Summary:

Recognize the Fundamentals of Investing: Learn the distinction between "speculating" and investing in stocks so that we may make wise financial decisions rather than taking unnecessary risks.

Why Investing from Home Works: Investing in stocks from home is now simpler than ever thanks to platforms like E*TRADE and Robinhood, which provide flexibility and a range of options to expand our portfolio.

Select Carefully: Learn how to identify stocks with solid fundamentals to focus on in order to achieve long-term investment success by examining market trends, management caliber, and financial health.

We may be thinking, "If they can do it, why can't I?" if we want to provide a stable future for ourselves and the around us or if we are motivated by the financial success of investors like Warren Buffett and many other financial investors.

Betting or Investing?

Understanding the difference between investing and speculating is a crucial first step. Put simply, it's understanding the difference between risking our money on ventures we shouldn't take and making well-informed financial selections.

Purchasing assets with the hope that they would eventually yield a financial return is the standard definition of investing. We get paid by our assets. We pay for liabilities. But making more money isn't the only goal. Increasing your purchasing power is the true aim. because annual price increases cause the US dollar's worth to decline.This is accurate regardless of how high, moderate, or low inflation is.

Therefore, merely keeping cash in the bank or beneath our mattress won't improve our financial situation, even when inflation reduces the value of money. However, investments that increase our buying power do.

We are well aware of the low returns on certificates of deposit (CDs), money market accounts, and savings accounts. It truly is offensive! While we make a few pennies a year, the banks use the money we deposit in our account to generate revenue. Even worse, when these "investments" get older, our purchasing power won't have increased in line with inflation.

Think about this instance:

Assume we get a $1,500 tax return. We may put it into a Certificate of Deposit (CD) to generate interest, or we could use it to buy something we have always wanted, like a new laptop.

Opting to save, we put the $1,500 into a CD. Given the current rates in June 2024, let's assume we choose a CD with an annual percentage yield (APY) of around 5.00%, which is a competitive rate right now. By the end of the year, we would earn approximately $75 in interest, for a total of $1,575. Meanwhile, if the price of the laptop increases by 10% due to inflation, it will cost $1,650 by the end of the year. Although we have more cash, our purchasing power has effectively decreased.

The lesson here is that inflation can reduce the value of our money over time. By focusing on investments that outpace inflation, we can protect our financial future and improve our investment outcomes.

The Drawbacks of Viewing Wall Street as a Gaming Casino

The appeal of making quick money can be even stronger in the post-pandemic environment.

Still, among the easiest ways to lose our hard-earned money is to pursue speculative investments in the hopes of making quick rewards. Speculation is placing large, risky wagers based mostly on intuition. Even while we might sporadically see short-term gains, there is a considerable chance of suffering large loses. Think of the 2008 real estate catastrophe or the dot-com bubble of the late 1990s. Assuming that prices would climb indefinitely, many speculators squandered their wealth by placing bets on expensive tech stocks and real estate. These bubbles burst, leaving them with enormous losses.

When we get to the post-2020 era, we observe comparable trends.

Many novice investors flocked to sites like Robinhood during the COVID-19 outbreak, following the stocks like GameStop and AMC, which rose sharply in value. These stocks were frequently driven by social media excitement rather than prudent financial research. Similar to gamblers, these investors experienced some early successes, but as the values of these stocks inevitably fell, many of them suffered large losses.

And further illustration would be the fluctuations in bitcoin prices throughout the pandemic. As the value of Bitcoin and other cryptocurrencies reached previously unheard-of heights, speculative investment poured in. However, individuals who invested at the top in the hopes of steady growth suffered significant losses due to the market's extraordinary volatility.

These speculators were not acting out of genuine investing, which is what they were unable to realize.

They were taking big chances that could result in disastrous long-term losses in addition to short-term profits. Many people are cautious about the stock market out of fear of making the same mistakes again. It is imperative that we recognize the distinction between investing and speculating if we are to meet our financial objectives. Investing is a methodical approach to gradually increase our money, whereas speculating is more akin to gambling.

For more dependable and continuous financial success, steer clear of speculation and concentrate on wise investments.

Why It Makes Sense to Invest in Stocks from Home

The ease of use and accessibility of home investment are more important than ever in the post-pandemic era. When comparing different investment possibilities, it is evident that the stock market has performed better in the long run than other asset types, such as real estate.

The stock market has historically produced strong returns. For example, since 1988, the S&P 500 has returned an average of almost 11% per year. Compared to other asset types, such as real estate, which usually yields lesser returns, this performs better. Comparatively, over a same time frame, the Case-Shiller Home Price Index displayed an average yearly return of roughly 3.71%.

Investing in stocks from home is an appealing option for the following reasons:

Affordability: We can begin trading in the stock market with comparatively little capital. In contrast to real estate or commodities, which frequently demand large initial investments, we can start investing as little as $1,000 in stocks or mutual funds.

Liquidity: Stock transactions are simple and quick to complete. Shares can be bought or sold in a matter of seconds, and transactions usually settle in a few business days. For example, we will typically have the money by Thursday if we sell shares on Monday.

Diverse Investment Opportunities: There are many different kinds of investments available in the stock market. We can invest in bonds, mutual funds, and commodities such as gold and oil in addition to individual stocks.

We can also trade on the foreign exchange market (Forex) and access a range of derivatives, including options and futures.

Online brokerage systems have become increasingly popular as a result of the pandemic, making it simpler than ever to handle investments from home.

The process has been made simpler by platforms like Fidelity, E*TRADE, and Robinhood, which provide comprehensive educational resources and user-friendly interfaces for both rookie and seasoned investors. Furthermore, the post-pandemic shift in favor of digital financial services is in perfect harmony with the growing popularity of remote employment and the digital nomad lifestyle. We can have freedom and control over our financial destiny by managing your investments remotely.

Home stock market investing offers special benefits and chances.

We can create a robust and resilient investment portfolio that is suited to your financial objectives by making use of the many tools and choices that are readily available online.

Selecting the Best Stocks for Trading

While stock investing may appear complicated, there are a few fundamental guidelines that can help you choose the right stocks to purchase. This guide will assist we in understanding the kinds of stocks we should have in your investment portfolio.

Determine industry Trends: Seek out businesses that are capitalizing on significant industry trends. Usually, changes in consumer behavior, societal developments, or technology advancements are the driving forces behind these movements. Businesses engaged in e-commerce, artificial intelligence, and renewable energy, for instance, have demonstrated tremendous development potential. You may determine which industries are likely to do well in the future by having an understanding of these tendencies.

Analyze Management Quality: Judge the leadership of the organization. A company's performance is mostly dependent on its management group and its CEO. Examine their background, experience, and past success in handling difficulties. Proactive, creative, and open with shareholders are characteristics of great executives. Strong leadership often helps a company better navigate changing market conditions and take advantage of new opportunities.

Verify the Company's Financial Health: Look over the financial records to make sure the balance sheet is sound. Growth in sales, profit margins, debt levels, and cash flow are important metrics. Strong financial positions put businesses in a better position to weather economic downturns and make growth-oriented investments.

Seek Value: Determine which stocks the market has undervalued. The pricing of these equities, which are frequently the result of investor ignorance or market overreactions, do not correspond to their actual value.

We can use tools such as the price-to-earnings (P/E) ratio to assess if a stock is reasonably priced in relation to its earnings. Purchasing inexpensive stocks might yield significant profits if and when the market corrects.

Apple Case Study

Let's use Apple in 2024 as an example of a real-world application of these ideas.

Given its enormous market share and high price, many investors would be skeptical of Apple's ability to grow. But a closer look reveals why it's still a wise investment.

Market Trends: Apple remains at the forefront of a number of important market trends. The company is concentrating on extending its ecosystem, which includes AirPods, Apple Watch, and the services sector (which includes Apple TV+ and Apple Music). This is in line with the growing trend of linked gadgets and subscription-based business models. Furthermore, Apple is well-positioned in developing tech industries thanks to its innovations in augmented reality (AR) and artificial intelligence (AI).

Management caliber: Apple has kept its operational superiority and creative edge under CEO Tim Cook. Cook's leadership has made savvy acquisitions, efficient cost control, and consistently high-quality products possible. Strong and progressive leadership is further demonstrated by the company's engagement in sustainability and green energy programs, as well as its capacity to handle supply chain difficulties.

Apple's financial health: is impressive, as evidenced by its strong balance sheet, large cash reserves, and reasonable debt levels. Apple's $394.33 billion in revenue and $94.68 billion in net income for the fiscal year 2023 highlight the company's stability and profitability. Strong cash flow generated by the business allows for ongoing R&D, dividend payments, and share buybacks.

Value: Given its potential for future growth, Apple's stock may still be cheap despite its large market capitalization. Despite being higher than some of its competitors, Apple's price-to-earnings (P/E) ratio indicates the market's faith in the company's capacity to continue innovating and turning a profit. Long-term growth-oriented investors can benefit from Apple's potential to keep generating impressive financial performance.

We can choose stocks with greater knowledge if we consider factors like value, market trends, management caliber, and financial stability. These guidelines position us for long-term investing success by assisting us in identifying businesses with great growth potential and sound foundations. Especially in the wake of a pandemic, stock market investing demands meticulous research and strategic planning.

We may negotiate the intricacies and create a robust investing portfolio by adhering to these rules.

"Do We Actually Require a Stockbroker?"

The days of needing a stockbroker to handle our finances are long gone. In 2024, with the advancement of technology, trading stocks from home is now simpler than ever. We don't need a broker to navigate the stock market if we have the appropriate financial information and resources. There's a reason stockbrokers are called brokers—after all, if they were that good at predicting winners, they would be wealthy!

Selecting the Best Internet Brokerage

It's important to choose an online brokerage. Finding the broker that best suits your trading style and objectives is more important than trying to discover the finest penny stock broker.

Here are important things to think about:

Trading Costs: Commission-free trading is a service provided by many brokers, but watch out for additional costs, particularly when trading OTC equities.

Trading Tools: Verify if the platform offers strong tools and resources, such as stock screeners, advanced charting, and instructional materials.

Mobile Trading: To trade while on the go and stay up to date with the market, you need a reliable mobile app.

Customer service: Having dependable customer service is essential. Verify that we can get assistance when needed by testing the broker's support alternatives.

Stock Analysis: Having access to in-depth market data and stock analysis can assist you in making wise choices.

Leading Online Brokers

Numerous online brokers serve a range of trading requirements:

Robinhood: Well-known for having an intuitive UI that's perfect for new users.

TD Ameritrade: Provides cutting-edge tools for all kinds of traders on its highly regarded think or swim platform.

E-Trade: dependable for both day trading and long-term investing, with strong tools and first-rate customer service. Interactive brokers are excellent for both foreign traders and short sellers.

TradeZero: A more recent broker that provides commission-free trading and top-notch day trading tools.

The Benefit of Education

A strong grasp of the stock market is the biggest advantage we can have. Experience is expensive; education is cheap. We must therefore make an investment in our education rather than depending on a broker. Understand market trends, become knowledgeable about various investing techniques, and keep up with financial news.

We may improve our chances of success in the stock market and make better selections by educating ourselves. In 2024, we will see an increase in the accessibility of trading from home.

We may successfully navigate the stock market and make wise investing selections if we choose the proper online brokerage and are dedicated to lifelong learning. Accept the resources and tools at our disposal and assume responsibility for our financial destiny.

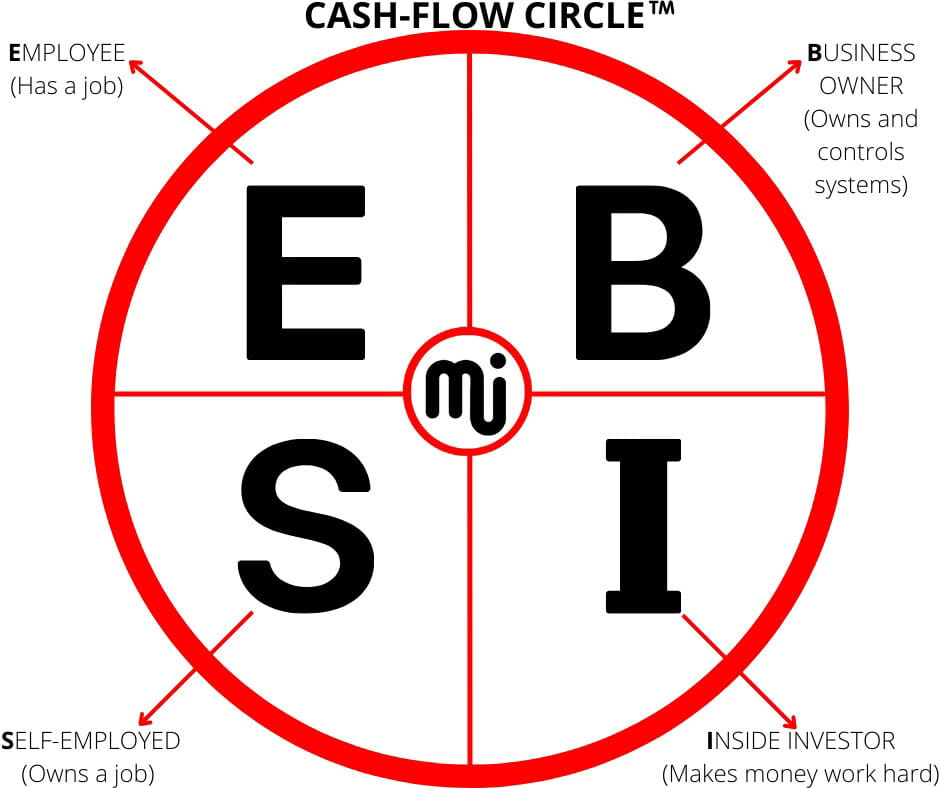

Build on The Right Side of The Cash Flow Circle

Four players in the cash flow circle and two sides. Which player are we and which side are we on today. Where do we want to be tomorrow?

Start Investing

Anyone can start investing in the stock market with the correct mindset and resources; it's easier than we would believe.

Research and homework are the greatest ways to determine if investing is the correct decision for us.

A minor expenditure might be necessary to fully comprehend the procedure and choose whether or not we love it. To help those who are attempting to figure out which investment class is best for them, Master Investor was created.

Anyone can begin investing and trading in the stock market from home by following these instructions. Recall that what matters is how regularly we invest in and expand our knowledge, not how much we start with.

Master Investor is offering literature, and courses if we think the benefits of investing in stocks outweigh the drawbacks and would like to learn more before we start.

Get a free copy of our books, by clicking in any of them below.

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: How to Invest in Stocks from Anywhere?

Comment, like, share and follow for more High Quality Financial Education Made Simple.