Summary:

The only path to financial independence is to become an expert with money.

Financial literacy and self-control are essential for money management; leave our justifications at home!

These are the pointers for becoming financially independent through mastering money.

It is nearly hard to become financially independent if we lack the skills and information necessary to manage our finances.

Money is undoubtedly a significant element in our lives. Despite the widespread desire to become wealthy, it is actually this urge that keeps individuals trapped in the rat race—working 9 to 5 at a "secure" job that withholds an excessive amount of our income for taxes and, incidentally, has the potential to fire you at any time. Paychecks deceive people into believing they will always have money, which makes them labor until retirement only to find they have nothing left.

Very depressing.

However, that need not be the case for every individual. We can start to see that money is driven by more forces than just desperation and false information if we take the moment to reflect on the rat race we are in and recognize it's a trap.

Making, spending, and utilizing our money in a way that genuinely improves our financial situation is the key to being a money master.

To be wealthy, one must possess self-control

We will never be financially free if we are unable to cultivate and maintain self-discipline. This is because we will never be an expert with money.

In theory, creating cash flow from the asset column should be simple, but in reality, allocating funds to the right uses requires mental toughness. Nowadays, it's much simpler to just throw money away in the expense column than to allocate it wisely in the asset column.

Our money will follow the path of least resistance if we lack self-control. The majority of people's financial difficulties stem from that.

The Rule of 3%

Here is an illustration of the 3% rule in action.

The Master Investor’s idea describes how the year would conclude if we gave $10,000 to each of the 100 recipients at the beginning of the year.

90 would be left with nothing. If they had used the money for a down payment on a new automobile or some other exciting gadget, they very likely would have more debt now.

7 would most likely have added 5–10% to that amount.

3 would have raised it to $20,000, maybe even higher.

The majority of people attend school to pursue a career so they can work for earned income. But at Master Investor, we contend that understanding how money functions for is equally vital. True money masters make up only 3% of the population, and they are the wealthy ones. The 3% is where we want to be. Here's how to do it:

Purchase pleasures using: Positive Cash Flow From Our Investments

The importance of leveraging assets to pay for pleasures is a key lesson we will discover on our path to financial mastery.

That everyone enjoys luxury is a well-known fact. The wealthy, in contrast to most people, do not purchase things without first having an asset that is creating passive income. That's the pitfall of trying to stay up with wanting to pay liabilities without revenue from cash flowing asset. Rather, they concentrate on producing enough income in the asset column to fund it if they desire anything beautiful.

Wealthy people tend to use our consumption demands as a source of inspiration and drive while making investments. Instead than borrowing money to buy toys first, we concentrate on borrowing money to make money for us through sound investing. Then, once that is successful, we then acquire the liability we wish, now we have an asset that will pay for all the expenses of that liability.

It is simple at the end, once we have financial education in us then we can make money from thin air, literally.

It requires self-control, but it's well worth it.

Give up trying to get satisfaction right now.

We will see the benefit of delaying gratification after we have a clear understanding of our objectives in order to truly handle our finances. As an illustration:

More time to reflect and decide on wise financial moves. When we practice delayed gratification, we stop making impulsive purchases. We will eventually cut back on wasteful spending and bad debt for the meantime until we have the asset that will take care of the liability’s expenses then we shall not acquire the liability yet. But if we already have it in the our liability column and we cannot get rid off because maybe we have contact that we must finish before letting that liability go. Then, we should all focus on simply increasing our asset column with real assets that we control with our companies that we each incorporate.

When we do that then we increase passive income and capital gains income. Also, we would be able to minimize the highest expense humans have in their lifetime, taxes! Because we are operating with the new rules of money and have assets that generate positive cash flow.

Improved financial self-control: We can develop our self-control, discipline, and general investing skills by engaging in delayed gratification. In the end, these qualities support our ability to follow a flexible, strategic financial strategy that supports our long-term financial objectives.

Which Income Are We Working For Daily?

Majority of people in the world only master how to make money through selling time for money which income is called earned income. That income is tax at the highest bracket and it does not provide freedom.

A person must learn how to move their capital into financial education and sound assets that are control 100% by the investor. Therefore, we are actively investing and we do not give our capital to anyone to invest it for us. We make the investments and we control the companies that owns the assets that we are acquiring to building passive income and capital gains income.

Savers are looser in today’s economy because the US dollar is loosing value daily. The US dollar is no longer real money. It is a currency, and more specifically is created with debt.

That is why we must use debt as much as possible to become wealthy because debt is tax free. That is right any debt is tax free according to the law simply because money is created with debt.

Today the US is 34+ Trillion Dollars in debt and it is not going to stop increasing by any means. Inflation will continue to rise and things will cost more money making it difficult for those who work for earned income to maintain their lifestyle. They would have to get a raise in their earned income and work more hours to pay their expenses monthly.

We must look ahead and figure a personal investment plan to create passive income today and capital gins income. We must take control over our finances and build the assets column.

Saving money s loosing money. Do not park the money because it goes back to is intrinsic value which is zero. Money must move from a cash flowing asset to another sound asset that we control with our companies.

Here in our community at masterinvestor all of ours partners work to build passive income and make money work hard for us. It is the only way to achieve financial freedom and true wealth.

Master money. In other words, money is our slave.

Develop becoming a master

It's best to start teaching ourselves and the people we care about how to invest money as early as possible. Money has a lot of power. Sadly, people often turn financial power against themselves.

We must possess sound financial judgment in order to be a master of the money. Excuses have no place here—only continuous improvement. The first steps in this process are self-discipline and financial knowledge; the last is learning how to use money to work for us by using assets to pay for responsibilities.

Start now on the journey to leveraging money to work for us instead of the other way around. For additional information, visit Master Investor’s free financial education community by clicking this link.

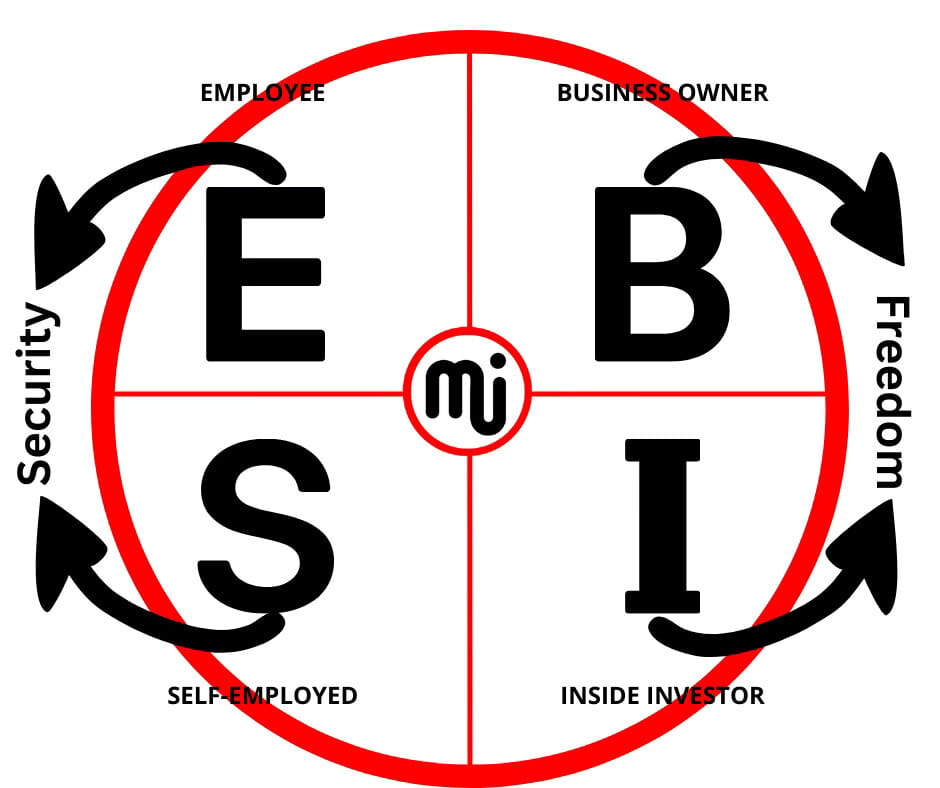

Which side of the Cash Flow Circle We Wish To Master?

It makes a difference the side we pick and the players we choose to be. Just remember true freedom and wealth I build on the right side the ash flow circle. Therefore, when the person’s goal is to become more financially free and create true wealth then that is only possible to be achieve by being a business owner and an inside investor (Capitalist aka Master Investor).

To become wealthy we must follow the following values in this order below:

Wealthy

Comfortable

Secure

Majority of people will put secure as their number one priority in life, and they put becoming wealthy last. That is why many people will always struggle to figure out the game of money and how to win without working for earned income. it takes financial education to be able to make money like the wealthy. But it is more possible today than ever before due t the technology we have today.

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: The Secret to Achieving Financial Freedom is Money Mastery

Comment, like, share and follow for more High Quality Financial Education Made Simple.