Summary:

Distinctions between typical bank loans and crypto loans.

Recognizing the dangers associated with crypto loans.

Where to get loans for crypto.

Were we aware that cryptocurrencies can be used to obtain loans? The way these loans operate differs from how standard loans operate. Our annual or monthly income is not taken into account, a flawless credit score is not required, and there is no drawn-out approval process. There's almost no middleman between us and our cryptocurrency loan, but there is a catch.

Everything we need to know about crypto loans—including how to utilize them, where to get them, and the hazards involved—will be covered in this article.

What are the 5 Asset Classes of Today?

Business

Real Estate

Crypto

Paper Assets

Commodities

In order to protect our wealth from down economies and hedge form inflation is by diversifying among the asset classes that exist today. Therefore, we must acquire financial educate on each asset class as we grow our passive income and capital gains income. They are different from one another and often have different regulations to become aware about in order to succeed in them.

The idea and goal is to have passive income and capital gains income being deposited into our bank accounts from an our investments we made. We must have speed and leverage when it comes to reaching financial freedom and true wealth. Today is easier than before due to technology and AI. We have to use them as tools to deliver our business missions across the globe.

Remember to use the Cash Flow Tetrahedron to build our wealth. Meaning our businesses revenue and surplus buys us other cash flowing assets in different asset classes. Take a look at the diagram of the Cash Flow Tetrahedron and ensure we follow this formula when we want to tap into infinite return on investment and the velocity of cash flow.

Money for nothing and where we can legally obtain everything for free by acquiring whatever is that we want with ROI from a cash flowing asset and in many instances utilizing debt.

Three essential keys we must keep present as we build our wealth are debt, control and leverage. Master how to utilize the power of these keys to ensure a long-lasting cash flowing business empire. Now let’s dive into the crypt loans and why we shall consider using them to build our wealth before simply cashing out from a cryptocurrency.

Today crypto is also a currency. Crypto is no longer only an asset and an asset class. Today crypto is money like the US dollar.

Crypto Loans: What Are They?

Secured loans of this kind, known as crypto loans, are generally offered on DeFi networks like Ethereum, Avalanche, Base, and many more. This implies that we utilize digital assets as collateral, such as cryptocurrencies like Ethereum, Bitcoin, and others. Through these sites, we can borrow other cryptocurrencies for a fee that ranges from 50% to 70% of the total value of the cryptocurrency we pledge as security.

Crypto loans are just dependent on the current market value of our cryptocurrency holdings, as opposed to traditional loans, which also include our credit history and credit score.

As the value of our Ethereum increases, so may the amount we can borrow.

As an illustration, let's say we want to launch a new brand with a nice website but we are unwilling to sell our Ethereum investments. At the going rate of the market, we own $1,000 worth of ETH. We choose to use our ETH as collateral for a cryptocurrency loan rather than cashing it out. Using debt to invest for passive income is key to building true wealth as we have said many times before. Plus all debt is tax free according to law. Therefore, we are winning when we use debt to invest for passive income and capital gains income too. But pimply we focus on cash flowing assets.

Here are the three easy steps we take to do obtain a crypto loan:

We use $1,000 worth of Ethereum as security on a platform that facilitates cryptocurrency loans.

We obtain from the platform a $500 USDC loan, (a stablecoin tied to the US dollar, in exchange for our $1,000 worth of Ethereum as security.)

After that, we exchange the $500 USDC for cash to launch our business and website.

Now we can see how we can use debt in a way that will produce positive cash flow (passive income) for us.

In this manner, we retain the benefit of our Ethereum and won't have to sell it in the event that its value increases in the future. We pay back our $500 loan over time at a modest interest rate—usually less than that of a standard bank loan. We get our $1,000 worth of Ethereum back when the debt is completely paid back. The debt was paid back with the revenue of the business and website we launch with the loan.

Therefore, it was all free at the end. Instead of focusing not the interest rates of the loan, pay attention to the return o investment in which shall be higher than all expenses combined for the loan and business. As long as the loan gets pay back with the positive cash flow of the business and it also leaves us with a surplus than it is consider good debt and tax free legally.

How Do They Differ From Loans From Banks?

There are some key distinctions between crypto loans and traditional bank loans:

Procedure for Approval: Credit checks, proof of income, and other papers are needed for bank loans. By using an automated method, crypto loans get around this. We can utilize any amount of the supported cryptocurrency that we own for lending or borrowing.

Collateral: Property or other assets may be used as collateral for traditional loans. Only the digital currencies that its platform enables will be accepted by Crypto Loans.

Flexibility: Crypto loans offer more latitude when it comes to interest rates, and in certain situations, we can even create our own repayment plan for them.

In contrast to bank loans, lenders automatically claim our cryptocurrency collateral in the event of default or liquidation on a crypto loan. One of the main dangers of employing loans based on cryptocurrency is this.

What Crypto Loans Entail In Terms of Risks

Even while everything we read might sound amazing, there are risks associated with anything, and cryptocurrency loans are no exception. Remember that there is risk associated with all cryptocurrencies, so manage our risk appropriately before investing.

Variability and Settlement

Because it's based on the dollar value of the cryptocurrency we pledge as collateral, our assets may be immediately liquidated to pay back the loan if the value of our cryptocurrency declines.

Let's return to us as an example and picture this:

We borrow $500 USDC using $1,000 worth of ETH as collateral.

We have 0.5 ETH as collateral as ETH is worth $2,000 per ETH when we take out the loan.

Assume ETH becomes $1,000 per ETH in value. Our 0.5 ETH is only worth $500 right now.

A liquidation threshold, often equivalent to 80% of the loan amount, is present on many lending platforms. Here, $400 represents 80% of our $500 debt.

The platform may liquidate our collateral to pay back the loan because it is now worth $500 and perilously close to the $400 liquidation barrier. In this case, we would lose our 0.5 ETH.

Uncertainty in Regulations

The regulatory framework surrounding cryptocurrencies is another major worry when it comes to lending and borrowing in them.

These days, it seems like they're actively searching for DeFi and trying to find ways to prevent people from making money off of it. This implies that these choices could ever stop working or become restricted to a certain area.

Where to Apply for Loans in Crypto?

We can apply for crypto loans on a number of platforms. The following are some of the ones available today.

AAVEThis well-known DeFi loan platform has withstood both bull and bear markets in the cryptocurrency space. These blockchains are currently supported by them as of this writing: Ethereum, Base, Arbitrum, Avalanche, Fantom, Harmony, Optimism, Polygon, Metis, Gnosis, BNB Chain, and Scroll.

CompoundCompound has a track record of enduring the crypto winter and emerging stronger than before, much like AAVE.They have a decent assortment of blockchains but only accept a small number of cryptocurrencies. As of the time this article was written, they were accessible for the following blockchains: Ethereum, Base, Arbitrum, Optimism, Polygon, and Scroll.

Mai FinanceWe can borrow Mai Finances' stablecoin MAI for 0% interest against the value of our cryptocurrency. Although this is fantastic, Mai may only have a certain number of vaults; be sure to see what is available.As of the time of writing, they are compatible with the following blockchains: Base, Linea, Polygon ZKEVM, Fraxtal, Ethereum, Arbitrum, Fantom, Moonriver, Moonbeam, Avalanche, Gnosis Chain, Harmony, Optimism, BNB, Metis, and Base.

BenqiBenqi is the Avalanche Network's lending platform. Stablecoins like USDC are normally borrowed against AVAX as collateral.

SolendSolend has a platform for borrowing called Solend. Stablecoins like USDC and USDT are commonly borrowed using SOL as collateral.To choose which platform best suits our needs, examine the terms, interest rates, and collateral requirements of each one as they differ.

Crucial Points to Remember

Before obtaining a crypto loan, think about the following:

Important Things to Think About:

LTV, or loan-to-value ratio: the proportion between the loan amount and the collateral's value. larger interest rates and risk can accompany larger LTVs.

Interest Rates: Over time, the interest rates on cryptocurrency loans will fluctuate. Examine prices on several platforms.

Terms of Repayment: Be aware of the terms of repayment, including any penalties that may apply for missed payments, defaults, or liquidations.

Liquidation Risk: We run the risk of losing our digital assets if the value of your collateral significantly declines and is liquidated to pay off the loan.

DeFi Smart: This is not a procedure for novices in cryptocurrency. We must fully comprehend the operation of non-custodial wallets as well as standard precautions to take when using wallets and the internet on DeFi networks.

Financial Acumen: To prevent liquidation, we will need to be adept at handling our money and keeping an eye on our loan.

Which side of the Cash flow Circle Are We Operating Form Today?

Last Words

An intriguing way to leverage digital assets without selling them is through crypto loans. Despite the excitement, they carry a distinct set of risks of their own that need to be controlled before taking them into consideration.

To protect our cryptocurrencies, take the time to educate ourselves and fully comprehend everything there is to know about cryptocurrency. As we progress into the DeFi realm, knowing how crypto loans operate can help us make wiser financial decisions in the future.

If we think that taking out a crypto loan is too risky, we might want to look into less risk alternatives. Take a look at our crypto e-book for tips on other investing methods.

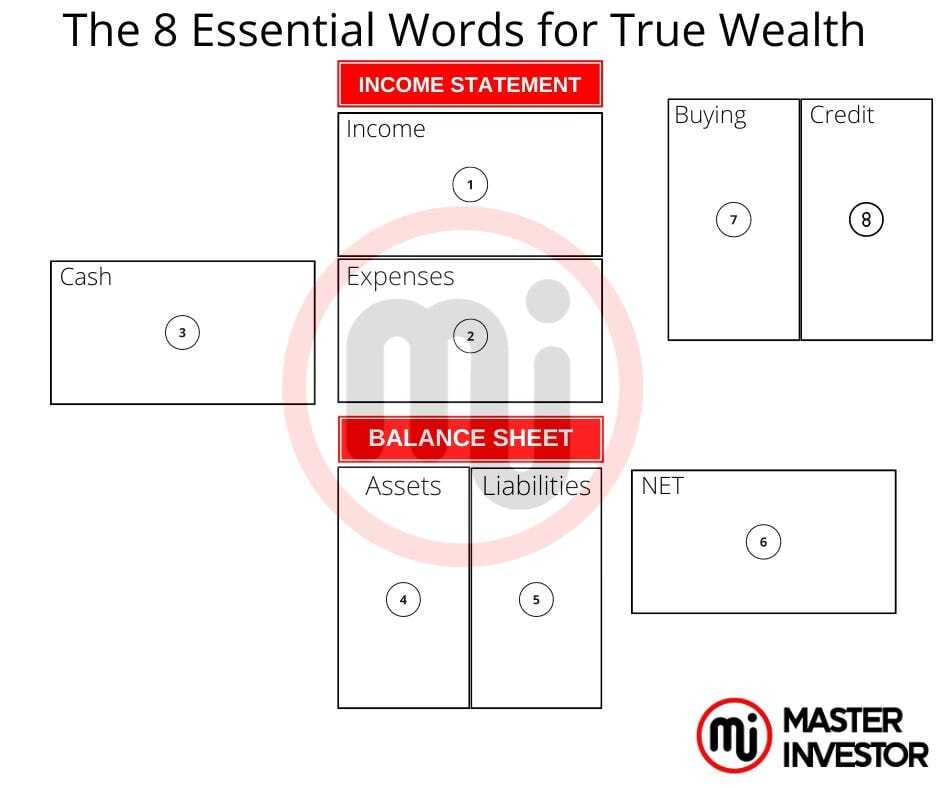

We must expand our business vocabulary in order to have more wealth in our lives. Interesting the words are free and available to all of us but only few actively expand our vocabulary. Therefore, only about 3% of the entire population experience total freedom and excess of positive cash flow. Words are the most powerful tools humans have ever created, use them wisely as we build our business empire. A business owner and inside investor have our own vocabulary that we must master. Exactly what we are learning here at Master Investor daily and throughout our products.

(Disclaimer: Our content at Master Investor is meant purely for educational reasons; it is not financial advice. None of the teams, businesses, coins, or protocols mentioned in our articles are sponsored by or associated with them. It is crucial to carry out extensive study and only make investments that we can afford to lose. Seek professional assistance for individualized financial guidance.)

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: How to Get Crypto Loans?

Comment, like, share and follow for more High Quality Financial Education Made Simple.