Have a look at the Vox graphic below, which illustrates the US jobless spike in 2020. Simply put, it's one of the most accurate portrayals of the risks associated with employment.

In an attempt to survive as the coronavirus spread throughout the country, millions of individuals claimed for unemployment benefits. There is no precedent for this, as the far right side of the graph illustrates. not the Great Depressive State. not the Great Downturn. Nothing.

Because of this, the way businesses operate in terms of expenditure and personnel as well as the state of the economy as a whole have fundamentally changed.

An employee who was fortunate enough to have a high-paying job even though they didn't feel secure talked about how their employer stopped hiring and cut millions from their budget. When their company, like many others across the nation, went entirely remote, they said, "We know what? We're producing more now than we have in the past.

We can be sure that his CEO is aware of the amount of bloat they have unintentionally been carrying around for a while. Those contracts and jobs will not be reinstated because the Covid scandal exposed it.

Good occupations are delegated to automation, robots, and contractors.

American companies have never worked so hard to employ so few people.

Thus begins the introductory paragraph of an article titled "The End of Employees" that appeared in the Wall Street Journal in 2017.

The article describes how many large American corporations are making every effort to automate or contract out their work rather than hire staff. According to some estimates, the proportion of American workers who are not directly employed by a corporation has increased by about 100%, and this trend is continuing. Investment banker Steven Berkenfeld, who has devoted his professional life to assessing corporate strategies, claims that businesses of all kinds are increasingly considering:Is it possible to automate it? Can I outsource it if not? If not, is it possible for me to give it to a freelancer or independent contractor?

Few businesses, workplace advisors, and economists see a reversal of the outsourcing trend. Relocating non-essential tasks from an organization enables it to focus more time and resources on its key competencies. An independent company that manages labor takes on the daily rigors of hiring, dismissing, and scheduling. If necessary, employees are promptly changed, and the company's only concern is the finished product.

"Eventually, some large companies could be pruned of all but the most essential employees," the story adds. One of the 2,000 biggest firms in the world will have "no full-time employees outside of the C-suite" within ten years, according to a prediction made last year by consulting firm Accenture PLC.

Does financial stability equate to job security?

The only things poor mindset people teach their kids is to attend a reputable school, earn a degree, and land a well-paying job that would keep him safe and secure. The majority of people were reared and have lived their lives in a manner similar to this. Working for earned income. The majority of Americans prioritize having a high-paying job that provides job stability.

Advice on how to think like an entrepreneur. We are against becoming employees, instead we chose to be business owners and inside investor (capitalist). We wish for all to become an inside investor and business owner.

A job was the ultimate symbol of financial security for the poor mindset (poor and middle class). Working at a job is dangerous for the business owner and inside investor.

Here at masterinvestor we are trailblazer in our field. Being employed creates a false sense of security. The employees are not in charge, even if the employee receive a consistent salary. The economy and the business owner have the last say over us.

When a person lose their job and, if they are extremely unfortunate, a lot of other things like their house, car, and more, if either decides they are not needed. Furthermore, it is undeniably riskier to be an employee today than it has ever been.

This is hardly shocking, and many of those who have experienced furloughs, layoffs, or firings have just responded, "I'm not surprised." Many feel frustration and depressed. However, there is still time to make a difference. For individuals with the correct attitude, the other side of this crisis may be a gold mine.

Robots, automation, and contractors, oh my!

In the Wizard of Oz, Dorothy finds herself in the shadowy, ominous woods with her motley group of other travelers. "Oh my, lions, tigers, and bears," they sang.

Many people's financial situations are bleak and unsettling these days. They fear contractors, automation, and robots more than they do bears, tigers, or other natural predators like lions and bears.

An increasing number of tasks are being delegated to technology, whether it is through automation or robotics. And contractors are increasingly taking tasks that aren't taken by technology.

Just take a look at how businesses like Uber and Lyft are upending the taxi and hotel industries, how Airbnb is upending the lodging industry, and how driverless cars will upend the shipping industry.

The risks associated with having a job and the gig economy

Contrary to popular belief, the emergence of contractors and the so-called gig economy are not positive developments. The claim is that we are at last giving the general public access to business prospects. They say that entrepreneurship has become more accessible.

In actuality, the majority of gig economy participants are not business owners.

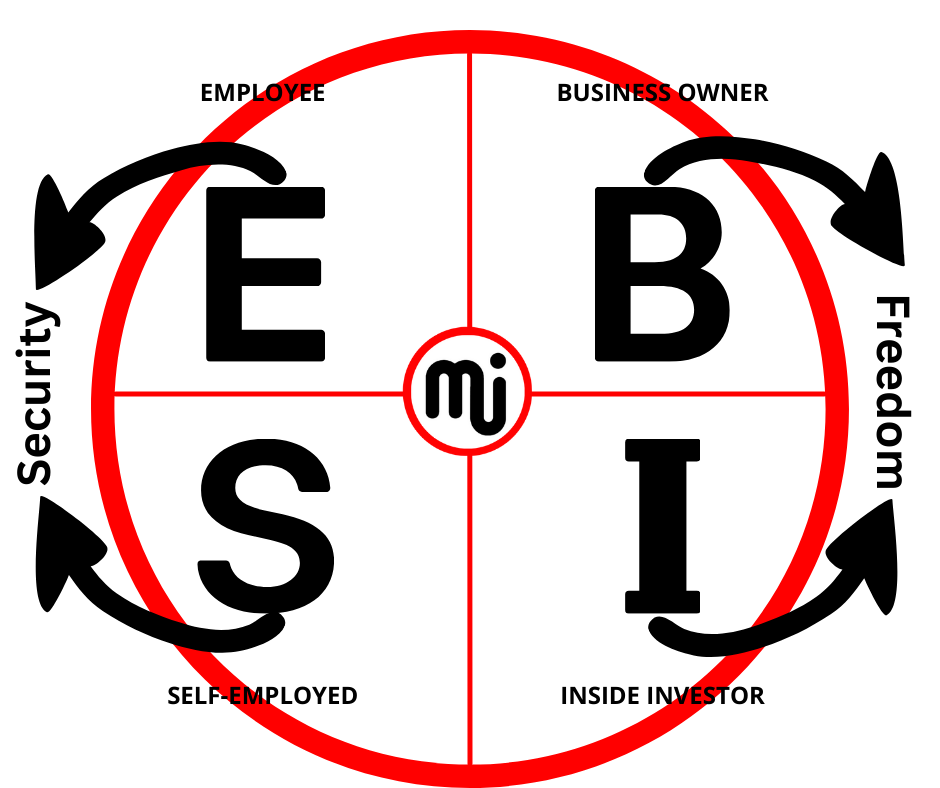

Instead, they merely possess a job. Their operations remain inside the left portion of the Cash Flow Circle; they just do so as independent contractors as opposed to employees.

For businesses, who are spared from having to pay for health insurance, retirement plans, or payroll taxes, having a job is a huge benefit. They receive all the work but none of the benefits. All of it is encapsulated in the charm of liberty.

Regretfully, gig workers do not enjoy financial independence. They put in a lot of overtime yet receive less pay and benefits than previous generations of workers. They don't make the money if they can't put in the hours. That's not how business owners function. Even when they are not working, entrepreneurs continue to make money.

Of course, the ultimate goal of anyone searching for a solid career or making every effort to work in the gig economy is to become financially independent. Regretfully, neither industry will allow them to achieve financial independence.

Why having a job doesn't equate to having money

On the Business (B) and Investor (I) sides of the Cash Flow Circle, on the right, lies the road to true financial independence or stability. Regrettably, the Employee (E) and Self-Employed (S) sides of the Cash Flow Circle are where most people look for security.

The poor mindset people are usually well educated folks. Their obsession is also with job security.

Having a well-paying job was the most essential thing to him. He reinforced this concept in his children from an early age, as did the majority of people in his generation. Before he lost his job and was unable to locate another, he believed that having a job meant having financial security.

However, wealthy people never discussed work security. Rather, we speak about financial independence all the time. We have been demonstrated by our mentors the Cash Flow Circle’s patterns for various levels of freedom and security.

The trend of job security

Those that adhere to this pattern perform well at work. They have a great deal of expertise and are well educated. Their lack of knowledge on the B and I right side of the Cash Flow is the issue. As they have merely received training for a job and are dependent on others for their subsistence, they experience financial insecurity.

People that fit this pattern frequently fund their retirement accounts. They don't truly know what is happening with their money, therefore even in that case, they continue to feel insecure. They anticipate that the account manager will perform admirably. However, the majority of the time, the money simply vanishes from their paycheck every month.

Those in the pattern of work security need to learn how to invest and become more financially educated in order to feel comfortable in their financial situation.

The financial security pattern

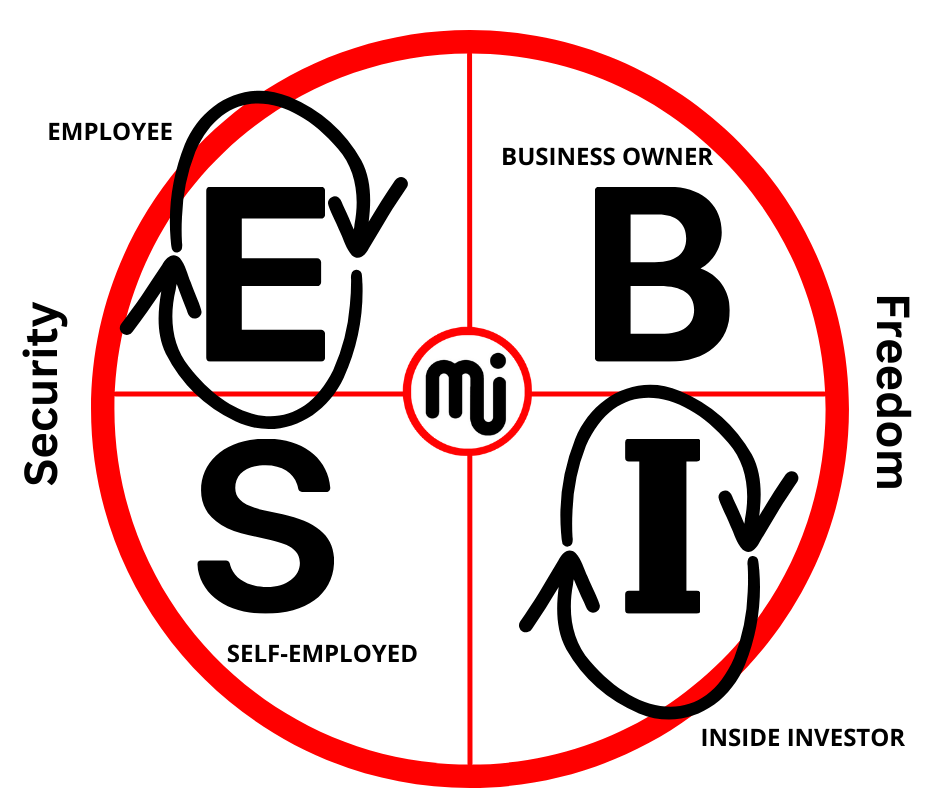

The financial security pattern for an E (employee) looks like this:

Rather of simply depositing funds into a retirement account and crossing their fingers, this loop is intended for individuals who have faith in their education as both workers and investors. Just like we study at school to learn a career, we should study to become a professional investor.

The pattern for an S's (self employed) financial security is displayed in this image:

The typical American millionaire works for themselves, has a frugal lifestyle, and makes long-term investments. That financial life path is reflected in the pattern above.

Furthermore, S's (self-employed’s) and E's (employee’s) can both go into the right side of the cash flow circle B (business owner) & I (inside investor) side. For example, successful businesspeople such as Steve Jobs choose that path. Although not the simplest, it's still among the greatest.

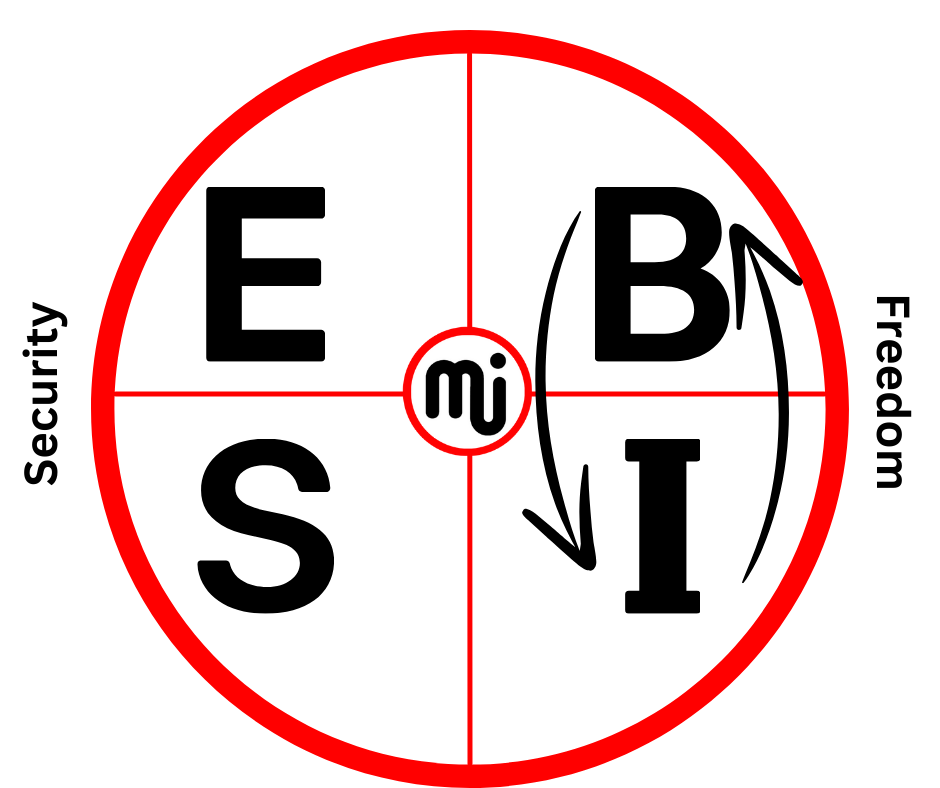

The habit of financial independence

There is nothing wrong with the majority of people being anxious about their financial stability. But being financially free is even better than being safe. That is the result of living and breathing exclusively in the CASH FLOW Circle’s right side.

The pattern for financial freedom is as follows:

We suggests this pattern, but it's not for everyone. But because people are working for us in the right side of the cash flow circle and our money is working for us. This is the pattern for true financial independence. We can work or not work at all. This is the trend we will see in the ultra-wealthy.

Select the route that will lead to financial stability.

We have the freedom to choose your financial route these days. Will employment security be involved? stability in finances? or independence from money?

Regretfully, the majority of people, particularly during difficult economic times, select job stability. But how truly safe is it when we know that we are dependent on someone else for our entire livelihood?

Additionally, employment come and go during periods of economic uncertainty and technological disruption. The "Wall Street Journal" notes that businesses are making every effort to do away with job security going forward. Furthermore, as demonstrated by recent history, many millions of employment can vanish overnight.

Learning about financial stability is crucial, if nothing else. This involves having faith in our ability to make investments through good and bad times, as well as in our passions.

The best—and most difficult—path, if we possess it, is to choose financial independence. To thrive in the B (business owner) and I (inside investor) right side of the cash flow circle, one needs to possess a high degree of financial literacy. It also requires a great deal of vision, dedication, and enthusiasm. However, the reward is total freedom and financial abundance.

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading:

Comment, like, share and follow for more High Quality Financial Education Made Simple.