Summary:

Working from 9 to 5 isn't as safe as it once was.

We may always improve your abilities to better suit the circumstances of today.

The secret to prosperity and security? The spirit of entrepreneurship.

Many people around the world advised others to "attend school and get good grades so you can get a safe, secure job" on numerous occasions. People around the world are setting up to spent their time working on the left side the Cash Flow Circle as E (employee) and self employed. Paying the highest in taxes and not having freedom to enjoy life at the maximum.

We can often hear "A person should become a doctor or lawyer if he or she want to be rich," but remember rich is not the same as wealthy, and that is what others frequently advise others to do, to go to school and be a professional though schooling to get a high paying secure job. In this manner, a person will always have a career to fall back on. That advised is the poor mindset and is setting others up for earned income. But not only we learned on yesterday’s livestream and article that rich is not the same as wealthy. Wealthy comes with total freedom, and rich does not come with total freedom.

Our recommendation here is that we should mind our own business if we want to be wealthy not just rich. We recommend others to pursue our dreams of being an inside investor and business owner, on the right side of thew Cash Flow Circle, where we find the B (business owner) and I (inside investor) players.

We should mind our own business if we want to make it to total freedom. And in order to accomplish this, the entrepreneurial spirit must be nurtured. That's easier said than done, though. It requires time, effort, and energy to commit to building passive income and capital gains income.

The robots are coming, along with a huge disruption in the workforce!

I'm sure we have heard a lot about robots and artificial intelligence. The Boston Dynamics robot that was able to unlock a door by itself caused quite a stir on the internet not so long ago.

We made a article some time ago about how jobs will change as artificial intelligence and robotics become more prevalent. We stated in the post:

Being employed is the least financially secure job there is, now more than ever. This is directly related to the growth of AI and automation. However, the majority of workers are unaware that their jobs may be at danger.

The next wave of robots is being compared to the Industrial Revolution by several academics. The majority of individuals would prefer to ignore these unpleasant facts. And if we were a betting man, we would guess that the majority of workers would claim they don't think robots could perform their jobs if they were surveyed. They'd be mistaken, though. Oxford University researchers have estimated that 47 percent of U.S. jobs could be automated within the next two decades.

It is not significant for China alone that China is becoming a superpower in AI. There will be no stopping the rapid advancements in AI brought about by the rivalry between the US and China. There will be a significant shift that isn't entirely positive. The gap will grow. My Cambridge Uber driver has already predicted that AI will cause a significant number of jobs to be lost, which would lead to social unrest. Take the development of Google DeepMind's AlphaGo software, which in early 2016 defeated the top human Go players. Then, in 2017, AlphaGo Zero was unveiled, and in just 40 days, it had surpassed all of its predecessors thanks to its ability to learn through self-play games. Imagine now that such advancements would spread to regular white-collar and blue-collar jobs like truck driving, production lines, reception desks, and customer service. It won't take long to realize that robots and artificial intelligence can perform half of our work activities more efficiently and for nearly nothing. We are not prepared for the fastest shift that humankind has ever encountered.

AI industry will eliminate up to half of all jobs and create new ones.

We want to know what we plan on doing about it. Our recommendation is to mind our business and invest in real assets among the five asset classes that exist.

The epidemic and employees' perspectives

For individuals with the employee mindset that is, those who believe that having a "good job" is the most secure position one can have the rise of AI and robots is frightening enough, but the coronavirus epidemic has demonstrated that job losses can occur quickly and at large scale.

As the coronavirus swept over the world in a couple of weeks, almost 22 million jobs were lost in the US alone. People who had previously believed they were safe and had a "good job" were suddenly struggling to make ends meet.

What is even more alarming for workers is that, according to Marketwatch, just 42% of the jobs that were lost during the early stages of the pandemic were regained.

To put it simply, people who wager on a "good job" are losing a lot of money.

Individuals possessing an entrepreneurial mindset will have an advantage in terms of future recovery.

The necessity of an entrepreneurial spirit

According to the article above about AI and jobs, today's workers would be best served by honing their talents and cultivating an entrepreneurial mindset. It will be better to either own companies where you can control how those technologies are employed, or even better, own companies that create those technologies and apply them to your field of expertise, than to lose your job to automation and artificial intelligence (AI) or to wait for a job lost to the pandemic that might never return.

Thus, launching a business that automates legal research and briefing could be an option for an attorney. For a truck driver, this could entail locating a location to establish a business in the autonomous vehicle sector.

Regardless of the industry you work in now, it's likely that you can identify a market niche that automation and artificial intelligence (AI) may disrupt and develop a business around. Alternatively, aim to establish a business in a field like real estate investing where artificial intelligence (AI) can assist you get a competitive edge but where automation or AI replacement will be challenging.

It's challenging to maintain the entrepreneurial spirit

If we agree that the greatest way to survive and prosper in the future is to go from being an employee to an investor or entrepreneur, be aware that this will not be an easy transition. It will be worthwhile, though.

Many people believe they can jump very high very quickly. The truth is that you cannot suddenly go from working for a large company (B) or becoming an investor (I) from being an employee (E) or self-employed (S).

It will require dedication if we are sincere. Here are three explanations for this.

Reason #1: It takes time to cultivate an entrepreneurial mindset

The construction of Starbucks took several years. Building a McDonald's took years. Years passed before Sony emerged as a major force in entertainment. Put another way, the development of outstanding businesses and business leaders takes time. The majority of individuals do not think in years. Most people have ideas about being money quickly and experiencing instant gratification.

That explains why the population of the B quadrant is so small. The majority of people don't want to spend their time in exchange for money.

Reason #2: We must acquire an entrepreneurial mindset in place of the employee mindset

The adage "We can't teach an old dog new tricks" is said. Fortunately, people are not dogs. However, there is some validity to the notion that the harder it is to relearn things we have spent years acquiring, the older we get.

Feeling secure in the E and S quadrants is one of the reasons why so many people are more at ease there. They had trained for years to be there, after all.

Thus, despite the fact that their comfort ultimately serves them poorly, a lot of individuals go back there because it is cozy.

Give ourselves plenty of time to learn and unlearn. Unlearning the perspectives of the E and S players can be the most difficult aspect of moving from the left to the right side of the cash flow circle for certain individuals. The shift will happen far more quickly and easily once we have unlearned what we have learned about money and wealth.

Reason #3: This is more than simply a shift; it's a metamorphosis

Every caterpillar creates a cocoon before turning into a butterfly.

As a result, the process of becoming an inside investor and business owner is very similar to that of that caterpillar. It takes business failures before we unexpectedly discovered our entrepreneurial spirit. We have to discover our passions and who we are as individuals to excel in the entrepreneurial world. No matter how difficult things get, we have never wavers from the right side of the Cash Flow Circle as a B and I players thanks to this entrepreneurial spirit.

Due to the understanding that total freedom is achieve on the right side of the cash flow circle not on the left side of the cash flow circle.

Knowing these three factors that contribute to the difficulty of transitioning from an employee to an investor or entrepreneur will help us to endure through difficult times. Furthermore, persistence will be crucial in a world where machines which never weary or give up dominate.

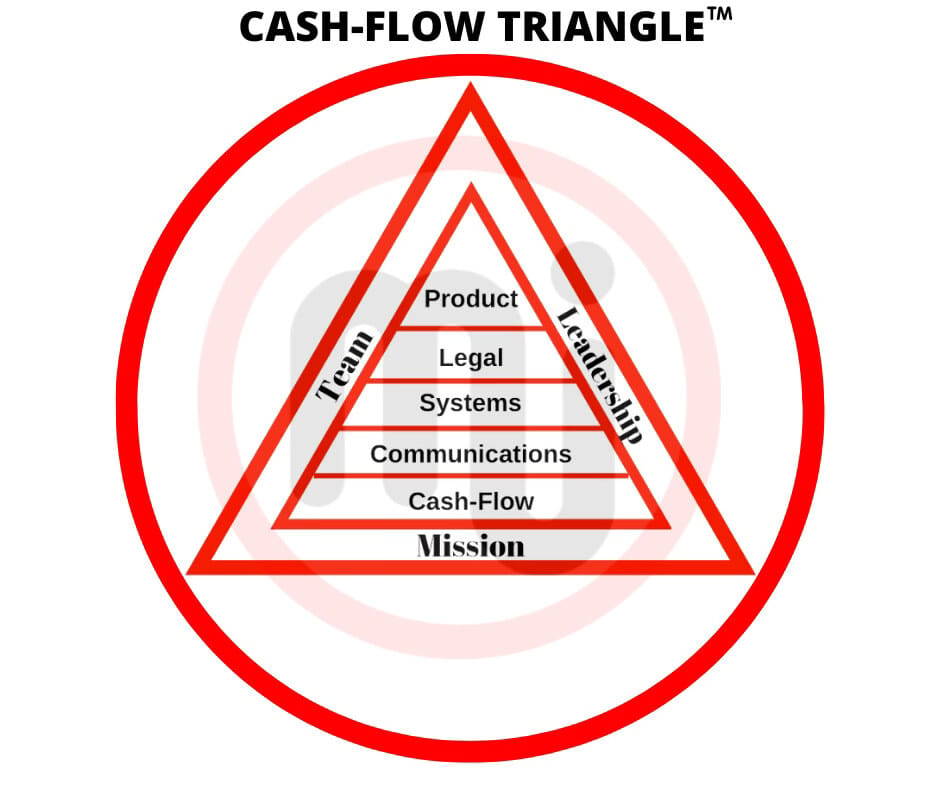

When Building Our Business Ensure To Use The Cash Flow Triangle To Create A True Brand

The 8 integrities found inside the cash flow triangle above is the guide to help us build a real business that becomes a brand for the world. When a business or investment struggles is due to the lack of one or more of the integrities found in the cash flow triangle. The most successful business in the world have all the 8 integrities in place, just take a look at our favorites brand. We can easily see all of the 8 integrates display on each successful brand.

Master The 8 Essential Words On A Financial Statement

The most important words on business and investing are CASH FLOW and DUE DILIGENCE. In addition, to the ones we see on a financial statement. True wealth comes from the ability to read financial statements and improving them starting with our personal financial statements. The way we keep the entrepreneurial spirit going is by using the new rules of money and having daily financial education in our lives.

Copy The Cash Flow Pattern of The Wealthy

In order to build true wealth we must have the cash flow patter of the wealthy class. Which focuses on the assets column. Constantly expanding our passive income and capital gains income through sound investing. A person that has 9-5 for 365 days has no time to make passive income and capital gains income. We must create the time to learn about business and investing.

Then, begin to invest for passive income and diversify among the 5 assets classes that exist today. (Business, Real Estate, Crypto, Paper Assets, and Commodities). There are two types of investing income passive income (positive cash flow) and capital gains income. All assets will not only bring passive income, some assets will give us capital gains income, but we will know even before we invest what type of income we will receiving and how fast we will have it.

Investing comes with risk, but the more we know about money, business and investing then the risk is calculated and we will always invest to make money multiple. Using our businesses’ cash flow to buy other cash flowing assets is the essence of the velocity of cash flow and reaching infinite return on investment (money for nothing) on our investments.

When we invest like the wealthy do, then we can obtain anything for free and legally because we know how to acquire and build cash flowing assets that will pay for of our living expenses and any other expense we wish to acquire.

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: How to Keep The Entrepreneurial Spirit Going?

Comment, like, share and follow for more High Quality Financial Education Made Simple.