Summary:

To become truly wealthy, the most promising approach is to invest for passive income.

The ability to create passive income demands a high level of financial literacy.

Investing in a variety of areas can yield steady passive income.

We can most clearly distinguish between two quite distinct kinds of investors in difficult economic times.

For instance, we might speak with someone who appears prosperous but is actually having financial difficulties and they might say something like, "It's rough out there, my 401k is taking a beating." Those assets are fake because they do not put any cash flow into the pocket of the investor, it only withdraws money from their paycheck every month.

Conversely, a prosperous investor with a distinct background may declare, "I'm doing fantastic! Money keeps flowing in.

What separated these two investors from one another? To begin answering that question, it is best to examine three distinct kinds of cash flow patterns.

The three distinct categories of patterns in cash flow

We can find thorough explanations of the three distinct kinds of cash flow patterns in the article Our Cash Flow Patterns Determine How Wealthy We Will Be, but it will be beneficial to go over them again here.

Cash-flow pattern of the poor class

It's common knowledge that the impoverished bemoan living paycheck to paycheck. They are also not mistaken. The majority of the impoverished have a cash flow pattern similar to the one below. Paychecks are the source of income, which is then swiftly allocated to different costs.

With any hope, they will be able to pay for their monthly expenses. If not, they incur debt, usually in the form of credit card debt, which only serves to worsen their situation by raising their monthly costs. Getting a better paid work or taking on another job is their only chance to advance—just to make ends meet. It's a really depressing way to live.

Cash-Flow patter of the middle class

People who live paycheck to paycheck are not limited to the impoverished. The middle class's cash flow pattern is seen here.

The middle class frequently appears wealthy to an outsider peering in. They may have large incomes, opulent homes, luxurious vehicles, and more. However, in reality, they are merely surviving the Rat Race. Rather than allocating their income just to living expenditures, like the impoverished do, they purchase obligations like luxury automobiles, homes, and trips, which causes their money to disappear from the expense column. They may also invest some money in 410k, but as you will see later, that is a liability rather than a asset.

The middle class exhibits an intriguing trend whereby their taste increases and they desire more as they take on greater responsibilities. As a result, they take a job that pays more and take on additional debt.

The frightening part is that they won't be able to pay their bills if they lose their work. Why? They frequently have significant debts and costs, and their only source of money is their salary. With luck, they'll be able to find another work before it catches up with them. They file for bankruptcy if they don't.

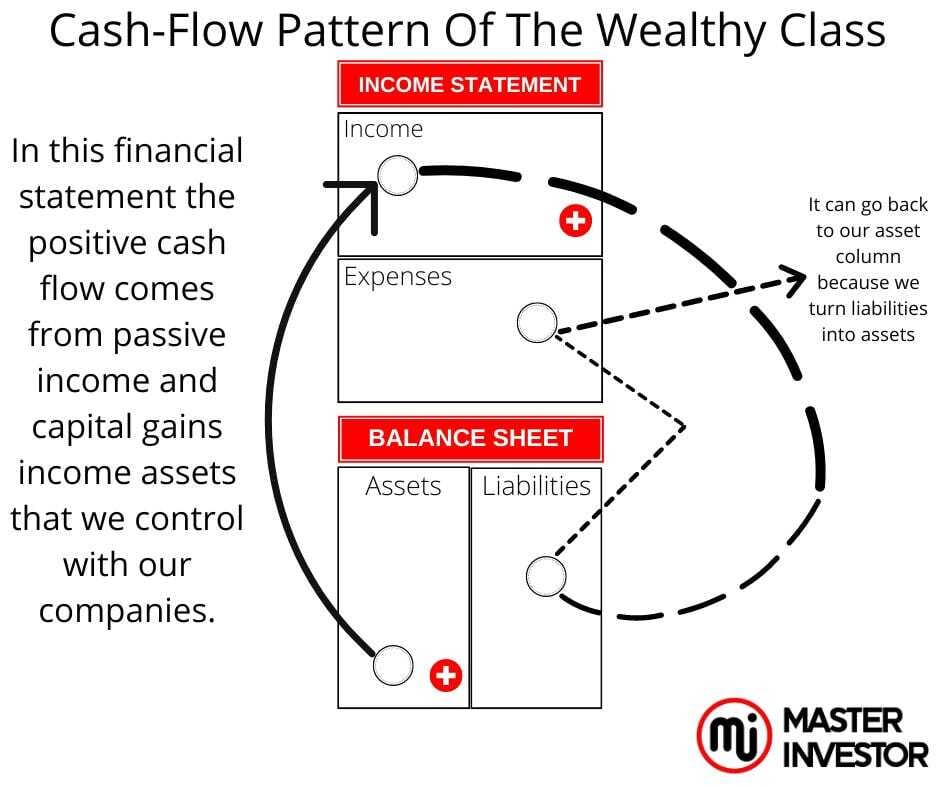

Cash-flow pattern of the wealthy class

The financial flow patterns of the wealthy and the middle class are very different. This is how it appears:

An inside investor can always turn some liabilities into assets in our financial statements. Therefore, we can recycle back the surplus of our business as a good expense. In other words, we will let our positive cash flow from our businesses serve us as leverage to buy other cash flowing assets.

To put it simply, cash flow from their investments is how the truly wealthy get their income. They then purchase liabilities and cover their expenses with this income. To achieve this, they don't need a job or an income. Each month, the funds arrive in the form of passive income.

What separates earned money from passive income

The primary distinction between the individuals we met previously is whether they had earned or passive money, which is fundamentally a mentality difference.

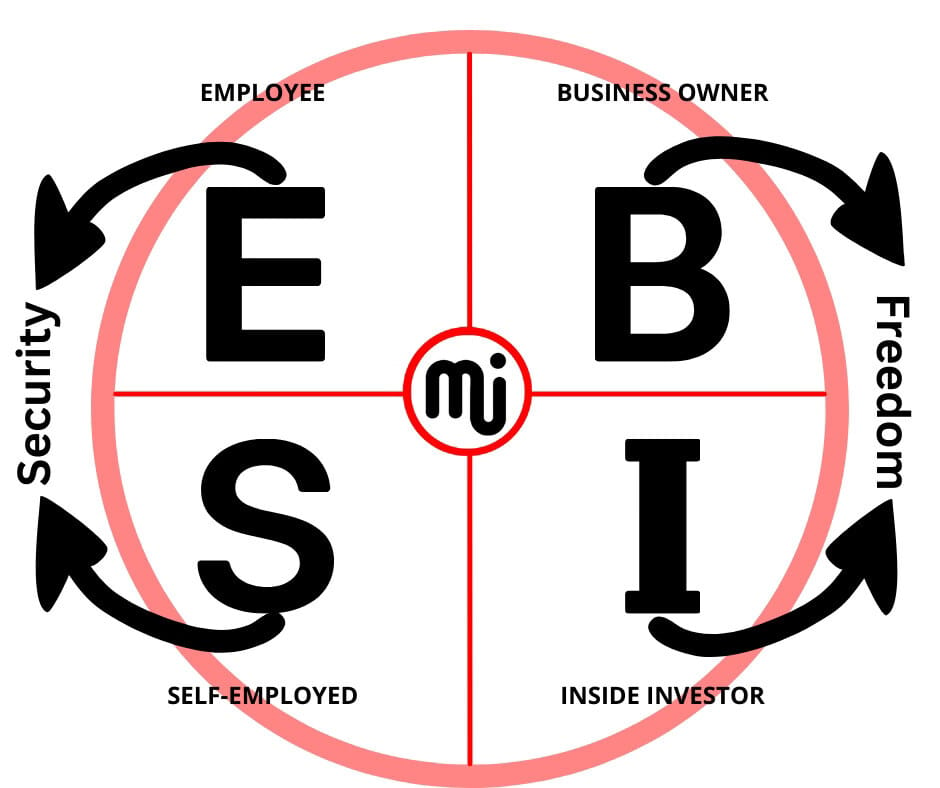

First, let's examine the CASH FLOW Circle.

We must understand that 97% of the world works for active income or also know us earned income, which is taxed at the highest bracket. Such income is the hardest to attempt to become wealthy due to the fact that it requires the individual to trade time for money. And as we know time is priceless, we cannot sell our time if we want to become wealthy. We must invest our time instead into our assets columns, by focusing in investing for passive income. The left side of the cash flow circle seeks security through job security. And the right side of the cash flow circle, we attract total freedom by accumulating wealth through investing for passive income.

E stands for employee

Workers seek a wonderful position with a competitive income and value security.

S stands for self employed

Self-employed people appreciate their independence and freedom, yet often are socially awkward. They don't trust others because they are the finest at what they do. They are employed, yet they do not own a firm. They cannot make money if they do not work. They are therefore not truly free because they still have to work, even though they are free in the sense that they are their own boss.

B stands for business owner

Owners of businesses also value freedom and independence, but they get it through teamwork and system development. Their company generates the income, thus they don't need to labor for it.

I stand for inside investor

I'm a financial investor, we must receive cash flow to be an inside investor.

Among the people in the CASH FLOW Circle, inside investors and business owner are the most financially savvy, that it the right side of the cash flow circle. By investing in assets that generate positive cash flow each month, we use our money to make money.

The mentality and financial flow of individuals on the left and right sides of the cash flow circle differ from one another. Because Es and Ss are worried about their security, they work for earned income that is, money that other people create and then compensate them for. The left side of the cats flow circle basically market time.

The number reason why people do not become wealthy is due to focusing only on working at a job for earned income.

True freedom is a worry for Bs and Is. To pay for their expenses, they construct companies and make investments that yield passive income. They will never have to work another day of their lives if they so want.

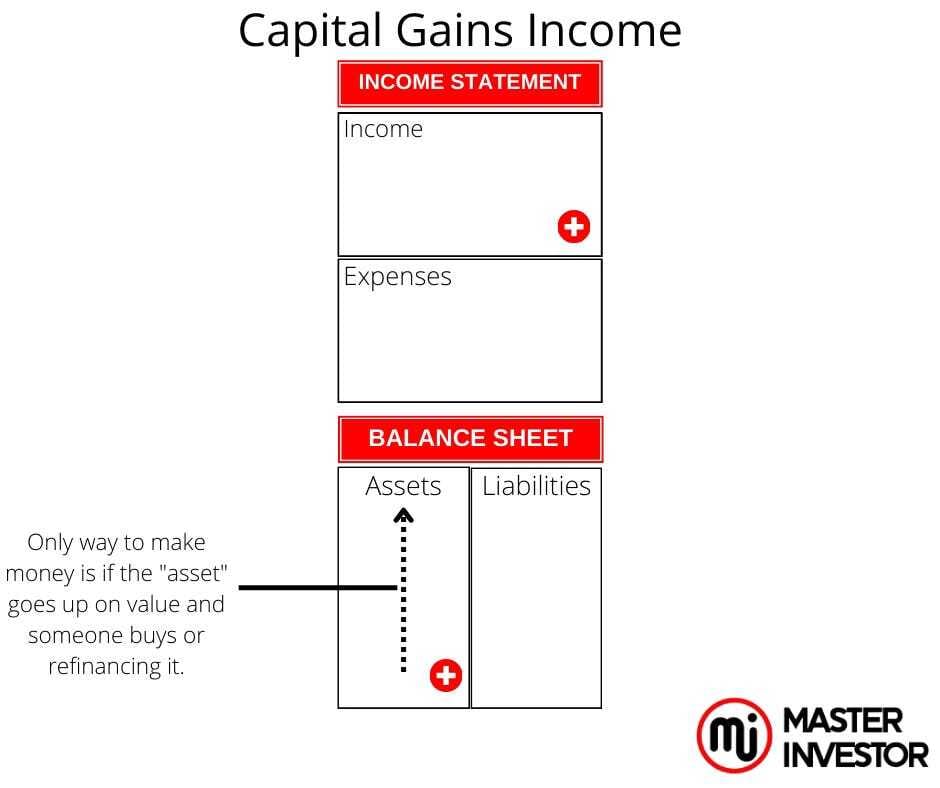

There are two kinds of investing: passive income and capital gains

People who are on the left side of the Cash Flow Circle may consider themselves to be investors; for example, they might be someone who gets nervous when they think about their 401(k) not doing well. Actually, they're more of a gambler than an investment.

Not that Es and Ss aren't intelligent, mind you. They are frequently quite intelligent, but not wealthy.

If, for example, they invest in a 401(k) plan, they will be dependent on the fund's monthly fluctuations.

Even worse, because it deducts money from their pocket each month rather than adding to it, it's truly a liability. If earnings are collected, then it might be considered an asset. That is a liability up until then. This is the appearance of that investment pattern:

This is the kind of investing meant to generate capital profits. When Es and Ss invest in a 401(k), they are hopeful that the value will increase and they will eventually be able to sell and profit. Like any bets, it's a chance, but it might pay off. Regretfully, it also has the highest taxation of any investment.

Real estate investors are located on the right side of the CASH FLOW Circle, which represents investors seeking to generate passive income, also known as cash flow. For instance, they receive monthly rent from their properties, take advantage of favorable tax treatment, and invest very little of their own funds in their transactions.

Additionally, they only perceive opportunity when the market declines since these kinds of assets are put up for sale.

Assets pay for expenses each month because these investments are meant to generate passive income. This is what real freedom looks like. This is the appearance of that investment pattern:

Types of investments for passive income

By now, hopefully we should have enough knowledge to understand that investing for passive income is far superior to earning any other kind of money. In order to wrap off this topic, consider the various strategies for investing in order to get passive income. Our recommendation is to identify our areas of interest and then delve deep to learn everything we can about them.

Real Estate

All of masterinvestor’s partners love real estate. In fact, we think it's the best investment category for passive income together with digital businesses. In real estate, rent is what makes up our passive income in real estate. Put simply, we will have passive income if our rent pays for our living expenses.

Our passive income will increase with the number of investments we have or their size. Great tax advantages and the ease of utilizing OPM (Other People's Money) to invest in real estate are further advantages.

Stocks

Although stocks aren't our preferred choice for capital gains investing, we do think they're a great source of passive income. Dividends and covered calls are two strategies we can use to invest in companies for cash flow. Check out other articles about Investing for Cash Flow With Stocks that we have published here before, to discover more about these asset class that allows us to create positive cash flow.

Business

To take use of the advantages of the B side of the cash flow circle, we do not need to be a business owner. Investing in the ventures of others is a fantastic method to generate passive income too. As an inside investor, we have the power to direct a company toward enormous profitability typically by holding a board seat. We always want to be able to have control, scalability, and leverage in our investments. We are not accountable for running the day-to-day operations of the business, unlike a business owner. To compensate for our capital, we just get to enjoy the earnings. Now, we do suggest that we master how to start a business from scratch and turn such business into a brand is an unfair advantage to have in us. Let’s not hesitate in starting a new business because awe will learn more from starting than not to anything due to fear. We must be active investors that are investing for passive income. However, we must use a company of our own to collect income from our affiliate partners in order for that income to be passive income.

Crypto

Now crypto is a currency not just an asset and asset class to invest for capital gains income. We can generate cash flow with crypto as it is a currency now, and we can use the gains instantly to buy other assets.

Follow the Cash Flow Tetrahedron to Invest for Passive Income

This is diagram can guides us to ultimate wealth by tapping into the velocity of cash flow and infinite return on investment. basically once we follow this formula to build wealth below, we can get anything for free legally due to the finance education and financial experience we posses. Our businesses surplus’ goal is to buy other cash flowing assets for our assets column. We will rinse and repeat to the point where we have excess of positive cash flow (passive income) flowing to our pockets even while we are sleeping or doing what we love to do.

Invest now to generate passive income

Although it's a terrific technique, investing for passive income requires financial intelligence. Begin by gaining as much knowledge as we can on the investments that most interest us. Study as much as we can about money as well. Enroll in classes, work with a real financial mentor, and take advantage of all available free financial education. Resources-wise, there is an abundance of them available. More than in the history of humanity. All we need to do is seize the opportunity and proceed accordingly.

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: How To Invest For Passive Income?

Comment, like, share and follow for more High Quality Financial Education Made Simple.