Summary:

Product, marketing, systems, legal, cash-flow, communications, leadership, and a strong team are necessary when starting a business without money.

When beginning a business without our own capital, taking advantage of tax incentives by operating with an entity is a smart way to grow our company.

We will discover how to create a business without money in steps 1- 6.

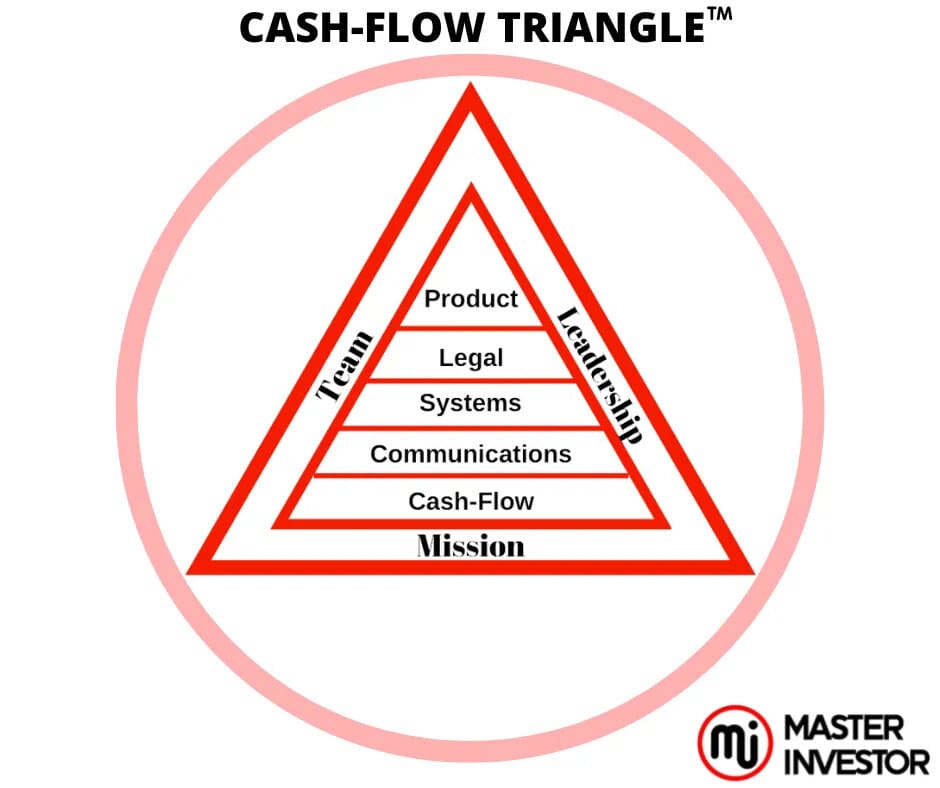

We were introduced to the idea of the Cash-Flow Triangle (see eBook “ How to Build Cash flow with the Internet"?”) in a chapter we cover all the components found in the cash flow triangle. The eight components are essential for any business to succeed and be profitable. In the first section of this plan on how to launch a business without money of our own, as well as the significance of determining our objective, establishing our authority, and putting the fundamental processes in place for success.

Read part one in its entirety here if we will need a refresher on everything we covered; if we are unfamiliar with the Cash-Flow Triangle, specifically, make sure we read this.

The key processes required to decide what product to offer, how to market it, build a staff, and expand our company will all be covered in this piece.

Introducing the Cash-Flow Triangle

How to Start a Business Without Money?

It requires constant financial education to master the ability to raise capital to fund our business ideas successfully. Once we can put the deal together that shows to be sound based on facts and the actual numbers, then money will find us our will find our money.

1- Upgrade our team

Life and business are team sports, observed the wealthy class. We cannot succeed in business by ourselves if we want to be successful. A team is required. Because of this, it is one of the eight components of the Cash-Flow Triangle, along with leadership, and Mission which is provided in this instance by us as we are the owners and the subject matter expert in the field.

This team also include mentors and books which devote time to learn from. Our team is those in our businesses and also in our mentorship list. We must always have mentors regards of how successful we are. There is always a twist that we can apply in our lives and businesses to take us to the next level.

We will require diverse experts on our team depending on the industry we are in. We can use freelancer as we need them for certain task. Today we can have systems and AI very much in our infrastructure to optimize the capabilities of the business operation to increase the bottom line (positive cash-flow). However, we should have a decent CPA, bookkeeper and business lawyer as a starting point. We can find in our network here in masterinvestor. From there, figure out what more we could need and get suggestions from people in our inner circle.

Using social media as part of the Cash-Flow Triangle is another technique to maximize communication, which is one of the component of the Cash-Flow Triangle.

Individuals enjoy spending more time on social media than they do offline. Utilizing social media sites such as Facebook, Instagram, Pinterest, and Twitter can therefore instantly allow you to reach billions of people through audiences. This will provide us the opportunity to interact closely with our audience and discover their preferences.

To keep our audience interested, sending out daily emails to your community or publishing content on a regular basis are also helpful tactics. Make sure our communication strategy combines product-related material (offers, how-tos, etc.) with valuable content (our SME content).

Building an audience on social media means offering value rather than focusing just on making sales pitches. That is going to alienate people.

When someone comments on your website, email app, or social media account, be sure to respond. These are the exact individuals to whom you will be making sales. Social media is powerful when it comes to fostering relationships and trust. Similar to real life, consumers prefer to purchase goods and services from businesses they trust.

3- Create or find a product that is in high demand

We haven't talked much about making money thus far. We haven't spent a lot of money either, either. We've spoken about how crucial it is to comprehend our sector and establish our presence in the market.

Even social media is giving us some momentum.

Congratulations! We have now defined our goal, handled cash flow (by continuing in a day job), and put in place some systems and communications. Let's choose the product to sell now.

We advise utilizing the strength and speed of digital products before devoting the time and effort necessary to sell tangible goods.

Do we recall those blogs we have been writing that address issues in our markets? That seems like a great resource for our initial product idea.

Assume we would like to work in the home garden sector. We have studied the industry and are aware that different soil types lend themselves to different flower-growing techniques. Perhaps we talked about each technique on our blog.

Make an eBook or pay some to make one using OPT (other people time and talents) and OPM (other people’s money like the bank’s money) to start our business without money. .

It shouldn't take much work on our behalf to do this. Actually, we can merge them into a single document using a basic program like Google Documents, and then export it as a PDF.

If a person is struggling to decide what to make, check out Barnesandnoble.com or Amazon.com. What draws our attention? Do we believe we can perform better? Think of ways we can do better by innovating.

4- Generate positive cash-flow (passive income)

The eBook is finished. It has been refined into a coherent product suitable for printing and large distribution. However, why pay for its printing? Why not sell it online and take use of the community's strength?

Initially, we will have to save it online somewhere. After uploading it is complete, copy the URL and begin promoting it. Make use of our email list by running daily sales. Use our social media following's influence to assist get the message out.

After determining the best location for storage, we must determine how our consumers will purchase it. Payments can be made online via PayPal or Stripe, which are the two most popular gateways that are secured.

PayPal: provides support for online money transfers and acts as an electronic substitute for customary paper-based transactions using money orders or checks.

Stripe: makes it possible for companies and private individuals to take payments online.

Law is a crucial component of the Cash-Flow Triangle's integrity. We must have terms and disclaimers, privacy policies, return policies, and more if we are selling a product and developing a list.

It enables them to alter their key customer interaction practices, goods, and business strategy in order to increase sales.

Because of overconfident entrepreneurs, the significance of a second view is frequently underestimated in the business world. To ensure that our organization gets off to a good start, we must, however, make the most of the testing data. Never forget that a concept that seems good on paper may not work well in the marketplace.

The worth of our product or service will be determined by the market, so we need to have an acute awareness of when to listen to it. Being able to adapt will set our company apart from other budding entrepreneurs who are set in their ways with their preferred course of action and ideas.

5- Extending into tangible goods

We have succeeded! Sort of, anyway. Maintaining communication and expanding our network are important. Keep updating our online presence with new information and promoting our digital product to both existing and potential clients. It may be time for our business to get physical at this point.

Every month, millions of things are sold on Amazon alone. All those products fit into an industry of one kind or another. That also applies to the floral shop we previously launched. Consider every kind of tangible good we could provide to promote our digital eBooks, and vice versa.

Pots, dirt, gardening equipment, gloves, watering hoses, seeds, and so forth There are countless items on the list.

6- Raising money to se for a business

It's time to start looking for loans, venture capital, angel investors, or even crowdsourcing after we are certain that our business will succeed. Our approach to raising finance will be influenced by the kind of business we establish.

Although partnering with investors is highly encouraged in the startup and entrepreneurial communities, we are not restricted to individuals. Additionally, we have access to a number of lending programs designed to support entrepreneurs and small enterprises.

For startups in need, the US government has approved various lending programs offered by the Small Business Administration (SBA). But in order for our company to be eligible for the loan, it needs to meet a certain requirements.

If we operate a business in the US, it must adhere to SBA rules and be completely compliant with all applicable local laws and regulations.

That being said, having the government pay us to start a business is the best way to start a business with no money. An effective tax plan for our company might provide the first funding we require to get going. The excellent accountant we added to our team, our accountant, may assist us in determining the prospects in our industry.

In addition, our business needs to turn a profit and maintain a solid credit standing. We can also ask for money from our friends, family, and other network members. We might even want to enlist the assistance of a co-founder to assist with fundraising and other administrative tasks. When we have a solid business plan that is prepared for implementation, the options are virtually limitless.

Money is a useful instrument

We have an alternative perspective on money. We believed it is ridiculous to live our entire life working for earned income and acting as though money didn't matter. We think that although money was necessary to support life, life itself was more vital.

We only have so many hours in a day, and we can only work so hard. So what good is working for money? Acquire wealth and make others work hard for us so that we may devote our time to the things that truly matter.

Wealthy people’s values for investments are driven by:

With ample time to do what we love

Having excess of passive income to contribute to worthy causes and endeavors we are passionate about

Providing the economy with jobs and financial growth

Possessing the resources and freedom to optimize the four pillars of extraordinary life: health, wealth, love and happiness.

Being able to take his family on international travel

That requires money. Money is significant to us because of this. Mastering how to invest successfully it is important regardless of who we are. Money will always be part of our lives one way or another. Lets master one of the games that we all have to form part off.

We know that accumulating wealth produces a lot more stability and comfort than a life without it, and that happiness is made possible by wealth too. Money simply magnifies who we are. The same thing would eventually be discovered by the poor mindset but far too late in life.

What matters to us?

The majority of people value the same things that wealthy people do but they are afraid of failure and start their venture. We just have to be right one time and we reach the American Dream. Total freedom and ability to express oneself.

But most people’s attitude toward money is the reason majority will remain with the poor mindset. Meaning they will be left either in the middle class or poor class. Additionally, majority of people that are unwilling to seek financial education are unable to completely do the things that were significant to the wealthy due to their values they operate with regarding money.

While money isn't everything, it answers everything, and it does enable us to pursue our passions.

Money does not make us happy; rather, the things that money can buy make us happy. Thus, deciding what matters most to us and how money may help us attain those goals should be our first priority before starting a business.

Wealthy people evaluate investments differently

Wealthy people value investments differently than the average person. This is how it appears:

Wealthy

Comfortable

Secure

All three are significant in the realm of business and investing. The sequence in which we place them is a very personal choice that will determine whether we achieve financial freedom. It should be carefully consider before making any investments.

Poor dad prioritized security over all else. A business owner and inside investor prioritize wealth over all else. It's critical that we determine which matters the most to us. We have to be uncomfortable when building wealth because we are always suppose to be growing.

Which values do we invest in?

Having wealth, comfort, and security are fundamental human desires. There is no superiority between the two. But choosing which of our basic principles is most essential can frequently have a big long-term effect on the kind of life we lead.

Knowing which of your basic values are most significant to us is crucial, particularly when it comes to money and financial planning.

We might want to spend some time today listing our values in order.

It can require us to process our actual emotions during this procedure. Discuss it thoughtfully with a partner or mentor. List the pros and cons.

However, understanding our own priorities will help us avoid a lot of painful choices and restless evenings in the future because we are optimizing for the appropriate values to build wealth.

Money is good not evil

majority of people who worked hard for their earned income, those who have the poor mindset, firmly believed that having an overwhelming desire for money is a sign of greed and that having too much of it is a sin or something bad.

The poor mindset usually don’t discuss finances with others because they have been taught that talking about money is not classy, which is the biggest lie of all. We must talk about money if we want to have a lot of excess of cash flow to the point that we are financial free and building true wealth. The financial illiterate thinks that material wealth is unimportant in life.

Must people will mention this repeatedly:

"Money doesn't really interest them."

"They will never be wealthy."

"They are unable to pay it, they can afford it."

"Investing is dangerous."

"Wealth is not everything."

But true wealth is everything because it provides us with total freedom and the support to fulfill our purpose and live though our passions daily. The lack of money is evil better put. Most people lives will be happier if they just master passive income to improve their financial situation overall and relief stress about lack of money.

Here at masterinvestor we master money and we make it our slave through sound investing.

Comfort and security without wealth don't bring us happiness

Despite scientific evidence to the contrary, it is not unexpected that a large number of people refuse to accept the idea that wealth can bring happiness.

People frequently invent stories about money to support their investment ideals since most people's primary motivations in life are security and comfort, and many of them have complex views of money from their early years.

To begin with, the majority of individuals like to claim that having money will make us sad in order to justify their own lack of it.

Some people's perceptions of money are influenced by the lessons they learned as young children, such as the idea that "money is the root of all evil" and that it should be shunned, avoided, and demonized. The enemy is everyone who makes money. The wealthy are against the poor which is not true.

Some people value money beyond anything else. To obtain it, they'll put their integrity, friends, ethics, intiegrity, and family at risk. The world is dog-eat-dog. Although that is wicked, money is not inherently bad.

Money is just a tool for some people, though

Our lives are frequently shaped by our perception of money. Furthermore, a lot of the time, our conception of money is something that is unseen, uncritically accepted, and instilled in us from an early age.

Because we don't fully comprehend money and how it functions, it often dominates us in ways that are incomprehensible to us.

The majority of people believe that comfort and security will make them happy, but we've all worked with unhappy people who don't face an immediate threat to their jobs. This is due to the fact that financial resources permit happiness far more so than safety and comfort.

How having excess of passive income might actually make us happier?

These folks frequently express the opinion, "They will rather be happy than wealthy." Wealthy people have often been poor people. They would contend that both situations had both happiness and unhappiness. Which raises the question: Why is it impossible to be wealthy and happy at the same time? Actually it is possible as long as the person behind the money is happy without money too. Happiness must come fro within not form outside. Then, money simply magnify who we are as people.

In actuality, what individuals are really saying is, "They would rather feel comfortable and safe than wealthy." This is because they are not pleased when they are uneasy or uncertain.

Furthermore, this is a crucial topic. Most wealthy people are prepared to experience discomfort and insecurity in order to succeed. Put differently, we are willing to accept the necessary risks and make the necessary sacrifices to become wealthy.

These people who posses the poor mindset will also likely say that "money doesn't buy happiness." As it happens, science proves that to be false. A "The New York Times" story describes a multi-decade Swedish lottery winning research including hundreds of participants. As stated by the Times:

Compared to lottery losers, lottery winners reported feeling significantly more content with their life. Additionally, winners of awards totaling hundreds of thousands of dollars expressed greater satisfaction than those who only received tens of thousands.

These effects last a very long time. Even twenty years after a significant victory, they were still visible. (The data needed to determine even longer-term effects was unavailable to the researchers).

The study used a variety of metrics to quantify happiness, such as subjective responses, mental health, and individual financial behavior. It's evident that having money might actually make us happier.

Again, people can be happy whether they are wealthy or not, but because of the opportunities that come with wealth, those who concentrate on accumulating riches are far more likely to experience true pleasure.

So we have three main options or motivations for investing when it comes to money:

safe,

comfortable, or

wealthy.

All three options are significant, but we the way people prioritized those options distinguished those who are wealthy from those who are poor.

The majority of people earn money in the above-mentioned order. This indicates that security, comfort, and wealth are their top priorities when it comes to investing. For this reason, the majority of people prioritize having a stable job. Once they have a stable employment, their priorities shift to comfort. Their last priority is building passive income and true wealth through sound investing. We must place wealth above comfortable and security in order to achieve total freedom.

Most people will give up on becoming wealthy if it disturbs them or makes them feel insecure.

In Conclusion

This is the ideal moment to begin, so let ‘s go forth and work smart. It is inevitable that blunders will occur sooner rather than later. We must prepare for any type of economy or situation y controlling assets that'll cash flow positively to us without us working. We are aware of the proverb that states that failure serves as the foundation for success. The phrase that it takes money to make money is not accurate, what it takes is financial education before we can make money make money money. Creativity and innovating goes a long way when building our wealth maximizing advance strategies to create passive income and infinite return on e investment. (IROI).

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: Start A Business Without Our Money

Comment, like, share and follow for more High Quality Financial Education Made