Summary:

Financial Education reduces money stress

Having excess of cash flow from our assets increases freedom

Actively invest in mentors

Three Causes of Our Excessive Money Stress

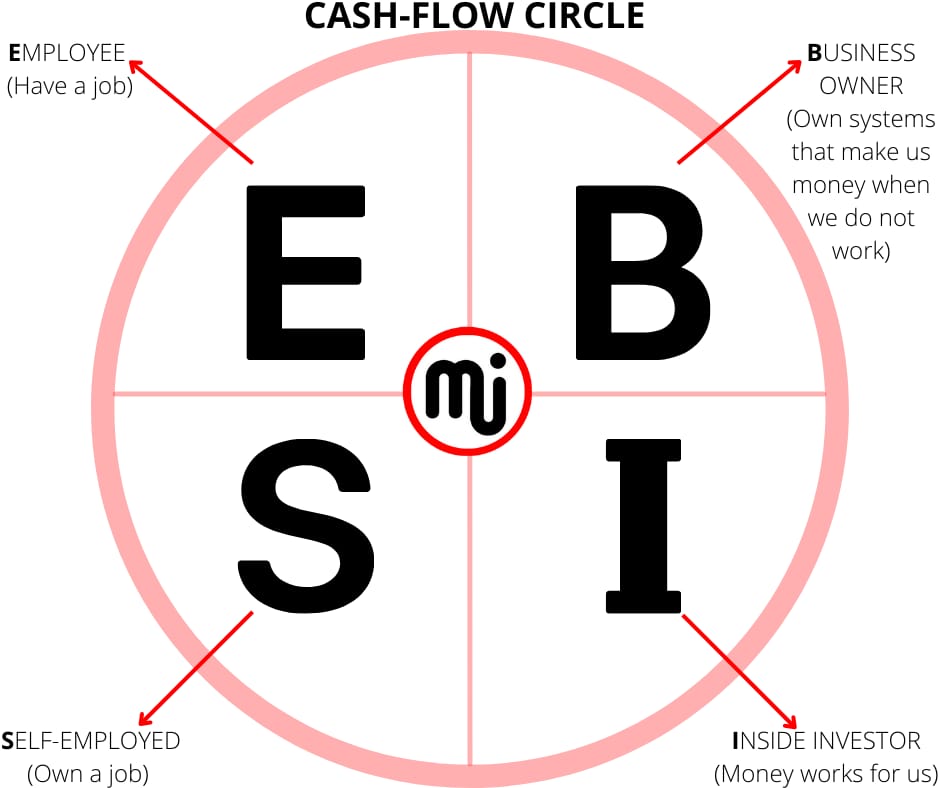

Depending on where we stand in the cashflow circle, there are differences in how we handle financial stress.

Majority of people avoid talking about money due to their context which they operate with that one found in the “poor mindset”. Those who operate on the left side of the cash flow circle are operating with the poor mindset. In actuality, people tended to steer clear of the subject. Obtaining a college degree and a well-paying profession at the time was considered essential to a stable financial future.

The majority of those who depended on well-paying employment for their income never achieved true prosperity, thus that goal wasn't always realized. Regretfully, it is still taught as the only route to financial independence. However, individuals who choose this route discover that their financial stress levels have increased.

People are anxious about money as a result of poor financial guidance.

The belief held by so-called "financial experts" to this day is that the safest place to be financially is in a high-paying job. There are plenty of lists available to assist you in identifying the highest-paying positions. Accompanying this is the conventional wisdom that says a college degree is a prerequisite for landing a decent job."A college degree is almost always required if a person wants a career path that is leading to high incomes and raises year after year, which psychologically really matters to people," says Tara Sinclair, chief economist at Indeed, in an interview with MarketWatch. Furthermore, as MarketWatch notes, "A college degree is more expensive and more necessary than ever to earn a decent living."

All of this is framed in the party line that says a person needs a college degree to get a high-paying job, and that position will secure the person a financial future. Nevertheless, it's interesting to note that, according to PwC's "2016 Employee Financial Wellness Survey," which was published by U.S. News & World Report, "In the United States, 52% of employees reported feeling stressed about their finances...among them, 28% reported that financial stress had impacted their health."

For what reason might this be the case?

It's as a result of poor financial advice that consumers have received. They have been informed by the so-called experts that obtaining a well-paying job—which frequently entails a college degree—is the most reliable route to financial success.

However, as the record of 3.3 million jobless claims in 2020 demonstrated, working, whether for a good salary or not, is truly a risky occupation if we wish to accumulate wealth.

Ultimately, the people who stand to gain the most are business owners and investors, with employees and independent contractors bearing the brunt of the consequences.

If feel powerless with money, which is why part of the stress exist.

Employees are powerless, while investors and business owners are in complete control. Just ask someone who was dismissed or laid off without warning about their sense of security following the event. There is frequently little an employee can do to change the company's poor judgments, even if they believe that's the case. They depend on the owners to ensure the success of their company.

What happens if a person own stock in our company or have stock options? This is a typical query that frequently demonstrates a lack of financial literacy. Realizing that there are various kinds of stock is crucial.

Because they are common stock, the stock options held by the majority of employees may appear to be a kind of control. Nonetheless, the majority of businesses provide many stock classes.

Consider the following Investopedia example:

Let's say that XYZ Corp. had two classes of common stock: Class A and Class B. Each class of shares is entitled to the same assets as the company. Put differently, out of a total of 100 common shares held by the company, 50 belong to Class A and the remaining 50 to Class B.

Assume that a shareholder has one vote for each of their B shares and ten votes for each of their A shares.

One Class A share gave us 1% of the company's assets and 10 voting rights at shareholder meetings. A Class B share holder would be entitled to the same 1% of the company's assets but would only be able to cast one vote at shareholder meetings.

Furthermore, a corporation will ensure that its founders do not option out more than a controlling position to any one person or group of employees, even in the absence of distinct classes of stock. They guarantee a controlling position in the business by doing this.

Who do we suppose is in charge of establishing these stock classes and deciding what proportion of shares is distributed?

The investors and proprietors of businesses. Their option plans are not designed to accommodate a loss of company control. That would only be possible if a wealthy and successful investor managed to acquire a majority stake. No worker will act in such manner.

Ultimately, options serve as a coercive tool to give employees the impression that they are part of the company and have power over it, even when they do not. Every employee knows in their hearts that this is reinforced by their daily contacts at work. It produces a subdued feeling of unease.

Employees pay the highest taxes, therefore their financial worries are intensified

Of all income brackets, employees pay the highest amount in taxes. There is really nothing that employees may do to lower their tax liability. They have to pay when it's tax time.

The capacity to expense several items and employ financial tools like depreciation, however, gives the business owner or investor the ability to produce phantom income—income that appears to be a loss and lessens tax liability. The tax code allows a lot of investors and business owners to use things like phantom income to drastically cut or even completely eliminate their tax liability.

To illustrate this, consider the CASHFLOW Circle.

Because of the nature of their income, those on the left side of the quadrant—employees (E) and self-employed people (S)—pay the highest taxes. We refer to this income as earned income. It's a wage or an upfront payment made to the individual. In essence, it is acknowledged as revenue that is directly related to the labor we perform. It also has the highest tax rate of any type of income.

Because their income is deemed passive, business owner (B) and inside investor (I) on the right side of the cash flow circle pay the lowest taxes. We can get passive income without working directly. Instead, it is the outcome of owning assets with strong cash flows that produce wealth independently of our own work.

Consider every McDonald's hamburger as an asset that generates $1 for the franchise owner as a basic example. After paying the employee's earned money from the hamburgers, covering operating expenses, and keeping a portion of the proceeds for himself or herself as passive income, the owner receives a dividend from the company. This income has the lowest tax rate.

This brings us back to the idea of control. Business owners and investors have all the control over how they can lower their tax burden. Workers don't. This also produces a subliminal sense of unease.

Majority of people lack a safety net, so their financial worries are stressing them out

Some people effectively sell their time as an employee. After giving that some serious thought, it will surely get a money stress melancholy!

For example: an employee may not receive compensation if he or she are not employed or if he or she is unable to work. This creates a significant obstacle for employees who get sick or hurt. Typically, individuals lack a safety net to shield them in the event that they are unable to work.

When someone asks himself, "How long could he or she survive if the salary was lost?" he or she will come to this realization.

On the other hand, prosperous inside investors and business owners make passive income from their investments or from the goods they sell.

They are earning money even if they are not employed. That's what real financial security looks like.

It's crucial to emphasize that this is not the same as savings, which decrease with each withdrawal. Wealthy investors and entrepreneurs build assets that bring in money even while they aren't working. In actuality, these assets frequently increase.

What does all of this mean, then?

In other words, our financial stress is a direct result of our position in the cashflow circle. Given that they should feel secure, it's understandable that employees experience such high levels of stress when it comes to money.

On the other hand, because they know how to make money work for them, receive passive income that pays their bills without them having to work, and have a safety net to protect them in the event of a catastrophic health catastrophe, many entrepreneurs and investors have low levels of stress related to money. When it comes to managing stress, they also think differently.

But how can one change their perspective? It's all about how we deal with financial uncertainty.

How do we handle adversity in our life?

Turbulence is dealt with by pilots right away. Given that the crew and passengers' safety is in jeopardy, they are at a loss for options. They make swift, wise decisions by relying on their instincts, expertise, and training. The majority of prosperous investors, business owners, and entrepreneurs immediately handle turbulence. Even in difficult judgments, they evaluate the circumstances and apply their expertise, network of support, and financial education to make wise choices.

Pushing our troubles aside and dealing with it later can be much easier if we are just starting out on our path to financial freedom.

We are not alone if this sounds familiar to us.

A cash flowing system and wealthy context

What should be at the center of our support system is resilience, or the capacity to bounce back from setbacks. We design our own framework that enables us to overcome the obstacles and setbacks that we will inevitably encounter on the path.

Say these two words to ourselves at every moment of turbulence:

"This too will pass."

"This will lead to something extraordinary and positive"

When we say them, we might not be grinning, but in time, we will come to believe!

In actuality, turbulence can be frightening, and the anxiety level may increase the longer we put off dealing with it.

It's also something we have to handle alone. Although they can offer us support, we shouldn't depend on our loved ones to make decisions for us. Science Daily reports that experts refer to this as "self-regulatory outsourcing." This is essentially what happens when we unintentionally depend on someone else to help us achieve our objectives, which makes us less likely to make decisions on our own.

As a novice investor, we may feel uneasy about the numerous choices we have to make. How do we handle uncertainty? Inhale and pose these queries to yourself:

What took place?

What kind of turbulence am I dealing with specifically?

Now what can I do?

Who better than me to call with greater knowledge on this?

What details are necessary, and where can I locate them right now?

What am I going to do, given my options, right now or as soon as I get the chance?

Answering these questions and taking quick action can help you gain control over the situation and prevent an issue—as well as needless worry—from getting worse.

Why financial crisis is valuable

An old English saying goes, "A smooth sea never made a skilled mariner."

Sometimes it's only a minor error, a letdown, an issue, or a failure. It all boils down to what happens when we don't know something. Extracting that "something" from the chaos is crucial.

And never forget this: when a person do not invest in their financial education and steer their financial path avoiding crisis in the economy, two things occur:

The person do not learn, and

He or she makes zero cash flow.

Therefore, equip ourselves with all the financial knowledge we will need to go with our mindset as a person successfully moves from the left side where we find the E and S, to the right side where the B and I operates in the cash flow circle. It will be a rocky journey but possible to overcome any obstacle along the way, so lets start building together the asset column. Every step of the journey will be worthwhile.

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: Strategies for Handling Financial Volatility

Comment, like, share and follow for more High Quality Financial Education Made Simple.