Summary:

Raising capital with other people's money (OPM) is a clever approach to leverage our way to financial freedom.

Obtaining OPM requires a plan that addresses the primary concerns of the investors, banks or lender.

There are numerous methods for obtaining the money of others legally through debt.

Let's say we get the chance to buy a quaint yet traditional ten-room boutique hotel that is on the verge of foreclosure. However, something is lacking. Is it perhaps money?

Alternatively, imagine that we want to build a small firm we already own or create, but we need a financial boost to get things off the ground. We identify a few individuals we know outside the company as possible investors, but how do we convince them to fund our venture?

Here's a more scenario: A woman who we have met multiple times asks us to invest in her privately held wind-energy business, which has been up and running for five years.

We have the money, but how can we determine if this is the correct investment for us

In the realm of investment, raising funds, sometimes referred to as OPM Other People's Money is essential. However, it's also among the most daunting aspects of becoming an investor at first.

Utilizing Other People's Money (OPM): Its Power

OPM, or other people's money, is precisely what it sounds like: investing and controlling greater and more assets with capital and funds that are not our own. There are numerous advantages, but one that stands out is that we can increase our cash flow considerably more quickly, consistently, and profitably than we could have done with our own funds and capital. Even though it may sound strange, employing money that isn't legally ours is the key to successful investing.

OPM provides us, the investor, with leveraged power! We can harness the strength of larger capital as an investor with less money to make investments that can "lift up" larger assets.

Imagine a playground see-saw used by kids. It would be difficult for us to pull a smaller child off the ground if we were on one end of the spectrum and the older, bigger youngster was on the other. However, when the little youngster is positioned closer to the center, the little guy's power increases, enabling us to raise the larger investment off the ground.

Some people become wealthy and others do not because of leverage.

Less than 5% of Americans are proficient at using leverage, which explains why less than 5% of Americans are extremely wealthy. Here's an illustration of leverage's power:

Let's say an investor has $10,000. She will have $10,000 in assets under her control and $10,000 to invest in the stock market. Investing like this is "leverage-free."

However, she would now own a $100,000 asset if she put the $10,000 down as a 10% down payment on a house and used OPM (in this case, a mortgage for the house). Compared to a $10,000 asset, this property or asset has the potential to create far more cash flow. This investor was able to purchase a larger asset thanks to OPM.

When many people hear this concept, they frequently automatically think of "debt." However, the truth is that both good and bad debt exist.

Bad debt is anything is OPM we use to acquire anything that does not increase our positive cash flow, and we are ultimately responsible for the expenses that come with such liability. There is nothing wrong with having bad and liabilities as long as we have cash flowing assets with good debt that will pay for the expenses of all our liabilities. Building wealth is not about cutting expenses or living below our means. Building true wealth is the opposite, we must master how to actively spend more wisely and multiple each dollar we handle. We must learn how to successfully invest money in assets. Bad debt is anything (like charging a non business expense or getting a yacht only for fun rather than commercial use) that does not increase our positive cash flow. But we could always turn our liabilities if possible into assets. We could rent the yatch out to others and we use it for free when we wish. Now the yatch is an asset because it is making us positive cash flow and its paying itself off through te revenue is generating monthly. Conversely, good debt is when we use debt to invest in an cash flowing asset. For example, we use debt for our company to finance the purchase of new machinery that boosts sales and profits (such as buying a property that can be rented out and provide cash flow) and even to launch a new digital business tat brings in daily sales o autopilot trhough sales funnels.

Financially freedom to a professional investor

It's critical to comprehend the many perspectives on capital raising.

Many people have been socialized to live below their means their entire lives.

Regretfully, people frequently bring to the financial world their same perspective on personal money.

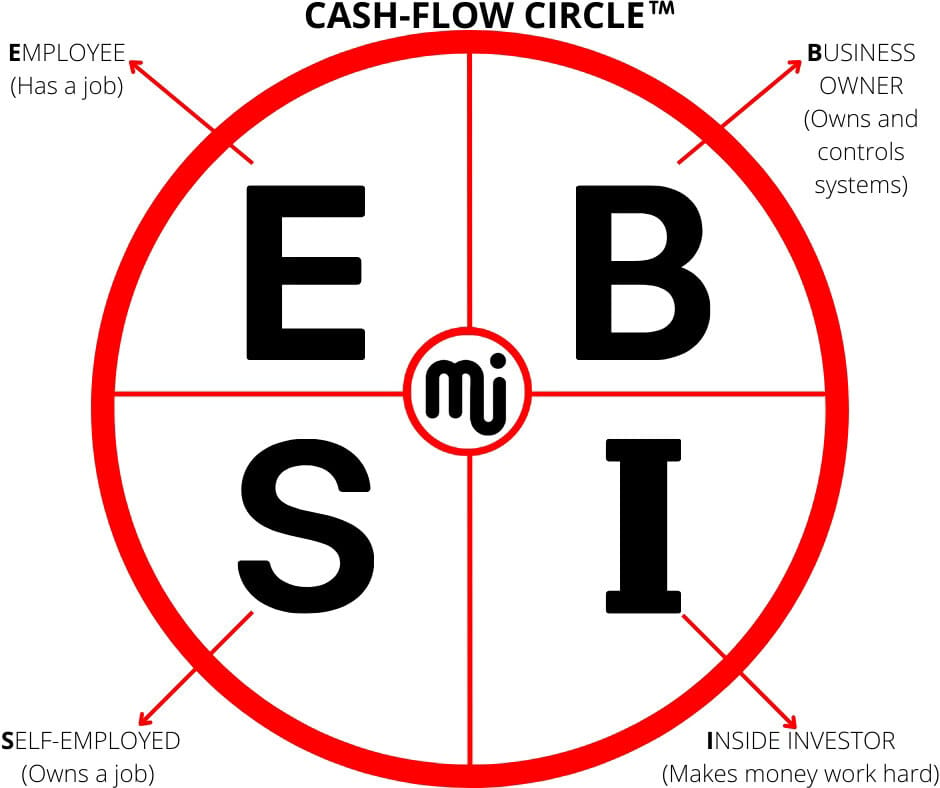

View the figure below for a more thorough explanation of the differences. This straightforward illustration is known as the Cash Flow Circle. We know the four categories of individuals in the world using the Cash Flow Circle. See the diagram below if we have not yet seeing it before. Four players int he game of money: Employee, Self-employed, Business Owner, and Inside Investor.

The Es and Ss are on the left. These folks trade their time for money whether they are employed by a firm or operate as lone proprietors. The Bs and Is, or "Business Owners" and "Investors," are located in the right quadrant. The ability to effectively utilize other people's time and resources is what really separates those on either side, despite the fact that there are many other differences as well.

To become a professional investor, we need to move from the E/S side to the B/I side and learn how to generate wealth using other people's money.

What a financier or investor truly desires

The enormous mystery has an explanation here: All banks, private companies, and other lenders and investors want to know is that they will receive a healthy return on their investment. How much money will they get back if we give them X dollars? A strong return on investment is what they seek.

Long or complicated presentations are not necessary. Depending on the type of business or investment, it will vary. A pitch that is brief and to the point frequently conveys the presenters' assurance that they understand the investor's needs and are capable of meeting those needs.

Therefore, the four pretty basic components that will enable them show the ROI they are looking for are the key to collecting money.

Now let's get straight to the point with this useful formula:

What precisely is the investment, and why is it so appealing that people should put their money in it rather than another, if we are raising money for an investment?

Recall that while it may be simple to highlight all the benefits of our idea to a potential investor, we should also be truthful and realistic, which implies that there might be some drawbacks. Prepare a strategy for overcoming obstacles and maintaining momentum.

Make it easy. Don't be too long. Be truthful.

If we were an investor, what essential information would we need to know to feel confident about our investment?

This is only good business sense; the investors' degree of confidence will be directly impacted by the partners' experience.

InvestmentConsider the following questions as you pitch the project to oursleves: For what project is the lender giving us funding? If it's for our company, what precisely is our company? What distinguishes our company from competitors in our field? And what is the benefit our company offers that will convince investors that it will succeed.

PartnersWho are the main project participants? What history do those partners have? What background do they possess? Stated differently, who is arranging the arrangement and what level of success have they achieved? A significant portion of the equation is the knowledge and skills that each partner brings to the table.

Obtaining FundsAs precisely as we can, demonstrate to the investor how the initiative (company or investment) will generate revenue. Every business and investment initiative has difficulties; acting as though ours won't makes we appear inexperienced. Instead, be realistic and don't shy away from talking about the obstacles that lie ahead. We should include documentation of the overall amount of money we are raising, its source (private individuals, conventional lenders, etc.), the terms under which it is being borrowed, and the intended use of the funds.Hint: Doors will close if we even imply that some of the funds raised will go toward paying our salary. Get a job if we want a paycheck. Two things are of interest to potential investors:When will their initial investment be repaid? and the nature of their comeback.We can use these figures to gauge how appealing our financing terms and structure are.

ManagementAs they say throughout history, "Money follows management." Due to the fact that the daily operations of any business are vital to its continued success, investors are curious about who is in charge of them. Describe the person, their history, their response under pressure, etc.The partners and management team may be the same if we are launching our own company or seeking capital to expand an already established one. If the staff has experience and knowledge that will inspire trust in the investors, then that shouldn't be a problem at all.Management is essential for rental properties, whether they are residential or commercial. Our bottom line will be determined by how well our office building, retail strip mall, single-family home, or apartment building runs on a daily basis.

Where can we get OPM?

So, where can you earn OPM and how can we use leverage to increase our net worth? The following is a list of some typical methods for obtaining other people's money.

Angel investors: Sometimes known as venture capitalists, are typically prosperous business owners with substantial sums of money to give; yet, they are not qualified investors. They might make riskier investments and lend more money than a bank would. In certain cases, their investments are motivated more by a sincere desire to see the business flourish than by a simple financial one. However, venture capitalists are typically groups of experienced investors who are able to raise substantial sums of money and provide their project-specific knowledge. As we might anticipate, they will also demand a great deal of control over their investment a position on the board of directors, for instance.

Conventional Financing: This popular and well-known method of financing a purchase is frequently simple to obtain. However, bear in mind that in order to accrue "good" debt, finance traditional investments with money that will put into our pocket or generate cash flow. NOT obligations.

Conventional and Bank Loans: We can obtain OPM through home equity lines of credit, auto loans, and mortgages. These loans fall into two different categories: secured and unsecured. Secured will require real estate or a vehicle as security to support the loan. Credit, morality, and repayment capacity are the main criteria for unsecured loans. Since unsecured loans carry greater risk for the bank and are frequently harder to get, they typically have higher interest rates.

Credit cards: Are a common and easy-to-obtain form of open payment money that is abused when used for financing. Individuals without financial resources frequently utilize them to maintain their appearance. Generally speaking, using credit cards for little transactions results in higher costs and lower cash flow. Credit cards can be useful, though, if used properly. Use it to fund an investment for example, remodeling a kitchen to raise the investment property's worth. This raises our cash flow (as well as your total investment) by enabling us to charge a greater rental rate.

Non-traditional Financing: Although it may appear like a dubious or hazardous method of funding a venture, the poor and middle class are the only groups who use this less frequently. The wealthy make frequent use of it.

Creative Financing: Frequently observed in seller-carryback agreements, leasing options, and owner-financed properties, this kind of financing can occasionally benefit both sides equally. Sometimes an investor can buy a property with little to no down payment. As a result, this kind of transaction can save the seller money by avoiding the capital gains taxes that would otherwise be due on a typical sale.

Peer-to-peer lending: PTP lending is a non-traditional financing model that eliminates middlemen like banks by connecting investors and borrowers directly. This usually occurs when a borrower uses an internet platform to request a loan.

Investors can choose to invest as much or as little as they choose after perusing the listings. The borrower receives their money once the loan is fully funded, while the investors receive principal and interest payments on a monthly basis.

Hard money and private lenders are those who are eager to lend you money because they have it. Private lenders may be someone we know personally or through connections with them. Friends and family are usually involved in these loans because they want us to succeed. The distinction with hard money lenders is that their motivation for issuing the loan is solely financial.

A hard money lender will likely be our first encounter with them; their priorities will be the collateral and the payback.

In conclusion: advice on investing with borrowed funds or OPM (Other People’s Money)

It's a good idea to thoroughly comprehend and investigate the available sources for OPM. Identifying how we will utilize the money will help us decide which choice is best for us.

Although it could initially seem daunting, obtaining money doesn't have to be a protracted process. When making a pitch to investors, keep it brief and direct. The chances of obtaining the funding we need are higher if, when attempting to acquire funds, we can confidently and clearly address each of the four aforementioned difficulties. Delivering is all that's left to do for us!

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Join our Discord.

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: How to Invest With Other People Money (OPM)?

Comment, like, share and follow for more High Quality Financial Education Made Simple.