Summary:

Even though they are the most educated generation in US history, millennials still find it difficult to comprehend how money functions.

Due to the numerous financial double whammies they face, millennials' finances are still fragile.

Additionally susceptible to the love of obligations are millennials.

When it comes to our culture and the workplace, the millennial generation has firmly taken the lead. With a population of 72.2 million and the oldest members over 40, they are now the largest and most influential generation to date. Therefore, it's important to examine their financial practices; sadly, they might be in for a great deal of trouble.

Millennials' financial practices

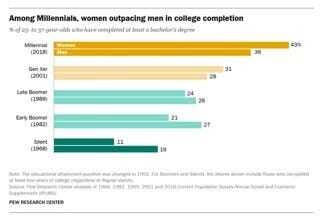

The millennial generation is, by all accounts, the best educated generation in US history. Examine the following Pew Research graph.

But they are having an issue. In 2020, despite having received more schooling, their unemployment rate was at its greatest, and their income was 20% lower than that of their parents at the same age.

Furthermore, according to Refinery 29, "66 percent of surveyed participants believed their savings accounts alone will be sufficient enough to rely on in 20 years," which only serves to exacerbate the situation. This indicates that they strongly favor saving money as opposed to making investments.

That being said, preference does not necessarily translate into action. According to a survey by Bank of America, just 20% of millennials have even begun to save, and of those who do, 40% have savings of $5,000 or less.

According to the same poll that Refinary 29 quoted, 88% of millennials say they want to save more money in 2016 compared to just 36% who say they want to spend less.

What does this demonstrate to us?

The majority of millennials possess relatively little financial acumen, and what little they do know about money comes from antiquated financial theories. This demonstrates the necessity for millennials to adopt a new financial strategy.

Being concerned about this research would be an understatement. The modern financial landscape will always be unfavorable to savers and we cannot allow the majority of our generation to be impoverished.

Experiences are important to millennials.

We are also writing to baby boomers, a generation that loved to buy items like TVs, homes, and cars, and not really know how to invest successfully due to the old rules of money and being tough to work hard for earned income instead of building wealth through businesses.

The current generation of young people, known as the millennials, have distinct values. They value experiences more. According to "USA Today" states, "a recent Harris Group study found 72% Millennials plan to focus on 'experiences rather than physical things' in their future spending."

Those who live this lifestyle even seem to have a sense of moral superiority. According to "Forbes" writer Marian Salzman, CEO of Havas PR North America:

Few people know why this was one of the most significant shifts in contemporary history.

The U.S. dollar was known as a silver certificate before 1971 because it was actual money that was backed by gold and silver. The US dollar was changed from being an IOU from the US government to a Federal Reserve Note after 1971. Our dollar was made into a liability rather than an asset. This shift has led to the United States of America being the most debtor nation in history.

If we briefly review the history of modern money, we can easily see why the 1971 move was so significant.

Germany's monetary system broke after World War I. This was due to a number of factors, one of them being the freedom of the German government to generate money whenever it pleased. The resulting money deluge led to unchecked inflation. Even though there were more marks, fewer and fewer were purchased. A pair of shoes cost 13 marks in 1913. The same pair of shoes cost 32 trillion marks in 1923!

The middle class's savings were destroyed as inflation rose. The middle class, having spent all of their savings, wanted new leadership. Following Adolf Hitler's 1933 election as Germany's chancellor, the Holocaust and World War II transpired quite quickly.

A fresh monetary system

The Bretton Woods System was implemented in the latter stages of World War II with the aim of stabilizing global currency markets. Since there was a gold backing for the currencies, it was a quasi-gold standard.

Up until the United States started importing Volkswagens from Germany and Toyotas from Japan in the 1960s, the system functioned perfectly. All of a sudden, the United States was exporting less gold than it was importing, and gold was fleeing the nation.

President Nixon terminated the Bretton Woods System in 1971 to halt the depletion of gold reserves, and the US dollar took its place as the primary medium of exchange worldwide. Never before in human history has the fiat currency of one country served as the global currency.

\Let’s look up the following definitions in the dictionary in order to better grasp this.

“Fiat money: money that is not convertible into coins or other currencies with the same value, such as paper money."

"Fiat: an order or deliberate act that produces something with or without additional effort."

Does this mean money can be created out of thin air?

Germany did it and now we are doing it. The USA government does it, then we can also do it too.

Savers are losers. During World War II, we cannot forget that Hitler rose to power as a result of the middle class losing their money. When people lose money, they behave irrationally.

The illness of liability

Fundamentals are fundamentals at the end of the day, regardless of how attractive they are packaged. Despite their contempt for their parents' generation for consumerism, millennials are actually afflicted with the same financial ailment: an insatiable need to spend lavishly on debt.

To put it plainly, experiences, no matter how wonderful, are still financial obligations. And we won't be able to savor such experiences in later life if we don't start making wise financial decisions now.

What then should a millennial do?

Being wealthy doesn't mean being greedy

The timeless lessons from our content are relevant today: develop our financial literacy, make investments in cash-flowing assets, and use that cash flow to fund our passions.

The millennial generation has a wonderful opportunity to leverage their passion for experiences to increase their wealth and financial literacy. The goal is not to acquire more possessions. It's about making sure we have enough money to do the things we love and continue to be the giving people we are for the rest of our life.

Move the currency (today’s money)

This brings up a further crucial point: money must always move someplace as it is no longer just money but rather currency.

Financial currency is like an electrical current; it cannot exist without movement.

In essence, saving money means letting our money depreciate. Money is moving, which is why we observe extreme fluctuations in areas like the stock market, real estate, and even cryptocurrencies. The wealthy are aware of this and make frequent use of their financial literacy to ascertain early and regularly where money is going. As per the proverb, they purchase low and sell high. Furthermore, they use their revenues to buy assets that increase their wealth rapidly and generate cash flow.

The good news is that, with a high financial IQ, anyone can accomplish this.

Adhere to the four pillars of financial literacy

Knowing the four pillars of financial literacy is a smart place to start if, like many millennials, this post has us contemplating our financial future and we want to become more financially literate.

Although we may read more about them at the aforementioned link, in short, they are:

The distinction between a liability and an assetMany people believe they understand what constitutes an asset. For example, majority home owners most likely believe that their home is a valuable asset, but it's not unless is producing positive cash flow for the homeowner via renting to others and the revenue must cover all expenses including the margate of the house in order for it to be a true asset. In actuality, the majority of accounting systems have overly convoluted the term. To put it simply, an asset adds positive cash flow to our finances while a liability depletes them. If we stick to that definition, we will succeed.

Capital gains compared to positive cash flow (passive income)Most investors hope to make capital gains. Affluent people invest for positive cash flow. Putting it another perspective, investing for capital gains is similar to gambling. We make an investment and hope that the value increases. Wealthy people invest for cash flow, on the other hand. Additionally, any capital gains are a bonus and it also gets reinvested into a cash flow asset. There are always cash flowing assets available to acquire and we can also build one from scratch. That is why financial education is key to our true wealth, because it gives us the power to create cash flow from thin air, literally.

Making money through taxes and borrowing good debtWe will hear from our financial advisor that taxes are unavoidable and that debt is terrible. However, the wealthy are aware that massive riches can be generated through taxes as well as loans. There are two types of debt: good debt and bad debt. Good debt is the kind of debt that's used to buy assets, like real estate. Liabilities are purchased with bad debt, such as when a vacation is paid for with a credit card.

Taking charge of our financesWe allow other people to dictate our financial judgments when we lack confidence in our financial acumen. We give our broker complete control over how your funds are invested. We allow our bank to choose the appropriate interest rate for our funds. We adhere to whatever investing fad that makes headlines. Having great information to act on and great wisdom to recognize which course of action is best is the key to building tremendous wealth. Only those with a high level of financial intelligence acquired by a commitment to financial education are capable of possessing this kind of information and insight.

How to address the financial issues facing millennials

Nevertheless, there are at least some promising developments in America's financial literacy scene. There could be significant good change if a generation decides not to participate in the higher education monopoly in this country.

It's not too late for Generation Z and millennials alike, but it begins with financial literacy and an awareness of how money functions in the modern economy. Here are a few short suggestions:

Make the most of our travels to learn about the regional real estate market, people through networking and locate possible assets with strong cash flows.

Utilize sharing economy platforms such as Airbnb and Uber to generate revenue streams.

Create an investment club with our friends, and add a socially conscious element to the concept for example, pooling some money to support a charity together to make it more enticing.

To raise money and develop a business, look for ways to sell the products we make as a hobby.

The goal is only to get our brain working; each of these concepts may be a post unto itself. The principles learned in our community are relevant now more than ever. If we want to secure our financial future, we will need to adjust our perspective on investment and money.

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: How to Win in Today's World of Millennial Money?

Comment, like, share and follow for more High Quality Financial Education Made Simple.