Summary:

It need not be hard to understand our personal financial statement.

The wealthy have become experts at interpreting their own financial statements.

Understanding the connection between an income statement and a balance sheet is the first step towards knowing our personal financial statement.

What does having wealth entail?

Possibly the most significant question we can pose and have answered is this one. Being wealthy is typically defined y many as having a large income. For most people they believe that all of their issues will be resolved if they could just increase their monthly income. They are going to live like royalty.

Understanding our personal financial statement is the first step toward financial literacy

Money alone does not, in fact, make us wealthy. We are wealthy because of our high financial IQ. If we provide $100,000 to someone with a low financial IQ and someone with a high financial IQ, we will notice that their spending and growth of that money differ significantly.

Understanding a financial statement is a basic but important literacy that is essential to distinguishing people with high and low financial IQs.

We may wonder what a personal financial statement is. It keeps track of our income, expenses, assets, liabilities, and cash flow; each of these is important to comprehending our own financial situation and acts as a barrier to entry for potential investment opportunities. The link between these ideas is shown in the Master Investor personal financial statement, which we can obtain here.

The ability to read an income statement and balance sheet independently is something that many accounting and other students acquire. But these courses don't cover the significance of one document to the other or how they interact with one another.

Believed that our team is vital. How is it possible to comprehend one without the other? We shall ask this question, “How can we determine the true value of an asset or debt without the income or expenses columns?”

When we optimize for financial education found it easy to see the direction of our cash flow and assess whether or not something was profitable by knowing the relationship between the two.

Something was an asset if it was profitable. It was a liability otherwise.

Just because something is listed in the asset column, doesn't mean it's an asset. People who buy liabilities and list them under the asset column are the ones who suffer financially.

It matters more how much we keep (expenses) than how much we make (income)

The concept of having a big salary is generally positive. It's horrible for the wealthy people. Low costs are generally seen as a positive feature by the poor mindset (middle and poor class).

Once again, it is awful for the us the wealthy. Actually, the only people who believe that "making a lot of money" through earned income (job or salary) is a good thing are those who lack financial intelligence. These are typically well-paid workers, such as members of the C-suite or A students. Despite their seeming wealth, they have poor mindsets.

Money is just an idea.

One of the most important facts of this concept of money will become clear to us once we accept the notion that having excess of passive income, high expenses, and low income is advantageous. Many people become bankrupt because they fail to grasp this basic idea that creates infinite wealth.

The actual functioning of money

Now let's discuss the 90/10 rule. Ten percent of the world's income is earned by 90% of the population. How do they accomplish this? by appropriately allocating their revenue and expenses.

It will seem unusual to those who are unfamiliar with money and finance concepts that the ultra-wealthy present themselves as having excess of passive income, high expenses and low income.

"How can zero personal income and high expenses make us wealthy?" is a question we may have.

The way the astute investor uses corporate and tax rules to move those costs back into the income column of their financial statement holds the key to the solution.

Keep It Super Simple When It Comes To Investing

Making complex things extremely simple shall be a skill we must constantly apply in our investments and business ventures. One of our financial maxims is to "keep it super simple. We shall simplifying difficult financial concepts such that even a little child could grasp them.

We must fill out an our personal financial statement and review it as much as possible. Actively improve the asset column, expand it.

We stand a better chance of becoming extremely wealthy if we can make sense of the following diagrams.

Patterns of cash flow

Something that puts money in your pocket is an asset. On the other hand, a liability is something that costs you money.

It really is that easy.

Master Investor made the observation that a lot of people become confused since both assets and liabilities can be included under the asset column in widely recognized accounting procedures.

We created this straightforward illustration to clarify:

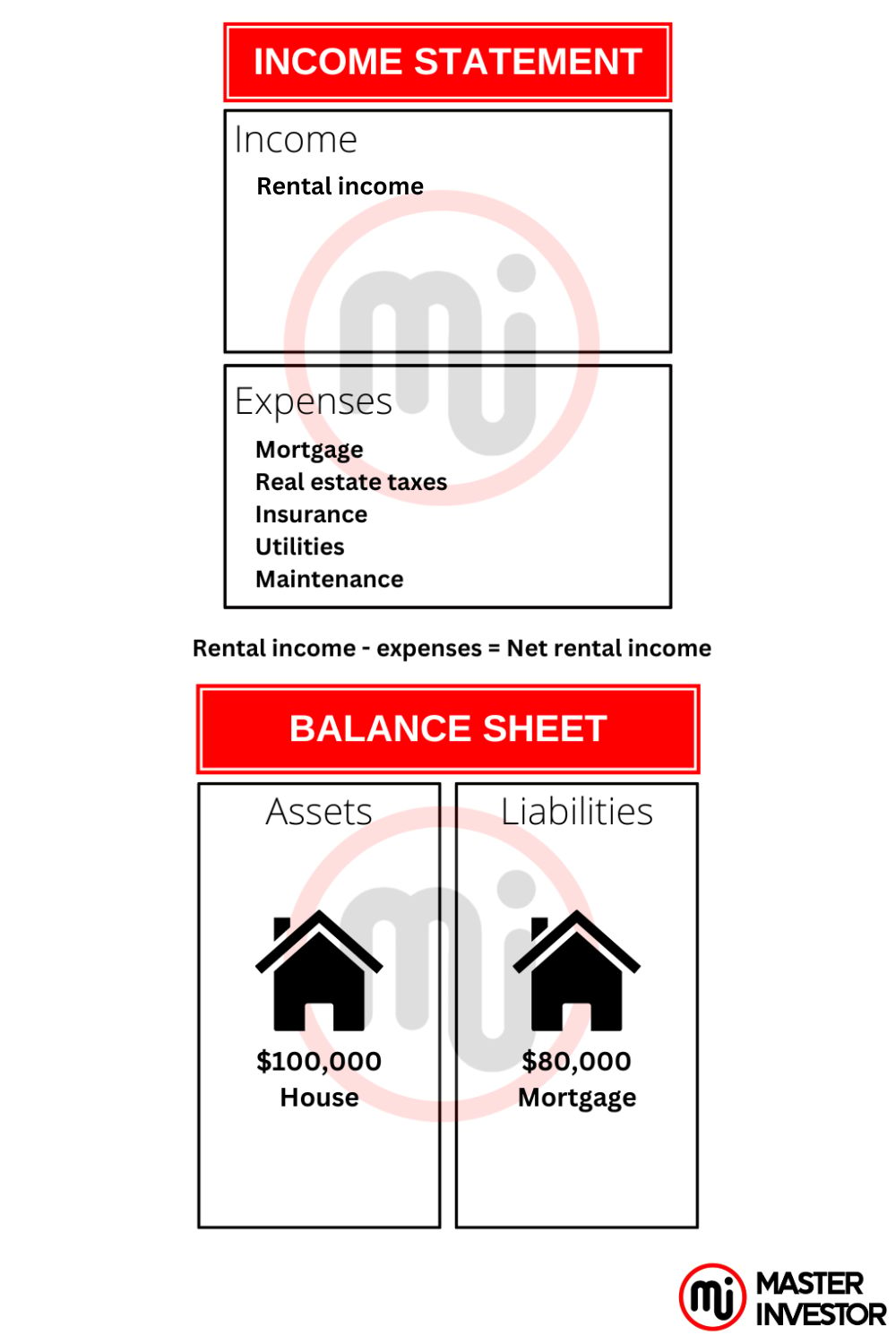

We regret to break the news that, despite what others may have been told by financial uneducated people, that majority of people’s home is a liability rather than an asset.

This is why things get confusing. In this diagram, a $100,000 home with a $20,000 cash down payment and a $80,000 mortgage is shown. How can we determine if this residence is more of a liability or an asset? Just because the house is mentioned in the asset column, does that mean it is an asset?

Naturally, the response is no. We would need to check the income statement to determine whether it was an asset or a liability in order to be certain.

Wealthy person's financial statement and cash-flow pattern

Here is an illustration of the tasks that a knowledgeable investor works to complete, for instance:

We will witness a world of ever-increasing financial prosperity once we start to make sense of what's going on in this diagram.

This diagram essentially illustrates how wealthy people use our money to buy assets (and expenses) that generate further revenue for us in the form of positive cash-flow (passive income). This is because the income generated by these assets is passive income, which is exempt from taxes, rather than earned income. These assets can also be retained in entities that offer significant tax advantages. To put it briefly, even though we might be extremely wealthy, our personal income is not as high as that of a high-paid employee. In many instances the wealthy’s personal income is zero but ti does not mean we are broke nor poor. Actually it means we are financially sophisticated.

What percentage of the money going out our expense column winds up back in our income column in the same month? is one of the most crucial controls we can have.

We will see a whole other world when we comprehend the other side of the coin that we are talking about, one that most people who put in a lot of effort, make a lot of money, and manage their costs never get to see. a world of perpetual prosperity as opposed to one with diminishing returns.

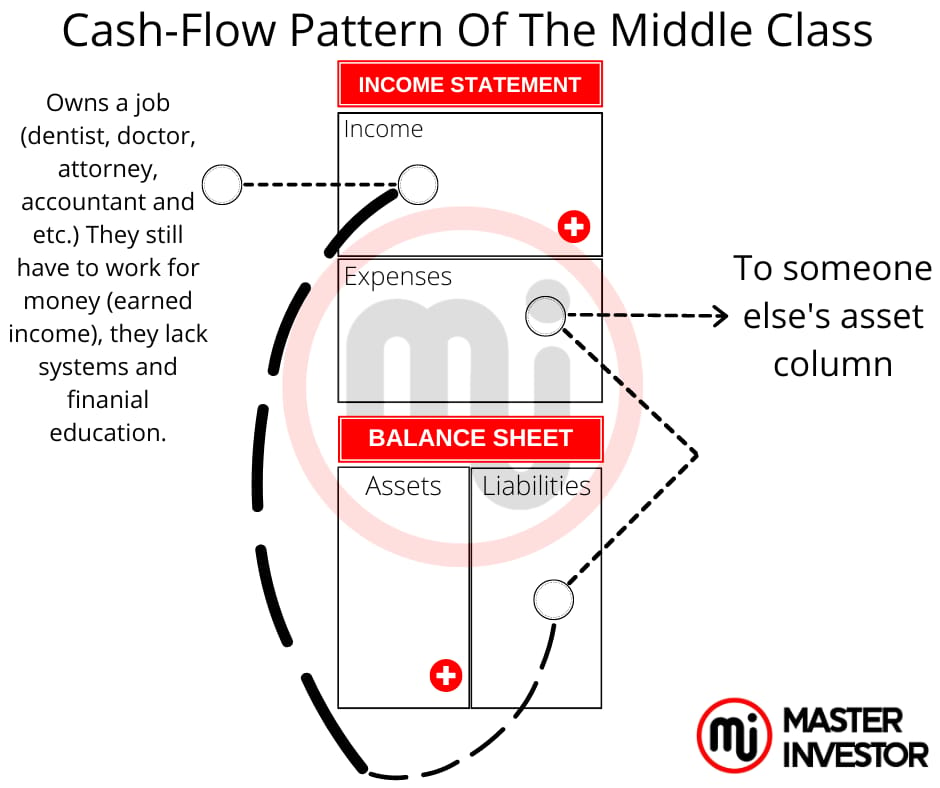

An individual from the middle class's financial statement and cash flow pattern

Compare the diagram above with the conventional framework for conceptualizing money:

This represents the majority of people on the planet's financial diagram. Stated differently, funds enter through the income column and exit through the spending column. It never reappears. For this reason, a lot of people attempt to make a budget in order to live within their means, save money, practice frugal living, and reduce their spending.

For this reason, even though the money leaves the property and doesn't come back—at least not right away—the majority of individuals will still claim that their home is an asset. It also clarifies the reason behind statements like "They lose money every month, but the government gives me a tax break to lose money," as opposed to "We are profiting from our investment, and we get a tax break from the government to do so."

An individual from the poor class's financial statement and cash flow pattern

Compare now the poor class which is similar to the middle class except that the may not have enough personal credit to get high end liabilities because they lack of a high paying job. The banks have no confidence in their ability to pay back and therefore they work to pay for their expenses every month just like the middle class, no difference except the differences in earned income. Both poor and middle class operate with the poor mindset’s context.

Why a house is an asset or liability

We created this diagram to demonstrate how some people’s homes are an asset and a liability:

How is the home the bank’s asset

Next, we have inserted a line that said "rental income" and "net rental income," with the word "net" being crucial. The residence was no longer a liability but an asset thanks to that inclusion to the financial statement.

In essence, we clarified that a house qualifies as an asset if its rental income, less its expenses, results in a positive net rental income (positive cash flow aka passive income). It becomes a liability if not.

Simplified personal financial statement

These seeming elementary teachings hold great significance. And upon them all great prosperity is built. Recalling what was said previously, an individual with $100,000 and a high financial IQ would be able to decide how to invest it in real assets, or ones that increase monthly income. That same amount of money would be spent on liabilities by the individual with the poor financial IQ, but they would be unable to identify the issue.

Instead, they would strive to put in more effort in order to increase their income—a vicious cycle known as the Rat Race.

We can easily determine whether an investment is an asset or a liability by knowing the relationship between the income statement and the balance sheet, as demonstrated by our personal financial statement template. With this knowledge, we will be able to make the proper investment every time.

Ask ourselves the same thing now. In a given month, what proportion of our wealth moves from our spending column to our revenue column?

We too will discover a world of wealth that never stops growing if we can figure out how this is accomplished.

See our eBooks and courses below for additional education on how to interpret our personal financial statement.

As a wealthy entrepreneurs and inside investor we must strive is to always in the present moment optimize for the extraordinary life which incudes the four pillars. They are the following:

Health

Wealth

Love

Happiness

We must master and nurture these four pillars of the great life everyday to achieve an extraordinary life.

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: The Personal Financial Statement: The Basis of Our Wealth

Comment, like, share and follow for more High Quality Financial Education Made Simple.