SUMMARY:

Wages are not increasing while inflation is, so saving will not help anyone to become wealthy because money is not longer real money, it is fake or a currency.

Discover how to legitimately "print our own money" and get infinite returns in our investments.

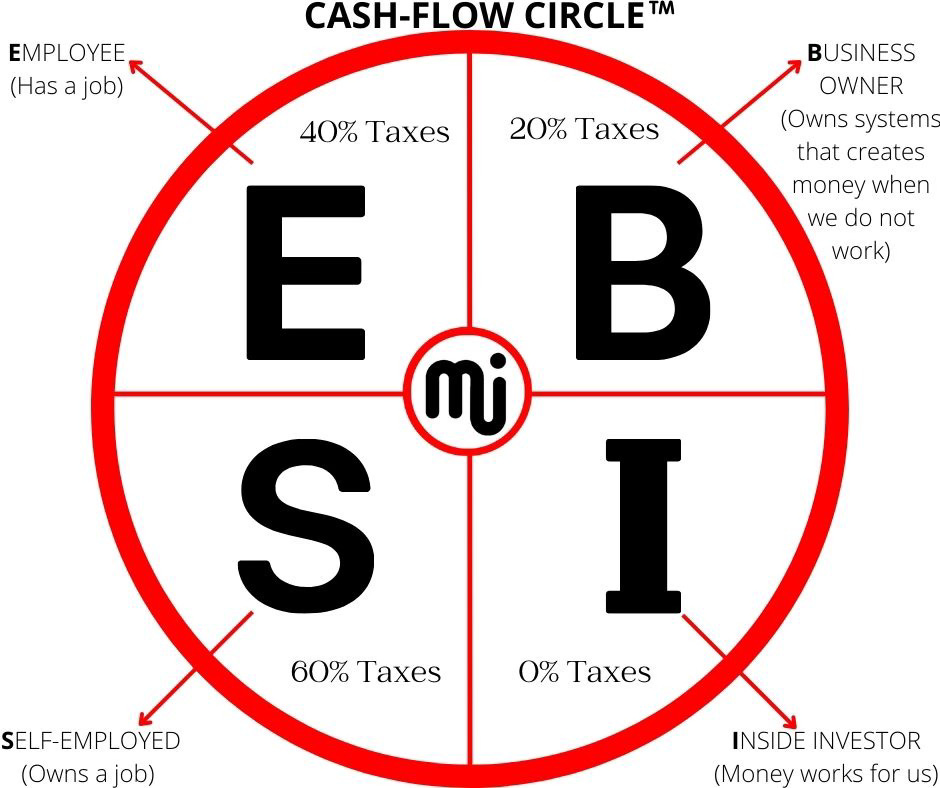

We must first work on the right side of the CASHFLOW Circle in order to "print money legally".

At the end of today’s article we will cover our bonus question “What are ways to use good debt (OPM/Money/Good Debt) for real estate investing?

The average salary for American workers has either decreased or remained unchanged over the previous twenty years. In the interim, inflation has kept rising. Simply put, this indicates that our currency is decreasing in value and that we are getting less value for it. Savers are losers and good debtors are the winners in today’s economy.

It is insane to believe that we can succeed in today's economy by securing a good job and putting away money. Every day, our money's worth decreases. It is crucial in the modern world of finance that we master the art of legitimately painting our money. through sound investing. To be successful we must act like the government acts in capitalist nation.

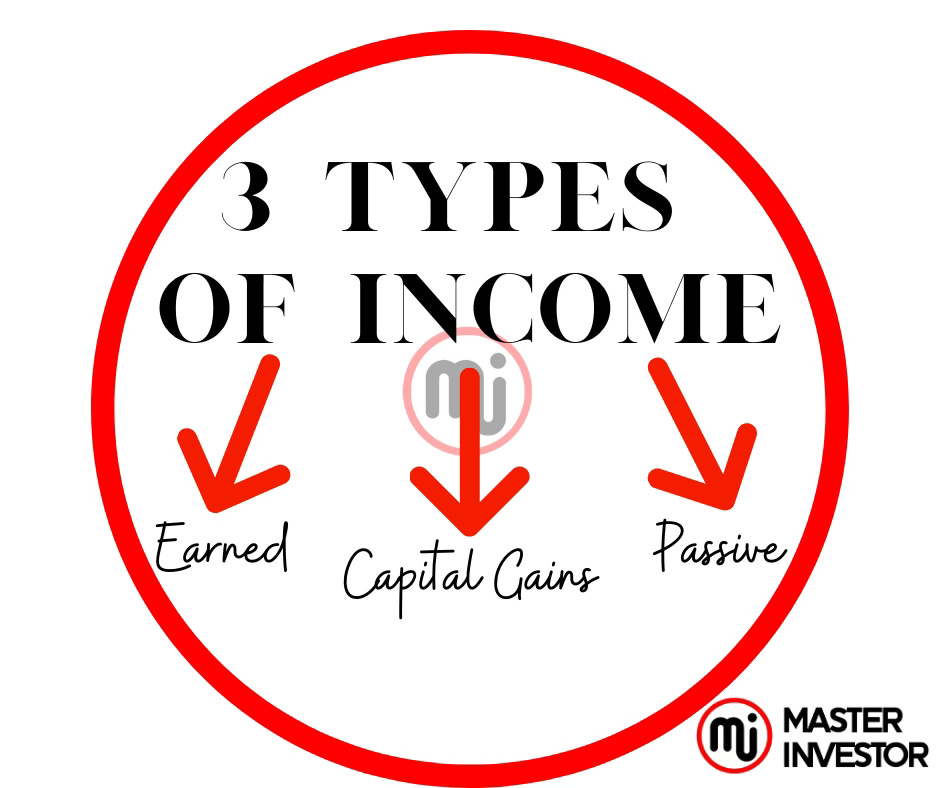

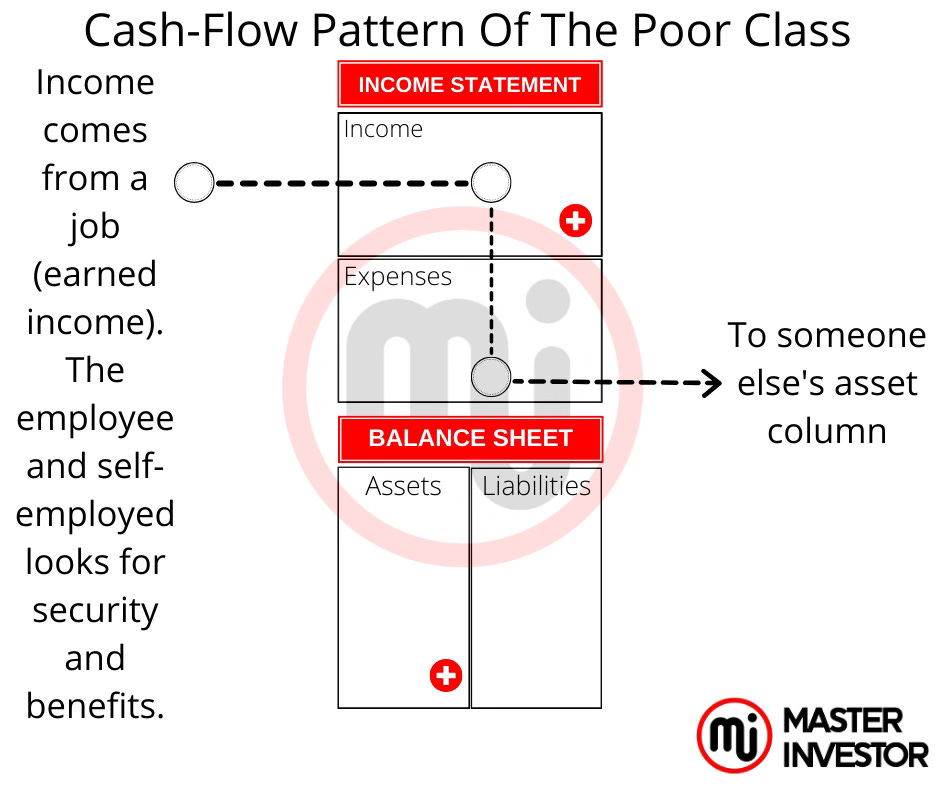

The more the government prints money the more inflation we will have in our economy. That is only a problem for the people playing with the old rules of money and working for earned income only which income is taxed at the highest bracket of the three main types of income that exist. See the diagram below. It will be difficult for the employee and self-employed (those on the left side of the cash-flow-circle) to get ahead financially because of inflation.

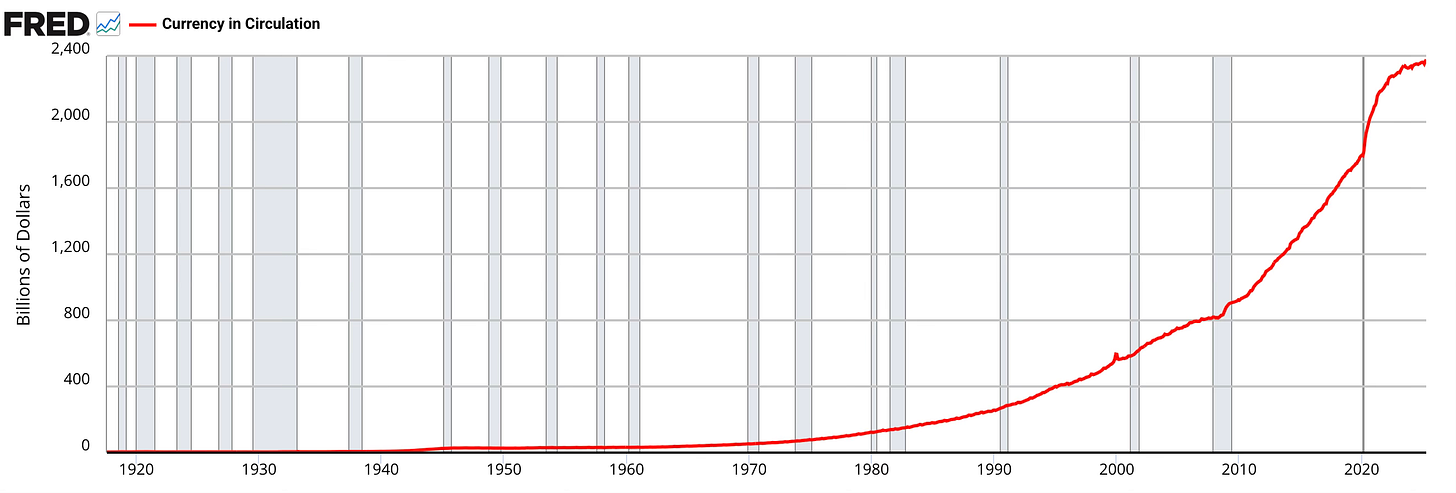

Currently, the national debt of the United States is $36.22 trillion. Discover the mechanics of the national debt and its effects on us. The US government creates approximately $16.9 billion in spending each day. And some of the money that is created digitally daily gets printed in the form of cash and then gets injected into the economy. As a result of this action, the devaluing of the U.S Dollars increases.

The US government collects around $13.6 billion in revenue each day, mostly from individual, and some for corporate income taxes. The US government spends around $6.2 trillion annually, or around $16.9 billion per day. This sum includes a diverse array of government initiatives, such as Medicare, Social Security, defense, and state and municipal expenditures. In FY 2024, federal income rose to $4.9 trillion. The majority of this comes from corporate and personal income taxes, and it amounts to around $13.6 billion every day.

According to USAFacts, the national debt of the United States is rising at a rate of about $6.6 billion every day. The increase of around $2.41 trillion during the previous 365 days serves as the basis for this average. The average amount of borrowing by the U.S. federal government is about $6 billion a week.

Today money is debt, fiat, an idea backed by confidence and a full currency. In other words, money is a full currency since August 15, 1972 (President Nixon separated the gold standard from the U.S Dollar). The U.S. dollar looses value each day and goes back to its intrinsic value of zero. Let’s put it this way, as the government prints more and more US dollars digitally and physically then the U.S. dollar loose value to eventually reaching zero and being replace by a new currency. Every currency in history has gone to down to its natural state of inception which is $0 (zero) where it started.

Around $541 million worth of banknotes (fake money) are printed daily by the Bureau of Engraving and Printing, which translates to about $38 million. The main purpose of this money is to replace worn-out or damaged banknotes, not to create new money for circulation into the economy.

The Federal Reserve (the Fed) has the authority to regulate the total amount of money available. There are a number of ways for them to raise the money supply, including changing interest rates or buying Treasury bonds on the market. Banks may then have additional reserves available to lend out.

As shown in a CNN story about a $128 billion injection over several days, the New York Fed has sometimes intervened in the market with massive amounts of money to support financial institutions, albeit not on a regular basis. This should be music to the financial educated business owners and inside investors. Because this type of economy has the power to make anyone who focus on acquiring assets become ultra wealthy at the speed of light.

See the diagram below which shows how much the government prints daily in billions of dollars since 1971. That year President Richard M. Nixon declared his New Economic Policy on August 15, 1971, a program "to create a new prosperity without war." The plan, popularly known as the "Nixon shock," signaled the start of the demise of the Bretton Woods system of fixed exchange rates, which was established at the conclusion of World War II.

That is extraordinary for us on the right side of the cash flow circle, the business owner and inside investor. Because when the world is run on a currency and not real knee (gold) then we can print it like the government does in an economy that is run by debt. Money is created with debt in a world of a full currency and not real money.

That means anyone who adopts the wealthy context can become ultra wealthy and fast! Using OPM (debt as money and leverage.) That assuming that we must invest debt in the right places for passive income and sometimes for capital gains income.

Wealth have to know about due diligence and putting business plans together. A plan that disclose the assets and liabilities of the operation for potential investors and ourselves to understand at full. Every business coms with its risks but such risks can be calculated with facts and financial education. In order for us to attract money to our investments, we must have a winning business plan with a lucrative exit strategy.

We define investing in our community here at masterinvestor as having a winning plan with an exist lucrative strategy.

The other look of that is that when a currency begins to disappear then new ones will emerge to replace it. More in world of AI and advanced technology. For that new final currencies are here in the new asset class of crypto, which is another asset class we have mastered to invest in successfully here at masterinvestor.

We have to grasp this change in our economy. The change from real money (gold) to fake money (debt). We no longer operate with real money (gold), we operate legally through debt.

That is why savers are losers and good debts are the winners of today’s economy. Money that gets save under the mattress or a bank accounts looses value and makes the person poorer not wealthier. However, by investing the money in sound assets and moving it from an asset to another cash flowing asset. That is the key to maintain the value of money and provide excess of cash flow for us.

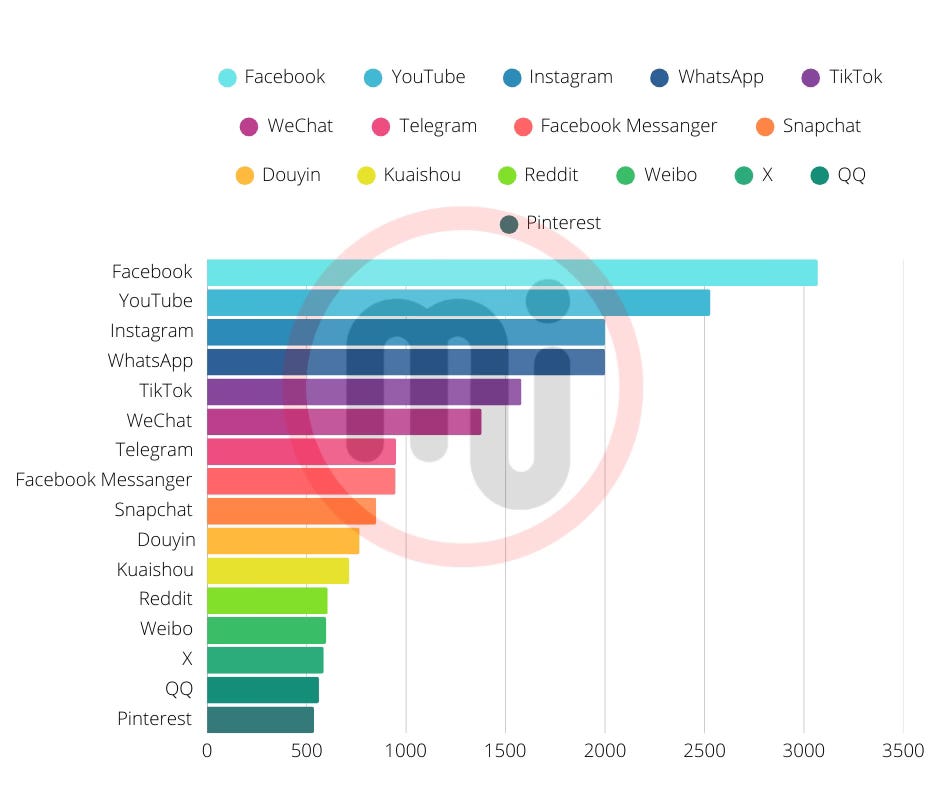

An infinite amount of customers available online

We must use all the resources available to all of us and take advantage of the possibility to capture unlimited leads for our businesses daily. The following are the most visited social media platforms today by active users. Every platform provides us with tools and resources to target market our prefer clients. Those who are in need of our solutions from our businesses to expand without limit to reach more potenital customers. This is ideal and beneficial to all. It is a win-win situation. It creates an environment that is friendly to capitalism, which is key as the highest level of an inside investor is being a capitalist.

The five levels of investors are the following:

Novice

Saver/Passive

Amateur

Professional/Active

Capitalist

The highest level of an investor is being a capitalist. Operating with the wealthy context on the right side of the cash-flow-circle.

That is level number five in our list of five levels of investors. However, take look at the diagram below and use it to start getting in front of new potential customers. The golden rule to succeed in the online world is to provide value and real solutions to the world. Becoming more generous is a habit we should continue to build. We must be problem solver.

Each social media platform has its mission and solves specific problems. Every social media platform is a business and investment. Let’s keep all that in mind as we use them to reach new clients, however, we can potentially invest in these companies as we diversify among the five asset classes that exist today.

One of those asset classes is the asset class of paper assets (stocks, etc). Stay informed by doing our own due diligence and ensuring that we are constantly expanding our reach for our businesses and investments using systems. A sound business is a system of systems doing the selling and telling for us on autopilot using smart marketing and systems.

A boundless or infinite return on investment (IROI)

The capacity to print money like the wealthy do is one of the most beneficial outcomes of financial literacy. Literally printing money for “nothing.” The infinite return on investment (ROI) is a financial term that allows us to accomplish this lawfully. We will go over some real examples as how this applies in our lives.

Most financial professionals will tell us that a return on investment of 5 to 12 percent is acceptable, and if we lack financial literacy, it is. They will also argue that the greater the return, the greater the risk. If we lack financial knowledge, that is also true.

However, if we have a high level of financial intelligence, we will understand that it is not impossible to achieve an infinite return on our investments.

We describe an infinite return on investment as "money for nothing." More specifically, an endless return occurs when we invest in a cash-flowing asset, get our money back, retain ownership or control ( control is more powerful than ownership) of that asset, and continue to benefit from the cash flow every month.

Printing our money like the government

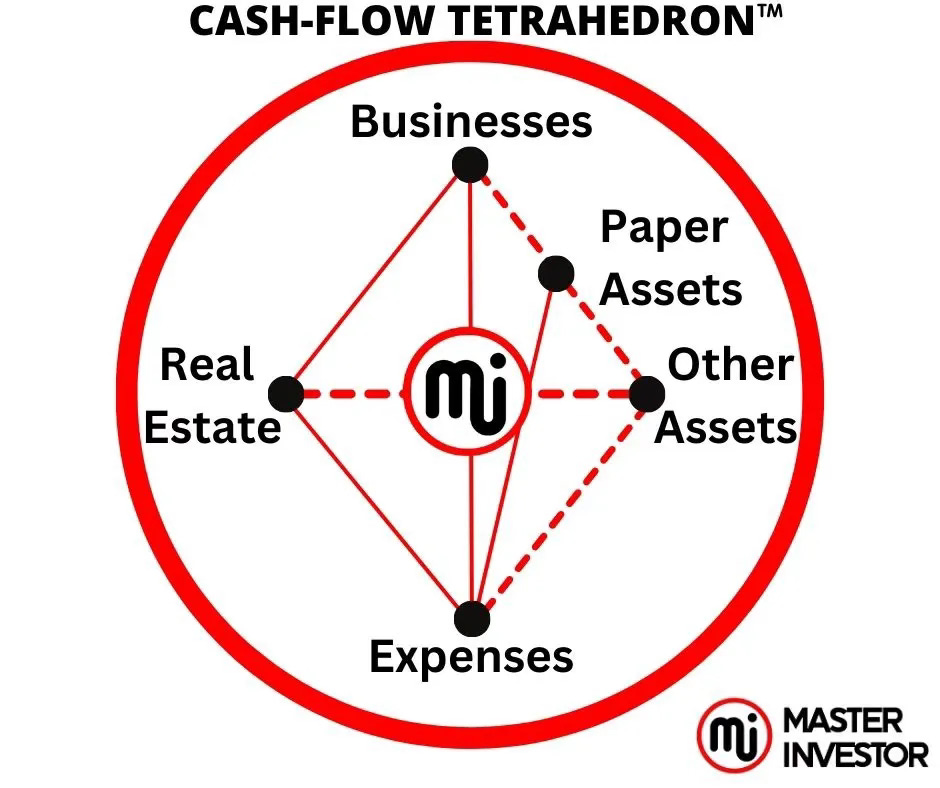

We often talk about being on the right side of the Master Investor’s CASHFLOW-Circle, which is the first step in printing money legally like the wealthy.

There are two types of individuals in each category of the CASHFLOW-Circle, for a total of four.

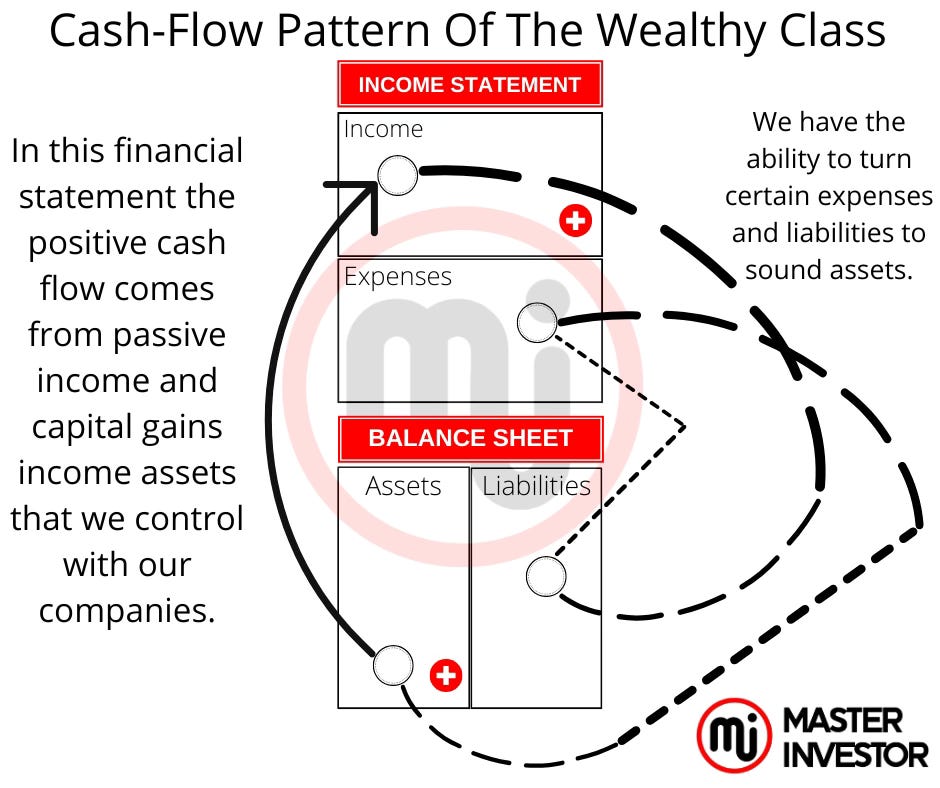

The cash flow circle has two sides, to sum up. The left side includes the employee and self-employed. Business Owner and Inside Investor is on the right side of the Cash-Flow -Circle. We are not permitted to print money on the left side of the Cash-Flow’s Circle as an employee and self employed has to sell time for earned income rather than making money work hard through investing.

To create a machine that prints money legally, we must eat, sleep, and breathe on the correct side of the cash-flow-circle. On the right side of the Cash-Flow-Circle we find the business owner and inside investor who devotes time in building passive income (positive cash flow).

This is because it's easy to understand. Employee and self-employed individuals work for the machine rather than owning or control it. Remember that control is more powerful than ownership when building wealth. Because controlling debt is how we become ultra wealthy and tax free. And when we control debt on assets that we mange then we may not be the owners as there is an outstanding debt but such debt is good debt because it is printing money for us via positive cash flow. Therefore, ownership is less important than control in the new economy run. y debt, then ownership does not matter as long as we have control over the assets, liabilities, and cash flow of the operation.

More on that later but let’s just understand that focusing on creating, acquiring and controlling assets is how we become financially free and build true wealth. Wealth that is measured with time and excess of cash flow not just with money.

Additionally, the machine is not owned by the employee and self-employed; rather, they hold a position that frequently contracts with the money printing machine. They are unable to generate the endless returns that a money-printing machine legally can produce because their hours, which are a limited resource, are what they sell. As we know here at masterinvestor we protect and do not jeopardize ever our most valuable assets that we all have since we were born. These assets are time, freedom and mind. We cannot replace them therefore they are not for sale!

On the right side of the CASHFLOW’s-Circle, construct a system of systems for printing money. With a product base business that solves problem in high demand.

The ultra-wealthy conduct business exclusively on the right side of the CASHFLOW-Circle, and they are the ones who have discovered how to make money legally.

They own the machine, which explains why. Business owners establish businesses just to solve problems and print money lawfully; once we recover our original investment, we can readily get unlimited profits (IROI). The same is true for inside investors. We are in the money printing industry and are making unlimited returns once we have recouped our initial investment back, still hold or control the asset and its cash flow.

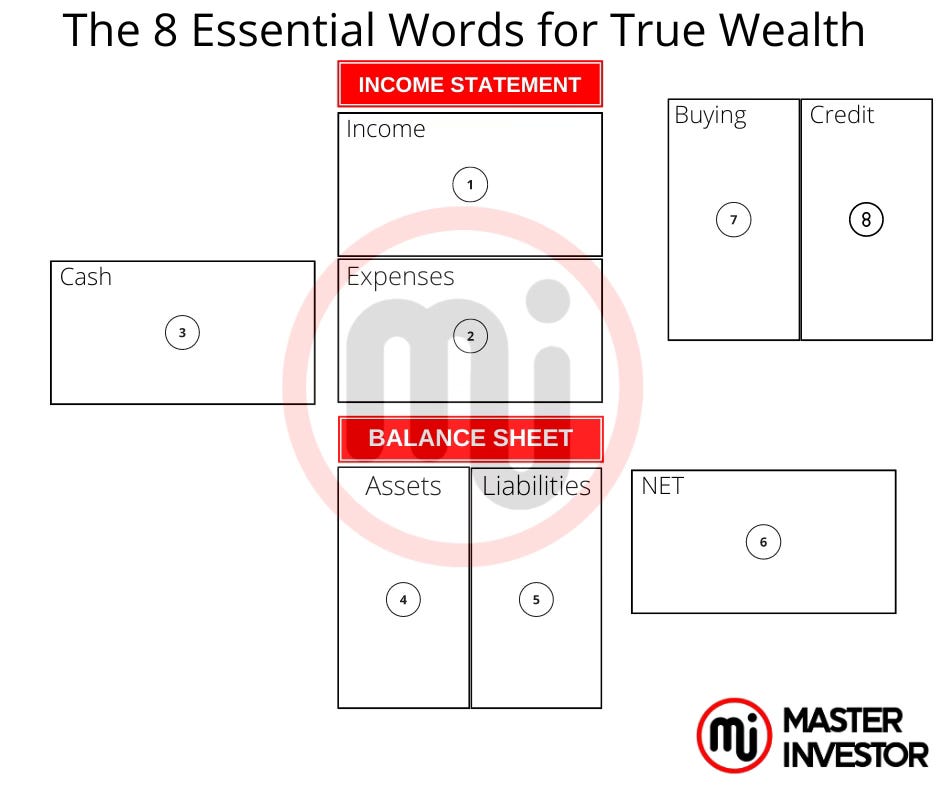

Remember that the most important words in the business language are cash-flow and the second most important word are due diligence. When we mastered them words in our core then we will have the keys to unlimited wealth. When we mastered them words, then we can always determine with assurance when an investment is sound or really an asset, and when is a liability or toxic investment. Majority people in the world that call themselves investors buy and invest in liabilities only making them average investors.

We are only are permitted to print money legally when we own or control the equipment and its systems, which means that we are working on the correct side of the CASH-FLOW-CIRCLE which is the right side as we can see in the diagram below the left side pays the highest in taxes while the ones on the right side of the cash flow circle pays less in taxes. We know that taxes are the highest expenses the average humans have in their lives. When we build our assets column we instantly begin to Lowe our taxes by simply playing on the right side of the cash-flow-circle. Consider a few instances.

In the business world, how can we print money legally?

From an idea to a kitchen table, garage, bedroom and laptop with internet, we founded the Master Investor’s (masterinvestor) Company and Brand. As many other big brands have been form from an idea and lunching it right from the household. Using common sense, products base businesses, internet and a smart device is how the biggest businesses are created.

In one instance, we successfully have collected $250,000 from investors rather than spend our own capital to acquire a sound asset. We are able to reimburse our investors 100 percent plus an extra 100 percent to buy back their shares in less than three years, thanks to the expansion of our company. The firm now generates millions of dollars for the investors, despite the fact that we haven't invested any of our own capital in it. That's an infinite return on investment (IROI). To put it another way, our businesses makes us money whether we put our own money into or not.

With other people's money (OPM), how can we print money/currency?

This raises a crucial issue: the rapid attainment of infinite returns through the use of other people's money (OPM).

The distinction between good debt and bad debt is a fundamental principle of Master Investor that we need to discuss before getting into OPM.

We have likely heard that debt is bad if we grew up knowing the old rules of money. That is, however, just not the case.

As long as it's good debt, debt is required by the new rules of money if we want to become wealthy.

A car, a holiday, or other liabilities are paid for using bad debt. These are items that we don't need and that depreciate with time. They take money out of our pocket every month. Therefore, we are suffering a double blow from both the loss of funds due to our obligations, the loss of money to interest and poor debt.

Assets that generate income for us every month are purchased using good debt. Equity partner funds, credit cards or a loan for an investment property, venture capital, and other items are considered good debt.

OPM is a kind of acceptable debt. Using it correctly requires a high level of financial literacy, but if we do, we can make money much more quickly. We have written a lot about the power of OPM for the business owner and inside investor, and here's an example from it:

Scenario 1

The buying price was $100,000.

$80,000 loan with a 5% interest rate.

$20,000 of our own money as equity.

Based on a basic mortgage calculator, the annual cost of this loan would be around $8,500.

If the property's income is $11,000 annually, after deducting costs, our net income will be $2,500 ($11,000 - $8,500).

$2,500/$20,000 = 12.5% would be our return on investment for this.

Scenario 2

The price was $100,000.

A loan of $80,000 at 5% interest

7% interest, $20,000 OPM

As the deal's finder, we get 50% of the net operating income.

In this instance, the other people's money we borrowed for equity at a hypothetical 7% would still cost us $8,500 each year for the loan, but we would also be responsible for an extra $1,500. Thus, the overall cost of the loan and OPM would be $10,000.

Again, supposing the property generates $11,000 in annual revenue, our total net income after deducting costs would be $1,000 ($11,000 - $10,000).

Our fee for arranging the transaction would be 50% of the NOI, which in this instance would be $500 (50% x $1,000).

Since we are earning $500 without investing any cash in the transaction, our return on investment for this would be limitless.

As we can see, if used properly, OPM is a potent money printing machine.

How to print money in the real estate industry?

We frequently collaborates with our real estate partners, mentors and other inside investors, in order to make money through real estate. We will acquire a community of apartments that is not performing well using investor funds (OPM), make improvements, raise rents, and enhance the property's value.

We can then refinance the property tax-free and use the loan proceeds to repay their investors while maintaining a healthy cash flow. The money flow is still available to investors even after we have been reimbursed. Money for nothing brewing point or known as Infinite Return On Investment (IROI). That's also a boundless return.

We can print our own money with the correct financial education, and these are just a few examples of how. And isn't it better than putting in more effort at a job to pay higher taxes, deposit the money in the bank (loosing value and being borrowed by business owners and inside investor) and see our purchasing power decrease, or invest the money in the stock market at risk for the long term?

It does, indeed.

Begin printing money the legal way by raising our financial IQ by actively investing in financial education, financial experience and achieving excess of cash flow in the present.

Many people teach that debt is bad or evil. They preach that it is smart to pay off our debt and to stay out of debt. Instead of saving and getting out debt, a person here at masterinvestor is encourage to invest in financial education, and use debt to acquire sound assets that eventually can pay for the bad debt that the person carries. It is not debt that is bad but the person behind the debt that makes it bad. The same goes for the debate of business and investing being risky, it is not that is risky but the person behind the operation and team makes it risky or not. People who do not have any assets yet should focus on the assets’ column and manage debt to increase true wealth that is tax free. We know that generally speaking all debt is tax free due the fact that today money is created with debt.

There is good debt and bad debt. It is wise to pay off bad debt—or not get into it in the first place until we have a real asset that is producing the cash flow to cover for the expenses of the liability or bad debt that we wish to have. It is not about shrinking or saving money when building wealth in today’s economy that will succeed. Actually is the very opposite, to become wealthy we must actively invest and expand our positive cash flow through sound investing by expanding. Simply said, bad debt takes money out of our pocket, and good debt puts money into our pocket whether we work or not.

A credit card is often bad debt because people use it to buy depreciating items like big screen TVs, cars, and vacations. Conversely, a loan for an investment property that we rent out can be good debt if the asset’s cash flow covers the debt payments, all expenses and puts money in our pocket in the form of passive income (positive cash flow).

Those who decry the evils of debt fail to realize its importance to the American and the worlds’s economy. The fact that our entire economy would fall apart without debt is unquestionable, even if it may be debatable whether it's a good thing or a terrible thing. Stable inflation forms the foundation of our whole economy. And we promote that inflation through debt. We must leverage debt to become wealthy fast and legally of course!

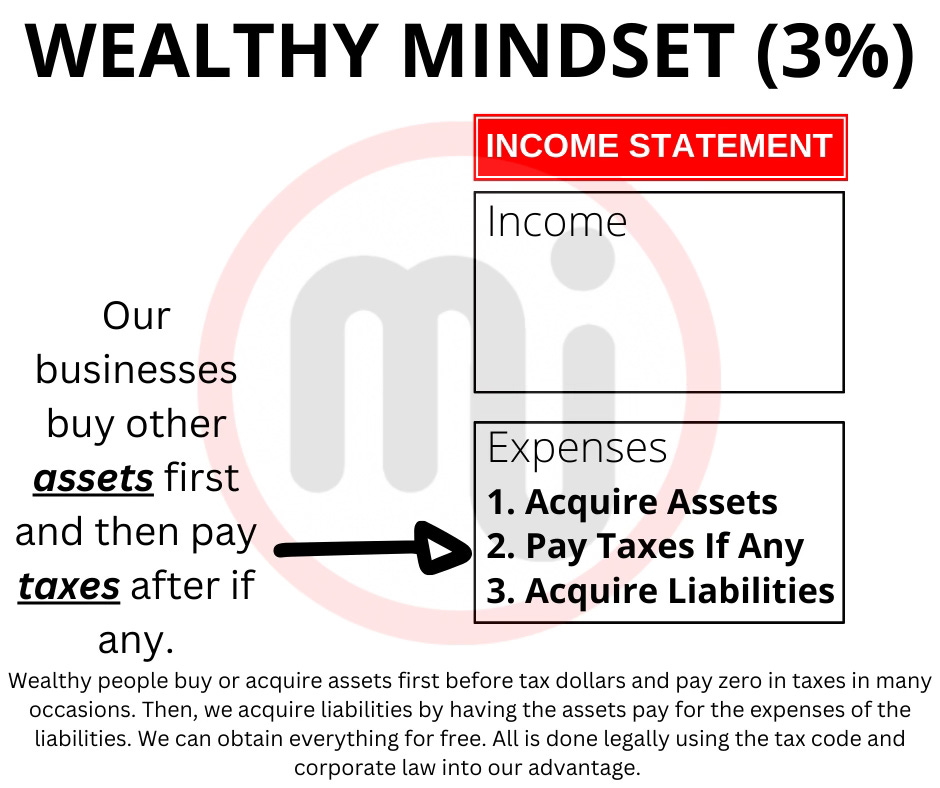

Regretfully, the way the wealthy utilizes debt is very different from how the poor and middle classes do. Both the poor and middle class operates with the poor context’s mindset and they live on the left side of the cash-flow-circle. The wealthy context’s mindset operates of the right side of the cash-flow-circle as a business owner and inside investor. When it comes to wealth there two types of mindset the poor and wealthy mindset. The middle calls and poor class have the poor mindset regardless of how much money they make via a job or self-employment. And the wealthy have the wealth mindset.

How the poor use debt?

As stated previously, debt is often used by the middle class and the poor to purchase liabilities only such as a car or a trip. There is nothing wrong with acquiring bad debt and liabilities as long as we first have assets that will cover the expenses of those liabilities. Then everything will be legally for free. The following are a few instances of how debt is used by the poor mindset:

High-interest credit cards: For liabilities are the first example of bad debt.

According to a 2020 article on Bankrate.com, the average interest rate on credit cards is around 17%. Furthermore, credit cards frequently include hidden fees that can run us hundreds of dollars for items such as yearly fees, foreign exchange rates, and late charges.

On its own, a credit card is neither beneficial nor detrimental. It depends on how we utilize them. Unfortunately, the underprivileged frequently make the worst use of credit cards by purchasing liabilities such televisions and holidays and then just making the bare minimum monthly payments. In this manner, they pay significant interest on items that lose value over extended periods of time. It's a double whammy.

Unpaid Bad Debt: Loans to cover obligations/expenses/liabilities

There are several loans available for liabilities. Again it is all about the person and its mindset being the debt that will determine whether that debt would be good or bad debt. We may always discover a method to increase our debt, whether it's through payday loans, personal loans, or auto loans, but it usually comes at a cost.

Additionally, the poor mindset takes out loans for items they consider to be investments, like their own house. A house, however, is not considered an asset unless is been rented out now to others and we are receiving positive cash flow after all expenses are paid by the revenue of the house. An asset is simply defined as a business or investment that makes us money on autopilot whether we are present or absent. In contrast, money is taken out when we have a liability. A private residence simply takes money out of the wallet if he or she does not rent it out. The house going up on value does not mean or make the house an asset because such is speculation and not real at that moment. Now if the house goes up in value and the landlord sells the house for a capital gains income then that house became an asset when it put profits into the landlord’s pocket rather than take money out its pocket. Don't assume that getting a mortgage is a wise investment unless that mortgage is use to invest for passive income, and especially don't take on too much debt than we can handle with our current assets. However, this is not to imply that we shouldn't get a mortgage. In fact, we encourage everyone to use debt to invest in real assets that can cash flow today. Here at masterinvestor we view debt for what it is which is money and leverage in the new economy.

Due to the way that this approach uses bad debt to get items that typically depreciate in value over time, the majority of individuals are financially bound to bad debt for the majority of their lives without simply first focus on good debt with sound assets to pay and acquire any type of bad and liability. When the poor mindset eventually opt to give up the addiction to toxic and bad debt, they frequently spend years toiling away in an effort to pay it off. There is a great deal of missed potential and wasted time.

Moreover, not all expenses are bad and as a business owner we must increase good expenses. Spending more and more successfully by investing is key to build our wealth.

Avoid thinking like the poor mindset

The following are 3 myths of the poor’s mindset. People who operate with the poor context they think the following to be true which is not true. The following three myths are not the reality when we have financial education and understand how wealth truly works today. Avoid the false beliefs and ideas that keep people poor their entire lives by refusing to update and learn the new ways to become wealthy.

Lie #1: Saving money is the way to get wealthy.

There’s no doubt about it, from an early age, children are taught the value of saving money. “A penny saved; a penny earned,” we chime. And when they are a bit older, we spin tales of the magic of compounding interest. Save enough, children are told, and we will be a millionaire by the time we are ready to retire.

Lie #2: A residential house where person lives is an asset.

The idea that one's home is an asset and one's greatest way to accumulate riches is another misconception that people fall for.

Lie #3: In order to build positive cash flow require our own capital.

The "save to get wealthy" fallacy has the other side of the coin, which is that we have to put a lot of our own money into investing. This is a result of the widespread cultural conviction that debt is bad and saving is good. People frequently claim that investing in real estate is risky, but if we are going to do it, attempt to minimize our debt. Pay off the debt with our own funds as soon as we can. There is not anything that could be further from the truth. Additionally, it originates from a basic misunderstanding of debt, which may have positive or negative implications.

How to use good debt effectively, like the wealthy?

The wealthy employ positive debt to increase their wealth and use Other People's Money (OPM), which belongs to both the bank and investors, to invest in cash-generating assets.

Master Investor’s basic premise is that OPM demonstrates a high level of financial literacy. We can significantly increase our Return on Investment (ROI) by employing both beneficial debt and OPM, and we can even get infinite returns.

A sort of OPM is good debt. Debt has the drawback that we may typically only borrow a certain percentage of an asset's purchase price. That's typically 70 to 80 percent of the purchase price, as illustrated by our real estate case from my last blog about healthy debt.

As a result, there are two options available when we come across a worthwhile investment:

Utilize our own capital, and

Utilize OPM or good debt.

Here at masterinvestor we understand that being creative and sophisticated means using OPM rather than our capital. The more debt we have the better for our taxes and returns on investments. Only lazy, novice, and financial uneducated people use their own capital to invest.

We will have a greater return if we set up the transaction properly and make the most of other people's money

Although some may believe it to be a fictional environment where individuals would simply hand our cash to invest, the reality is quite different. The truth is that the majority of individuals are too busy to look for bargains. Rather, they depend on individuals with the necessary financial knowledge, skills, and motivation to provide them with agreements.

Our partners and mentors have mastered the use of OPM. We purchase and invest into apartment complexes through our business, Master Investor, LLC. We handle all the laborious tasks of locating deals, conducting due diligence, negotiating with owners and lenders, and managing operations. People queue up in the hopes of investing their money with us as a result.

Master Investor makes large transactions nowadays that need a specific kind of investor. Not everyone can invest with us. However, we worked our way up from modest transactions. The three Es’ of a master investor are Financial Education, Finance Experience and Excess of Positive Cash Flow (passive income).

How to use debt to accumulate wealth and purchase property?

Here is a real-world illustration of how the wealthy use good debt as a source of money to increase our wealth.

One may leverage their funds by investing through the bank. Let's use elementary arithmetic to suppose that "Maria" owns $100,000 and wants to invest it in a $100,000 home that rents for about $800 a month. With a lot of searching, we may discover several homes like this.

With all of her funds, Maria might buy one home for $100,000, or she could use excellent debt to buy five homes for $100,000 each.

She would divide her $100,000 down payment into five $20,000 installments, and the bank would give her $80,000 for each property.

With taxes and insurance included, the monthly cost of the loans would be about $500 at 5% interest. As a result, Maria would have a monthly cash flow of $300 for each property ($800 in rent - $500 in debt payments = $300 per month), for a total of $1,500 ($300 x 5 = $1,500) each month, which is an 18% annual return.

With OPM, we may learn how to utilize debt to our advantage even more. Print money by mastering the ability to use good debt to invest for passive income.

Here is an example of how using good debt in conjunction with OPM makes it an even more potent investment instrument for the affluent.

Maria is able to boost her return and protect even more assets by using OPM. Suppose she can invest 5% of her $100,000 across 20 properties rather than having to pay 20% on five houses. She can accomplish this by lining up investors to invest in 20 fantastic offers she finds.

The arithmetic is as follows

Using OPM to get the additional $15,000 she needs for each property, Maria would split her $100,000 into twenty $5,000 pieces, and the bank would give $80,000 for each home. The payment on the loans would be about $500 per month at a 5% interest rate. Let's imagine she will offer the investors 7% interest on their funds and pay a little bit more for it. Although the amount owed to them would be little under $100 each month, we will round it up to $100 for simplicity. As a result, her monthly expenses would amount to around $600.

This indicates that Maria will have a monthly income of roughly $200, which she will share equally with the investors. The investors will make $100 each month, or $1,200 a year, while she will get $100 each month, or $1,200 a year.

When all 20 transactions are added together, the total return is $24,000 in annual positive cash flow (passive income), which represents a 24% return. In addition to earning 6% more annually than if she had used her own funds, Maria also owns 20 assets rather than only five. She can refinance these properties later, repay the investors, retrieve her investment, and keep making money from the 20 properties—an unlimited return. Using creativity and debt is the way to becoming financially fee, ultra wealthy and tax free.

Once more, the mathematics is rather straightforward here. The numbers are far larger and more complicated in reality. However, the concepts remain the same. A high degree of financial acumen is necessary in order to invest using OPM. However, both Master Investor began little and gradually built up to the large apartment transactions they now conduct. We may do the same.

Be cautious. Keep enhancing our financial literacy. Put in a lot of effort. We will become wealthy if we learn the basics of OPM and good debt.

Bonus question: “What are ways to use good debt (OPM/Money) for real estate investing?

Master the skillset to put OPM to work for us in real estate. As a business owner our number one duty is to raise capital and number one skill to master is to sell using smart marketing and systems.

We learned that there are two ways to get wealthy, however, OPM reaps the highest reward. There are six types of OPM that we can use for successful real estate investing. Success with OPM for real estate requires a strong financial education.

We have discuss the importance of understanding good debt and how to utilize it in our talks. The use of OPM, or Other People's Money, or Good Debt is what we refer to it as here at Master Investor.

Simply put, there are two ways to become wealthy. Using our own funds is one option. Using OPM (debt=money) is the alternative method. One, which uses our own money, needs some financial sense, takes a long time to pay out, and yields just moderate returns. The other, known as OPM, needs a high level of financial intelligence and generates tremendous velocity of money, as well as returns ranging from significant to limitless.

What would we rather use?

Everyone, including a new business owner and inside investor, can master the art of making money in real estate using good debt. Basically creating money without our own capital.

In fact, whoever does not learn how to use debt to become wealthy and print money will be struggling in the future. People who work for earned income and save money will not be able to keep up with the speed of inflation and interests on their savings will be negative.

We may start investing in the manner described above, which is fantastic news. Using debt and being creative to raise capital in different legal ways. Initially, it may not be with huge apartment complexes, but it may develop into that. Think bing, execute and grow wealthy that is one of or mottos here at masterinvestor.

Our first investment, a rental property, was made through OPM. We currently have control over apartment units under our companies’ ownership. Using this strategy of good debt, we are able to raise the velocity of our cash from a small rental home to a sizable cash flowing portfolio compose of assets in all the asset’s classes of today. And anyone is capable as well. Thinking differently about money, enhancing our financial IQ, and getting to work to build passive income right now are the first steps. Putting pan together because only do business and invest with a business plan.

Mastering Other People's Money (OPM) or Good Debt

Using other people's money (OPM) is a basic tenet of Master Investor and a sign of strong financial intelligence. We may significantly boost our Return on Investment (ROI) and even earn infinite return on investment (IROR) by utilizing both good debt or OPM.

A form of OPM is good debt. For reminder purposes, any debt that brings money into our bank account is considered good debt. In contrast, bad debt takes money out of our pockets. For example, a car loan is a form of bad debt. Even though the vehicle loses value the moment we leave the lot, we still have to pay for it every month. On the other hand, a loan for an investment property is considered good debt if the rental income from the property covers all of the expenses, including the debt repayment, and generates monthly income.

The drawback of acceptable debt is that we are often limited to borrowing just a specific proportion of an asset's acquisition price. In line with our real estate illustration, that usually falls between 70 and 80 percent of the total cost.

Let's break this down using the example of a $100,000 house for the sake of clarity. We may only borrow about $70-$80,000 for the house through a standard arrangement with a bank. The balance of the funds must come from equity from a different source.

OMP for a greater return on investment

As a result, there are two possibilities when we identify a viable investment: use our own funds or utilize other people's funds for the equity necessary in addition to the loan. The more we can utilize other people's money, the better our return will be, as long as we arrange the transaction properly.

Let's consider a few possibilities in the context of our real estate illustration.

Situation 1

$100,000 acquisition cost

5% interest rate on an $80,000 loan

Equity for $20,000 of our own cash

When using a basic mortgage calculator, the yearly cost of this loan is roughly $8,500.

After deducting costs, our net income would be $2,500 ($11,000 - $8,500), presuming that the property generates $11,000 in annual revenue.

The return on investment for this would be $2,500/$20,000 = 12.5%.

Scenario 2

$100,000 is the price of the purchase.

A loan of $80,000 with a 5% interest rate.

At a 7% interest rate, $20,000 OPM.

As the finder of the transaction, we are compensated 50% of the net operating income.

Even with the assumed 7% equity loan, our annual borrowing expenses would still be $8,500, plus an additional $1,500 for the money we borrowed from others. Therefore, the entire cost of the loan and OPM would be $10,000.

Once again, if our annual income from the property is $11,000 after expenses, our net income would be $1,000 ($11,000 minus $10,000).

In this instance, our charge for arranging the transaction would be 50% of the NOI, which would be $500 (50% x $1,000).

Since we are earning $500 without investing any capital, this would represent an unlimited return on our investment.

Naturally, these are only a few instances. This is possible in the actual world of investing, where we may achieve significant gains and, as in this case, infinite profits. However, it requires a lot of financial savvy.

Getting OPM can be frightening

It all about asking the right question presented with the right cash flow analysis and business plan to accomplish rising capital. The majority of individuals are enthusiastic about the notion of OPM and even about its potential. However, they are then frightened by the specifics of how to locate and utilize OPM.

People experience this all the time. Our brains try its best to come up with explanations for why the idea is flawed or won't work when we encounter new concepts. Our minds inform us of things such as the following:

"No one would ever give us money."

"We can't locate investments that are alluring enough to entice OPM."

"Too much danger is involved in using OPM. It's preferable to simply invest our money in our retirement account."

The most challenging aspect of OPM is knowing how to locate the best real estate investment deals to draw in cash, but even that isn't hard if we put in the effort to learn how.

For instance, our partners and mentors have mastered the use of OPM. People, in turn, queue up hoping to invest their money with us as our business, Master Investor, purchases apartment buildings, and other assets. Our team handles all the labor-intensive tasks of locating bargains, completing due diligence, dealing with landlords and lenders, and managing people. We engage in significant transactions nowadays that demand a specific kind of investor. With us, not just anybody may invest. However, we began with little transactions.

To get us started learning more about wealth, consider our books and courses. Knowledge is the new money. With financial education we can make money make money through sound investing. Without financial education a person usually can only make money through selling time for money in a job and if the person is a professional then he or she may be a successful self-employed. They are high paying employees that own their own jobs through their profession. They could make a lot of earned income or salary but that does not meant they are truly wealthy. We know wealth is measure in time and not just with how much a person makes. The manner in which any person makes their money determines who they are in the game of money. A person can focus on building the three types of income. Each type of income requires different education. The three incomes are earned income, capital gains income and passive income. The last two incomes come from investing and the first type of income comes from a job or owning a job.

Securing OPM becomes simple once we have the perfect property, team and business plan—if we know where to look. Additionally, it gets simpler as we start to establish our real estate portfolio and a track record of success.

Money will find us or we will find money when we have a great deal orchestrated on a business plan.

Here are six reliable OPM sources that we can use to benefit ourselves and our real estate holdings

Real estate OPM #1: Banks

This one should be clear. We know what it's like to apply for a mortgage at a bank if we own a house. A mortgage is a type of OPM, but most people don't consider it that way. In most cases, a bank will finance up to 80% of the value of a single-family house. The remaining 20% is our responsibility as the buyer.

Nevertheless, this is not always the case. With an FHA loan, first-time homebuyers can finance up to 97% of the purchase price, with the buyer only responsible for paying the remaining 3%. Naturally, there are conditions attached to this, such as the requirement that we reside in the property for a set period of time before we may rent it out.

In real estate investing, a home is considered a commercial property when it reaches a specific size. This implies that banks considering loan applications will use the property's operating income as the basis for the loan requirements, as opposed to the "market value" that they use for a house.

We may frequently finance a large portion of our capital expenditures with the bank's funds if we can demonstrate the commercial rationale for a loan to cover not just a portion of the purchase price but also the implementation of the business plan to increase the value of the property.

A bank may not be the best choice if we want to have little to no funds in a transaction because banks are well known for being cautious. However, it can be a nice place to start.

The second form of real estate OPM is through private lenders.

We may collaborate with private lenders and equity firms that are willing to invest in real estate, even though banks are generally highly regulated public institutions. Investment clubs, angel funds, and other options are available.

The number of institutions whose only aim is to locate lucrative investments into which to invest money may astound us. These lenders may be found through online searches, where we may find things like private lender groups, or by contacting other investors we are acquainted with. With potentially higher interest rates, these loans might be somewhat more costly, so think about our alternatives.

Real estate OPM #3: Seller finance

The seller serves as the lender in a seller finance transaction. A seller may do this for a variety of reasons. It's possible that they are weary of the labor involved in managing real estate, or that they want a consistent income by earning set interest on their funds rather than depending on the fluctuations in rental income.

Since a seller finance is a private transaction, the possibilities are limitless, and it all comes down to how well we can negotiate. The vendor might pay for the entire property or just a portion of it. The rate might be at market or higher than market, depending on the risk involved. We would handle the work and management to implement the business plan, and the vendor might share some of the profit in return for a reduced rate. The possibilities are almost endless.

Although we can never be sure whether a seller will agree to self-finance, as with everything else, it never hurts to ask.

Real estate OPM #4: Investors

It will be simple to find private investors who will be willing to invest the equity capital for a decent investment property. This is frequently how we may get the funds for the portion of the purchase price that a bank will demand that we pay.

For example, we would use private lenders to obtain the majority or all of the equity capital needed for a 25% down payment if the bank demanded it when we are purchasing a four-plex.

As a result, we must create a strong investment prospectus that highlights the possibility of a return on investment for the investors. Ideally, we would have completed that for the bank as well, making it available for business.

We conduct our business in this way, and as a result, we have increased our portfolio from a single apartment building to many units in several places.

Real Estate OPM #5: Government Tax Credits

We may use a variety of tax credits to assist pay for our real estate investment if we are interested in investing in government-subsidized assets, such as affordable housing. We can explain these two:

Rehabilitation Credit:

The Rehabilitation Tax Credit may provide some relief to investors who choose real estate linked to gentrification. This one aims to motivate developers to remodel, rehabilitate, and rebuild historic structures. A 10% credit is provided for buildings that were first used prior to 1936. A structure may be eligible for a 20% tax credit if it is deemed historic in the tax year in question.

A loan from Freddie Mac that is tax-free:

In an effort to promote particular behaviors, the government provides tax breaks. Municipal bonds, as well as certain federal government-issued loans, may be tax-free for the interest they accrue. Through Freddie Mac, the government permits specific loans to be exempt.

In order to support multifamily property owners, the government established a tax-free loan program through Freddie Mac. This plan is designed especially for people who are refinancing, purchasing, or remodeling an affordable house. It offers funding with 4% Low-Income Housing Tax Credits, also known as LIHTCs.

Because these investments demand a high degree of financial knowledge, we should not dive in headfirst. However, we may earn a respectable income if we put in the effort to turn professional.

We may also be eligible for tax credits for making eco-friendly improvements to existing buildings or constructing new ones. Since it differs from industry to industry, do our research and find out what we can get.

Real estate OPM #6: Operational Cash Flow

The reason why real estate is thought to be one of the best ways to increase the speed of our money is because this is when things start to get really interesting. After we have a solid real estate investment property and a strategy for increasing its worth, we can use the property itself as a vehicle to create money out of thin air for additional real estate transactions.

Finding apartment complexes that are underperforming is what Master Investor and business partners do. Any chance to raise Net Operating Income (income minus expenses) is a chance to earn a good return on investment (ROI) since the value of a business property like an apartment is determined by its Net Operating Income.

A number of things may contribute to this for our team. As an example, the current landlord might be renting apartments at rates much lower than those on the market. Raising the rent and switching those units might significantly boost NOI. It may be possible to raise rents by $25 to $50 per month by renovating the units with washers and dryers and giving them a facelift. When multiplied by hundreds, this results in a significant increase in income.

A rise in income is a significant increase in value because the bank bases a property's value on its Net Operating Income rather than its "market value." This increased value allows us to refinance, extract funds from a property tax-free, and then reinvest them in another real estate asset. Our portfolio—and our wealth—grow exponentially as we repeat this process continuously for several years. Additionally, everything is done with OPM.

Begin with a course in finance here at masterinvestor

A significant amount of financial acumen is necessary to invest with other people's money and successfully print money legally that is tax free wealth. Like minded investors begin with modest investments, thinking big, and eventually move into the large investment’s transactions that we can engage in now. We are all able to achieve financial freedom and true wealth fast.

Be diligent. Keep improving our financial knowledge. Put in a lot of effort. Learn the principles of OPM or good debtand infinite return on investment. Then, we will be wealthy beyond our dreams. This is true!

All of our great Financial Books and Courses from Master Investor’s catalog, will teach our partners more about investing like the ultra wealthy do.

Start investing in high quality financial education, by reading our financial eBooks: