Summary:

There are two kinds of investors, but only one has the potential to make us wealthy.

Learn more about money management to become an investment strategist like the wealthy.

We need to have a wealthy in order to be a wealthy investor.

Investors fall into two categories.

Packaged investor:Investors that purchase packaged investments are the most prevalent type of investors. He makes a purchase over the phone from a retail establishment, like a stockbroker, financial planner, or real estate firm. It might be a bond, stock, mutual fund, or REIT. Investing in packages is a neat and easy method; it's similar to shopping for a computer at a store and purchasing it off the shelf.

Create investor:Investors with a creative mindset make investments. They typically put together a contract in a similar manner to how a computer is assembled by a component buyer. Just like constructing a computer from the ground up, investing of this kind requires skill, expertise, patience, and time.

Be a creative investor if we want to invest like the wealthy

An experienced investor is the creative investor. There are situations where a deal may not come together for years. And occasionally, they never do. It's critical to acquire the skills necessary to assemble a creative investment. When things don't go your way, you can suffer significant losses. But there's a big payoff when everything comes together.

We have been using these financial teachings as a creative investor since our best mentors, who are wealthy, encouraged us to be one. It was a wise investment.

Three abilities of imaginative investors

We must put a lot of effort into increasing our financial literacy through education if we want to be a creative investor. Following our financial education, we will need to hone three key competencies.

Raising funds is a skill that most people find difficult to learn, yet it's essential for becoming a creative investor. Even when the bank refuses to grant her money, the resourceful investor needs to know how to get finance. The good news is there are plenty of ways to get money that don't require a bank.

Seize a chance that others have passed on.

See with our thoughts what the eyes fail to seeGive the story of a man who purchased an old, dilapidated house that had a creepy appearance. His surroundings would question why he purchased it, but he was able to see what others were unable to. We found that the house came with four more lots after visiting the title firm. He just demolished the house after purchasing it and sold the five lots to a builder for three times the price of the complete package. His salary after two months of work was $75,000. Though not much, it is certainly better than the minimum wage. It's also not technically challenging. All it required was a shift in perspective.

Raise moneyThe typical person only visits a bank to withdraw cash. They say things like "they don't have the money to buy it" or "The bank won't lend them money" when a wonderful opportunity presents itself. The way the typical investor thinks about money and investing hinders them. We have to become creative when it comes to building wealth. We must use OPM (Other People’s Money) to invest for passive income. We can do that by mastering how to manage good debt and bad debt to build wealth. Understanding how money is created today is required for us to manage debt successfully. We must use debt to become truly wealthy and minimize taxes as much as legally possible.

Put intelligent people in orderSmart people recruit or collaborate with smarter people than they are. Make sure we select our consultants carefully when we need help.Being a wealthy investor requires a lot of knowledge and experience in several areas. However, the benefits are enormous. It is strongly advised that we become a package investor if we do not wish to acquire such skills.Ultimately, our biggest asset is our knowledge. And our biggest risk is what we don't know. However, danger will always exist; therefore, learn to manage it rather than eliminate it. Invest in our financial knowledge so that we can use creative investment to become a wealthy investor in the future.

Bonus question: What are we going to do today daily to increase our financial education?

The wisdom in starting our business small but smart

When we are first starting out, work to learn, not to make money. Making a move to the right side of the CASH FLOW Circle is crucial for launching a brand. Establishing a business is an experience that calls for a spirit of entrepreneurship.

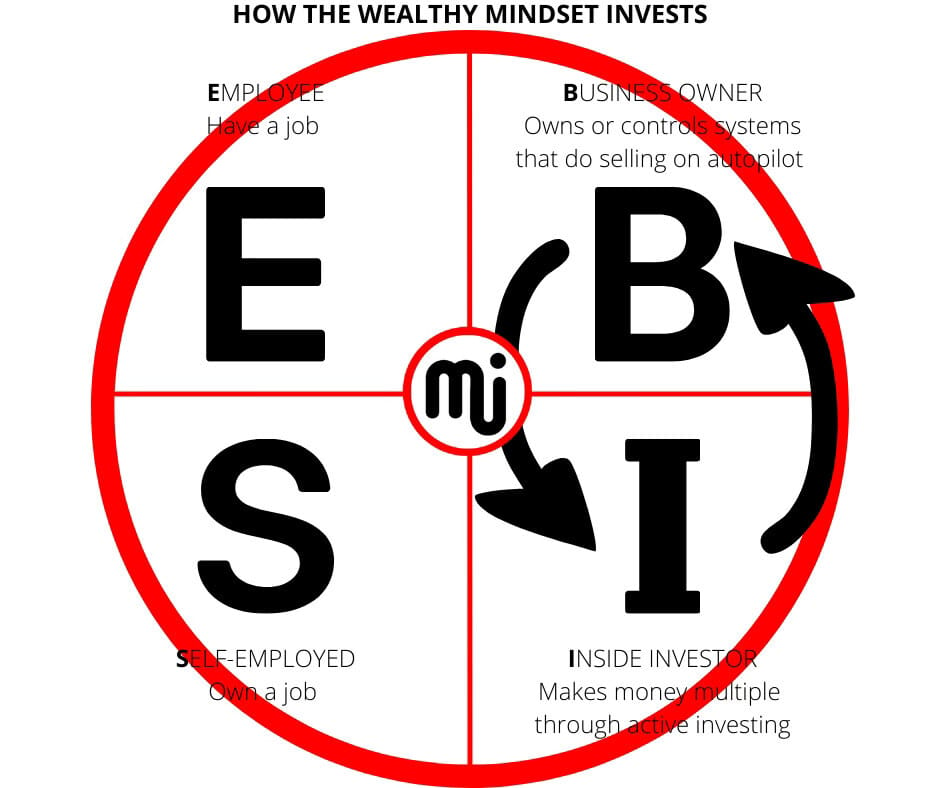

Understand the cash flow circle will help us decide which money player we wish to become and which side of the cash flow circle we will be operating from.

To begin, consider the CASH FLOW Circle.

We have probably already become acquainted with the CASH FLOW Circle by this point.

This cash flow circle provides a straightforward explanation of the four distinct career paths and the driving forces behind each money player in the game of money.

E stands for Employee

Workers long for stability. Workers don't place a high value on understanding money and how it operates. Employees search for higher-paying positions when they require more money.

S stands for Self-employed

When someone becomes extremely proficient at their job and is weary of working for employers they know they can outperform, they typically shift to the S quadrant. S quadrant workers include physicians, attorneys, dentists, accountants, and employees of other service-oriented companies and consultants. Although they still want for security, these workers have a larger risk threshold than typical employees and are willing to take on a little bit more danger in order to maintain control.

B represents Business Owner

Owners of businesses don't want to be employed. They aspire to possess a product or system that generates income even when we aren't working. They are the ones who create jobs and boost the economy since they are excellent delegation skills. Being able to earn money from your business even when we are not working is the nicest aspect of being a business owner. Above all, entrepreneurs want expansion and autonomy. We attract finical freedom through positive cash flow.

I represents Inside Investor

The most financially literate individuals in the quadrants are investors. They know that we may live a life free of labor if we locate assets that generate steady income flow. Making money work for them rather than the other way around is what drives them.

They search for a chance to buy an asset that generates more passive income when they require more money. We make money work hard through sound investing to acquire more true wealth and total freedom.

Recall that this is an adventure

When we are prepared to shift to the right side of the Cashflow Circle, it's crucial to keep in mind that the process itself is an adventure.

For instance, many are overcoming with a sense of helplessness and lacked confidence after deciding to resign from their position.

Start our own business. But in the process, we still need to put a roof over our head, invest in financial education and eat. Therefore, we must focus in a having money available to us for those important things that we need as we build our wealth.

Let’s continued by outlining a very important guideline: work to learn, not to earn.

We build a business because of the challenge. We start a business because it excites us, is difficult, and will need everything we have to succeed.

We would acquire the skills we need to launch the company we intend to launch by accepting a task that teaches us necessary skills. Some of us can have extreme shyness and fear of rejection, so we suggest that we accept a position that would teach us sales techniques. We wished for all of us to become adept at overcoming our own anxieties. we must attack our fears in order to do that and achieve our dreams.

Though it can be a difficult learning process, it will bring us excess of passive income and capital gains income. It is a true financial commitment that we must follow.

Even though we rose to the top of any company, the person will at some point feel strapped because it is only so much he or she can make per day if they are working for earned income.

There three types of income: earned income, capital gains income, and passive income. Out of those three only the two latter are investing incomes and the earned income is from trading ones time for money and it is also the highest tax out of the incomes we can all build.

A second lesson in light of this reality about finding a way to true wealth is: maintain a day job while beginning a side business can be the smoothest way to transition from the left side of the cash flow circle to the right side of the cash flow circle. It will be a way to escape the rat race successfully but it requires attention and actively investing.

The biggest mistake people make is working too hard for money.

The majority of people don't advance financially because they take on part-time jobs when they need more cash. They would start a part-time business and continue their day job if they were truly determined to become wealthy. This holds true for businesses such as Dell Computers, Facebook, Microsoft, and Amazon.com.

Thus, if we are prepared to launch a brand or company, here are seven strategies we can use without leaving a current and temporary job.

Develop our pastime into a companyIt will take a lot of time to start a business, to start with. So why not engage in something we enjoy? Examine how we choose to spend our free time. About what do we truly have a strong passion? It might be cooking. Now figure out how to monetize it. Could we launch a blog? Write about the meal prepare and record our creative process. Sharing our talents with the world should be enjoyable as we already do it. Additionally, we will probably run into people who are passionate about the same things we are. And even better, do we have an e-book with recipes? Put together our top 100 recipes, then charge $5 for an e-book.

Pay attention on products, not servicesMany employees and financial uneducated mindset’s first idea is to start a service business by taking the skills they utilize in the business sector and offering them as consultants. The issue with running a service business, especially part-time, is that they are merely the owner of their employment rather than a company or brand. Being in the service industry means that the person must sell their time too. They cannot make money if they are not employed. Additionally, working long freelance hours is a proven way to burn out while they are full-time employees.Instead of offering services, find a means to produce a product. If our focus is consulting, create a course that we can market.If we are not into cooking, figure out what we are and find a method to be paid for it. Not even work will feel like it. Pay attention to the product, team, and systems rather than the services. Or write books that you can sell if you're a writer. Many writers make money while they sleep by selling their books as e-books on Amazon for just $1 each. The secret is to identify the product angle by considering the services we may offer. We will be generating income even when we are not working if we can pull that off. That is an actual side business, a real asset that produces cash flow for us.

Discover how to make investmentsStarting an investment business is another fantastic option to create a successful side gig.Saving money for investments and investing some time in our financial education are necessary for this, but once we start, the possibilities are endless. And we can quickly complete everything in our free time.

Work on rather than in our businessThose who operate a side business may be tempted to take on all the job alone. Finding capable contractors or even hiring one or more employees to work for the company is a far better option, though, since it will free up our time to manage them and grow the company. Delegating is an important skill we shall master in order to build true wealth. We may develop our business and make it more than simply a side project by putting our all into it from the beginning.

Form a fantastic teamMany owners of part-time businesses are low-cost. They attempt to cut expenses on legal and accounting services.However, because they aren't taught in those areas, they wind up requiring more time from them in the long run, as well as occasionally paying more in litigation and tax liens.Use the excellent team members we find. Obtain a competent CPA. Locate a top-notch lawyer. When making real estate investments, work with a trustworthy and accomplished broker. Concentrate on our areas of expertise and delegate the rest to others.

Take charge of our scheduleThe usual justification for not launching a business is a lack of time. This is untrue. Most people would find that they have plenty of time to work on a side business if they audited how they spent their time.The issue lies in the fact that most people don't own their schedules; instead, they are owned by it.Being a productivity and time management whiz is essential if you want to manage a profitable business full-time. Reduce TV time, give up going out to bars, and get in bed. We wouldn't believe the benefits that a half-day on Saturday and an hour or two of work in the evenings may have on us.

Make use of technologyLastly, a ton of technology is available to help reduce many chores that took hours to only a few seconds in some situations.To automate many of our repetitive emails, look into and use a reliable CRM and marketing automation software. We can also use administrative software like Quickbooks, which connects with our smartphone, to keep track of our income and expenses while on the road. To scan and make searchable our crucial documents, use an appropriate apps for each task. Utilize project management software to assist in overseeing our group of contractors and specialists. There are countless options out here that can help us run our systems of each business or investment. Use websites like fiverr to get delegate tasks.

Developing Our Spirit of Entrepreneurship

The entrepreneurial spirit is ignited when a business is started.The majority of large companies began as part-time ventures and that the real issue facing the world today is not a scarcity of brilliant ideas, but rather a dearth of outstanding businesspeople.

Regardless of whether we approved of the product or not, we urged our partners to launch a business of any kind. There is no fear of failure because is part of success. All we want for others is to begin and win. Great spirits have always encountered violent opposition from mediocre minds. It is one of our favorite statements. We merely want others to launch a company that turns into brand in order to push the average intellect and cultivate our passions of entrepreneurship.

Put our all into it.

Making ourselves an excellent businessperson should be our main motivation for starting a part-time venture. Money alone does not make us wealthy, it is the person we become along the way that determines our wealth. Pay attention to what we consume and ensure we are doing self development daily.

Many aspire to become accredited investors, which requires earning $200,000 annually in earnings. That may seem like a lot of money to some, but it is not a good enough reason to launch a company.

To be honest, launching a business comes with too many risks for such a modest investment. Don't start a business for pennies on the dollar if we decide to do so. The profit is so little that the hazards are too great. For a far larger payoff, do it. Why? Since creating a business would require everything we have to see it through to success.

As an employee, a person can earn $200,000 while taking on far less risk and worry. Having a higher purpose in mind is essential when starting a business.

Because of this, it's advisable to begin by creating a successful side gig in order to gain experience in managing a profitable company.

Establishing a business is a love affair

Having said that, money is not the main driving force behind starting a business, despite its importance. The easiest way to respond to the question "Why would we start a business?" is to pose it in a different manner. "What would make we continue to play golf?" The essence of the game contains the solution. Because we will playing for the rest of our lives the game of money.

Entrepreneurs persevere because of the thrill, the challenge, the enthusiasm, and the possibility of a large reward at the end.Creating a company is a lifelong love affair driven by an entrepreneurial spirit.The finest aspect?

It is possible for anyone.

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: How To Be A Wealthy Investor?

Comment, like, share and follow for more High Quality Financial Education Made Simple.