Summary:

Understand the causes of inflation before attempting to capitalize on it.

Do our own study and don't allow the government's figures deceive us.

Hedging and leveraging are the two main strategies to profit from inflation.

We have made a post a while back explaining why the middle class is doomed. We explained how people who were formerly financially comfortable were spending less and less on necessities due to the growing expense of healthcare. We had already written about the reason we feel and are poorer.

We talked on how middle-class salaries have essentially remained same. Some have made very slight, but not significant, progress. While low-class salaries have decreased by 5% since 1979, middle-class wages have increased by just 6%.

The only ones who succeed? extremely wealthy people, with a 41% rise in income.

There will be inflation soon!

Inflation: What is it?

Let's take a moment to define inflation before discussing how it affects wage growth.

Inflation is simply defined as a rise in prices accompanied by a decline in a currency's buying power. It implies that we will be able to purchase less than we did in the past.

Every economy goes through periods of inflation and deflation. Problems arise, though, when a population's income levels fall short of or surpass inflation. In that scenario, even if people believe they are making more money, they actually grow poorer.

Why does inflation occur?

In an economy, inflation can occur in a variety of ways.

A decrease in supply of a good might result in higher pricing due to rising demand. This is evident in a hot property market when there are more people seeking to purchase a home than there are available properties.

Rising costs for things like labor and materials can result in the increase of prices. For example, a few years ago, hops became more expensive globally, increasing the price of a six-pack by a few dollars.

Inflation is also influenced by the link between workers' pay expectations and rising costs. We refer to this as the "wage-price spiral." Put simply, it means that workers expect to be paid more when prices rise, which drives up prices.

A fourth method that inflation can occur is if the government prints money or manipulates the money supply, as the US did with quantitative easing following the previous financial crisis. Recap: QE is the process by which the Federal Reserve purchases Treasury bonds in order to maintain low interest rates. It would be similar to printing money to settle our credit card debt.

Which kinds of inflation exist?

Although there are many different kinds of inflation, the three primary forms are hyperinflation, walking, and galloping inflation.

Creeping inflation: Most economies seek and expect a normal, mild inflation, which is known as creeping inflation. The Federal Reserve, for example, establishes policy with the goal of achieving a 2% inflation rate. An economy is said to benefit from this, and employee compensation should be able to keep up.

Walking inflation: An increase in inflation in the 3-4% range is referred to as "walking inflation." People start to feel poorer as a result of this and find it more difficult for their wages to keep up.

Hyperinflation: is extreme inflation that can reach 20%, 100%, 200%, or even higher. "A loaf of bread in Berlin that cost around 160 Marks at the end of 1922 cost 200,000,000,000 Marks by late 1923" is an example of the high hyperinflation that occurred under the Weimar Republic.

Majority of people shouldn't be concerned about inflation but should master it through investing

Most people anticipate consumer inflation, or the rise in prices of goods, sometimes at a high rate, as a result of inflation.

After all, artificially low interest rates cannot stimulate the economy by preventing money from pouring into the market and driving up prices for goods. Economics is a really straightforward subject.

However, the government is not disclosing that information.

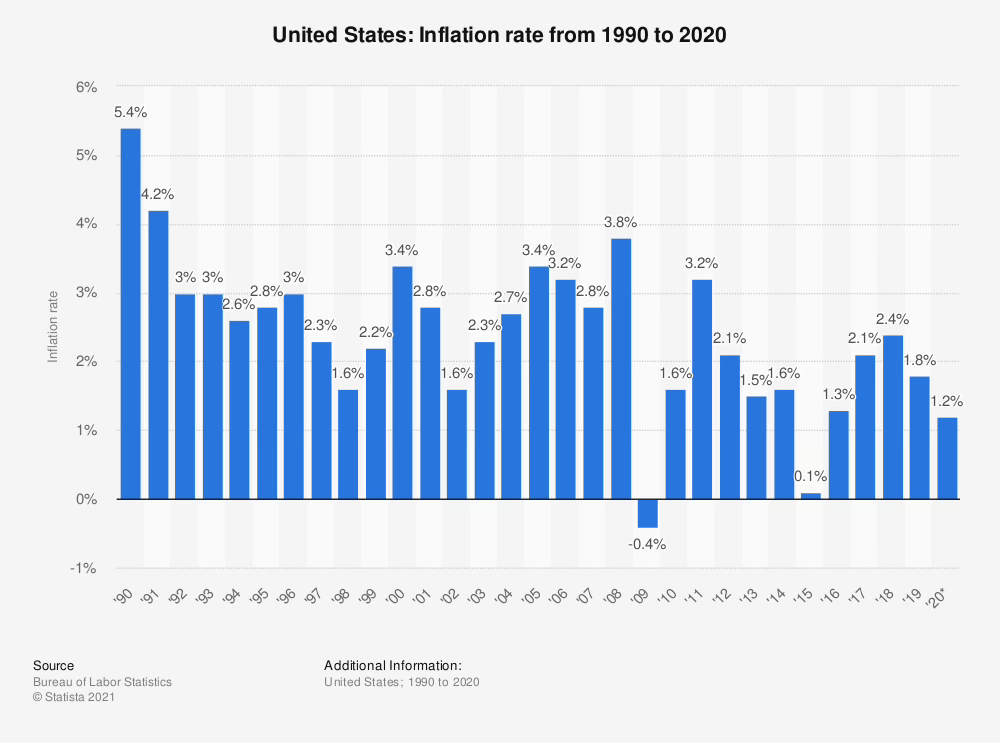

Consumer inflation has not increased significantly, based on official measures of inflation. It's actually historically lower, as this Statistica figure illustrates.

Source: Statista.

How is that possible?

The first explanation for this is that inflation is occurring, but because of the methodology used by the US government to measure it, it is not always easy to see. "There are three kinds of lies: lies, damn lies, and statistics," as the saying states. In this instance, it means that governments can manipulate the data in statistics to tell any narrative they choose. Since 1990, it has been evident from these figures that the administration wishes to portray low inflation.

In the past, a constant basket of products was used to measure inflation. This supply basket represented the collectively agreed-upon necessities for a decent standard of living.

However, as shadowstats.com notes, that formula was modified in 1990 to align with a widely accepted scholarly notion known as the "constant level of satisfaction," which was then deemed a "true cost of living concept."

The common contention was that consumers would switch from more costly to less expensive goods as a result of changes in the relative costs of commodities. By facilitating the replacement of items inside the fixed-basket, consumers might achieve a "constant level of satisfaction" by optimizing the "utility" of their money.

The GDP concept, as it is currently employed, is more suited for this kind of inflation measurement since it measures changing weightings with actual consumption as opposed to the fixed weightings required to calculate the expenses of upholding a constant standard of living.

To put it plainly, the statisticians assumed that if the price of a steak increased, people would replace it with a less costly hamburger. Instead of tracking the same products every period, this allowed the government to continuously change the goods in the basket in order to manipulate the inflation rate to a lower rate.

Why would they act in this manner? In essence, it was a means for the government to save money by, for example, not having to raise Social Security payouts to reflect genuine inflation (Shadowstats.com goes into more detail).

It is clear why when comparing the measurement methods from 1980 and 1990.

Shadowstats.com, the source

This graph illustrates how inflation has been averaging 10% over the past few years, which is among the highest levels since the 1980s, when the formula was altered. And while the pandemic is ending, it's soaring to some of the highest rates ever recorded, heading toward hyperinflation.

Naturally, we don't actually need to be informed of this. We probably already know that costs have increased for relatively simple items—in some cases significantly.

Inflation's effects on wage growth

Regretfully, inflation has wiped out the tiny pay gains of the majority of American workers. According to "The Washington Post" says,

According to a Labor Department study released on Friday, the cost of living increased by 2.9 percent between July 2017 and July 2018, outpacing a 2.7 percent growth in salaries during the same time. In the United States, the average "real wage," which is a federal indicator of compensation that accounts for inflation, decreased by 2 cents to $10.76 per hour last month.

Who is to blame for this rise in expenses? energy, housing, medical insurance, and health care. essential requirements. Once more, only those with high incomes are experiencing pay growth. This is a result of businesses emphasizing to reward highly skilled employees solely with raises—a practice known as the "massacre of the Dilberts," according to Governor of the Bank of England Mark Carney.

Regretfully, this is nothing new. For decades, American workers' average income has not increased in line with inflation. According to PEW, after accounting for inflation, the average hourly salary has roughly the same purchasing power as it did in 1978.

This is in contrast to a prolonged period of decline in the 1980s and early 1990s and erratic, uneven recovery in the years that followed. The average hourly wage really peaked over 45 years ago: in January 1973, the rate of $4.03 per hour had the same purchasing power as $23.68 now.

Inflation has the effect of making people poorer

Now, since they don't know how to take advantage of inflation to become richer, some people view inflation negatively.

Rather, inflation makes them impoverished. Employees are negatively impacted by inflation, for example, since they are limited to selling their time, which is not a very good inflation hedge. If there are any raises at all, they usually occur annually after inflation, not before.

In addition, since the Fed typically boosts interest rates to combat inflation, those with interest-only mortgages or credit card debt also suffer from inflation. A large portion of bad debt has changeable interest rates, which increase in inflationary times and increase the cost of debt payments.

Lastly, because they think it is sensible and practical to save money in the bank, those who adhere to the traditional financial norms suffer from inflation.

However, the bank is not stupid. Additionally, the bank abides by the updated money laws and rules. On money that doesn't keep up with inflation, they pay interest. When the bank utilizes our money to produce additional money, it loses purchasing power.

For the middle class worker, things seem bad everywhere they look.

So let's get over the negative and examine some lessons learned from Master Investor about how to prosper in an inflationary economy.

How to take advantage of inflation?

We were taught here at masterinvestor how to cash flow from inflation by using it in the form of leverage and hedging. And we continued to do so ever since learning this knowledge.

As a wealthy entrepreneur and inside investor, we have to master how to play the same financial games that the banks and government(s) “plays”. We must understand how they create and make money. We may duplicate how they do it to become as wealthy as we wish to become. The point is that we master money and we can use it to become wealthier. Which means that we have more excess of positive cash flow and maintain total freedom. Control over our time at all times. Once we have excess of cash flow from our assets that such cash flow exceeds our expenses and still control our time at all times then we are part of the 3% of the population who experiences total freedom in any type of economy. Even during hyperinflation.

By taking out a fixed-rate bank loan, we use less of our own funds to acquire a cash-flowing asset that pays off the debt and boosts our return on investment.

If the loan payment is fixed in an inflationary economy, the dollar loses purchasing value and becomes less of a burden, increasing our income and investments.

Our income and investments increase because we buy assets that act as a hedge against inflation. For example, rents typically increase in economies experiencing inflation. Our rent increases as a result of inflation when we buy an investment property, but our debt payment remains constant. This increases the cash flow. We just owe the bank the agreed-upon amount, which gets pay by cash flow from the asset. So ultimately is free as it brings all the capital back that initially invested and continues to provide us with cash flow even in moments of hyper inflation.

The growing rent payments go directly into our pocket.

This also applies to businesses. Businesses can modify their prices and profit from inflation as consumer costs of goods rise.

Because investors and business owners aren't selling time, this works. Products that provide a relatively real-time inflation hedging are being sold by them. They have the upper hand. Employees do not control their money; that is the responsibility of the bank or mutual fund. Neither do they control their product, which is time.We make commodity investments as a hedge against inflation. Energy products, like oil, have been popular lately. These are excellent investments during periods of inflation. Not ideal in the event of deflation.

We are therefore not suitable investments for everyone, particularly for those who are still learning about the market and investing and may find it difficult to respond rapidly to shifting market conditions.

There will be inflation soon, which kind? It looks like hyperinflation!

We understand that the greatest way to make cash flow from inflation is to invest in assets that act as a hedge against it.

We might be mistaken, but investing in different asset classes including paper assets like stocks, bonds, and mutual funds instead of saving money is a safer course of action.

However, in order to ensure the success of our own investments, we must put in the effort to carefully consider the information and choose whether we believe this approach would be beneficial to us.

Ultimately, it boils down to the classic advice from our content: invest for cash flow. It's the most sensible and safest tactic that will work for us in an inflationary market. It is a surefire method to get money.

As we mentioned investing for cash flow is a way we can beat hyperinflation and cash flow in any type of economy. The more the dollars gets printed by the government, the more it looses value. The only way to make the money maintain value is by investing it into a cash flowing asset. And when we invest it and create cash flow, the surplus of the cash flow should be invest it into another cash flowing. The holy grail of investing is maintaining and controlling cash flowing assets even after they have brought back all the initial capital invested. At that point we will reach infinite return of investment. It is asset that has become free and continues to produce passive income and at times it will create capital gains income for us. The importance of using debt to become wealthy is crucial to master.

Master The Cash Flow Circle and The Side We Chose to Operate From Determines Whether we Become Wealthy or Not

Investing and operating form the right side of the cash flow circle will allow anyone to beat and cash flow during any type of economy. It requires constant study of money and application of the knowledge we are learning about creating wealth. Investing for cash flow will protect us even during hyperinflation seasons. The economy goes up and down. Therefore, as an inside investor and business owner, we shall prepare for any economy to win and take advantage of the opportunities the people who are financial uneducated can’t see.

As we can see the best thing we can do to become wealthy is overt for cash flowing assets and doing so requires us to operate from the right side of the cash flow circle. We must adopt the context and content of the ultra wealthy, which we are doing daily here in our community through self development and financial education with actionable steps to create true wealth. As a wealthy entrepreneur and an inside investor that we are, we must receive cat flow. What are the 3 Es’ of a Master Investor?

Financial Education

Financial Experience

Excess of Positive Cash Flow

Once we thrive from the right side of the cash flow circle and we are paying all of our expenses with our investments then we are financial free. When we have financial education then we can see why inflation creates financial opportunities for the inside investor and wealthy entrepreneur.

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: How to Cash Flow from Inflation?

Comment, like, share and follow for more High Quality Financial Education Made Simple.