Summary:

We can survive a financial disaster by being aware of financial bubbles.

Financial bubbles come and go, therefore we need to be able to know when to move when and how.

To "get" financial bubbles, we must invest in our financial education.

Our economic circumstances are unstable and even perplexing. Recently, inflation reached its greatest level in forty years, and recession is predicted by economists everywhere we look. Since the start of the Great Recession in 2008, interest rates have increased. There are significant layoffs in many industries, notably in technology. However, job growth is still strong, and the stock market is rising once more.

It should come as no surprise that a lot of investors are searching for a secure location to move their money in light of all this uncertainty.

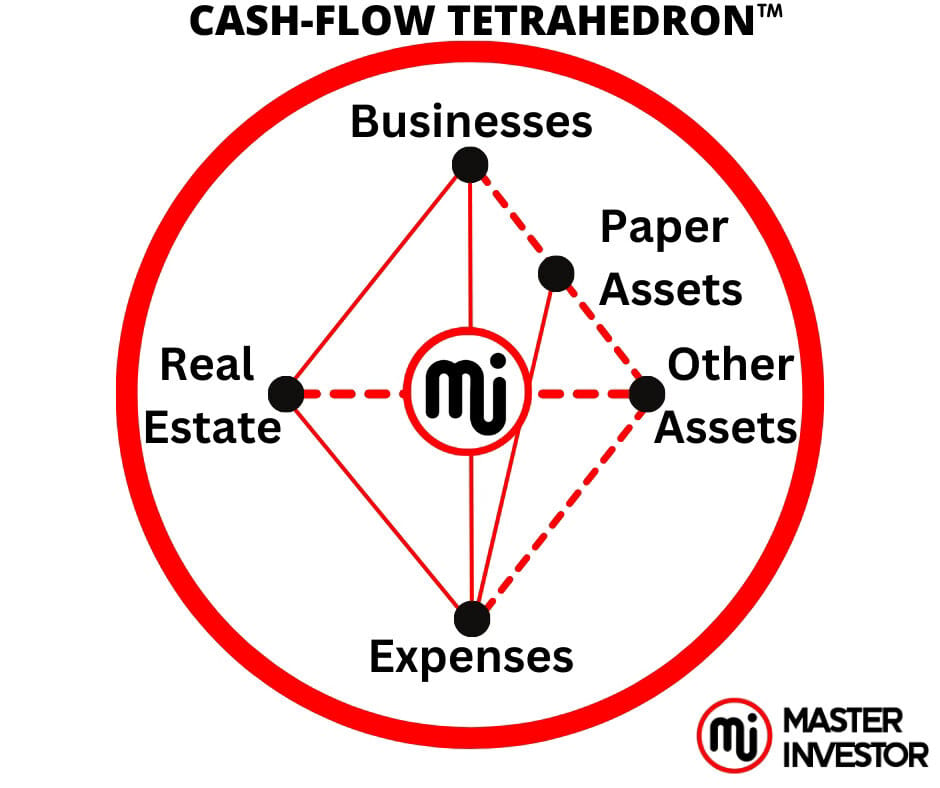

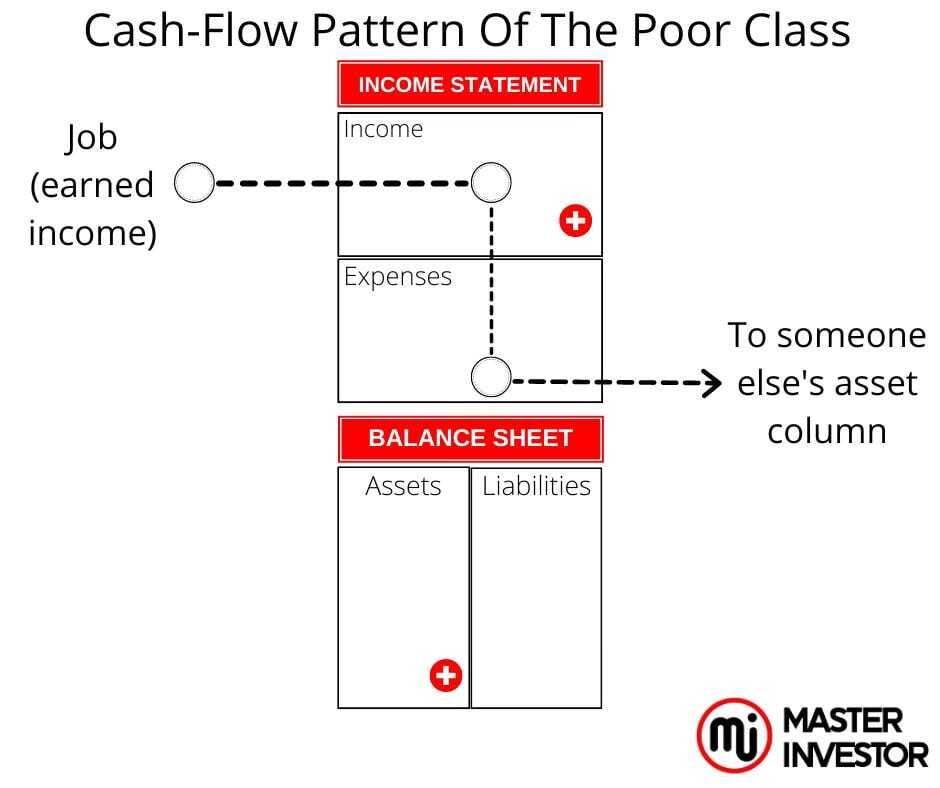

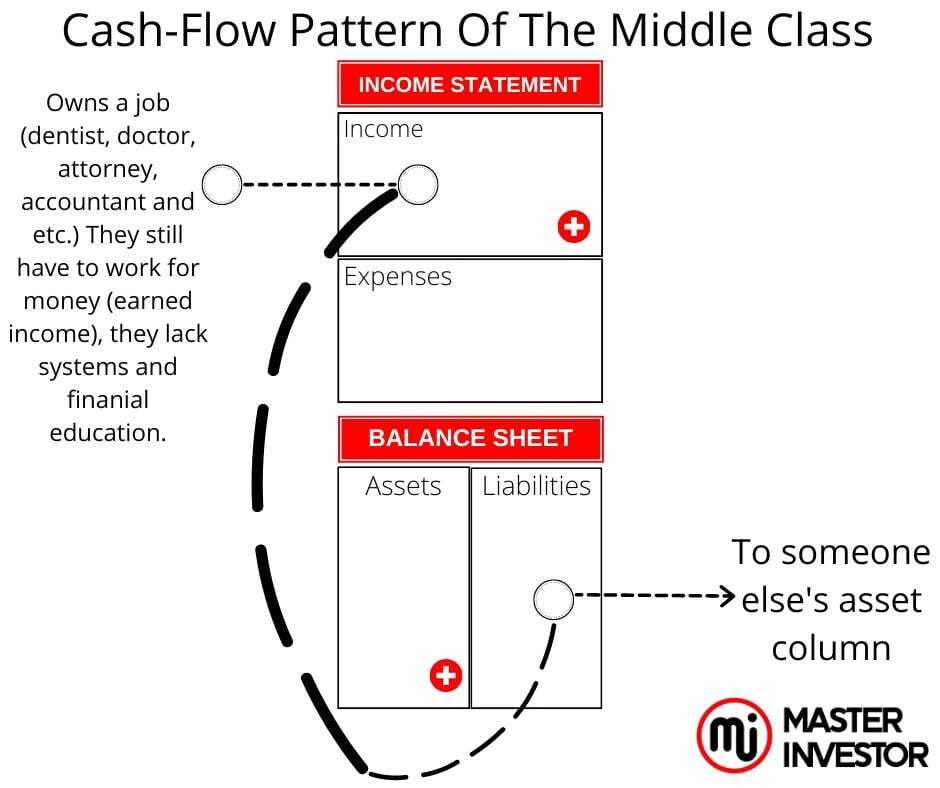

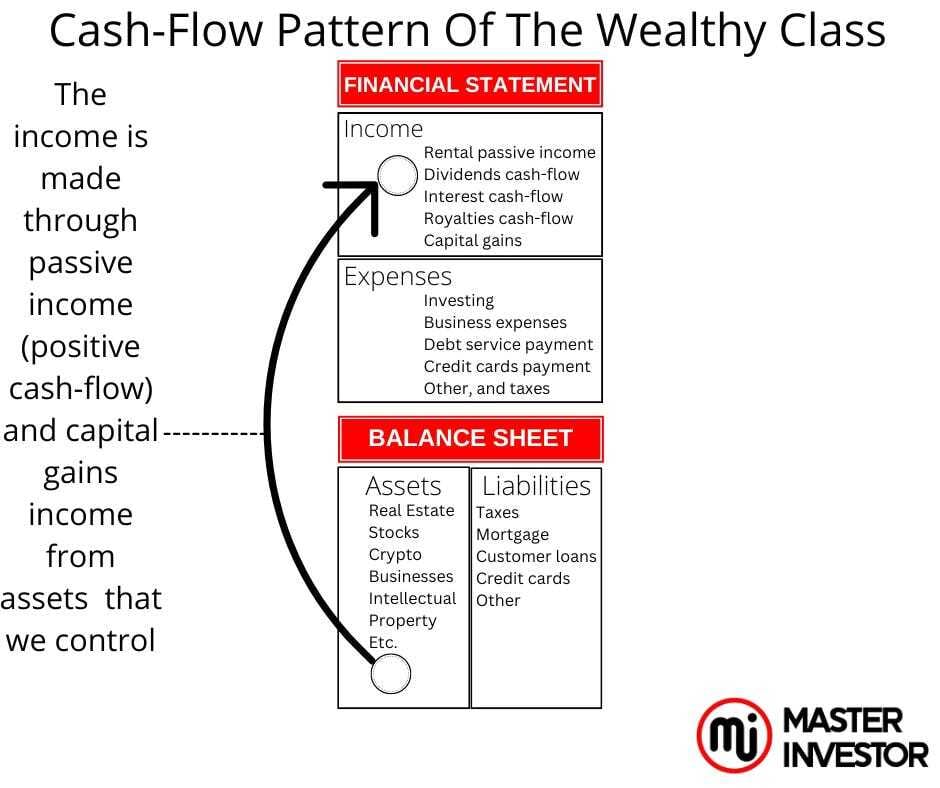

Transferring money (currency) to a cash flowing asset

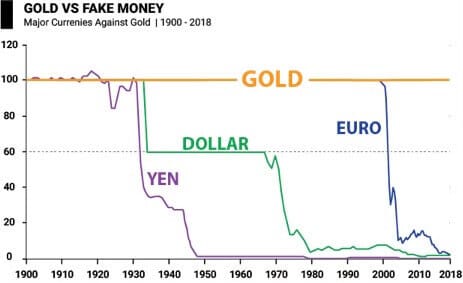

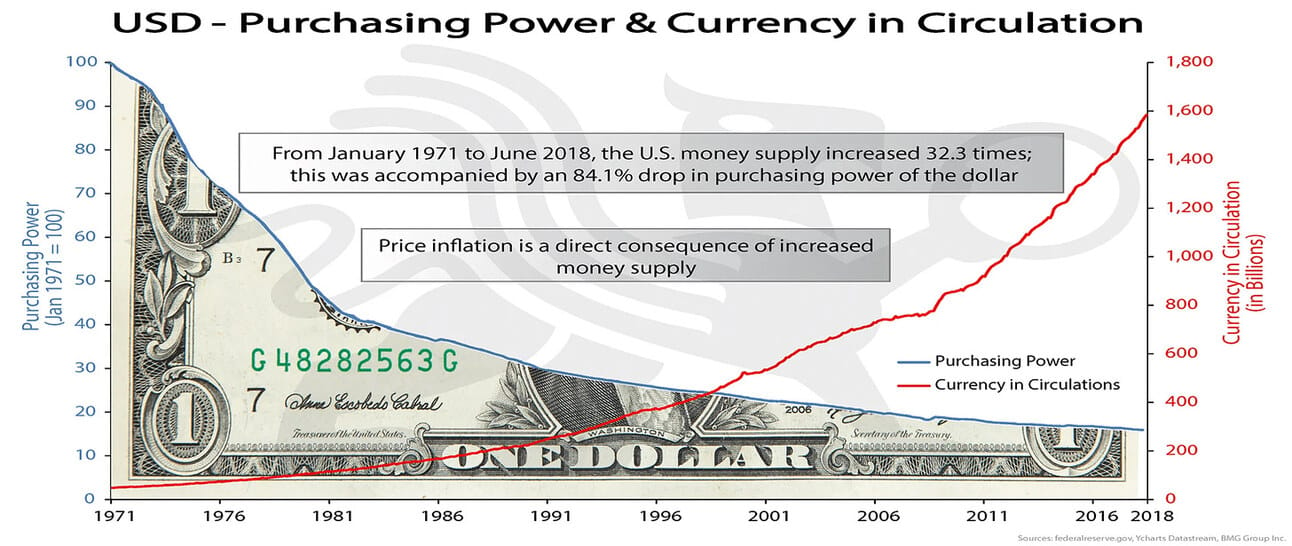

The distinction between money and currency is as follows, as stated in the post:

The dollar is a currency in use today. Its value is subject to fluctuations based on many economic factors and how other currencies are doing. It can travel fast in either direction and is unattached. The Wall Street Journal reported in 2021 that the value of the dollar was "dwindling." "The New York Times" reports, "A Rising Dollar Is Hurting Other Currencies," today, in 2022.

What does it mean, then, that the dollar can be used as money? Discussing this subject in relation to electrical currencies is beneficial. Electricity is transported from one location to another using an electric currency. Any currency that wants to live needs to be in motion. In order to create wealth with currency, it must move from a cash flowing asset to another cash flowing asset.

Utilizing the 5 steps to the formula of velvety of cash flow:

Acquire a cash flowing asset

Recoup the initial capital invested back

Keep control over the asset and its debt if any

Invest the cash flow from the asset into a new cash flowing asset

Repeat the steps 1-4 as many times as possible

Money dies when it stops moving

In a similar vein, the dollar's function as a currency is limited to transferring money between regions. For example, astute investors who anticipated the 2016 bond market meltdown most likely shifted their holdings from bonds to an industry poised to gain from rising interest rates and a strengthening dollar. Given the current high rate of inflation, astute investors are probably shifting toward commodities. Everything is cyclical, but the wealthy are aware that real wealth is now found in assets rather than in volatile currencies during a financial crisis.

With the possibility of a recession looming large over them, investors started gravitating into bonds in 2022.

Despite shielding American investors' capital from inflation since 1998, Series I savings bonds have never enjoyed as much popularity as they do in 2022, according to CNET. For I bonds bought between May and October, the highest interest rate ever was created by skyrocketing prices toward the beginning of the year, 9.62%. The Treasury's computer systems crashed when the record rate was disclosed in May because to the tremendous demand for I bonds this year, and the website suffered sporadic failures during the final few frantic days while the rate was accessible in late October.

No one wanted bonds for a long time. However, they're the hottest item on the market due to increased inflation.

A plethora of articles about where to get them have just been released. This whole thing indicates that money is changing.

Burst Financial Bubbles

Money is no longer money; it is now a currency, which is why it is not surprising that financial bubbles frequently burst. An asset that has had its value artificially inflated by investor enthusiasm and occasionally hysteria is referred to as a financial bubble. Financial bubbles expand endlessly before popping, just like actual bubbles do!

The bond market is an imminently burstable bubble. There is a bubble in the housing market that looks poised to burst. The stock market has also experienced significant volatility. The bubble that was cryptocurrency burst really violently.

Like in any financial bubble, the majority of inexperienced investors will enter the market later and will probably lose money while the smart money has already moved on to the next promising asset.

The story of financial bubbles is as old as time

Financial bubbles are an inevitable part of life, just like death and taxes. They've also been in existence for a while. Tulips were implicated in one of the greatest and funniest financial bubbles.

In summary, the price of some varieties of tulip bulbs a highly valued flower rose dramatically between 1634 and 1637. Things took a very hot turn in 1636–1637. Alastair Sooke, in a piece for the BBC, provides a clear description of the situation:

One of the peculiarities of the 17th-century tulip market was that bulbs of rare and valuable types were traded rather than the actual blossoms. As Dash notes, the outcome was "what would be called a futures market today." Even as a sort of currency in and of itself, tulips were utilized in 1633 when real properties were auctioned for handfuls of bulbs. A single bulb of Semper Augustus was already valued at an incredible 5,500 guilders in 1633. By the beginning of 1637, this had nearly increased to ten thousand guilders. Dash contextualizes this amount:

"At a time when homes in that city were as expensive as property anywhere in the world, it was enough to feed, clothe, and house a whole Dutch family for half a lifetime, or sufficient to purchase one of the grandest homes on the most fashionable canal in Amsterdam for cash, complete with a coach house and an 80-ft (25-m) garden."Early in February 1637, the tulip market crashed.Flowers lost all of their appeal and were now worth a fraction of what they once were. As a result, many faced the possibility of financial ruin.

However, instances of financial bubbles in the present day are also easily located.

The financial bubble of banks

The Wall Street Journal revealed in 2010 that "Bargains on Failed U.S. Banks Are Over."

The article claims that investors were pulling out of deals to purchase failed banks from the FDIC because the prices were getting too high, even though it was predicted that there would be more bank failures in 2010 than in 2009. The average buyer purchase gain as a percentage of assets was 2.5 percent in 2010 compared to 4.5 percent in 2009; the average discount on failed bank assets was 9.5 percent versus 14 percent; and the average cost to the FDIC of loss sharing pacts as a percentage of assets was 22 percent versus 27 percent.

As absurd as it may sound, by all accounts, some investors were paying more, which increased the price of failing banks even as the market was worse and more banks were failing.

The financial bubble of gold

In another article from 2010, Bloomberg.com titled "Gold Rallying to $1,500 as Soros's Bubble Inflates," it was reported that the December gold futures contract was trading at $1,500, an increase of 18% over the record gold price of $1,266.50 set on June 21, 2010. The article claims that George Soros, who referred to gold as the "ultimate asset bubble" in January at the Davos World Economic Forum, was among the largest buyers of the metal. It seems that even with the record pricing of gold throughout the summer, he believes that the bubble in gold assets is still young.

Gold reached its peak in March 2022 at $2,066. In other words, George was correct. He most likely made a huge fortune. People who bought close to the top didn't. The current price of gold is about $1,700.

The financial bubble of GameStop

Consider the madness at GameStop, for instance. As stated in the article "GameStop, Retail Investors, and the 10 Controls of the Sophisticated Investor," GameStop's stock reached a high of $380 on Friday, January 29, 2021, making it one of the most traded stocks in the market. In the midst of a pandemic, how did this happen to a mall retailer with an antiquated business model?

Euphoria was the response. Leaping in to take advantage of a rocket ride are amateurs. Eventually, GameStop dropped to about $40. It's around $11 right now. You can bet that many people made and lost a lot of money during the journey. But all of it is gambling.

Bubbles in cryptocurrency finance

Maybe the best illustration of overpaying is the bitcoin industry. Unfortunately, a lot of individuals buy when the price is at its highest, wait too long, and then become hesitant to buy when it falls because they believe they have "lost" money.

The peak price of Bitcoin was $64,400 on November 12, 2021. Since then, it has varied, climbing to $71,678 (as of this writing) and falling as low as $16,416.6. Professional investors most likely bought on the dip along the way while all the amateurs were selling and lost money.

Numerous tulip crazes exist today

Should we believe that a phenomenon such as the Tulip Craze was a historical aberration caused by retrograde people from hundreds of years ago, all we have to do is consider our own contemporary crazes, such as the tech stock bubble of the early 2000s, the sub-prime crisis of 2008, and even the designer fruit craze in contemporary Japan, where a square watermelon can fetch up to £20,000.In every case, logical people have succumbed to the herd mentality and purchased and sold things at prices that did not correspond to their true worth.

Investors frequently use the argument that they are operating in a new paradigm and that the current situation will never change to defend their choices. Usually, it is not the case in reality—quite the contrary.

Financial bubble psychology

All of this raises the question of why people would overpay for investments.

Today's investors often believe that the good times will last. They sincerely think that they are in a new paradigm. Here are three causes for this way of thinking:

Anchoring: The tendency of an investor to "anchor" to a price that is significant to them even if it may have little bearing on the market they are investing in is known as anchoring. For instance, concentrating on double our investment and holding off on selling an asset until the price hits this target.

Loss aversion: Most people find it painful to recognize a loss, so they will do everything in their power to prevent it. This implies that an investor is willing to wait in the hopes of breaking even if the asset's value is less than what they paid for it. If the asset is nearing the end of its useful life, this could be disastrous. At most, it indicates that we have money that could be better used elsewhere but is instead locked in a bad performing asset.

Herd behavior: We are taught to give in to peer pressure as the easiest way out at a young age. We get comfort in the fact that others are investing in the same way as ourselves. If, for instance, everyone is purchasing pricey internet shares, we can rationalize our choice by telling ourselves that "all our friends are doing it and they are making money, so it must be OK" despite our reasonable brain telling us that this is insane.

Buffett must know better than to engage in the three activities. Being among the wealthiest individuals globally, he resists the allure of the market frenzy. All he gains from them is profit. How?

Buffett stated that he believed stocks may still be inexpensive a few years ago, when they were once again hitting records. Buffett made a crucial disclaimer when he said that stocks appeared inexpensive because his assessment was predicated on a low interest rate environment. "If interest rates were seven or eight percent, these (stock) prices would look exceptionally high," he stated.

That is the distinction between an amateur and a professional inverter. While amateurs chase exhilaration, Buffett invests for fundamental market reasons. With interest rates rising today, we can expect that Buffett will leave the market well ahead of the amateurs. We will profit handsomely while others suffer significant losses.

What would we do, in our case, to avoid being a an average investor and instead become an Inside Investor?

Phase 1: A wave of financial shocks

A disruption in the existing economic status quo triggers the start of a financial crisis. It might be a new technology, as in the dot-com boom, a conflict, or cheap interest rates.

Phase 2: Acceleration

Not every financial setback results in prosperity. Fuel is what's needed to start the fire. Fear following the 9/11 attacks, which resulted in a stock market meltdown and a drop in interest rates, most certainly drove the real estate boom. The largest real estate boom in history occurred as banks and the stock market poured billions of dollars into the system.

Phase 3: Feeling of Joy

If an investor has missed the present boom, they will know to hold out for the next one instead of making a hasty investment. But the greater foolish rush in when acceleration transforms into pleasure.

By 2003, real estate was becoming the domain of the foolish. Talk about the housing market at parties became very popular. The term "flipping" gained popular during PTA gatherings. As credit card borrowers took out long-term loans to pay off short-term debt, homes turned become ATMs.

Mortgage companies pushed for more loans by running advertisements on a regular basis. Financial advisors became mortgage brokers because they were fed up with having to tell their clients why their retirement plans had lost money. In this euphoric time, novices thought they were real estate experts.

They would brag about their wealth and intelligence to anybody who would listen.

Phase 4: A financial crisis

Outsiders buy from insiders. Now the bigger idiots are piling into the snare. The people who saw prices rise for years while staying out of the market because they were afraid to enter are the last fools. Eventually, the exhilaration and tales of acquaintances and neighbors striking it rich in the market catch up with them. Finally, greed overcomes the skeptics, beginners, hesitant, and latecomers, and they rush into the trap with cash in hand.

Before long, sorrow and reality set in. The bigger idiots are aware that something is wrong. When panic sets in, they start to sell.

Regardless matter whether it’s a stock, bond, mutual fund, real estate, or precious metals, people start to despise the item they previously adored.

Phase 5: The boom becomes a bust when the market reverses

The novices start to understand that costs don't always rise. They might observe that the experts have sold and aren't purchasing any more. When prices start to decline and buyers become sellers, banks start to tighten up.

Minsky calls this time frame "discredit. This is when God reminds us that we are not as smart as we thought we were. Losses begin to mount as the easy money disappears. The bigger fool in real estate understands he owes more on his property than its market value. His finances are in disarray.

Phase 6: Fear sets in

Today's amateurs despise their assets. When prices drop and banks stop lending, they begin to dump it. Panic increases in speed. As of right moment, the boom is a bust. As is frequently the case with the stock market, regulations may be put in place at this point to limit the decline. People start searching for a lender of last resort to save us all if the decline doesn't stop. This is often the central bank.

The good news is that professional investors start to become thrilled again at this point, waking up from their sleep. They resemble a bear that has been hibernating and wakes up to see a row of trash cans outside their lair, brimming with costly food and champagne from the previous night's celebration.

Phase 7: The arrival of the White Knight

Every now and then the bubble bursts completely, and the government is forced to intervene. This is what happened after the 2008 catastrophe when it purchased stock in GM and other huge Wall Street institutions that had taken on excessive leverage.

What stage do we think we're at right now, and how can we take advantage of it? Fortunately, there is a five-point strategy that can help us make money in any market.

The five-point masterinvestor’s strategy for making money during stock market corrections.

The first step to success in any market is very apparent, yet it's overlooked much too frequently. Find out where our money is being invested!

Save our money in our 401(k) and leave it alone if we don't intend to invest in financial education. Compared to transferring money without understanding how or why, it is safer. However, we must know how to turn that money into our advantage if we want to be ready to profit in any market.

Reading Master Investor’s articles is a terrific place to start. The five points strategy are:

Recognize our roleThe unfortunate truth is that the majority of people have no idea where their retirement funds are invested.The funds are taken out of a check, placed in a managed investment account, and are maintained by a financial manager, who is a genius.

Be aware of our performance levelOnce we are aware of the investments your money is made in, we must ascertain how well those investments would do in a particular market. The majority of investors' retirement funds are made up of equities and bonds, so there's a considerable probability that they will decline if interest rates are raised significantly, as the Fed appears to be planning to do.It might therefore be a good idea to buy real estate in such a market before interest rates rise.

Become knowledgeableThis implies that we must educate ourselves in order to recognize what's coming and have time to prepare; you cannot simply rely on advice regarding the market.

Reduce our risk graduallyWith the right knowledge, we can make better predictions about the direction of the markets, the performance of our present asset mix in the upcoming markets, and our level of risk. This enables us to choose positions that will perform well in an up or down market and make the necessary adjustments to reduce our risk. And that brings us to our last point.

Purchase in pairsTraders with experience always purchase in pairs. There are two positions: one for protection and the other for expansion.For example, we should consider taking an insurance position in commodities or precious metals if our portfolio consists primarily of paper assets and the stock market. It is advisable to purchase insurance for any real estate we purchase.There is no end to the list. Naturally, financial literacy is required for this, but the investment pays off.

Why acquiring financial literacy is essential for surviving financial bubbles?

Regretfully, the typical investor is ignorant of market fundamentals, let alone how interest rates affect stock values. Simply put, they buy because everyone else is doing it and the market is rising.

This raises an intriguing query, too. What is the opposite of herd mentality, loss aversion, and anchoring?

And how do we successfully implement the five-point plan?Financial education has the solution.

We can spot trends and make money from them if we have a solid understanding of how money and markets operate. That's exactly how Buffett and others alike have amassed our wealth.

Investing in our products and courses can be a fantastic place to start if we wish to improve our financial literacy. The world has great and real teachers that can help us achieve true wealth. Find and invest in our mentors.

However, it doesn't stop there.

For example, we would gain a lot from learning under our content if we were interested in paper assets and any other asset class. We can master how to make investments like Buffett, not like most average investors. A hint: it's not as simple as "buy, hold, and pray." It takes more than that poor strategy, it takes understanding how to acquire and build real assets. We can create cash flow with stocks by utilizing advanced strategies explained in greta detail inside of our volumes and courses.

If we have the correct financial education, we can prosper when others are barely scraping by. To actually grasp how money works and how to make it work for us, we just need to go past concepts like herd mentality, anchoring, and loss aversion.

It does not take only money to make money, it takes financial education for us to be able to make money make more money through sound investing. A person that lacks finical education, he or she lacks control, knowledge and is gambling when investing.

We invest o make passive income instantly.

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: How to Profit From Financial Bubbles?

Comment, like, share and follow for more High Quality Financial Education Made Simple.