Summary:

Bitcoin bonds combine fixed returns with the potential for Bitcoin's growth.

By tying a portion of our investment to BTC, investors may decrease our reliance on fiat money.

These bonds are experimental, providing potential upside but also increased risk.

While traditional bonds provide stability, they do not protect against inflation.

At the end of today’s talk, we will cover our bonus question: What Are Benefits Of The Economic Booms? The basics of investing should be learned right now.

What are Bitcoin Bonds?

Although a Bitcoin bond is similar to a conventional bond, there is a twist. We may still lend money in exchange for fixed returns, but now, a portion of our return is dependent on the future performance of Bitcoin.

A Bitcoin bond might include a tiny percentage of BTC, such as just 1%, that pays out in Bitcoin when the bond matures, rather than backing the bond entirely with fiat currency like USD.

Essentially, it is a hybrid that combines traditional and cryptocurrency elements and can earn interest quickly.

To provide some background, the BitBond idea was proposed on Twitter by Brian Estes, CIO of Off the Chain Capital.

This is how it operates:

A bond with a 0% coupon is issued by the U.S. Treasury, but 1% of its worth is included in Bitcoin and the remaining 99% in USD.

If there is considerable demand, the bond will sell for more than its face value. With no debt service, that would provide the government a favorable cash flow. We, the bondholder, receive the Bitcoin kicker along with our principal upon maturity.

Ideally, that's how it would operate.

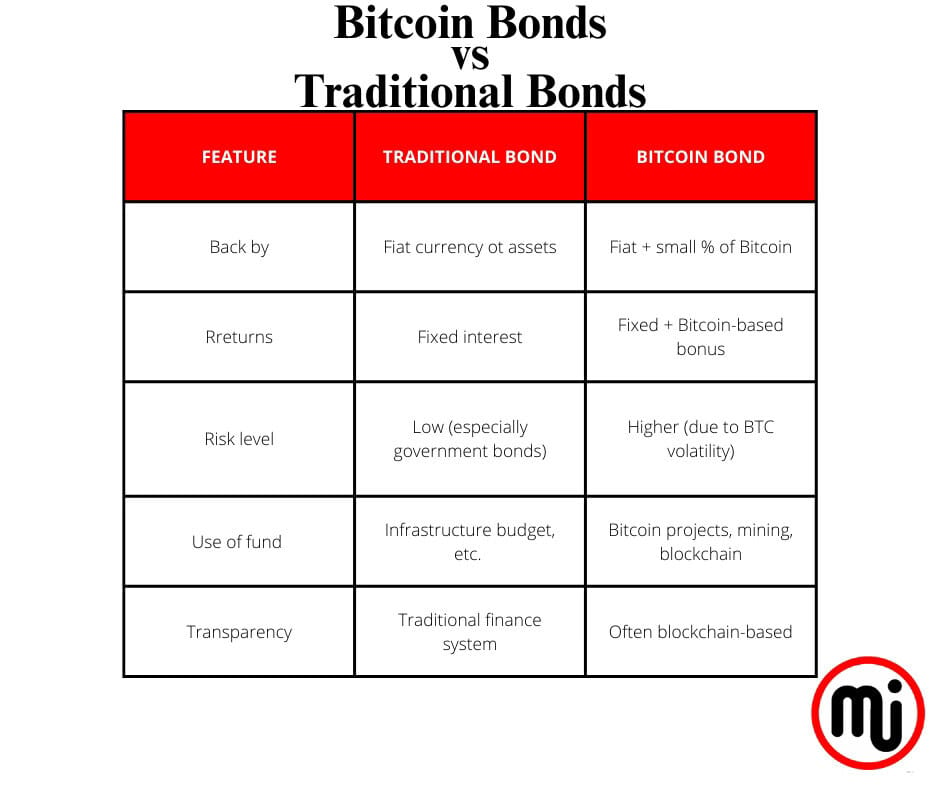

What distinguishes Bitcoin bonds from conventional bonds?

Bitcoin Bonds are very similar to traditional bonds, with the exception that they include an extra element of BTC mixed with fiat to serve as a kind of collateral intended to counteract inflation and the reduction in dollar purchasing power.

This is how it would function:

Like in the traditional bond market, our fixed-income investment provides exposure to Bitcoin.

We don't rely solely on fiat currency, which depreciates in purchasing power annually.

We leverage blockchain transparency rather than the bureaucracy of traditional finance.

We take on more risk because Bitcoin's price may fluctuate significantly.

Certainly, these things may sound well, but these bonds are not flawless, thus appropriate risk management should be considered. Although a Bitcoin bond has the potential for upside growth, it is a highly unpredictable asset that requires more study, self-control, and a long-term perspective.

Are Bitcoin Bonds Superior to Traditional Bonds?

It truly depends on our individual financial objectives.

Staying in the conventional bond market makes more sense if we are playing it safe and simply looking for stability. However, Bitcoin digital bonds give us the chance to accumulate money when fiat currency is continuously devalued.

They combine the well-known fixed-income framework with Bitcoin's long-term potential.

Holding both is also an option. Maintain conventional bonds for our stability and include Bitcoin bonds as a speculative yet strategic component of our investing portfolio. However, be sure to get expert advice and do our homework on this.

Advantages of Bitcoin Bonds

Bitcoin bonds have a number of benefits, including:

We acquire Bitcoin with a long-term horizon without making an outright purchase.

Instead of the typical bond market, we still receive a structured bond product with a maturity date.

If there is a lot of demand, governments might sell these bonds for more than their face value, which is beneficial to taxpayers.

Blockchain technology provides us with traceability and transparency.

Disadvantages of Bitcoin Bonds

With every good comes the bad:

Bitcoin's extreme volatility may have a negative impact on our overall return.

These bonds are still in the experimental stage and have not yet been widely used.

A Bitcoin bond does not give us ownership of Bitcoin. We must have faith that businesses or authorities will take care of Bitcoin custody.

Regulatory framework for hybrid instruments is still being established.

What about bonds on the blockchain?

Blockchain bonds are the digital equivalent of conventional bonds that are issued and administered on blockchain networks.

These bonds automate their operations, including interest and principal repayments, through the use of smart contracts. These bonds have quicker settlement times and don't require intermediaries, which is an advantage over traditional bonds.

Because every transaction is recorded on an unchangeable ledger that is available to all relevant parties, blockchain bonds also provide improved transparency. This transparency allows investors and issuers tosee all that happens inside the contract, which can help foster trust.

Fractional ownership and round-the-clock trading are also features of blockchain bonds, which may draw a wider variety of investors. Some people may prefer this democratization over traditional markets due to the possibility of greater market liquidity.

However, remember that there are still obstacles, such as the need for standardized frameworks to support widespread adoption, regulatory ambiguities, and technological dangers like smart contract vulnerabilities.

Despite these obstacles, blockchain bonds provide us with a glimpse of a future capital market that is more open and inclusive. This increases their uniqueness over conventional treasury bonds.

Examples of Current Bitcoin Bonds

El Salvador's Volcano Bond is the finest illustration of a Bitcoin bond. The initiative, which was named after its aim of funding Bitcoin mining infrastructure using volcanic geothermal energy, was unveiled in 2021 as a $1 billion bond. It was intended to generate funds for both Bitcoin acquisitions and infrastructure development.

The bond was set to debut in the first quarter of 2024 after receiving regulatory approval in December 2023. However, up to April 2025, there has been no official update or confirmation on its release. Since the first announcement, the Salvadoran administration has said nothing on the issue.

The Volcano Bond intended to finance the creation of "Bitcoin City," a planned crypto-powered, tax-free metropolis at the foot of the Conchagua volcano. The city's geothermal energy from the volcano was conceived as a sustainable fuel source for its Bitcoin mining activities.

Although the Volcano Bond has not yet come to fruition, its idea has sparked debates on the viability of Bitcoin-backed bonds and the incorporation of bitcoin into national financial plans.

However, since there are no workable real-world instances to emulate, it is now all conjecture as to how these digital bonds will behave.

Concluding Remarks

Digital bonds like Bitcoin bonds might undoubtedly play a role in the financial future. They won't take the place of conventional bonds, but they do provide an opportunity to preserve value in a world flooded with debt and inflation.

The concept is to provide more choices than we have had in the past. This, of course, is not without its problems. First of all, Bitcoin's concept and purpose were to oppose the existing financial system and provide an option to opt out of it, not to reinvent the traditional financial industry in the digital securities arena.

The most important factor is ownership and custody, therefore nothing can compare to directly owning Bitcoin in a self-custody wallet.

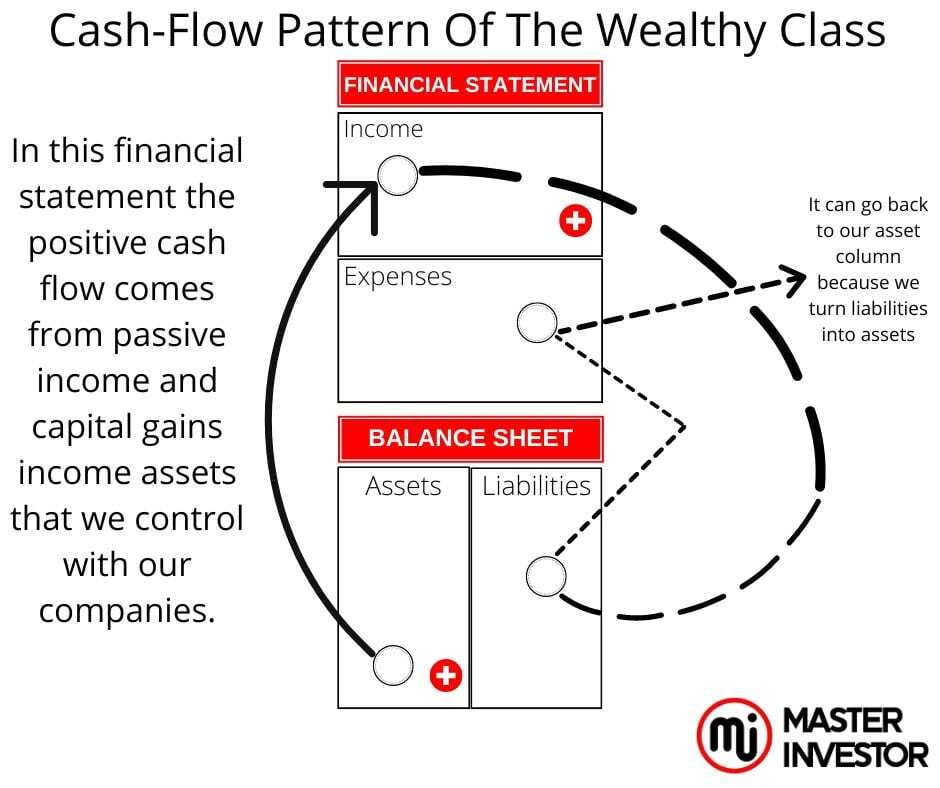

Being the one in control of the assets and liabilities of the asset is a key of the ultra wealthy, being actively and directly involved in the decisions of our investments is far more lucrative than simply handing our money to someone else to invest it for us is whichever asset, bond or investment vehicle available. We know that knowledge is power and money combined so we must continue with our learning about business and investing.

Diversifying in different asset classes is important as it is how we protect ourselves from down economies, and hedge for inflation. A prepared inside investor is always increasing passive income (positive cash-flow) even in down economies. Learning new investment vehicles that AI and technology brings us to invest is important to build true wealth as we adapt and capitalize new opportunties.

We continue the acquisition of sound assets even during bad economies or down economies. For a true business owner and inside investor there is not such thing as bad economies, for us, market crashes are wealth mines for the ones that are prepared to capitalize on them.

A sound investment is composed of a winning business plan with a lucrative exit strategy for the investor. Investing is having a plan. As long as we know everything about the investment and our return one investment is measured with facts then we are on the right path to successfully acquire real assets that makes us truly wealthy through passive income and sometimes we will obtain capital gains income.

We focus on building passive income which requires higher financial IQ than capital gains income. To aim for passive income we have to get close to the deal as close as possible to the inside.

However, we may always choose to go both routes: owning BTC and participating in the Bitcoin bond market. A positive upside for future Bitcoin prices could be indicated by the growth potential with financial firms and the rising adoption.

Bitcoin bonds provide us exposure without putting all our eggs in one basket if we have faith in Bitcoin for the long haul. However, remember that this is still an evolving field. Never bet more than we can afford to lose, and do our study.

(Disclaimer: This piece is for educational purposes only and does not constitute financial advice. It's essential to do our homework and only invest what we can afford to lose. For professional financial advice tailored to our needs, see a specialist.)

Bonus: What Are Benefits Of The Economic Booms?

The basics of investing should be learned right now.

While booms are wonderful, they are invariably followed by busts. Are we going to be ready?

Economic expansions provide chances for development and learning.

Using the booms to understand our investment fundamentals is the best method to reduce risks during busts.

Historically, periods of innovation, supportive government actions, or rebounds from recessions have frequently led to economic booms—consider the post-World War II boom and the roaring twenties as illustrations.

However, have we ever observed that people tend to become somewhat complacent during a boom, when they are plump and content? Complacency is a common byproduct of life on easy street, and some individuals lose sight of how they got there in the first place. Often, it was the result of factors like diligence, learning about specific fields through research, and asking a successful mentor for advice. This brings us to the conclusion that just because the real estate market is thriving and money is flowing in easily, we should not take this opportunity to cease our education.

Concentrating on the basics

Imagine that we have never set foot in a kitchen. We definitely would not begin our first experience in cooking by preparing a difficult dish. We would probably begin with something more basic, like sunny-side-up or scrambled eggs, since they have fewer ingredients and timing factors. Once we have mastered the basics of egg cookery, we may aim for a more difficult dish.

The same holds true for investing. Fifteen years ago, following the real estate bubble burst and the stock market crash, there were more people than ever cautioning that "investing is risky." The issue was that people did not all define "investing" in the same manner.

The majority of individuals define investing as any circumstance in which they spend money in the hopes of making a profit. Sadly, gambling is what most people believe investing to be as they invest without a plan. They invest with the poor formula of buying, holding and praying for the market to boom. This is why the incidents caused so many individuals to suffer. Many so-called "investors" entered the real estate market when it was hot and prices were skyrocketing, betting that home prices would continue to rise. They even purchased properties that were more expensive to buy and upkeep than they could rent out. Business and investing is simple when we apply common sense into our investments, the numbers have to always make sense otherwise it is a liability not an asset.

Conversely, seasoned investors who grasp the fundamentals of real estate investment avoided purchasing homes that couldn't generate cash flow and sold properties they had bought prior to the boom for a handsome gain. Which approach seems to be the best course of action now?

An understanding of the fundamentals distinguishes genuine investors from gamblers in any form of investing. Understanding and adhering to the fundamentals reduce a lot of the risk associated with investing. There is always some risk, but the risk may be considerably decreased by following solid investment practices and preparing for how to address the downside.

The advantages of economic expansion

Along with the stability and protection that economic booms bring, there are numerous other significant advantages:

Job creation and low unemployment: During economic booms, companies experience higher activity, which results in more employment vacancies. Furthermore, as businesses compete for qualified candidates, salaries frequently increase.

Increased consumer spending: Greater discretionary spending from consumers as a result of economic confidence contributes to the growth of sectors like automobile sales and real estate.

Increased tax revenue: higher business profits result in more taxes being collected. As a result, they may use the excess revenue to fund social and infrastructure development.

The increase in the economy promotes a far more seamless functioning overall machine, as seen by these only a few of the advantages to the economic boosts that we experience.

Compelled adaptation

Economic booms might lead to a gradual complacency because of the comfort they bring. Rather, it's crucial to view these as opportunities to take action.

People and organizations should prioritize ongoing learning and adaptation to prevent complacency during economic booms.

Diversifying income streams can reduce hazards when the boom ends, while investing in skills development guarantees preparedness for upcoming challenges. To stay competitive, both individuals and organizations should improve efficiency, strengthen customer relationships, and innovate. Establishing financial reserves during good times also creates a safety net for recessions, promoting long-term growth and stability.

After all, one shouldn't lose sight of the fact that a boom is followed by a bust.

Grasping the boom and bust cycle

The boom and bust cycle is an economic phenomenon marked by rapid expansion (boom) followed by a decline (bust), as we may already be aware.

Boom: The economy grows as a result of increased job creation, consumer spending, and investment. Asset values increase, and trust abounds.

Bust: The rapid expansion becomes unmanageable, resulting in economic contraction. Asset prices decline, investment declines, and unemployment increases.

This cycle repeats itself as economies recuperate from recessions and eventually expand once more.

However, during a "bust," it's crucial that we are not caught up in the rat race. In reality, a financial literacy boom is an opportunity to seize.

Booms: the ideal time to acquire knowledge.

So, how do we intend to pass our time during a fantastic boom? Do we keep learning? Or are we lounging around content and plump?

The greatest danger we run is not taking actions to actively enhance our financial knowledge, which would prevent us from adhering to the fundamentals or building our base. In our rapidly changing world, it's essential to educate ourselves and learn something new every day. If pursuing an advanced degree is not of interest to us, that does not imply that it is time to return to school. Never let formal education get in the way of our learning for financial education. There are 3 types of education in life. We have academic education, professional education and financial education. Majority of people will only stay academic and professional education. Financial education is somewhat shadow banned from the school board system across the world. Due to the historic event that happened on around 1903 John D Rockefeller Wealth is something we attract not pursue by the type of investor that we are becoming daily.

Read as many financial blogs and books as we can, enroll in free online workshops, join an investing group or club that will let us to talk strategies with others while gaining experience with the process, and look for a real mentor in a subject or asset classes we wish to learn more about. Invest with facts rather than opinions. We must learn how to read and improve financial statements as that is the foundation of true wealth.

We may become an inside investor by learning the basics, starting small or big, and getting financial experience today.

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Subscribe to our Youtube.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: What Are Bitcoin Bonds vs. Traditional Bonds?

Masterinvestor’s mission is to be the global authentic brand of money, business, and investing that elevates the financial well-being of humanity through high-quality financial education made simple with lucrative opportunities to build passive income, win-win partnerships, and true wealth.

Comment, like, share and follow for more High Quality Financial Education Made Simple.