SUMMARY:

Turning regular income into passive income is the secret to increasing our wealth.

In fact, we can choose how much tax we pay by choosing the way the spend and make our money.

Go to the CASHFLOW Circle’s right side to become a super taxpayer (tax free-wealth).

Bonus: At the end of today’s article we will discover five legal ways to cut our tax bill like a wealthy person.

A person might believe that he or she has no control over the tax liability. Taxes must be paid by everyone, right? False.

The tax code and cooperate laws are a package of incentives for those who are a business owner and inside investor, those people operating on the right side of the cash flow circle. We want to become ultra wealthy due to our cash flowing assets that we control with our companies.

Which side of the cash -flow circle are we operating today and which side to we belong?

As we can witness on our diagram above is the CASH-FLOW CIRCLE, which demonstrates the four types of people in the game on money and two types of mindset that exist in the world of money. In addition, we can see the tax bracket of each type of person.

As we can witness on our diagram above is the CASH-FLOW CIRCLE, which demonstrates the four types of people in the game on money and two types of mindset that exist in the world of money.

Become A Super Tax Payer

As we understand more about money, we can clearly see that the data shows that taxes are the highest expenses that humans have because majority of people in the world operate form the left side of the cash flow circle not the right side of the cash flow circle where we can legally create tax free wealth.

When we position ourselves to lower our taxes by doing business and investing in what the government wants to invest in and develop, then we instantly get tax advantages.

Two important rules of the wealthy

The wealthy people's regulations

First Rule: Because we don't earn our money like employees and self -employed do, the wealthy pay very little in income taxes because we work for the other type of incomes that exist. We are aware that producing passive income from the business owner (B) and inside investor (I) or the right side of the CASHFLOW Circle is the most effective approach to lawfully evade taxes.

Second Rule: The purpose of tax law is to lower our taxes. For instance, the tax code in the United States is more than 5,800 pages long. Raising taxes takes up only about 30 pages. "Except as otherwise provided in this subtitle, gross income means all income from whatever source derived," reads one sentence of Section 61(a). After that, there are a few more pages with tax rates and additional taxes. The entire remaining 5,770 pages are devoted to tax reduction.

We will not only permanently lower our taxes by 10 to 40 percent or more if we follow the government's instructions, but we will also start to accumulate more wealth and cash flow than we ever thought was possible.

Government rewards those on the right side of the cash flow circle

What is the government's desire then? Their first goal is to increase employment. Who makes jobs? business owners. As a result, business owners receive a variety of tax benefits that serve as financial aid to promote the creation of jobs. What more is the government looking for? Reasonably priced housing. Numerous tax advantages are available to real estate developers, which serve as subsidies to promote the construction of affordable housing.

The government provides investors and businesses with all of their tax benefits in order to achieve these objectives. By providing particular tax advantages for oil and gas investing, farming and other agriculture, green energy, and low-income housing, governments further narrow down the kinds of investments and jobs they want the market to generate.

The government provides the inside investor and business owner with all of our tax benefits in order to achieve these objectives. By providing particular tax advantages for oil and gas investing, farming and other agriculture, green energy, and low-income housing, governments further narrow down the kinds of investments and jobs they want the market to generate.

Changing sides on the cash-flow circle

Fortunately, it's not hard to achieve that. Three actionable steps:

Become a business owner: All throughout the world, thousands of people own their own businesses or make investments in energy, real estate, or agriculture, and they all benefit from tax code savings.

Becoming an active investor or inside investor: Who entails actively investing for passive income rather than earned money. Simply put, passive income is money received from businesses, dividends, and rent of cash flowing assets that we control. Compared to earned income, which is derived from capital gains and appreciation or from our wage, it is taxed at a substantially lower rate. Finding profitable, cash-flowing investments that provide passive income is essential to becoming a super investor.

Learn from an active investor or inside investor: We are referring to an individual who invests their money directly in the tax-favored industries like energy, real estate, business, or agriculture and others. Another advantage for inside investor is that we can deduct a large portion of our costs. We can even deduct investment losses from other sources of income if we use the proper tax technique.

Make passive income out of earned income

Many people begin their lives working and receiving compensation for their labor. However, lowering our tax rate by turning the earned income into passive income is the secret to increasing wealth.

We can change our income that we focus on building by having an informed conversation with our accountant, mentors, and tax lawyer about how the various forms of income are taxed.

Be a super taxpayer

Moving to the right side of the CASHFLOW Circle and beginning a business or investing for passive income is the greatest method to take advantage of deductible expenses. We don't need to resign from our position. Just begin modestly.

Actually, lowering our taxes by every way possible is our patriotic obligation.

A super taxpayer doesn’t pay taxes legally because we are building passive income from our assets’ column. We constantly move the profits into a new cash flowing asset and obtain new tax advantages which results in tax free wealth.

Is it difficult to believe? Consider this:

The government must genuinely want we to lower our taxes if that is the purpose of 99.5 percent of the tax code. We will understand that we have the right to lower our taxes whenever we choose after we have these two guidelines ingrained in our head.

Who Type of Person Makes the Largest Tax Payments and Why?

The "wealthy" are often criticized for not paying our fair share of taxes.

However, if we examine the data, we will see that nearly all of the income taxes collected by the US government are paid by individuals who are generally regarded as "rich or high paid employee."

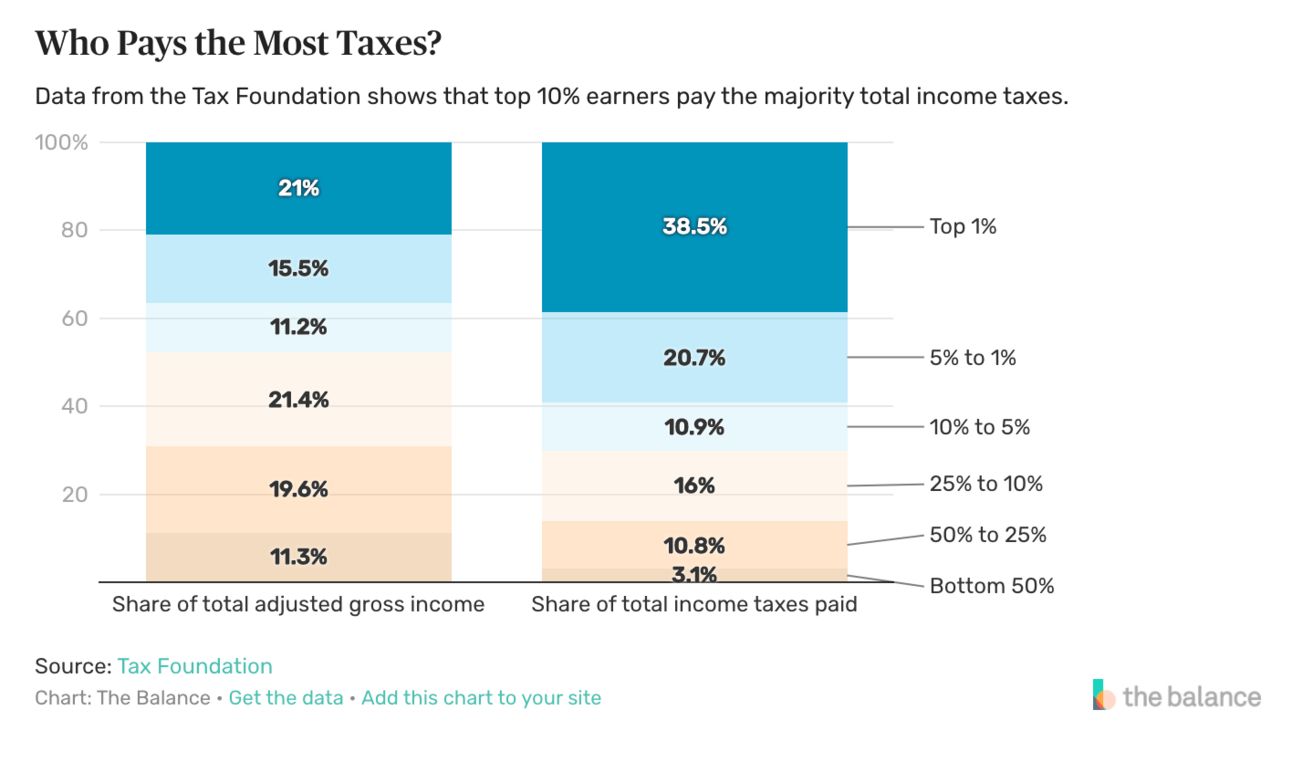

The top 10% of US incomes pay nearly 60% of federal income tax, according to this figure from The Balance. This is due the high paying employees in different fields and self-employed.

However, things become intriguing when we delve deeper into that 10% of the numbers. To help deconstruct the figures, "The Wall Street Journal" published a chart that displayed a 2018 analysis by the Tax Policy Center, a nonpartisan think tank located in Washington, D.C.

For those in the lower income bracket, net negative income tax is really paid by those earning up to $48,000 annually. They receive their money back.

The intriguing part, though, is when we compare the income tax shares paid by the ultra-wealthy and the highly paid. According to 2018 predictions, the 0.01% of earnings (those over $3.2 million) were only expected to pay 22% of all income tax, while the top 1% (those over $730,000) were expected to pay 43%.

The people who many would consider "rich," the top 1% of earnings, are really paying a lot more in income tax than the ultra-wealthy, the top 0.01%, when we consider that the typical earner in the 0.01% makes $26.1 million.

Why is this the case?

Not making any tax payments

How many of us know someone who avoids paying taxes by cheating on their taxes? Many people out there try to hide money in order to pay lower taxes, but that is illegal and the person lacks financial education. We can avoid paying taxes without cheating and by simply following the law.

To be wealthy, we need to play by the rules of the wealthy. In other words, the rules of money are biased against the working and middle classes and in favor of the wealthy.

Governments receive between one-third and one-half of the world's wealth. It's horrible news.

Why it counts and who doesn't pay taxes?

In actuality, the IRS tax law is designed to promote and incentivize particular kinds of conduct.

In general, the IRS encourages people to engage in activities that create jobs and stimulate economic growth. As a result, they provide investors and business owners with numerous tax benefits. However, for those who earn a lot of money but contribute little to the economy in the form of jobs or growth, the IRS is of little use.

Therefore, it should come as no surprise that the top 1% of earners pay a larger proportion of taxes than the top 0.01%. Why? since the majority of people in the top 1% are neither investors nor entrepreneurs.

The ultra-wealthy, on the other hand, are people whose fortune is frequently derived from professional investing or business startup. Since the IRS rewards these actions, they enjoy far higher tax advantages than even those earning hundreds of thousands of dollars annually. The ultra-wealthy are adept at limiting their paid income and generating the majority of their wealth through investments and businesses that generate passive income.

Employees are expected to pay roughly 40% in taxes on average. A person will pay a considerably higher tax rate—60 percent on average—if a person is a specialist or small business owner.

We can lower our tax rate to 20% as a business owner, but here's the trick. We can lower our tax rates to zero if we can become a wealty entrepreneur and an inside investor.

Here are several strategies, for instance, to prevent paying needless taxes:

Recognize that our money belongs to us and not the government is important to grasp in our minds. The money we make and the wealth we accumulate belong to us, unless we live under a dictatorship. Yes, we might have to provide a portion of it to the government in order to support schools, the military, and road construction. But at its core, it's our money.

Take advantage of the tax law's complexity. For instance, the tax code in the United States is more than 5,800 pages long. Raising taxes takes up about 30 pages. The remainder of the 5,770 pages are dedicated solely to tax reduction.Benefit from it!

Include tax planning in our wealth strategy. Keep in mind that our wealth strategy includes both our earnings and our assets. We keep more money and make wiser choices when we invest with using taxes in our advantage.

Just like the ultra-wealthy, we can pay zero in taxes.

The CASHFLOW Circle and Taxes

Finding out who pays the most and who pays the least in taxes is made easier with the masterinvestor’s CASHFLOW Circle.

A doctor who works for a Business Owner ( with a large organization like a hospital or pharmaceutical company) that doctor could be an Employee, for instance. As a self-employed or S in private practice, a doctor can also be a Self-employed by having his or her own private practice.

Alternatively, a doctor may be a B, the owner of a pharmaceutical firm or a hospital. Additionally, the doctor may be an investor.

Why the highest tax payments are made by Es and Ss?

We can discover who pays the highest taxes by taking another look at the CASHFLOW Circle. Once more, the tax code is designed to promote investment and business. For this reason, the highest tax payments are made by people that are E and S or left side of the cash-flow circle.

Apart from having children, deducting some debt, such as mortgage and college loan interest, and using low-level financial vehicles like a 401(k) or Health Savings Account (which are actually tax deferments, not savings), there is actually very little that those people can do to lower their tax burden.

However, the IRS laws give those in the B and I or the right side of the cash flow circle almost limitless options to lower our tax burden. The IRS regulations are actually designed to encourage activity in the B and I or the right side of the cash flow circle.

To pay less in taxes, move to the right side of the cash-flow circle.

Changing from the left side to the right side of the cash flow circle is the key to maximizing our tax bill deductions. This is not something we can do in a single day. Instead, it is constructed gradually, but the first steps are taken right now. The advantages are lifelong and that provided us to take the proper actions.

Changing our mindset is the first step in shifting to the right side of the cash flow circle. Spend as much time is can with people that have B and I or the right side of the cash flow circle attitudes and learn as much as we can about how money works.

Bonus: What are five ways to minimize our taxes legally?

Be advised that these are advanced methods that call for a deep understanding of finance. While not difficult, they do need for a certain level of financial intelligence. Start a course of study that provides the groundwork for these suggestions if we haven't already made an investment in our financial education.

#1: Start a secondary company to reduce taxes.

It's likely that we can launch some kind of business now by using ai and technology. Use our eBooks and eCourses to jump start and expand our wealth.

#2: reduce taxes by educating ourselves about business

According to the tax code and corporate law the following is another way we can deduct taxes legally. We can write off 100% of our business-related seminar expenses, including registration, meals, accommodation, and transportation charges, under Internal Revenue Code Section 162. We are not taxed on the advantages since the business body deducts the expenditures and they are not included in our income.

#3: Invest in rental property to reduce taxes

Investing in real estate is among the finest strategies to lower a tax burden. Many individuals who work in the Employee (E) but make real estate investments are transferred to the Inside Investor (I). We experience significant excess of positive cash-flow (passive income) and a significant reduction in tax burden in the process because of the type of income we have.

#4: Reduce our tax burden by investing in a gas or oil well

We can make investments in oil and gas ventures today. Transportation, food, warmth, polymers, and fertilizers all depend on oil and natural gas. We can see that oil is used in everything in our kitchen, including the food we consume. Because oil is vital to life, our economy, and our level of living, and because oil drilling is extremely dangerous, the government provides enormous financial incentives.

#5: Reduce taxes by hiring a lawyer and a tax counselor

Lastly, business and investment are team sports, as we used to say. Our need for expert assistance will increase as we become more adept in lowering our tax burden. To ensure that we are properly positioning ourselves and utilizing the tax code to the fullest extent possible (while not breaking any rules), we should have a tax counselor and an attorney we can visit on a frequent basis.

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Subscribe to our Youtube.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: How To Pay Zero In Taxes?

Masterinvestor’s mission is to be the global authentic brand of money, business, and investing that elevates the financial well-being of humanity through high-quality financial education made simple with lucrative opportunities to build passive income, win-win partnerships, and true wealth.

Comment, like, share and follow for more High Quality Financial Education Made Simple.