Summary:

Appropriate budgeting is the secret to financial success.

Comprehending the distinction between an asset and a liability is crucial for appropriate financial planning.

Spending will make us wealthy; saving won't.

There are two mindsets when it comes to money: poor vs wealthy mindset. We can study the wealthy and poor mindset. Then, carefully chose the one that we wish to operate with, our context is critical. Today we must be able to to handle pressure and withstand it in order to be a successful entrepreneurs and investor.

Which frame of mind apply to us?

Saving is an ineffective method when it comes to achieving financial freedom. It's crucial to keep in mind that money is only a means of exchange; it cannot have worth unless it is converted into something else. Money dies if it stops moving, similar to an electrical current.

A common misconception is that investing is the same as placing money in an interest-bearing savings account. Regretfully, inflation has the potential to cancel out or even neutralize the interest earned. Saving money therefore implies that our money is not increasing at all. In fact, as inflation outpaces our profits, there's a good possibility our money will lose value.

Because of this, one must budget like a wealthy person in order to become wealthy.

As an aside, too often the extra money is spent on something like a vacation or a new car, meaning money that could be working for us is now making us work for a liability.

First, we must build or acquire the asset, then with the revenue from it, we will spend on the liability we want to have and that way it is free because the asset is paying for it.

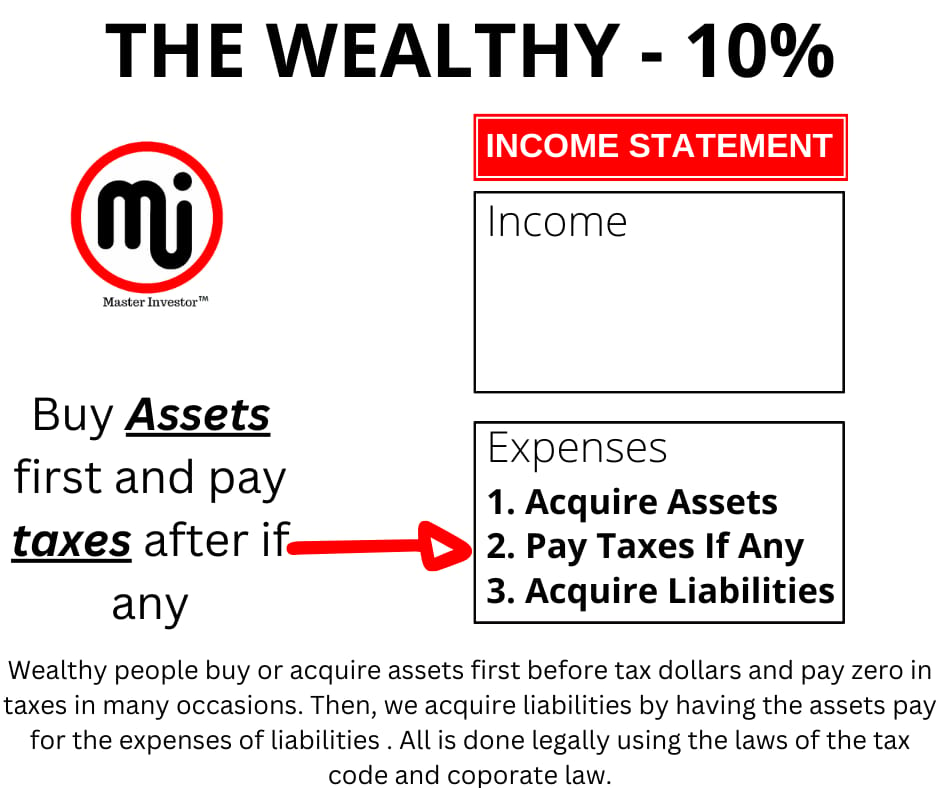

How wealhty individuals manage money

Once more, saving alone is not a winning path towards true wealth.

There are countless tales of currencies collapsing to nothing. However, the truth is that instances of financial saving gone bad can be found without going all the way back in time.

For instance, the US dollar and the Zimbabwean dollar were equal in value in 1983. By 2008, the same US dollar required 669 billion Zimbabwean dollars to be exchanged. People that stored Zimbabwean dollars lost a lot of money because the country was completely destroyed by hyperinflation in the early 2000s.

Cash is, in essence, a sum-zero game.

So how can one win if a saver is a loser? Start by examining our budgeting process.

The wrong mantra that others have adopted to “Live below your means” which is what majority of people have been taught. That is the context of the poor mindset that ultimate shrinks the entrepreneurial spirt rather than expanding it as it should be.

We must expand our asset column and live above our means.

The poor mindset’s way of handling money and budgeting is all about reducing costs to match their income. Paying everyone else first and then enjoying what is left, if any, is his or her top focus.

The goal of the wealthy mindset is to raise his our passive income which requires as to become great at raising capital legally. It was crucial that we take care of our expenses after paying ourselves first. Our budget is a plan to become wealthy; most people use budgeting as a plan to become poor or middle class (poor mindset) rather than to become wealthy.

So without further ado, let's examine the four wealthier people's budgeting financial guidelines.

Clue #1: An cost is a budget surplus.

The wealthy mindset taught us a valuable lesson here: "We have to make a surplus an expense."

We are making reference to the notion that the majority of people consider excess money to be an asset, and they support this perception by depositing it in the bank or using it for debt. An inside investor and wealthy entrepreneur see additional money left form our assets as an expense for investing, and charitable giving rather than as a resource.

The issue is that most people are paying everyone else first. To make matter worse they do not get wealthy, because they put investing in assets, and charitable giving as things to do after their bills have been paid. However, the wealthy mindset prioritize and budget for investing and give back by investing and paying ourselves first.

This practice, known as "paying ourselves first," involves setting away some cash flow emergency reserves.

The secret to knowing how to save money and become wealthy is this. Wealthy individuals use our extra excess of cash flow as a safety net. Just in case things turn tough. We may be unable to quickly sell our assets or other possessions. We do not use our extra cash flow to buy liabilities before we buy assets. The way the poor mindset spends money which is buying liabilities first and often never own any assets. That is what most people wrongly do. As an added piece of knowledge, aim to have available around six months' worth of living costs at all times but focus all the time on increasing the asset column by actively investing.

Clue #2: Our financial future is determined by the expenses we list first

Bankers don't care about our grades from schools once we step foot in the real world. Instead, our financial report card is the only thing that interests them.

A financial report card: what is it? Our personal financial statement has the solution.

All of our revenue sources, including earned (paychecks, tips, and wages), passive (cash flow from real estate), and portfolio (dividends from investments), should be listed in the income portion of our income statement. On the other hand, our monthly expenses should include all of our automobile, insurance, and mortgage payments.

Look no further than our cost column to make predictions about our financial future.

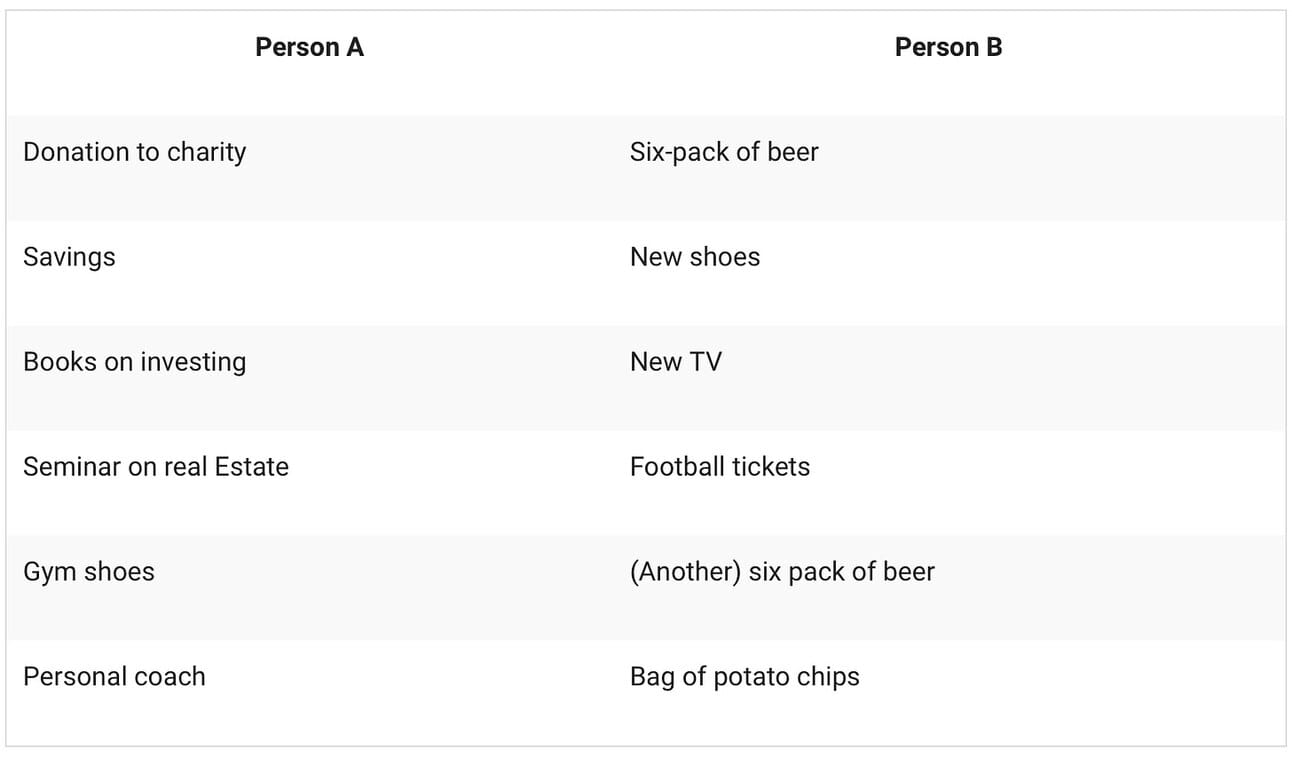

A comparison of two distinct expense columns may be seen here:

Even though it's a funny example, it's not too dissimilar from reality. The majority of people's spending columns are cluttered with payments to creditors and other parties. Expenses in each scenario only go toward items that permanently drain our bank account—never toward something that will generate revenue.

Look at our expense column when we review our budget for this year. In what way does it describe us? It will be harder for us to get wealthy if it resembles the right column above rather than the left column. How is are the expense being paid from the asset column or a job?

Clue #3: Make our assets duty to cover obligations

As we covered above, the majority of budgeting tools assist us in better understanding our finances by directing us to use a spreadsheet or budgeting template to make a list of our monthly income and expenses. Although this is a fantastic place to start, the income statement only provides us with a partial view of our finances. We must comprehend how our assets and liabilities compare in order to comprehend our overall financial situation.

Asking oursleves "how can we afford it" will help us avoid stating the opposite which it would be denying that one has the capital now to acquire xyz.

We can buy luxuries and liabilities by increasing our assets, which we can start with real estate investments, and acquire or build businesses that boost monthly cash flow. Invest our money until the asset generates the necessary cash flow to buy the lovely car we have always wanted. We will then have a wonderful asset in the form of a car. The most crucial thing we can do to get wealthy is to prioritize taking care of and paying ourselves first in our budget.

Tip #4: Spend to get wealthy rather than save.

Developing a mindset that states "when the going gets tough, the tough get going" is necessary to be able to implement the first three budgeting suggestions. When things are hard, most people quit saving, investing, and giving to charities. The budget of the wealthy is not like that. Even in hard times, the rich find methods to increase their income by investing more in assets.

We gain a mindset that will allow us to earn more money regardless of the situation by persevering through those difficult periods. We will become wealthier than we ever dreamed of as a result.

We shall start a company our goal is to become financially independent and have total freedom as we grow our wealth.

We are able to achieve our financial aim faster than ever due to technology and social media power. We know that we are financial free once we acquired a steady stream of passive money that paid our bills each month.

However, if the reader, have bad debt right now and regardless of the amount just know that there is a way out by focusing on the asset column. A person may have over $1 million in bad debt when he or she first starts a business, bad debt shouldn't be a poor excuse to hinder us to build true wealth. Bad debt should not make anyone give up, even if the person with bad couldn't bring him or her to seek employment, and couldn't settle into a middle-class lifestyle. We must be aware that accumulating assets is the only path to financial independence. This meant that in order to be held accountable, we need to pay ourselves first. We need to be using legal investing strategies to produce passive income.

Must people disagree with acutely investing due to fear and lack of financial education. Therefore, the financial illiterate gives money away to liabilities that often they believe they are asset such as 401k, mutual funds, bonds and others alike. Primary, they lack the free time to make money make more money through sound investing. Wealth is measure with free time and not only with money.

We may need to talk to our bookkeeper and get her or him to speed with our shift in mindset or upgrade the bookkeeper as they are part of our wealth empire. Today we can use software to do the books for us daily review of our cash flow. This give us the push we need to look for additional funding from cash flowing assets that we control with our own companies.

New companies must be treated like big companies and vice verse. To ensure we are growing a successful business regardless of how big or small may be.

We may as wealthy entrepreneurs have to endure the short-term suffering in order to raise our level of financial literacy, invest in assets, and become financially independent. The American Dream is more vivid than ever. Now the entire world can tap into unlimited wealth with the use of information and the internet.

The power is in what we know about money, in other words, our finical education needs to be on point daily.

We will gain the wealthy mindset by investing in our financial education that allow us to increase our passive income regardless of the economy. As long as we can withstand pressure and by persevering through difficult periods we can assure that the rewards are far beyond we can ever dream to experience which is total freedom.

The message is to crate a budgeting plan (investing plan) only to become wealthy and not poor. By simply first investing in our financial education and then turning our money into passive income.

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: Invest Money To Become Wealthy Fast

Comment, like, share and follow for more High Quality Financial Education Made Simple.