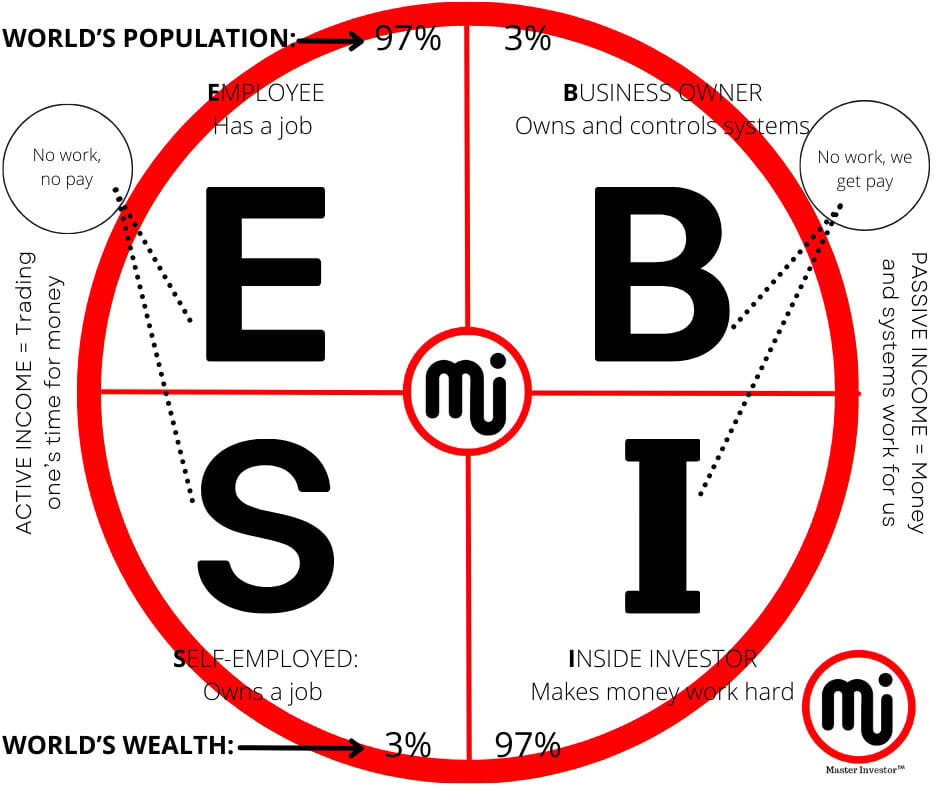

The four categories of individuals in the CASH FLOW Circle each reflect the four distinct methods of earning a living.

Employee

Self-employment

Business Owner

Inside Investor

The main difference between those in the Employee and Self-employed from the left side of the cash flow circle and those in the Business Owner and Inside Investor side, or the right side of the cash flow circle is that those in the Employee and Self-employed side left side of the cash flow circle, frequently get overly involved and make the common mistake of prioritizing working in our business over working on our business. We must focus on working on our business and minding our business rather than working in our business like an employee. We delegate and use systems to ensure to the business can run on its own without us present.

Master Investor’s culture is that "the key to financial success is “laziness.” What we mean by this, is that we have to use our minds to become wealthy more than focusing on physical work. In other words, the more hands-on we are, the less money we can make." Financial successful individuals do not roll up their sleeves and labor; instead, we come up with creative solutions to accomplish more with less, and we give our teams the tools they need to succeed on our companies’ behalf.

Don't be the average investor

It's critical to know how we generate money and whether it's truly making us wealthy in order to succeed.

For us here at masterinvestor, for instance, we are a Type-C investor in mutual funds.

We consults with tax and wealth strategists, stockbrokers, bankers, and real estate brokers as a Type-B investor looking for expert advice on our financial issues. These experts give a ton of knowledge that the average person doesn't have the time to learn on their own, but only when we locate the good and qualify ones.

Additionally, our partners and members here at masterinvestor is a Type-A investor who earns a sizable income by resolving issues that others are unable or unwilling to address. In areas where we may lacks expertise, we could potentially hand over task and delegate to other reliable Type A investors. Creating win-win partnerships all across the board.

The average is for the average

This is why we don't have to be ordinary or average.

Many "investors" have been investing for less than 20 years. The majority have either never experienced a market collapse or held real estate that was worth considerably less than what they paid for it. These fresh investors approach us and begin reciting industry averages.

Averages are for average investors. An inside investor wants control over our investments. We value more control than ownership. We want to control the asset and its cash flow more than owning it as we will be using good debt as much as possible to invest in assets that we control for passive income. And that control starts with ourselves, our financial literacy, our information sources, and our own cash flow. Yes, sometimes we will control assets that will pay us a capital gains income rather than passive income. Here at masterinvestor we will focus on investing for real passive income (positive cash flow) in all the assets classes that exist.

For this reason, "Don't be average," it is what we tell to the typical investor. Here at MASTERINVESTOR considered being an average investor to be a risky investor without financial education and a lack of mentors.

Furthermore, if we want to be the sort of person who makes assets that purchase other assets, we must discover ways to do less in order to produce more and construct more.

Take charge

To become wealthy, we must manage our personal cash flow as well as our financial education. As long as we maintain control over our finances now, there is nothing wrong with expecting that anything will increase in price in the future.

The inside investor understands that having a good financial education gives us more control over our finances now and, if we continue our studies on financial education, even more control in the future.

Stop being an average investor right now. Get involve with the proper mentors. Begin creating a future where we have control over our money and our investments by making an investment in our financial education right now. Put a business plan together to invest for passive income with a lucrative exit strategy.

Take massive action with a winning plan, because the life that we desire is literally a decision away and a sound plan to get there. Investing is having a lucrative plan in place. Everything is calculated and secure by facts.

Bonus question: What are the pros and cons of real estate investing?

Real estate investing has many benefits and very few drawbacks. We must be aware of what they are and the actions we must take to begin. Knowing the pros and cons of real estate investing are essential to our investment future. Successful real estate investors always start small. There are several ways to earn income from real estate investing; but positive cash flow (passive income) and capital gains income (appreciation) are the way.

Using real estate to build our wealth is a smart step to take as it is an asset class that allows the use of debt to invest in. Getting wealthy is all about mastering how to manage debt as much as possible. Debt generally is tax free. When we use it to build our wealth, such debt is tax free. The holy grail of investing is to reach IROI (infinite return on investment) and be tax free wealth entity legally because we are using the tax code and corporate laws to our advantage. As they were created by the wealthy to make the wealthy context wealthier. Anyone can learn the news and use the laws to create true wealth. Today money is created with debt and that is why the USA is $33 Trillion in national debt. Due to this fact, inflation will continue to rise, today’s currency, the (US dollar) will continue to loose value all the wya to its intrinsic vale which is zero, and new currencies will emerge like (Crypto). We must actively adapt and invest to beat inflation and economies.

Do we have any doubts about whether a career in real estate is the best option for us?

Real estate investing is something that we are familiar with and fond of. Everyone in real estate who has success started small and continue to build. However, keep in mind that the same energy, procedure, and effort goes into a bigger deal, so let’s get comfortable by thinking and aiming big. We acquire a six-unit apartment complex after we were ready to move up to bigger deals. Currently, we control many residential units for passive income utilizing good debt to leverage our tax free positive cash-flow. We began little and gradually expanded, as we can see. Almost all prosperous real estate investors began modestly as well. The cause will be clear to us soon.

The highness expense the average human has in their lifetime is taxes. The reason being is because the average investor does not know how to minimize taxes legally. The poor context believes that paying taxes is patriotic. The capitalism system is created to pay zero in taxes legally. Therefore, is patriotic to find legal ways to minimize taxes.

To be clear, we are concentrating on rental real estate that generates a positive cash flow—such as single-family houses, duplexes, triplexes, apartment buildings, office buildings, retail stores, shopping centers, storage facilities, warehouses, mobile homes (more on that in a minute!), etc.—when discussing real estate. It is crucial to understand that there are several investment possibilities outside of a typical home.

Advantages of investing in real estate

Let's explore the numerous justifications for making an investment in real estate:

Use of OPM (Other People's Money) Do we believe that we need to take money from our own savings or launch a GoFundMe campaign in order to buy a home? Think again! In a nutshell, the idea behind OPM is that a bank, lending business, or private individual would finance the balance of our funding if you make a down payment of 10% to 30%. This implies that for only $10,000 to $30,000, you may purchase a property worth $100,000. Where else in life might you find a bargain like that? Understanding OPM may be one indicator of the financial literacy we have gained from Master Investor’s material. We must become creative when building wealth, using our minds to raise capital from thin air by mastering the ability to put extraordinary deals together.

Cash flow Our property may provide fantastic prospects for monthly income if it is acquired and managed well. Master Investor’s community adores real estate because of this continuous stream of income from investments (positive cash flow or passive income), which is known as cash flow. In addition, to allowing the ability to increase cash flow through phantom cash flow (depreciation, appreciation, taxes, and other incentives) that we can use to maxine our IROI when investing in the Real Estate’s asset class. When we acquire and lease out real estate, we will get the rent every month and then use it to cover costs like the mortgage and any necessary repairs. That positive cash flow is our profit if we buy it at a decent price, keep a tenant, and earn more money than we spend every month. Isn't it gorgeous?

Appreciation We may make income from rental properties in two different ways. The second is appreciation, and we have previously covered cash flow. Appreciation is the term for the gain we make if we choose to sell after our home's value has increased. Keep in mind that we should always have an exit plan in place, even if we are not purchasing with the intention of reselling to make a quick profit (like the flippers on television programs who renovate a house and then list it for sale right away in the hopes of a huge payout).

Fewer highs and lows Do we not like the anxiety of seeing a stock market ticker go by every time? Because it is often a longer-term investment, a cash-flowing property is not susceptible to the everyday fluctuations of the markets. And, as we may be aware, a declining real estate market may be the ideal opportunity to acquire, loans are cheap in a down market giving us more room to realize a hefty passive income from thin air using goo debt thus we may be in the unusual situation of feeling thrilled while everyone around us is anxious and losing money. Trust us, it's a great place to be.

Tax benefits Tax credits are offered for select real estate investments as well as for low-income housing and the restoration of historic structures. A tax credit lowers the amount of taxes due by reducing it directly. We also get a yearly depreciation deduction, which is often a percentage of the value of the property that may be deducted as an expense against sales. Lastly, in certain nations, the revenues from the sale of real estate may be put off forever provided that the proceeds are reinvested in other real estate. Here in USA we use something in the law that is called 1031 Exchange, which allows us to roll the gains over into a bigger asset. As a reward we get to differ taxes on the capital gains, and yet we control a more valuable asset that produce even bigger return on investment. Wow, what a plus!

Less stressful When it comes to investing in real estate, there is no need to make a quick choice. Generally speaking, we have time to conduct due diligence, crunch data, compare options, facts, and then choose the best investment choice. Therefore, we must get active and execute our plan at the right time.

The drawbacks of investing in real estate

When it comes to real estate investments, it would be incorrect to ignore the little drawbacks. It is crucial to have a full picture before jumping in, after all:

Time lag Time is required for appraisals, inspections, finance, offers, and counters. Patience is a virtue for this reason. We will know what to expect in future situations after experiencing it once. Just concentrate on each stage separately during our first time out, and utilize the lag time to conduct additional study to make sure we haven't missed anything crucial.

Not in liquid form It's tough to swiftly convert real estate into cash since you can't easily jump in and out of it. Remember number six, where I said that time is on our side? If we need to sell fast, though, that's not the case.

Challenging or time-consuming After business, real estate is the second most challenging of the five asset classes. The management of properties, including empty units and problematic tenants, must be done on a daily basis. For this reason, we advise beginning little since it will occupy less of our time and we will also make far fewer errors on a smaller scale.

What, then, now that we are aware of the advantages and disadvantages? Starting out and taking the first small steps! Which of these appeals to us?

Three popular methods for beginning real estate investing

Rental real estate for residential use After purchasing a house, we become the landlord of our future tenants and are liable for the mortgage, taxes, and upkeep expenses (and maybe a property manager if we don't want calls about broken appliances at midnight). Ideally, we would like to be able to bill more than our monthly expenses in order to generate a positive cash flow. This is our income stream, which is our compensation for renting the property to a high-quality tenant. To illustrate, we began with no money, no cash flow, and a few rental units. Now we control many across key locations where the demand is high. When it comes to real estate we must focus on location, and numbers. We really began with one investment home using 100% good debt which didn’t require any money of our own. The down payment was put into a credit card, and then we use the cash flow to pay all the expenses including the credit card we used for the down payment. Debt is money, and money is debt in today’s economy. Two types of debt, good debt, and bad debt. Nothing wrong with controlling bad debt as long as we have good debt invested in sound assets that their cash flow is how we pay for the bad debt we control in our lives. We must live above our means and expand to build wealth. Do not shrink and live below your means as it is the result of whom operates with the poor context.

Trust for Investing in Real Estate When a firm (or trust) utilizes investors' funds to buy and manage income properties (residential and commercial), a real estate investment trust (REIT) is formed. Similar to any other stock, REITs are traded on the major exchanges. According to Investopedia, a company must distribute 90% of its taxable income as dividends in order to maintain its REIT status. As a result, REITs are not subject to corporation income tax, unlike a typical firm that would be taxed on its earnings and then have to choose whether or not to pay out its after-tax earnings as dividends. Because of their consistent payouts and enormous potential for capital appreciation, REITs have been a favorite option for investors ever since the 1960s. We encourage those in our community here at masterinvestor to master how to actively invest and manage debt instead of giving the money away to somebody to invest it for us as it takes control away from us and ultimate reduces our returns on investment. Handing money to someone to invest it can increase risk if the person or entity lacks financial education.

Investment companies for real estate This option might be the best choice for us if we want to control a rental property but don't want the hassle of being a landlord. Similar to small mutual funds for rental homes, a corporation will acquire or construct a collection of apartment complexes or condominiums and then give investors the opportunity to purchase them via the company, thereby joining the group. The firm that runs the investment group is in charge of managing all the units, handling maintenance, marketing vacancies, and interviewing potential renters in return for a cut of the monthly rent.

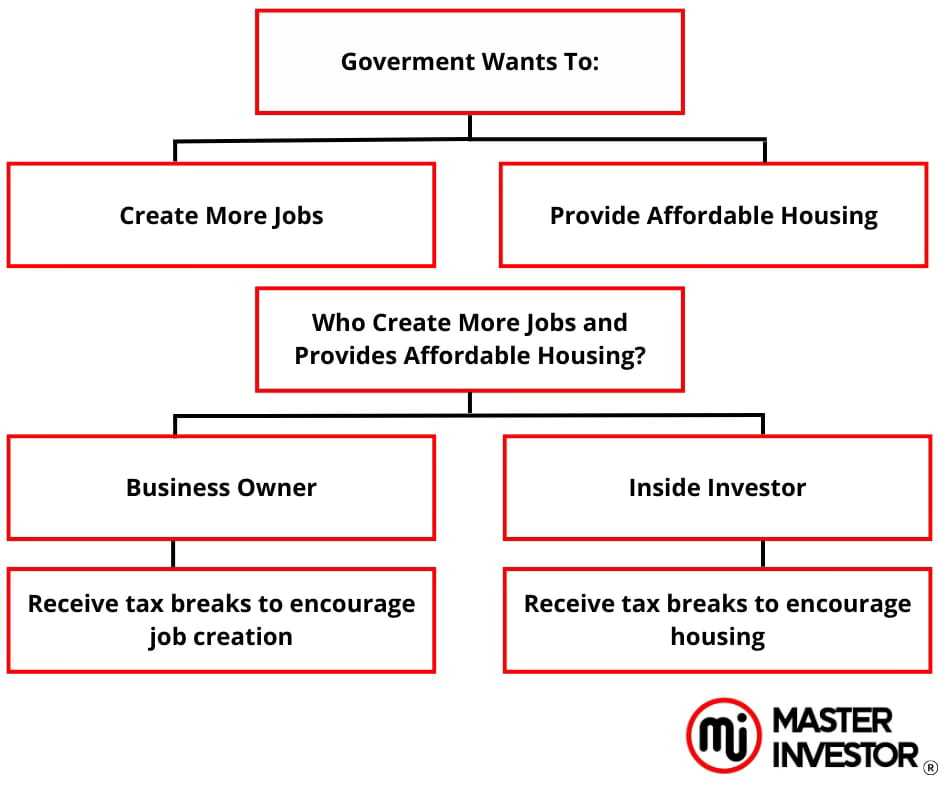

When we invest in real estate we automatically tap into incentives that are legally provide to us by the movements because we are doing what they want us to do to move forward the economy.

When we invest in certain sectors such as in Real Estate then the government becomes our business partner. As well as the banks become our business partner. They are interested in putting capital to work in sound assets.

Real estate is an asset class that banks, private investors and governments are interested in investing in with an inside investor controlling the deals. Our financial statements are our reports cards in the world of investing. Here below is a diagram of what the government expects us to do.

For real estate investing success, begin small when necessary

Now that we are familiar with the advantages and disadvantages of investing in real estate, as well as some strategies for getting started, let's discuss why every successful real estate investor began with a very modest investment. It is probable that we also began small if we control or are invested in real estate.

Mistakes are unavoidable given how much there is to learn. It is all a part of the procedure. It's far easier to make mistakes on smaller properties with less capital when we are just starting out.

Let’d use an example, Maria, as a close example to show how little we may begin and yet turn a profit. She was a Buddhist monk in His Holiness the Dalai Lama's company. She did live a very frugal life, though she never made a vow of poverty, which is not necessary.

After a costly medical scare, she understood the importance of money in her life and began learning about finance and investment.

Her quest led her to mobile houses, a low-cost and comparatively simple way to enter the real estate market. In many cities around the world, mobile homes are not a common sight. They are houses that are built or prefabricated and are theoretically capable of being moved.

Maria discovered that she could purchase a used mobile home for roughly $3,000 and earn a monthly profit of about $300. Her investment has yielded a really good return for her.

Additionally, Maria learned that California, where she resides, classifies a mobile home as a motor vehicle. This house does not require her to go through the complete real estate process of acquiring title.

She just walks to the Department of Motor Vehicles and picks up the title. This is a practical option for her since she started increasing her assets’ column while also having several duties that do not bring in any income.

And with that, the advantages and disadvantages of investing in real estate are crystal clear. Creating true wealth in real estate makes us financially free when we can overcome the few drawbacks stated above (which are by no means insurmountable; they just require expertise and ongoing financial education). Is not that the kind of legacy we would want to leave behind? And a life of no worrying about running out of fund on our retirement and instead have a lifestyle of total freedom because we have positive cash flow (passive income) from our assets in all the asset’s classes of today.

Finally, many of our deepest seated fears are based on unrealistic expectations and old habits. By thinking about them rationally, we can identify what is real and what is just arising from an on-going script in our head. The fear of risk, fear of failure and fear of being perfect. At some point, we simply must overcome our three main fears, potential humiliation and declare, "I overcome my fears by taking massive action, and I am doing this!""

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Subscribe to our Youtube.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: What Type Of Investor Are We?

Masterinvestor’s mission is to be the global authentic brand of money, business, and investing that elevates the financial well-being of humanity through high-quality financial education made simple with lucrative opportunities to build passive income, win-win partnerships, and true wealth.

Comment, like, share and follow for more High Quality Financial Education Made Simple.