If you’ve taken a ride with Uber lately, it’s readily apparent that more and more people are trading in their traditional corporate jobs (along with salaries and benefits) for the “gig economy” philosophy of part-time, contract and freelance work. And while plenty of people in their 40s and 50s are jumping on this bandwagon in search of the freedom and flexibility they’ve daydreamed about for decades, news headlines would have us believe that millennials are the ones driving this movement thanks to their aversion to cubicles and structure.

Applaud anyone who’s brave enough to break out of the stuffy and “safe” mold of climbing the corporate ladder to pursue their passion — or at least explore things they might be passionate about if they weren’t trapped somewhere from 8 a.m. to 5 p.m. (and then some) each day.

Millennials seem to have an entrepreneurial spirit driving them to make different decisions than the generations that came before them. However, it’s not happening as often as you think. While 66 percent of millennials surveyed by Bentley University want to start a business, less than 5 percent of American millennials are currently running a business. So what’s going on with these millennial business trends?

A generation headed in the wrong direction

Whether it’s because they are saddled with student loans, are risk adverse, or believe the nonsense their parents and teachers have told them about the importance of following a conventional education and career path, millennials aren’t veering from tradition as much as I’d hoped.

A report from the National Women’s Business Council (NWBC), Millennial Women: The Future of Entrepreneurship in America, examines the perception and reality of this demographic, offering a detailed look at female millennial entrepreneurs and their future as business leaders and influencers.

They found that since the 1980s, the percentage of people under 30 who own a business has dropped by 65 percent — and the rate of new entrepreneurship among those aged 20 to 34 fell from 35 percent in 1996 to 23 percent in 2013. Other highlights of the report include the following millennial business trends:

Only 3% of millennial women are self-employed at unincorporated businesses.

Millennial women are less likely than millennial men to be entrepreneurs.

Millennial women entrepreneurs make more than 25% less than their millennial women labor force counterparts.

Millennial men are more than twice as likely as millennial women to have paid employees.

Millennials are losing their chance at the ‘American Dream’

We all know the story of the American Dream. It’s the story of immigrants from all around the world, coming to the U.S. to build a better life for themselves and their children. They are promised work, the chance for upward mobility, and the opportunity to live a better life than their parents.

It turns out, however, that the dream that once held so much promise and hope for parents, is becoming elusive for their children.

“66 PERCENT OF MILLENNIALS WANT TO START A BUSINESS, BUT LESS THAN 5 PERCENT OF AMERICAN MILLENNIALS ARE CURRENTLY RUNNING A BUSINESS — BENTLY UNIVERSITY”

A study conducted by economists and sociologists from Stanford, Harvard and the University of California revealed some pretty unnerving news about the under-30-year-olds in America. The Equality of Opportunity Project set out to measure the American Dream by identifying the income of 30-year-olds in 1970, and comparing it with the earnings of their parents when they were about the same age. They then collected the same data from 30-year-olds and their parents today.

The results are staggering: In 1970, 92% of American 30-year-olds earned more than their parents did at a similar age, they found. In 2014, that number fell to 51%.

Children were once assured they would out-earn their parents. Rising inflation rates, growing job creation, technology advancements — all of these (and other) factors promised abundance to the next generation. No wonder we call millennials the “entitled” generation! They’ve been told their whole lives that if they follow the status quo they’ll outperform the past generation, just like their parents did.

But the numbers tell a different story. Today, only half of millennials are earning more than their parents did at their age. And that number is not expected to rise anytime soon. In fact, the Wall Street Journal reports:

“Even growing at 3.8% annually would only increase the percentage of children able to out-earn their parents to 62% from 51%. Many economists are skeptical that the U.S. can grow anywhere near that level and is more likely to grow at around 2% a year."

The article goes on to call for extensive political policy revision to help boost the economy. But, if you ask me, what America really needs is a new financial game plan.

Millennials need a new financial plan

Millennials’ problem is not the slowing economy or growing wage gap. Their real issue is that they’re playing by the old rules of money — and those rules don’t work anymore.

The old rules that their parents played by promised that if they went to school and got good grades, went to a good college, then graduated and got a good job, and steadily worked hard, that they would be rewarded with a cushy retirement package and plenty of money to live.

It may have worked for their parents in the 1970s, but today that old “American Dream” is a bigger fantasy than ever. We live in a different world than the 1970s. So it only makes sense that we need new rules and strategies to help the next generation not only match pace with the last generation, but surpass them. Millennials desperately need a new financial plan, one that teaches them the new rules of money.

Stop trying to climb the ladder

Now, more than ever, young women need to understand that there are numerous, better paths to financial success. We live in an age when one woman with a laptop and Internet connection can create a flourishing business. One woman can become a successful CEO by doing things her own way in a fraction of the time it takes women who are climbing the ladder to get to the same position.

And yet we are still educating the next generation of women about the old paths to career success that just don’t work anymore.

Why climb the ladder? Why not own the ladder?

I believe this advice is more important than ever.

If you feel like you’re not getting anywhere in your career, that you’re being passed up for promotions, or having trouble finding access to mentors, why do you keep looking jobs? Why not go out and create your own business?

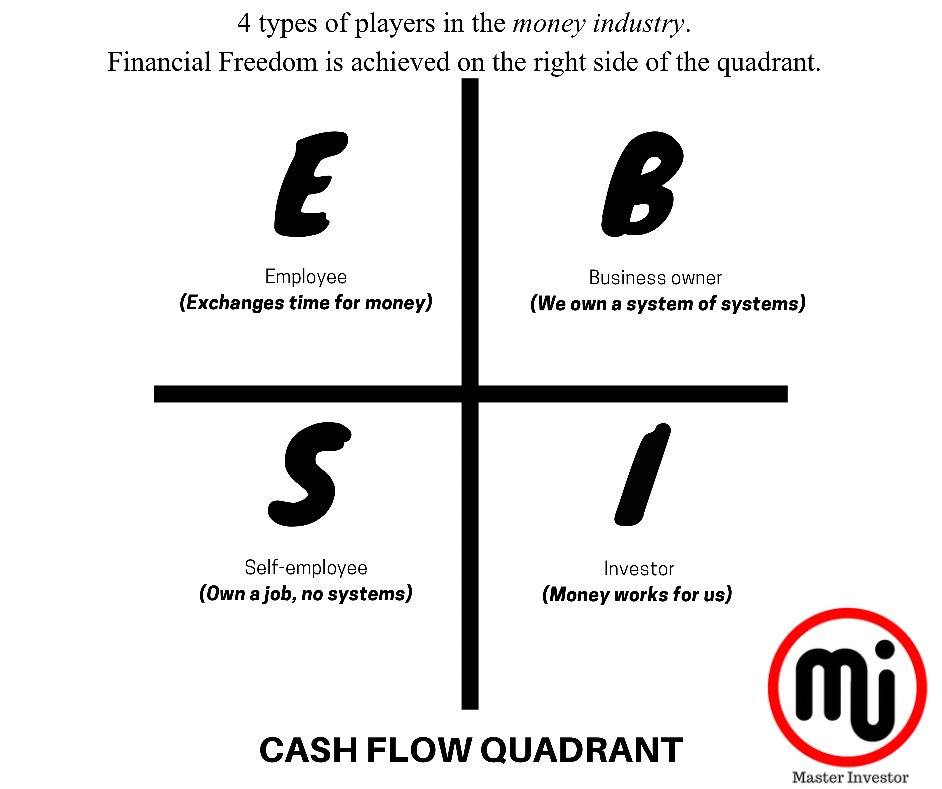

And this leap in career direction often begins once you understand the CASH FLOW Quadrant, a chart that shows you the difference between Employees, Self-employed, Business owners and Investors.

Millennials must shift their position in the CASH-FLOW Quadrant

Raj Chetty, of the Stanford part of the research team for the Equality of Opportunity Project, said, “Wages have stagnated in the middle class. When you are in that situation, it becomes very hard for children to do better than their parents.”

The key word here is “wages.” Millennials are earning less wages at traditional jobs than their parents.

But those wages are for employees, people on the left side of the CASH FLOW Quadrant. And, as we know, wages are not an indication of true wealth. Instead, they are shackles that keep you imprisoned in the Rat Race, bound to a traditional employer and the whims of the economy.

What 30-and-unders really need is a shift in mindset from the left to the right side of the CASHFLOW Quadrant. If you aren’t familiar, here’s what the letters stand for: E = employee, S = self-employed, B = business owner, and I = investor.

Employees and Self-employed are the ones who are trying to climb that ladder to success. They might have high salaries, but they also pay the most in taxes and trade their time for money.

On the right side of the quadrant, business owners and investors pay the least in taxes and invest in assets that make them money.

My bet is that most of the parents who were earning high wages in the 1970s were still Employees. Higher-paid Employees, but they still fell on the left side of the CASH FLOW Quadrant.

But playing by the rules of the left side of the quadrant just won't cut it anymore. Today, if millennials want to out-earn their parents, they’re going to have to drastically shift their mindsets, and make the move from the left to the ride side of the quadrant.

They can’t rely on being traditional employees or self-employed. This study just affirms that the left side of the quadrant is a sinking ship. Wages are going down, the poor are getting poorer, and the old rules of money aren’t going to save them.

If millennials really want to rise up, they have to move over to the right side of the quadrant by becoming business owners and investors. They have to practice the rules of the rich.

How? Millennial business trends will only shift once that generation learns the new rules of money.

The CASHFLOW Quadrant leads to the new rules of money

In today’s world, there are new rules of money. Think of all the changes that have happened in the world over the last 40 years. How could anyone think that the way to get ahead today is by doing things the same way their parents did them?

MasterInvestor wrote about the new rules of money in book Cash Flow. Below are the 8 new rules that millennials need to learn if they have any hope of thriving in today's world:

Rule #1 - Money is knowledge

Rule #2 - Learn how to use debt

Rule #3 - Learn how to control cash flow

Rule #4 - Prepare for bad times and you will only know good times

Rule #5 - The need for speed

Rule #6 - Learn the language of money

Rule #7 - Life is a team sport; choose the team carefully

Rule #8 - Since money is becoming worth less and less, learn to print our own

Learning these new rules of money will help millennials navigate a drastically different world. They still have the opportunity to surpass their parents, but they can’t do it the old way. They can’t rely on their parents’ advice and rules. They don’t just need to out-earn their parents — they need to out-think and out-grow them as well.

Millennial business trends can bounce back

I understand why a lot of millennials get branded as “entitled” or “spoiled.” In fact, I sympathize with them! They’re victims of unfulfilled promises and old ways of thinking and teaching that are way behind the reality of our world.

But that’s where the excuses have to stop. This might just be the wakeup call that gets Americans back on track and headed toward the American Dream.

If millennials can learn and embrace these new rules and mindsets, they can change the course of the nation for the better. We see it happening every day, with 25-year-old CEOs who think outside of the box running prosperous startups. They create and play by new rules, and we need more entrepreneurs like them.

The world has changed, and the next generation needs to change with it. Only then will they be able to leave a positive legacy, and achieve the New American Dream.

So please stop trying to climb that ladder. Don’t keep pushing your head against the glass ceiling hoping it will break. Instead, go where there is no ceiling and create something incredible.

Let’s show millennials the way with the CASHFLOW Quadrant

It’s clear this needle is moving in the wrong direction — so how can we redirect the next generation of female entrepreneurs? By taking action toward rewriting millennial business trends.

First, we need to identify and remove the barriers preventing them from pursuing entrepreneurship, such as unfair wages based on gender, the inability to secure funding, and student loan debt. It’s crucial that we, as a nation, gain a deeper understanding of the gap between their desires to pursue self-employment versus their ability to make it happen. Perhaps policymakers need to step in and make the path to entrepreneurship more accessible — it is, after all, part of the American Dream and our future economy depends on an entrepreneurial spirit.

Second, the female business owners need to step up and support these young women by mentoring them and providing resources to help them along their path.

For instance, it’s clear that they aren’t familiar with the powerful investment strategy of using Other People’s Money to fund their businesses — the NWBC report found that millennial-owned businesses use a larger portion of personal capital than prior generations. This is because they are risk adverse, likely due to coming of age during the great mortgage crisis and possibly watching their parents lose their homes.

Over 75 percent of millennials strongly or somewhat agree with the statement, “I am extremely wary of taking on business debt.” Also, 55 percent of millennial women strongly or somewhat agreed with the statement “I am willing to take financial risks in order to grow my business,” compared to 77 percent of millennial men. We need to help ease the fears these youngsters, especially the women, are holding onto by reassuring them that smart investments are not risky.