For everyone who loves real estate! Are we ready to master how not to be left out of the real estate festivities because purchasing, maintaining, and selling properties seem like an enormous hassle? What if there was a method to profit from real estate investing without getting our hands dirty in the details of becoming a homeowner?

Greetings from the amazing realm of Real Estate Investment Trusts, also known as REITs. Come along with me as we investigate this little-known but possibly profitable area of the investment landscape, where we may partake in the feast without having to cook the whole meal.

REITs: What Are They?

Friends, real estate investment trusts, or REITs, are a unique type of investment vehicle that let us invest in real estate without actually owning or managing properties.

Consider it as a chance to become a landlord without having to deal with troublesome tenants or leaky faucets. Companies that own, manage, and even finance real estate properties that generate income are known as REITs. These assets could be anything from office buildings to retail centers to residential complexes. The final flourish? According to law, REITs must pay dividends to shareholders equal to at least 90% of their taxable income. Thus, we won't have to work hard to enjoy a consistent income stream if we buy in a REIT!

Types of REITs: Discover Our Ideal Dancing Companion

Generally speaking, there are three types of REITs from which to pick, according on our investing objectives and risk tolerance. Let's examine each type in brief:

Equity REITs: These shady guys, known as equity REITs, invest in and own real estate. Rent collection from renters is the main source of revenue for them. The most popular type of REITs are equity ones, which are renowned for offering both the possibility of long-term financial appreciation and a consistent income.

Mortgage REITs: Mortgage-backed securities and existing mortgages are investments made by mortgage-REITs, also referred to as mREITs. These REITs also lend money to real estate owners. The interest on these assets provides the mortgage REITs with their income. Although they have the potential to yield better returns than equity REITs, they might also be slightly riskier.

Hybrid Real Estate Investment Trusts: As the name implies, these REITs include mortgage and equity components. In order to diversify their holdings and strike a balance between risk and return, they invest in both real estate and mortgages.

Investing in REITs: How to Get a Pass to the Event?

Okay, so how do you get into the REIT fun? Two choices are available to us:

REIT Stocks: Using a brokerage account, we may purchase individual REIT stocks in the same way that we would shares of any other corporation. Investigate REITs carefully, select those that best fit our investing objectives and risk tolerance, and begin constructing your real estate empire, one share at a time.

Exchange-traded funds (ETFs): And mutual funds for real estate investment are good options if we wish to reduce risk and diversify our real estate holdings. These funds combine the capital of investors to purchase shares in several REITs, offering immediate diversification and expert management.

*Warning: Investing in funds makes it considerably more difficult, if not impossible, to research the companies and property managers overseeing our interests.

The Benefits of Being a Real Estate Wallflower: Why Invest in REITs?

After discussing the fundamentals, let's move on to the advantages of investing in REITs. Why ought we to think about including them in our portfolio?

Passive Income: As I indicated before, REITs must pay out dividends equal to at least 90% of their taxable income. This implies that you won't have to do any work in order to receive a consistent flow of money. Bid adieu to the inconveniences associated with conventional real estate investing and welcome to passive income.

Diversification: It's common knowledge that you shouldn't put all of your eggs in one basket. We can diversify our investment portfolio and spread our risk throughout a range of real estate property types and markets by making investments in REITs. This might lessen the impact in the event that a particular industry or area encounters a decline.

Liquidity: Because REITs are listed on major stock exchanges, they offer liquidity in contrast to traditional real estate investments, which can take months or even years to sell. This increases the flexibility and accessibility of our real estate assets by enabling us to buy and sell our shares with ease whenever necessary.

Possibility of Capital Appreciation: Although REITs' capacity to provide income is their main draw, they also present the possibility of capital growth. In addition to dividend income, the REIT's share price may grow if the underlying properties in its portfolio appreciate in value. In this scenario, we could realize capital gains.

Professional Management: Purchasing a REIT is akin to contracting with a group of real estate specialists to oversee our investment. We can be confident that our investment is in capable hands since these specialists possess the knowledge and expertise necessary to make wise choices regarding finance, property acquisition, and management.

The Negative: Dangers and Consequences

It's important to take into account the dangers and disadvantages of investing in REITs before jumping in headfirst:

Market Risk: REITs are susceptible to changes in the market, just like any other type of investment. The value of our investment may increase or decrease in real estate markets due to erratic market movements, fluctuating interest rates, and prevailing economic conditions.

Interest Rate Risk: REITs are susceptible to changes in interest rates, especially mortgage REITs. The cost of borrowing for developers and real estate owners may go up in response to rising interest rates, which might lower rental revenue and property prices. The performance of your REIT assets may suffer as a result.

Management Risk: The caliber of a REIT's management team has a major impact on the company's performance, just like it does for any other business. Ineffective asset management or overpaying for real estate are two examples of poor management choices that can negatively impact the success of the REIT and our investment returns.

Leverage Risk: To finance real estate purchases and other investments, some REITs employ leverage, or borrowed funds. This can increase profits when the market is doing well, but it can also increase losses when it is not. When assessing our investing options, don't forget to take a REIT's debt levels into account.

Tax Drawbacks: We adore real estate investing because of its tax benefits. The earnings from real estate investing are tax-free because debt is typically used. The tax advantages of real estate are not passed down to REITs.

Debt Downside: Leverage is another fantastic aspect of real estate investing. Usually, my bank loans me four additional dollars for every dollar we invest in real estate. This implies that we can invest in real estate with debt leverage and increase our wealth more quickly.

Attend the REIT Party, but use caution when dancing.

Investing in REITs can be a great way to get into the real estate market without having to deal with the hassles of actual property ownership. But as with any investment, we must do our research, consider the advantages and disadvantages, and come to wise conclusions. We can take use of real estate investing's advantages, like diversification and passive income, without running the risk of ending up the main course at the predator's ball by choosing the correct REITs. So go ahead and don our dancing shoes and join in on the REIT celebration; just be careful when we dance.

Enhance Our REITS

Let's now discuss how to use REITs to boost our options strategies: Increase Our Real Estate Returns by Using Options Trading Strategies to Manage Risk and Improve Performance

Now that we have dabbled in the REIT market, we can take advantage of the benefits of diversification and passive income. However, what if we told anyone there was a way to perhaps increase our returns and improve our risk management? Discover the world of options trading, which we may use to boost our real estate earnings from our REIT assets. To improve our investing game, we will look at a few well-liked options methods in this part that we can apply to REITs.

Options: What Are They?

Options are financial instruments that grant the buyer the right, but not the responsibility, to purchase or sell shares of a REIT or any other underlying asset at a fixed price, or strike price, prior to the option's expiration date. Call and put options are the two different categories of options. The buyer of a call option has the choice to purchase the asset, and the buyer of a put option has the option to sell it.

Investing in REITs with Options: Common Techniques

Covered Call Approach: Selling call options on REIT shares that we own is the idea behind this. We get paid a premium (income) for selling the call options, which might raise our total return. Our potential gains may be limited if the REIT's share price increases over the call option's strike price and we are forced to sell our shares at that price. Investors who anticipate little upside potential but are bullish on the REIT in the near future might consider this strategy.Protective Put Strategy: As a kind of insurance, we might purchase put options if we own shares of a REIT and are worried that their value might decrease. We can limit our losses by selling our shares at the higher strike price of the put option if the price of the REIT's shares drops below that of the option. Although the put option's premium costs money, this technique can shield your investment from market downturns, lowering our total return.

And our top picks.

The Cash-Secured Put Strategy: Entails selling a put option on a REIT that you are considering buying and reserving the funds required to purchase the shares in the event that the option is exercised. The put option will expire worthless and we will keep the premium as income if the price of the REIT's shares remains above the strike price. We will be required to purchase the shares at the strike price, which may be greater than the current market price, if the share price drops below it.

Investors looking to produce income and ready to purchase the REIT at a fixed price in the event of a market decline can consider this method.Vertical Spreads: On the same underlying REIT, call or put options with the same expiration date but various strike prices are concurrently bought and sold in vertical spreads. These tactics might be applied to increase revenue, reduce possible losses, or capitalize on certain market assumptions. Purchasing a call option with a lower strike price and selling another call option with a higher strike price is known as a bull call spread.

If we think the price of the REIT's shares will climb somewhat, we can utilize this method to benefit from the increase while keeping the cost of the options to a minimum.

Unleashing the Double-Dip's Power

We typically invest in real estate to generate passive income. Rent collection is a satisfying task every month! But why end there? We can also include the passive revenue from trading in options! We are able to double dip! The first dip: profits! Dip number two: choices!

Our REIT investments may benefit from the added complexity that options techniques can bring, which can help us better control risk and possibly increase profits. When implemented properly, options methods can enhance our investments in REITs and assist us in reaching our financial objectives.

Options trading, however, is not for everyone since it necessitates a thorough comprehension of the underlying tactics and associated dangers.

Make sure we do our research and educate ourselves financially before we jump into options trading with REITs to make sure we are making wise choices.

To sum up, using options strategies to manage risk and improve our REIT investments can be very effective. We may maximize our real estate investing potential through options trading if we take the time to educate ourselves, start small, and adhere to a well-defined plan. Just keep in mind that there is no one-size-fits-all approach to investing; instead, we should always take our own financial circumstances and risk tolerance into account before making a decision.

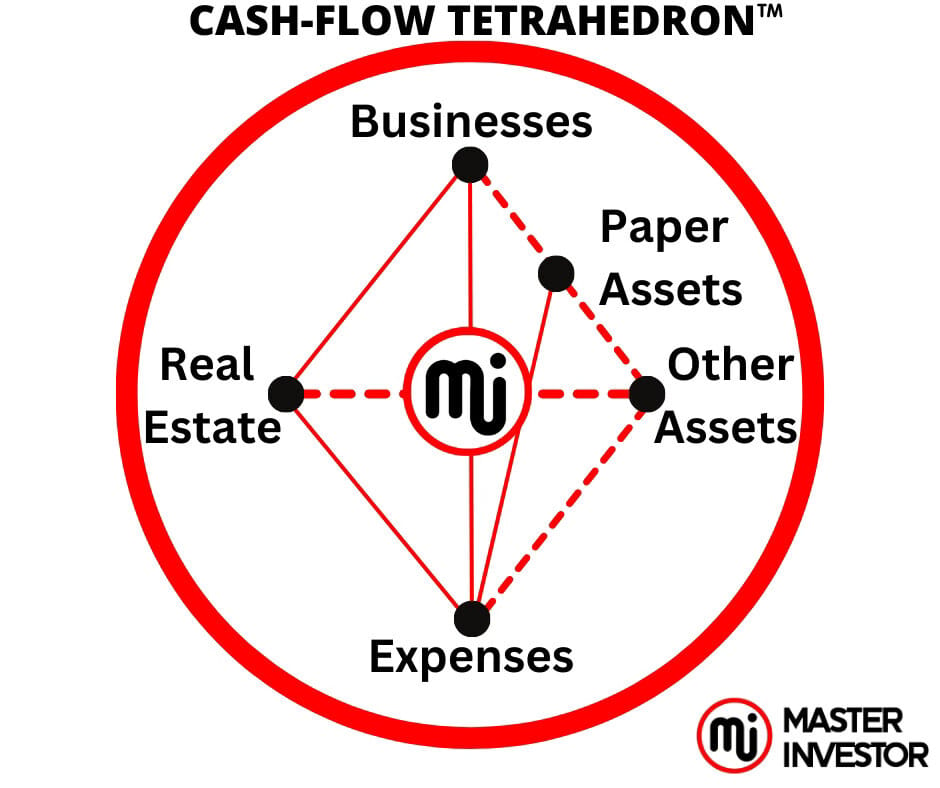

Use the Cash-Flow Tetrahedron to Accumulate True Wealth

The diagram of the Cash-Flow Tetrahedron shows exactly how we should obtain everything we ever wanted for free legally by building and acquiring cash flowing assets that buys other assets from other assets classes. As we can note we must control businesses that can buy as entry into other healthy investments. Wealth is measure in the free time we have to thrive without working for money, and have everything pay for with our passive income and capital gains income from our assets column. Wealth ultimately is total freedom.

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Join our Discord.

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: Invest In Real Estate Investment Trusts (REITs)

Comment, like, share and follow for more High Quality Financial Education Made Simple.