The real meaning of "pay ourselves first" and the reasons why wealthy people don't save money

Who do people pay first when they get a paycheck? If they are like the majority of Americans, they probably pay their rent or mortgage, groceries, electricity, car payment, insurance, government through taxes, and other bills first. The typical "paying themselves last" situation is when they finish paying all their bills and put what's left over (if anything) into savings. Then they repeat the process while eagerly awaiting their next payday. The great American Rat Race is that. Solution to the rat race, learn: How to pay ourselves first to build wealth?

But we are doing everything wrong if we ever want to escape the Rat Race.

The concept of paying oneself first is an important lesson, still applies today, regardless how the world will change. Paying ourselves first will helps us create wealth faster. Also, business and investing is a team sport.

Getting a bookkeeper with the intention of having a clear understanding of our financial condition because it is time to take responsibility. The bookkeeper will assist in realizing the way we manage our cash flow. If we are putting anything for our wealth. Every penny will show where is allocated to pay our expenses first.

The shortest path to poverty is in paying ourselves last, and fastest the path to wealth is paying ourselves first.

I am reading: How to pay ourselves first to build wealth?

Getting ourselves paid first

Start making behavioral changes and chose to pay ourselves and their debts first.

Whether it made sense or not, people set aside a certain amount of money each month and added it to our asset column. Even though our cash flow is less than our bills, we must make sure to give this column top priority by treating it like a cost/expense.

This is the other story of the money world:

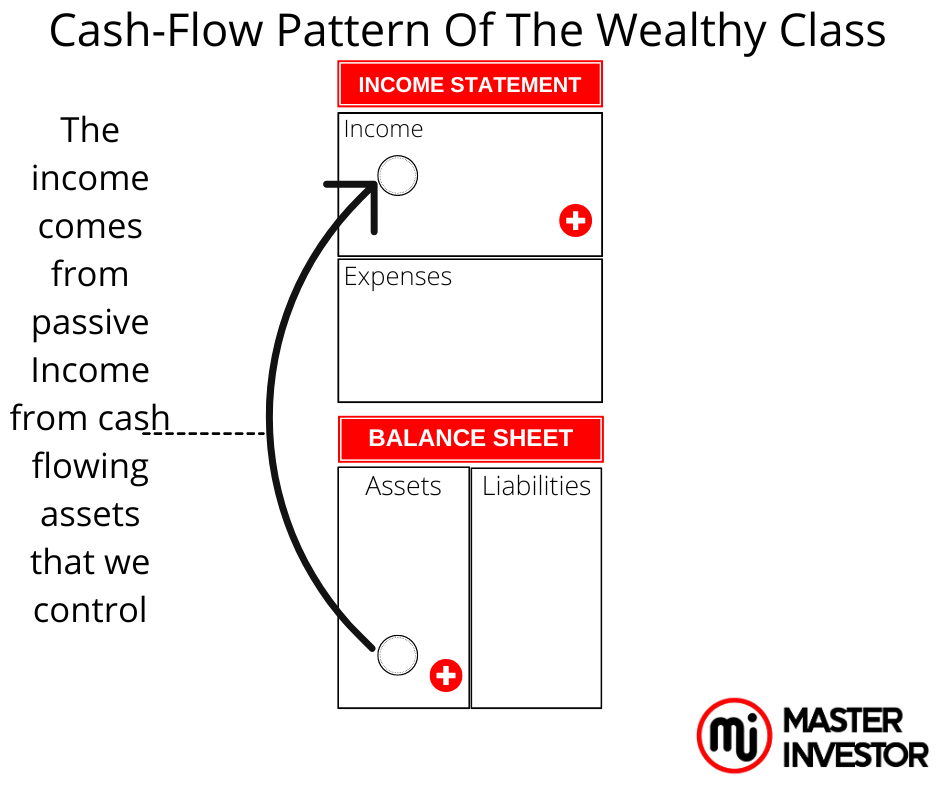

It's possible that we are thinking, "I thought we were going to share a story, but those are just pictures." As the saying goes, "A picture is worth a thousand words."

Try to identify some of the differences between the two stories by carefully studying the aforementioned diagrams. Financial savvy people can recognize key differences and the narrative they share.

The acts of people who adhere to the pay oursleves first principle are shown in the first diagram. Before we pay our monthly bills, we allocate funds each month to our asset column.

The activities of people who pay others before they pay themselves are shown in the second diagram. They set aside money each month for their expenses and use the remainder, which is typically little to zero, to save or "invest without financial education". The people in the rat race are depicted in this diagram as being destitute regardless of how much money they earn.

Understanding the importance of cash flow can help we recognize the flaws in the second diagram. Because of this, 90% of people put in a lot of effort throughout their lives and depend on government assistance like Social Security once they are no longer able to work. They pay themselves last, which is the cause o financial trouble and struggle.

We need the self-control to prioritize paying ourselves first if we want to be wealthy. This simply refers to investing our income in cash-flowing assets prior to paying our debts or treating ourselves to something pleasant. As a result, we will earn more money, which we may use to buy more assets with positive cash flow. If we do that, we will have more money than we can possibly need.

Paying ourselves first is difficult. In fact, it might even be frightful, particularly if the debts are mounting. But to do that, we must cultivate discipline.

The 10/10/10 Plan is presented

The 10/10/10 strategy is a greta plan of action that anyone can implement to begin creating wealth. We divide 30% of their earnings each month in the following ways:

10% Investment - We set aside 10% of our monthly income as a reserve for excellent investment possibilities. Usually, we decide to invest in real estate or other assets that produce positive cash flow instantly.

10% Emergency - We then set aside 10% of our income each month for unforeseeable events and unique possibilities. This wasn't an emergency account meant to last a lifetime instead to invest even more.

10% Tithing or Charity - And because we firmly believe that we must give in order to get, we set aside 10% of our total income each month for tithing or charitable giving to causes we are passionate about. Generosity is key when building wealth.

Changing habits

First, avoid taking on bad debt that we will have to repay with our own time and efforts. We can only acquire bad debt when we have an asset that will pay for that bad debt every month. Reduce our spending on liabilities until we can have assets that will provide the cash flow to pay for that payment. Create assets first. Later, purchase the large home or luxury vehicle we want with the cash flow of the businesses we have built or acquire. Expand our good expenses, and invest capital actively.

Second, rather than using our assets or savings as a safety net when we run into financial trouble, go ahead and let the pressure develop. As we can see, the poor have bad habits. One of these bad practices is using funds to pay bad debts. Use the pressure to motivate our financial whiz to come up with fresh ways and ideas to earn more passive income with assets, which we can then use to pay our all expenses. Bonus: Our capacity to earn more passive income will have risen, as will our financial acumen.

Let's assume that our monthly income is around $4,000. We will have $3,500 left over after paying ourselves $500 to cover living expenses. We will have paid oursleves $6,000 after a year. To avoid the temptation of spending the money on liabilities, we can even have our bank set this up to happen automatically. The money has to have a plan before we even get it so that we know where is going to work hard for us.

Do not be a saver, if we want to be wealthy

One of the most common pieces of conventional financial advice is to save our money. However, most people do not become or remain wealthy through saving.

In actuality, saving is a surefire way to lose for the great majority of people. Why? Due to the fact that inflation frequently increases faster than the interest rates savers receive on their money. Their savings are actually losing money the entire time they have their money in their bank account. While the wealthy mindset (good debtors), we are borrowing that money to invest which is the savers money, provided to us by the banks.

Let's choose a good round figure, like $100, to demonstrate this. By the end of the year, we will have $101.50 if we have that much in savings earning the typical interest rate offered by banks today of 1.5 percent. Unfortunately for the saver, inflation is currently 8.3%, so what they could currently buy for $100 will now cost $108.30. That represents a $6.80 difference. If they multiply that over time, we can experience a significant decline in their money's purchase value.

Worse still, money is a form of currency. It expires if it doesn't continue to move. Sad to say, people who save money never put it to work for them, which prevents them from becoming wealthy.

Because of this, we educate individuals to spend money wisely rather than train them to save it.

Too much bad debt to get wealthy?

Sometimes it takes bad debt to spark the entrepreneurial spirit to make better decisions when it comes to spending money. It can helps us become creative and invest debt into assets that will produce excess of cash flow (passive income) . The following advice:

Step 1: First, stop accumulating bad debt right away. Put an end to contributing to bad credit card debt.

Step 2: To ensure that everything is properly organized and accounted for, make a list of all debt we have (credit cards, student loans, vehicle loans, personal loans, etc.).

Step 3: The next step is to hire a “team" (a bookkeeper) so that we can not run away from the reality. This person will keep precise records each month of our cash flow situation so that we always know where we stand (even if we don't want to admit it).

Step 4: The 10/10/10 plan is step four. After consulting with our bookkeeper, we can make the decision to deduct a predetermined proportion from each dollar that entered our pockets and set it aside with a plan to invest the money to create cash flow. We start paying oursleves first at this point. Three piggy banks can be set up: one for emergency, one for tithe or charitable giving, and one for investments. Each receives a fixed percentage of 10%, totaling 30% of their earnings. Remember that we don't have to start with 30%, but we should stick with it each month and raise it when we can.

Step 5: Decide which debts should be paid off in what order, starting with the smallest and working your way up. Pay only the minimum monthly payments on all other debt. After paying off our first bad debt, which is the lowest, move on to the second-lowest loan, and so forth.

Stay the course in step six! Keep in mind that we must follow this plan every month. If we tell ourselves, "We will just break the plan this month," we won't develop the habit, and our bad debts won't disappear. Which hinder our wealth creation.

Clarity is essential

Some individuals misunderstand the phrase "Pay ourselves first" when they hear it. Actually heard the phrase "Treat yourself first." They believe it to indicate spending money carelessly.

In contrast, the goal is to intentionally add to the asset column so that we can invest our money and make it work for us.

This is when the adage "any money in the asset column stays in the asset column" comes into play.

For instance, we began investing many years ago, now we cam develop from that base to possess hundreds of apartment units across the United States by retaining the money made from that investment in our asset column. It only required some discipline (and financial education!).

Always strive with the formula of the velocity of cash-flow.

Acquire a cash flowing asset

Recoup the capital invested back as soon as possible

Keep control over the asset

Invest the cash flow generated into a new asset that generates positive cash flow

Repeat the steps

This is how we reach total freedom due to excess of positive cash-flow (passive income).

The wealthy don't reduce expenses—instead, we raise them

This does not imply that do not appreciate finer things in life. Saving money is something that the impoverished do. The wealthy do not make budget cuts. We instead ask, "How can we afford that?"

The number one duty of an entrepreneur is to raise capital. And the number one duty of an inside investor (master investor) is to make money work hard in sound assets.

Finding strategies to create money that don't involve depleting your asset column is necessary if we want to buy something good for ourselves. Simply put, look for assets that can generate enough cash flow to pay for our expenses and luxuries.

For instance, if we adore high end cars. We desired fantasy cars for a very long time. So we set to work to build an asset that produce passive income. We can discover fantastic assets that generated monthly income flow to pay for the car. We can acquire anything for free legally as a result of financial eduction, and increasing our asset column.

The key message here is to never increase our bad debt by deducting from our asset column. Keep it in the asset column instead, and keep adding to it, so we can buy the goods we want.

Planning ahead for the real estate investments that will make us wealthier is a good plan as we attempt to get our personal finances in order. Check out our free investing lessons to get started right away. Also, we diversify among the assets classes that exist for passive income and sometimes capital gains income.

It is not about shrinking and saving when we are building wealth. We must expand our expenses by expanding our passive income from our asset column.

I am reading: How to pay ourselves first to build wealth?

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: How to pay ourselves first to build wealth?

Comment, like, share and follow for more High Quality Financial Education Made Simple.