Learning to invest like the wealthy do!

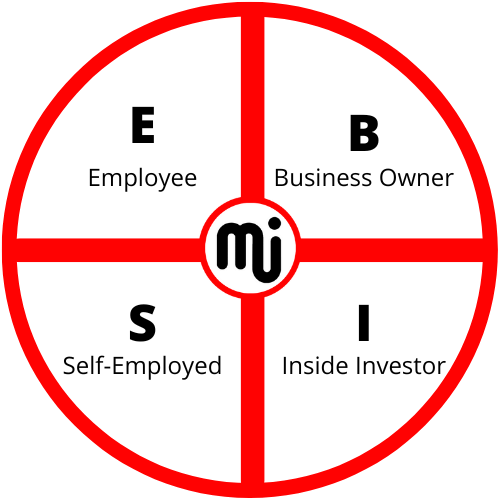

The continuous transition from the left side of the CASH-FLOW Circle to the right side of the cash-flow circle is one of the primary indicators of impending financial freedom. What are the simple rules for investing?

Similar to how a caterpillar transforms into a lovely butterfly, becoming an inside investor or a business owner requires transitioning from employment or self-employment. It takes time and frequently necessitates a complete shift in attitude and behavior about money.

Understanding what to do when you have more money unexpectedly available is one of these behavior modifications. The temptation for those on the left side of the cash-flow circle can be to, at best, follow traditional advice about money, or, at worst, to spend it all. This can happen whether it comes from an inheritance, a raise or bonus, or any other source, to, at worst, squander it on obligations like holidays or cars (liabilities).

Such common advice might be to raise your 401(k) contributions or to save as much money as you can while continuing to live within your means. All of these themes have been extensively discussed, so it should not be surprising that none of them are regarded as "good advise."

If you're about to get a windfall of fresh funds, this is the ideal opportunity to implement the wealthy person principle: invest in assets with a positive cash flow.

Nevertheless, you must first comprehend the basics of investing in order to do that. These are Master Investor's essential investing principles.

One of the hardest things about people in shifting is their mindset and habits about money. It requires dedication and execution with the new rules of money.

You are reading: What are the simple rules for investing?

Basic rule of investing #1: Adjust your money mindset

The idea of changing our thinking from that of the poor and middle class to that of the wealthy is discussed extensively in the book "How to Build Cash Flow With The Internet?": Tune Passive Income On.

Learning what the Wealthy Invest in, that the Poor and the Middle Class Do Not!

Both the middle class and the less fortunate instruct their children to go to school, find a good career, work hard, and save money. That'll make you wealthy.

The wealthy instill the following lessons in their children: "Learn how money works, create decent jobs, make money work hard for you, and invest in assets with positive cash flow. That'll make you wealthy.

The idea that you may get wealthy by working for a salary is one of the fundamental misconceptions shared by the poor and middle class. But because of the way the tax system is set up, it's actually very challenging to achieve that.

Money as a business owners can be invested before taxes. We not only have more money to work with as a result, but it also lowers our overall taxable income, which means we frequently pay less in taxes than people in the poor and middle classes. This is a wealthy mentality. That also explains why so many members of the lower and middle classes were outraged when they discovered Donald Trump had paid no taxes during the presidential race. They simply don't get how money functions or how the wealthy conduct themselves.

To become wealthy, you must first change your perspective about money and investing. That there are other sources of money is the first step towards doing that.

Basic rule of investing #2: Determine what type of income we are working towards

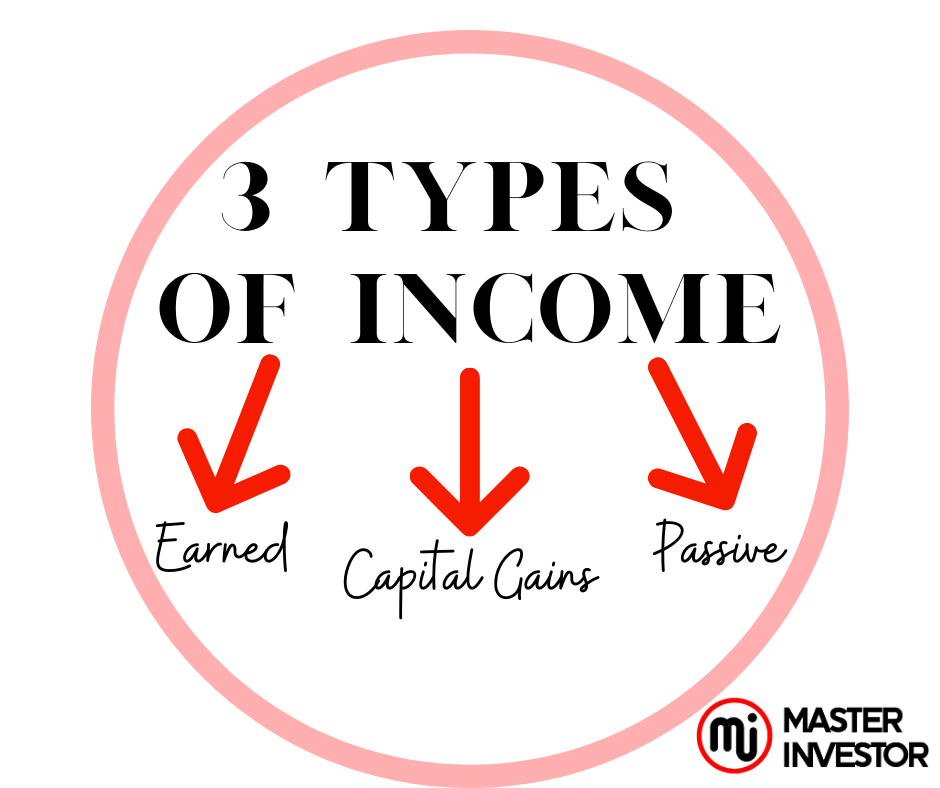

Most people just consider earning money at a successful job. They are unaware that there are various sources of money. But, Master Investor always stressed that there are three various forms of income, and that each is influenced by a different mindset.

1. The Ordinary Earned Income

The majority of individuals think of regular earned income when they discuss earning money. The 9 to 5 set makes money like this. It is typically obtained through a paycheck from a job. Due to the government deducting money from your paycheck before you even receive it, it is the most taxed income and is therefore the toughest to accumulate wealth with.

2. Capital Gains Income

A 401(k) and various paper assets, including mutual funds managed by a financial advisor, are common sources of capital gains income for the majority of highly compensated workers. The majority of capital gains income comes from paper assets like stocks, bonds, and mutual funds. Due to its poor yields and second-highest tax rate, it is somewhat challenging to accumulate money. The majority of experts agree that over a lengthy period of investment, you may anticipate returns of roughly 7% per year for your capital gains income. Of course, there can be significant ups and downs during that period. A person with little financial intelligence could think a return of 7% is a lot, but wealthy people would reject such an investment approach.

3. Passive Income

High financial Intelligence individuals executes an investment approach that will generate passive income. Real estate, royalties, and dividends from businesses and stocks are the usual sources of passive income. Rent from a rental property is considered passive income. Since Master Investor receives royalties from our books and digital courses, they are assets that generate passive income. It also counts as passive income if you own a company that pays out profits to you. In other words, it is money that you receive whether you work or not. Because to its mix of low taxes and potentially unlimited returns, it is the income with the lowest tax rates, the most tax advantages, and is the easiest income with which to accumulate wealth.

If we want to be rich, work for passive income, a wealthy advised from Master Investor.

Basic rule of investing #3: Transform earned income into passive income

Most people begin their lives earning regular wages as employees. Understanding that there are other sources of money and then converting your earned income as effectively as you can into those other sources of revenue are the first steps on the route to accumulating wealth.

You are reading: What are the simple rules for investing?

Master Investor created a straightforward illustration to demonstrate this:

That is all an inside investor should do, in a nutshell, according to Master Investor. It's as simple as it gets. This is the reason why receiving a raise shouldn't be invested in a 401(k) or used as an excuse to save money by living below one's means. Rather, they should pay themselves first and invest that money in cash-flowing assets inasmuch financial education. In short, convert your earned income into passive income. The easiest way to do this is to make our investment costs an expense and to make it our most important expense.

Basic rule of investing #4: Savers are losers

According to popular belief, saving money is not the key to achieving financial freedom and independence. Savers are, in really, losers. They're the ones that invest their money in low-interest accounts in the assumption that it would magically increase to provide them with their entire lifestyle by the time they retire. That is both ineffective and poor financial advice. Saving money has little value in a society where practically everything is designed to steal it. The odds are against you, from inflation to taxes to hidden costs in your 401(k) which are fake assets. Instead, today's winners are the spenders.

Money is not backed by anything. It is a form of payment that is constantly changing, much like an electric current. Money is now moving from one industry to another. It dies if it stops moving, just like a current. If our money isn't moving, it's slowly withering and losing value.

The wealthy are aware that we must monitor market activity and shift our money in accordance with it. This explains why the traders who executed the Big Short achieved a stunning profit. They observed the flow of money because they were paying attention. But more than that, they observed where the assets were moving into and realized their value was worthless.

They were aware that they could shift their money ahead of the curve to where other people eventually would. The first always feasts and the last always starves in the realm of money.

Basic rule of investing #5: The investor is the asset or the liability

Investing, in the eyes of many, is dangerous. Yet, in actuality, the risky party is the investor. The asset or liability is the investor.

We have seen investors lose money when everyone else is making it. In fact, because those are the places to find the true investing bargains, an inside investor loves to trail risky investors! ”

This implies that our understanding of finances can either be an asset or a problem. If we decide to invest heavily while having a low financial IQ, they will make a lot of blunders that high financial IQ investors will take advantage of.

Put money into your financial education first if you want to transition from being a risky investor to a master investor. Start modest with your investments as part of your education—because nothing beats real-world experience—learn from the failures, and then make bigger and bigger investments.

We can also develop our financial acumen by attending and reading daily investing knowledge. We specifically created an ebook and digital course, HOW TO BUILD CASH-FLOW WITH THE INTERNET?: TURN PASSIVE INCOME ON to show you how to think and invest like a wealthy person.

Basic rule of investing #6: Great deals attract money

Whenever we initially find a wonderful offer, we might initially be concerned about how to raise money. Keep in mind that our responsibility is to remain attentive to the chances before us and to be organized.

Master Investor's advised, "If we are ready, which entails having training and expertise, and we locate a good bargain, the money will find us or we will find the money."

The point made by Master Investor is that getting the money was the simple part. Finding a wonderful bargain that attracted the money was the challenging part, which is why so many people are willing to invest in a master investor. Other People's Money, or OPM, is what this is, and it is worth learning more about how to raise capital by using good debt.

Basic rule of investing #7: Learn to evaluate risk and reward

To succeed as an investor, we must develop the ability to weigh risk and return. A person opening a hamburger restaurant stand is an example.

Would that be a wise investment if you had a nephew with a $25,000 budget and a business plan for a burger stand? No, there's too much risk for not enough payoff.

Pretty nice, but what if we told you that this person has spent the last 15 years working for a significant burger chain, has served as vice president of every significant department, and is prepared to go out on his own and establish a global burger chain? What if you could purchase 5% of the business for just $25,000? Would you be interested in that? Sure. Yes, because there is a greater payout for a given level of risk.

It takes a lifetime commitment to investing in financial education to learn and master the laws of investing. Yet these fundamentals will get you going. It's up to us whether we become a master investor or just an average.

You are reading: What are the simple rules for investing?

Get our ebooks: The 10 New Rules Of Money

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

You are reading: What are the simple rules for investing?

Comment, like, share and follow for more High Quality Financial Education Made Simple.