Summary:

Being financially literate is the first step toward getting wealthy.

By putting in the effort to learn, we will master our trade.

A necessary step on the road to success is failure.

Will we put forth the effort to earn while valuing stability over opportunity? Or are we going to put in the effort to study (and acquire financial literacy), forgoing some stability in favor of more opportunities?

The one thing the poor's mindset wants to land a well-paying career. The poor’s mindset believed that attending a reputable university, earning a degree, landing a high-paying job, and climbing the corporate ladder were the keys to success.

We must decide what is going to be our financial destiny by picking either the wealth mindset or the poor mindset. Even having a well-paying job, we must recognize that working as an employee wouldn't get us wealthy. Wee wanted to be wealthy. Actually, the majority of wealthy individuals are already aware of this.

Use caution when acquiring new knowledge

The power of our mind makes it crucial to exercise caution when absorbing new information.

Because everything that we let into our minds shapes who we are, it's critical to approach learning actively as opposed to passively. Being a passive learner means that we end up becoming what other people wants us to be, not what we truly want to be.

We take charge of our life and destiny when we are an active learner. And when we are active investors, then we take control over our financial future.

Sadly, the majority of people are passive learners and investors, and as such, they are dying financially in a dynamic and ever-evolving society.

Two approaches to work

Consider these two radically dissimilar perspectives on work:

Job security is the most important thing, for most people in the world think in those terms. Which hinders them from acquiring true wealth or total freedom. Loving what we do is important but most people are lying to themselves about their job. Most people get comfortable with things they do not love and they just continue to accept them. Becoming a wealthy entrepreneur we must possess the mindset of the wealthy which starts with financial education.

The most important thing is learning. And to become wealthy we may have to learn things that we do not love but thy are necessary to build our financial freedom. Therefore, the sacrifices are worth it because we get total freedom as a reward.

In actuality, the majority of people have acquired work skills. The general public generally adheres to a single basic formula that they were taught in school: work for pay. Across the globe, the most common pattern is this: millions of people wake up each day, go to work, make money, pay their bills, balance their checkbooks, purchase mutual funds, and then return to their jobs. That is the fundamental equation.

The issue is that those are the antiquated financial regulations. In the modern world, they are useless.

Then there are those who will lighten up, understanding that working even if we aren't compensated or are paid very little might be a route to something bigger. These gradually get to the position of wealth.

What then makes this different? The wealthy use financial literacy to our advantage. The traditional education received by the poor leads to their demise in the game of money in real life.

The attitude of learning

The unfortunate truth is that, instead of viewing their jobs as chances to develop and learn, most individuals view them as a necessary evil in order to maximize their income.

When we study the data, then we have bright future ahead of us full of freedom and abidance. Focus on making money through systems and investments, rather than from an income from job.

Nevertheless, we must make changes now starting with our mind, and environment.

To acquire new abilities, we enlisted in the wealth. We aspire to become wealthy entrepreneur. We must be aware of the significant advantages our leadership abilities from the our own experiences will provide us in both life and business.

Many are always looking to secure a reliable, well-paying position. Nevertheless, choosing wisely what we do with our time determines how well we do at the game of money in real life. The way we make our money tells us who we are in the game of money. Even though being high paying employee may have provide the person with a “luxurious existence” and a sense of security, but in order for the person to become wealthy he or she must be interested in learning how to sell via systems.

That ability of mastering sales via systems and the ability to read financial statements and improve them is the foundation of true wealth. Moreover, along with the leadership qualities we acquire in our entrepreneurship journey, would bring us wealth.

Generalist versus specialist

The basic distinction between the work-related philosophies of the wealthy and poor mindset was one of specialization vs generalization.

Poor mindset people thinks that becoming more and more specialized in their career is the greatest course of action. They acknowledged that when one's knowledge of a given subject increased, one's pay as earned income increased. That's the reason poor mindset people are so happy to receive their high professional education’s certificates like a PhD. However, they are most likely never will become wealthy. Having money alone doe not make one wealthy, because if that individual does not know how to multiple that money to work through sound investing then the money will be gone sooner than later.

The wisest course of action, according to masterinvestor’s core values, is to become a generalist and learn a little bit about everything.

We advised against choosing a career path and instead emphasized developing abilities through working in various departments within a corporation. We are aware that being able to oversee experts from a variety of divisions within a corporation was the key to being wealthy and running a sound business.

How the wealthy learn?

The ways in which the wealthy and the poor navigate their education are what really set us apart from being wealthy or poor. It only takes a little adjustment to our money-making strategy if we are sick of what we are doing or aren't producing enough.

Wealthy people take charge of our financial education

Today is easier than ever to enroll in a financial courses in different asset classes that exist today.

Business

Real Estate

Crypto

Paper Assets

Commodities

Today, we pick up a proven wealth formula thanks to the internet, because the knowledge to make money through investing is not found the in the school systems. We must seek and find the financial education we need in order to build true wealth. Once that formula is apply, we will become extremely wealthy. Make an effort to master sales via systems which is called marketing. Master marketing and sales techniques. We will be extremely wealthy as a result of this talent.

But we do not stop there. We are constantly investing in our financial education and learning new concepts. We can choose financial courses intended for ay type of asset we want to acquire. We will gain valuable knowledge that enhanced the significance and profitability of our investments due to financial education.

The important thing to remember is that we must take charge of our financial education, and the reason we are wealthy is that we do not let other people dictate to us what he should or shouldn't learn when it comes to finance.

The wealthy pick things up quickly

The majority of junior colleges offer courses on financial planning and purchasing conventional assets if would like to take charge of our financial education. While they are a fantastic starting point, we should always look for a quicker formula. The wealthy make more money in a day than many people would make in a lifetime because of this.

In actuality, traditional education frequently imparts yesterday's methods. We must study considerably faster and take a more proactive approach to our education if we want to understand the formula of today. Think about reading books, going to conferences and seminars, and getting mentored by people who work in the fields we are interested in.

If we want to be a technical trader, don't learn from professors with yesterday's notions; instead, study under the top technical traders who are actively generating money every day. This also applies to business, commodities, real estate, and other areas. These are the folks who understand what has changed, what is evolving, and how to adapt in order to thrive. They possess priceless knowledge that will increase our wealth.

Because what we know is outdated, it doesn't matter as much in today's environment. Instead, it's our rate of learning. We will succeed in life if we can locate information people are looking for more quickly than they can. It's an invaluable ability.

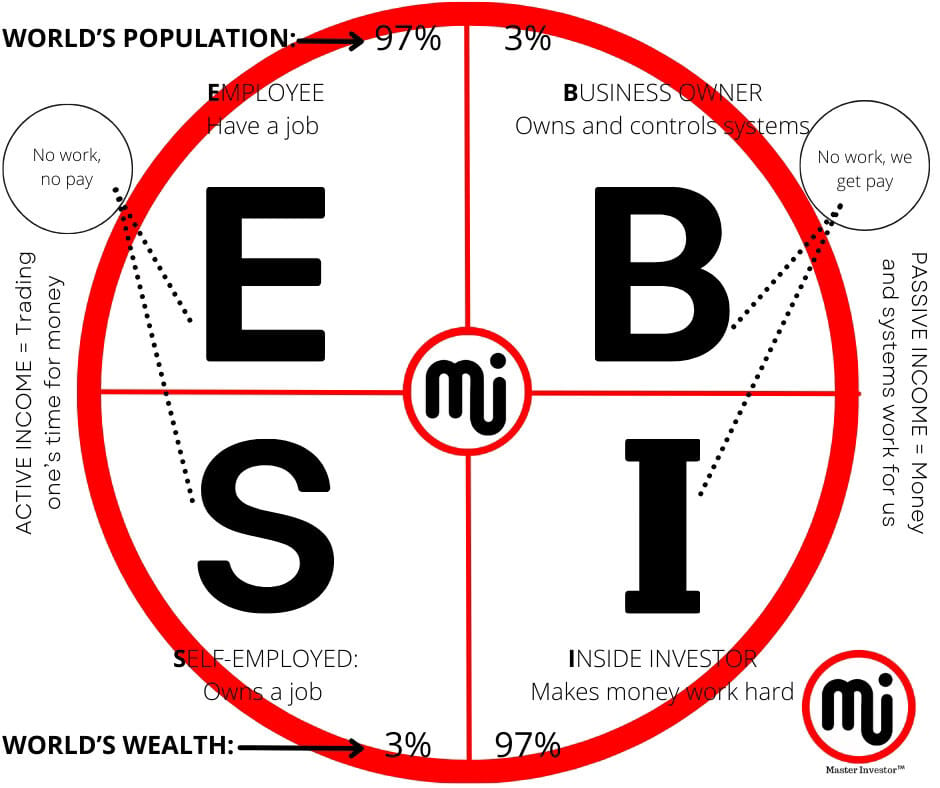

Where are we in the Cash Flow Circle?

Which type of income the wealthy works for to build?

Primarily we focus on passive income because of the 3 options we have, passive income or positive cash flow is the income that is taxed at the lowest bracket. Passive income it comes in constantly to our pocket on autopilot through systems and assets we control with our companies. And when we achieve passive income then capital gains income will also come in from other investments.

The poor mindset focus on working and increasing their earned income, which comes from a paycheck or salary of a job. The specialists in the world work for this type of income. As a wealthy entrepreneur we must look poor on paper as individuals. In other words, we do not received earned income like the poor do. Therefore, we do not pay taxes on such income because we do not make that type of income.

Rule #1 in our community here at masterinvestor is to work to build passive income and make money multiple through sound investing.

See the diagram below to observe the 3 types of income. Passive income and capital gains income both come from sound investing. And earned income as mentioned above it comes from a job., majority of people will spend their rest of their lives working for such income keeping them living below their means as inflation rises. The ones that work for earned income will be the ones suffering as they swim agains inflation, while the wealthy entrepreneurs, we will become wealthier due to higher inflation because we are prepare for any type of economy. We take advantage of the new rues of money and we apply them in our investment strategy daily.

Accept errors

Majority of people it the world are raised in the academic world, where errors are viewed negatively and should be avoided. In the field of academic and professional education, people are considered to be less bright the more mistakes they make.

The wealthy have a different view about education and why type is the one that makes us wealthy. We view mistakes differently, seeing them as chances to grow and learn. Here at masterinvestor we believe that we learn more from our mistakes. Every mistake has a little bit of magic hidden in it. We therefore have more magic in our lives the more smart mistakes we make as we attempt to do great things with our wealth and the time we take to learn from them is how we earn the mistakes’ blessings.

Everyone has heard the tales: Before he ultimately invented the light bulb for his company, General Electric, Thomas Edison tried more than ten thousand times. When Levi Strauss failed at gold mining, he started making canvas pants for successful miners. The adage "I have missed more than 9000 shots in my career" is attributed to Michael Jordan. He dropped nearly 300 games. He has been trusted 26 times to attempt the game-winning shot, but I've missed. Him and other great achievers experienced repeated failures throughout our lives. That's the reason we are successful.

These success tales are all connected by mistakes and failures. Our attitude towards failure is one of the largest obstacles to success in life, both personally and financially.

Which cash flow pattern do we have?

The wealthy don’t play it safe

Those who have never failed are among the biggest failures we know.

Here at masterinvestor, our partners and mentors are making the point that people never take any risks because they always attempt to be safe. To be wealthy we must overcome such fear of failure. Furthermore, poor mindset people never succeed in life because they never take any chances. They become stranded. We made the observation that the wealthy are successful financially because we have made a lot of mistakes and have grown from them all. Applying the knowledge learned from our financial mentors to advance to the next level financially in our lives.

Most importantly, after learning from it, we must make an effort to avoid making the same error again. Moving from experience to wisdom is what we called that.

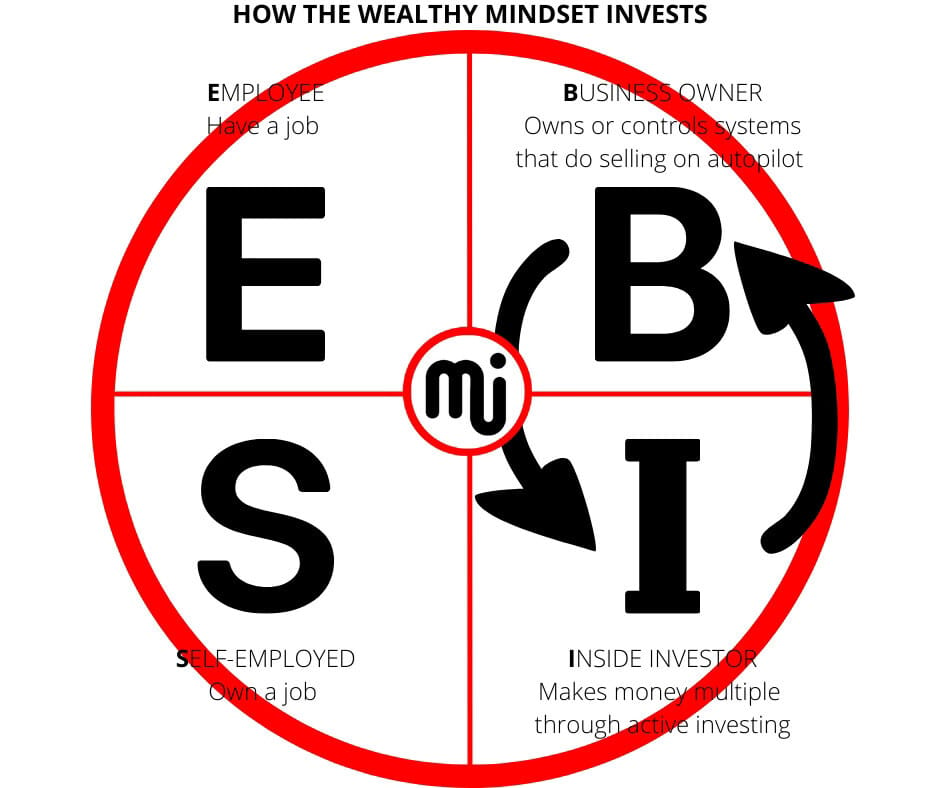

How do the wealthy invest?

We always invest from the right side of the Cash Flow Circle. Building and acquiring cash flowing businesses, then the revenue from these assets will buy us other cash flowing assets. Obtaining everything for free at the end just like the wealthy do legally. The poor mindset focus on thriving from the left side of the Cash Flow Circle as they lack financial education. Freedom is found on the right side of the cash flow circle.

Work for knowledge, not money

These days, we have a lot of options. Will we put forth the effort to earn while valuing stability over opportunity? Or are we going to put in the effort to study (and acquire financial literacy), forgoing some stability in favor of more opportunities?

The majority of people will opt to labor in order to make money, as is customary. However, work toward what you want to learn rather than what you want to earn if you want to be wealthy. Prior to settling on a career path or entering the never-ending race, decide what talents we wish to gain.

What abilities must we develop in order to lead a fulfilling life?

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: How to Learn Like The Wealthy?

Comment, like, share and follow for more High Quality Financial Education Made Simple.