Summary:

The secret to a successful investing strategy is to keep in mind that there is no right or incorrect response.

Make sure we comprehend both long and short positions before making an investment.

Being able to simultaneously hold two opposing views is a sign of a sound investment approach.

Teaching children to live in a world of "right" or "wrong" is one of the issues with education. That isn't clever, and it's not realistic. Similar to real life, there are frequently multiple options or solutions in the realm of investing.

There is just one correct response in the classroom. Teachers search for the correct answers when grading tests.

If our correct responses match those of our teacher, we are also regarded as intelligent in school. We are a "A" student if the answers we provided match those of the teacher and books.

The basis of academic education is the notion that there is only one correct answer.

There are multiple correct answers in real life.

For instance, for most people 1+1 equaled, "2." But somebody else the answer would be "11".

For this reason, one many are poor and only small percentage are wealthy. Due to the fact that the small percentage of those who reach our financial goals are those who are willing to unlearn old ideas and philosophies about money and adopt the new rules of money with the appropriate wealthy context. Which requires devotion into learning daily about financial education.

Well-made investment or a well-made investor?

Good or terrible investments don't exist; there are only good or bad investors. Stated differently, the value of the investment depends entirely on us.

The capacity to hold two opposing ideas simultaneously in the mind and still be able to function is the test of first-rate intelligence.

It is not new to discuss opposing viewpoints. Let's take a different approach. We know that all coins have three sides: the edge, the heads, and the tails. Most people only two sides.

The smartest individuals are able to view things from both sides and live on the edge.

Many graduates of schools hold the belief that there can only be one correct solution. Traditional schooling closes students' brains instead of opening them. After school, children come to believe in a binary world of good or bad, black or white, intelligent or stupid. This is the main cause of the dislike of education felt by a large number of people, even many "A" students. Students only see one side of an issue if they never reach the edge, or the point of view where they can see both sides. One response, one viewpoint, and one point of view.

The capacity to examine financial matters from multiple perspectives and approach the topic from a variety of angles is known as financial intelligence.

Here we describe the measure of a "first-rate intelligence" as "the ability to hold two opposed ideas in the mind at the same time." Put another way, the concept of right and evil that is taught in schools is illogical. It is actually foolish because right and wrong fails to consider the opposing viewpoint.

The foundation of all conflicts, debates, divorces, discontent, aggressiveness, violence, and war is the concept of right against wrong.

A sound investment plan takes both long and short positions into consideration

There are many opposites in the finance industry, such as income and expenses, assets and liabilities, and bull and bear markets. We frequently categorize these polarities in our environment as either positive or evil. We don't have a right hand and a wrong hand, we have a right hand and a left hand.

Let’s explains this in further detail and how it relates to investing.

Joe, Karla, and the Oil Price

To better understand this notion, let's examine a relatable example of an investing opportunity. There are two individuals: Karla and Joe. Every day, Joe drives to his place of employment. He has income and costs in his life, just like everyone else. The price of oil rises far from Joe’s residence. When he visits the gas station the following day, he notices that the price of gas has increased even if he is unaware of the factors driving up the price of oil. For Joe, this is significant because a rise in petrol prices means paying more money.

Without any fault of his own, Joe will have to lower his monthly cash flow in order to cover this cost increase.

Let's now examine Karla’s circumstances. Karla made an oil well investment a few years ago. As Joe’s oil price rose, Karla’s oil price rose as well. Karla didn't even have to move a finger, but her monthly checks from the oil well increased rather than decreasing her cash flow.

There are two perspectives to this one occurrence. Depending on our point of view, the recent spike in the price of oil may or may not be good news. It's critical to comprehend this in relation to the stock market.

A large portion of an investor's wealth is invested in plans like an IRA or 401(k), which makes them pleased in rising markets and sad in falling ones.

Recall that we wish to abandon the idea that investments are good or bad. Rather, we ought to acknowledge that they are only antitheses to one another. Once we grasp that, we may benefit from both sides.

The markets cannot be made to move in a way that suits our desires. However, what if there was a way for us to add more assets to our column as the market declines? What if we were able to take advantage of a market decline?

Marco’s Phone: The Wise Investor

This is an additional instance of financial knowledge elucidated by means of short and long positions.

Millions of people will want to get the brand-new Z9 phone that a well-known mobile phone manufacturer is about to release. However, the Z8 version is currently being sold by the mobile phone business, and buyers are grabbing it daily for $600.

Marco understands that the present Z8 model will almost completely become outdated when the new Z9 model is released after learning about the new phone. Marco believes that when the new one arrives, it will only sell for half of the $600 it presently sells for.

Let's think about how Marco may profit from this situation given his desire to invest without using any money and his knowledge of the future. Marco starts by speaking with Sally, who no longer needs her Z8 phone. Marco gets Sam to lend it to him for a few months. Marco just promises to provide Sally a Z8 phone soon; he doesn't pay her for it. Thus, Marco’s borrowed phone is now included in his asset column. But since he still owes Sally the money, it also appears in his liabilities column.

Marco is going to take that Z8 phone and put it up for $600 on the list.

Marco finds a buyer in a matter of days, and he ships it for $600. Marco’s phone is no longer listed in his assets. He has the $600 he recently made from selling the phone instead. He still owes Sam the phone, as shown in the liabilities column.

As Marco had predicted, the price of the Z8 phone drops shortly after the debut of the new Z9 phone. The Z8 is currently only $300 on eBay. Marco then pays $300 for it and gives Sam back the Z8 phone. Sam is pleased that Marco followed through on their arrangement and earned $300 without having to make any initial investments.

Go here to view our available classes if we would want to learn how to handle these transactions on our own.

Long and short of positions

We want to acquire something and hold onto it so that we can profit when its value rises when we expect that its price will rise. However, we prefer to borrow something rather than buy it when we think its price will drop. That positions us to benefit from price reductions.

We will see that Marco bought low and sold high when we examine his actions with the phone in detail. We refer to this conventional strategy of purchasing low and selling high as a "long position." Although the transaction in our case was comparable, it became a "short position" since we borrowed money, sold it, bought it, and then gave it back.

The advantage of short positions is that they enable us to make money regardless of the state of the market. The conventional wisdom is that we save money and pay off our debt. However, as we've covered in this section, owning anything if we believe its worth will decrease is not a smart idea. We don't want to possess something when we know its worth will drop. We would like to borrow it instead.

To have additional material in the asset class of paper assets then go to our website.

What is financial intelligence?

There are numerous ways to define and interpret intelligence. For the sake of this article, finical intelligence is simply the capacity to see the world of money from a variety of angles and viewpoints rather than falling into the trap of a right-or-wrong world that is promoted by our schools and others operating with the poor mindset context.

There is no right or wrong, good or bad, about the stock market rising. The collapse of the real estate market is neither good nor bad, right or wrong.

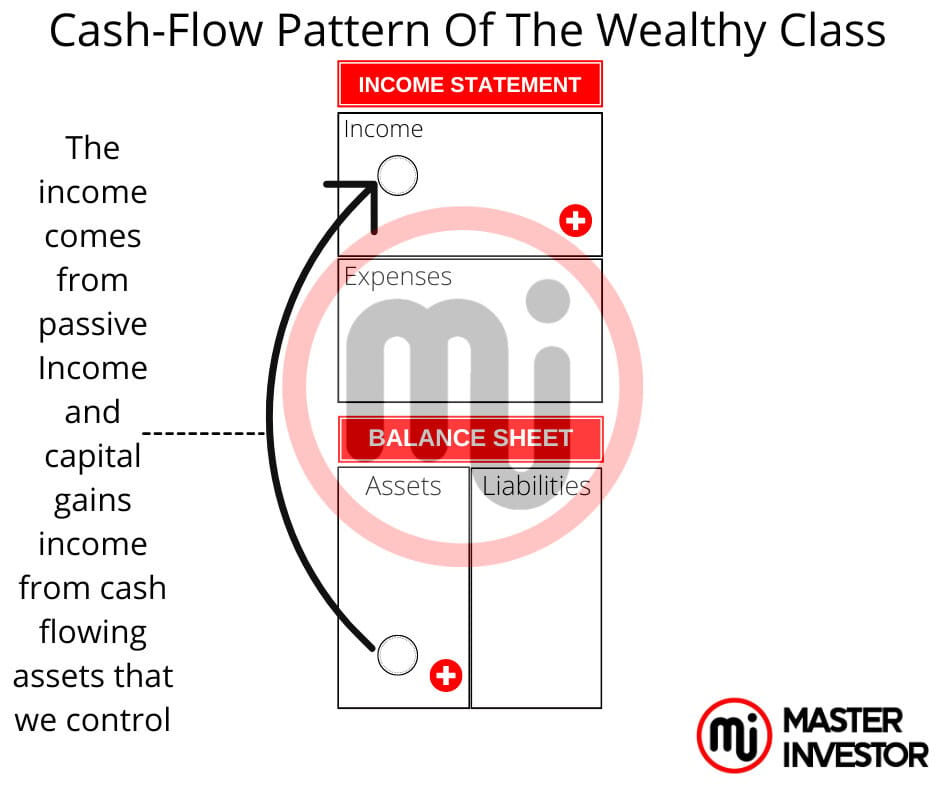

But there are three different cash flow patterns in financial statements from the different economic classes. We want to focus on building the assets column with sound asset we control with our companies.

It is up to us, the shrewd investor, to decide if our investments are profitable or not. We have the upper hand. Gaining knowledge gives us a lot more power.

Our control is given to someone else if we decide not to pursue education and live in a world where everything is dogmatically "right or wrong."

The level of Self-Actualization is the greatest level of human existence. The ability to confront the world with a "lack of prejudice" and "acceptance of facts" is known as self-actualization. There may be more than one correct response, for example.

A person who achieves self-actualization and becomes a good investor is also giving rather than taking.

It is in people's tendency to become takers rather than givers when they are living in dread and do not feel safe.

The lesson is: Our intelligence will increase if we keep an open mind to divergent viewpoints. Our ignorance is in charge if our thinking is closed to different viewpoints. Knowledge or ignorance? It is a deliberate decision on our part to be able to accept different points of view and maintain an open mind. And one that has the power to change our destiny and open doors for us.

Thus, the next time an opportunity presents itself, consider what a wise investor would do. It could be time to further our financial knowledge if we don't already know.

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: Profit Is Always Made by An Skilled Investor

Comment, like, share and follow for more High Quality Financial Education Made Simple.