Summary:

Certain Ponzi schemes are legitimate and backed by the government.

Keep in mind that the rules are set by those with the money.

The secret to staying out of a Ponzi scam is to educate ourselves.

At the end of today’s talk, will cover our bonus question: What Are Tax Deductions versus Tax Credits? Discover legal ways to maximize our wealth via taxes.

Many are involved in a pyramid or Ponzi scheme today. Are we being taken advantage of without even realizing it? We must value our time which is the most precious asset we all have together with our mind and freedom.

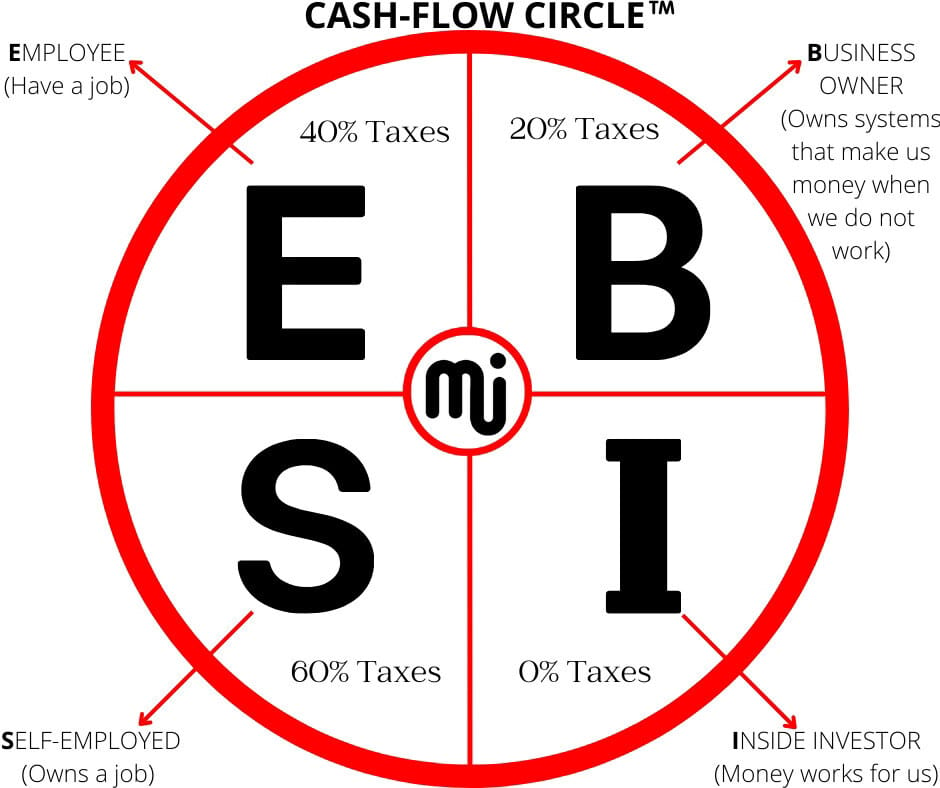

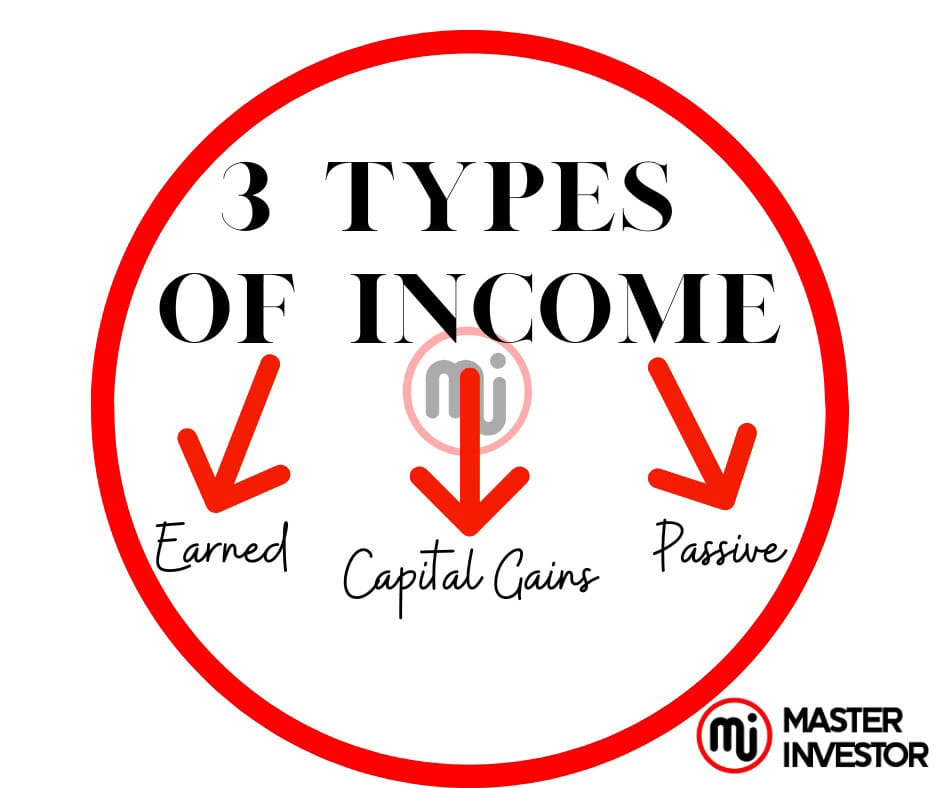

Majority of people end up selling their time for money working for earned income, which is tax at the highest bracket of the 3 types of income that we can build. When in reality we can make money work hard through sound investing without ever having to sell our time for money, working to build passive income (positive cash-flow).

The leader of the biggest Ponzi scheme in history, Bernie Madoff, is probably someone we have heard of. If not, we should learn more about him and others like him to avoid being like them and associating with anyone who is like him.

When we have financial education because we invested into it on our own, then we have an unfair advantage where it gives us the wealthy entrepreneur’s eyes. We get to spot all the red flags of a toxic business people and fraudulent investments. We have the basics and mastered the new rules of money to become extraordinary at the game of money in real life.

Madoff was given a life sentence for his Ponzi scam, and in April 2021, he passed away at the age of 82. He entered a guilty plea to the charge of cheating investors out of $65 billion, wiping out many people's retirement plans, life savings, investments, and aspirations. He ruined his clients' lives while amassing enormous wealth.

The most important factor is our degree of financial literacy. We will have the self-assurance and clarity necessary to find a path that complements our personality after we begin learning more and more. a route that enables us to concentrate on our strong points while fostering the development of our deficiencies.

A Ponzi scheme: What is it?

Few individuals genuinely understand what a Ponzi scam is, even if most people have heard of Madoff. This is a serious issue. Millions of people unintentionally fall victim to both legal and illicit Ponzi (pyramid) schemes as a result of this lack of financial literacy. To put it another way, many individuals are unaware that they are being conned in the same way as Madoff's victims, even though they may feel sorry for them or laugh at them for being wealthy people who lost money.

The founding tale of Ponzi

In honor of Charles Ponzi, an Italian immigrant to America who discovered a clever technique to make money, here is a brief history of Ponzi schemes.

In the days following World War One, Ponzi (1882–1949) devised his plan in Boston using the "International Reply Coupon," a method of prepaying international postage.

Ponzi's Coupon, purchased at a discount abroad, might be redeemed for a larger sum in the US due to a peculiarity in currency exchange.

Ponzi claimed that by purchasing and reselling the coupons, he could double investors' money, and initially, it was successful.

Ponzi received the money, paid out large profits, and then received even more money from investors—up to a million dollars a week in 1920 dollars.

However, Ponzi's deception was exposed when a publication reported that there weren't enough coupons in the globe to fund his scheme.

He had simply been using the money from his later investors to pay off his early investors; he had not been investing in coupons at all. The people that have fall for such scam or anything alike is because they lack the 3 E’s of a business owner and inside investor which are financial education, financial experience and obviously excess of cash flow.

As we gain financial education, we gain control over our investment and cash flow. That is key to be able to strive in business and stay out the fraudulent investments that exist even the ones that legal but they are liabilities for the investor.

While Ponzi was imprisoned, several of his clients filed for bankruptcy.

The sinister reality of Ponzi schemes: The reasons why even sophisticated investors fall for them

The truth is that not all Ponzi schemes are unlawful, despite the common misconception that they are run by dishonest persons. In actuality, governments not only encourage but actually legalize some of the largest Ponzi schemes, including one larger than Madoff's.

"Those who have the money, make the rules," as the adage goes. By being on the right side of the Cash Flow Circle, we can play by the rules of the wealthy and profit from them.

Let's examine a few of the most well-known legitimate Ponzi schemes.

Ponzi schemes' sinister reality: why even sophisticated investors fall for them

Although many people believe that Ponzi schemes are illicit operations run by dishonest people, the truth is that not all Ponzi schemes are unlawful. Actually, some of the largest Ponzi schemes—even larger than Madoff's scheme—are sanctioned by governments and are lawful.

The adage "Those who have the money, make the rules" applies here.

Let's examine a few of the largest legitimate Ponzi schemes now in operation.

Social SecurityMoney is taken from young people and given to the elderly in order for Social Security to function. The issue with Social Security is that, according to masterinvestor's assessment, it will implode sometime around 2040, just like all Ponzi schemes do. For this reason, the majority of young people anticipate seeing extraterrestrial life before they ever get a Social Security cheque.

The Market for StocksThe fact that most investors are aware that anything might happen to them at any time is the reason why so many believe investing is dangerous. The majority of early investors wait for a stock's price to rise as a result of additional capital entering the market before seizing their gains and fleeing.Today's High Frequency Trading (HFT) and algorithmic trading have made the stock market an even bigger Ponzi scheme. Giant investment firms that have the funds to purchase and run multimillion-dollar computers that can execute thousands of trades per minute are involved in HFT. These houses day trade whereas the big houses trade in milliseconds. Let's talk about suckers.The majority of investors in capital gains schemes are those that wager on the price of assets like stocks, real estate, gold, or collectibles rising. Late investors lose, and early investors profit.When we consider that the majority of people invest in 401(k) plans for their retirement, this becomes particularly problematic. Because the stock market is solely supported by 401(k) funds, successful investors believe it will crash. Smaller generations won't have enough money to replace the money taken out by large generations when they retire.

TaxesTaxes Politicians and bureaucrats collect taxes and give them to their cronies and family. The issue with taxes is that the inefficient handle the money that is stolen from the efficient.

Pension schemesLegal pyramid schemes make up the majority of pension programs. Pension programs rely on contributions from younger employees to cover the costs of retired employees.Underfunding is one of the main causes of the problems facing so many pension schemes. In other words, the old men are doomed if new employees do contribute or if the stock market does not suddenly rise by 20% annually.The insurance provider for these pension systems, the Pension Benefit Guaranty Corporation (PBGC), is likewise insolvent.For baby-boomers who took part in legitimate Ponzi scams, retirement is a financial precipice.Once more, see "Who Stole My Pension?: How We Can Stop the Looting" for additional details.

Network marketing isn't a scam

The majority of conventional companies, including IBM, are perceived by some as genuine pyramid schemes.

The majority of people are at the base of a pyramid, whereas there is just one person at the top. That individual is typically the CEO in the corporate world. There can only be one winner. There is only one seat at the top of the corporate ladder, and it is a win-lose, dog-eat-dog situation.

The reverse is network marketing. With the base at the top and the point at the bottom, it resembles an inverted pyramid.

The goal of the entire company is to elevate as many people as possible to the top. Network marketing is not dog-eat-dog; rather, it only succeeds when you help your friends and family succeed. Regretfully, a lot of people give up before they reach the pinnacle. They return to the true pyramid scheme after quitting, frequently working at the base of the pyramid and gazing up at someone else.

Learn from the experience of others in Ponzi schemes to avoid them

We must do our due diligence on every investment we ever get involve. We must make sure the investment, team, financing and cash flow are all legal and we have to understand via studying the numbers of that specific business from the financial statements.

We must have a plan in action before we invest. Investing is define as having a wining business plan with a lucrative exit strategy. A person who invests without a business plan is a gambler and a trader, not a true investor.

Cash flow are the most important words on the business language and the second most important words are due diligence. By respecting the most important words in the business language and applying them into our investment we will ensure to avoid Ponzi schemes.

Many people without knowing have been expose to a real scams or real, which is an unlawful Ponzi scheme. We have seem them in all shapes and forms. From having people thinking that going to a business party where the attendees must bring for example $1,000 to a "party" that a friend had invited them to go to learn about getting rich.

Many people have fallen for this type of Ponzi scheme, even today they still do it foolishly. For example: Many people give thousand of dollars—to the "party" host in less than an hour. The attendees are informed that they might earn $50,000, but only if they invite sixteen additional people to the "party," each of whom would need $1,000 or whatever the amount the host is requesting. The pyramid fell if anyone didn't bring in sixteen additional people. It goes without saying that the pyramid will always fall at some point, and someone stole will steal the thousands of dollars-usually the part host is the one that keeps the money.

A lot times this Ponzi schemes are painted through business opportunities that are toxic once a person does due diligence into the business he or she will find out that such is not a sound investment. As we have learn here at masterinvestor we must keep control over our investments, we should not Han out money to anyone to invest it for us. That would mean the investor lacks financial education, financial experience and excess of cash flow, the 3 Es’ of an inside investor.

Others scammers will come in the idea that they aren a "Hedge Fund" manager. Many of this scammers will claim that they possessed the touch of magic when it comes to investing. Once more, many learned about these Ponzi schemes via a reliable friend who also invited others to the business "party" so they could meet. The guests at the party are usually successful, smart, and wealthy. The returns of the "scammer" was producing thrilled them.

We must always conduct due diligence of every investment we invest in. This can include traveling to the business operation is located to meet with the employees and tour the corporate offices if it exists at all. It goes without saying that some Ponzi schemes are sophisticated and they may look completely legit from the surface. Even to the point that their staff and quarters can be magnificent people at first glance.

Ponzi schemes scammers may displayed their "Wall of Fame," celebrity images, charity awards, and political civic honors during their presentation. They also emphasized their commitment to Jesus and their Christian beliefs at times to target people that are true believers.

That is why here at masterinvestor we encourage all of our partners to commit to acquiring financial education daily and master the ability to read financial statements to know what is a true asset and what is a liability.

Have we fallen victim to a Ponzi scheme?

However, it wasn't the final scam. Con artists such as Ponzi, Madoff, or "Golden Boy" are typically exceedingly smart, charming, and persuasive.

Their success can be attributed to their ability to deceive otherwise intelligent people. Their buddies inspire us to believe in them because they do. In order for a Ponzi scheme to succeed in the first place, they must be convincing.

Asking oneself, "Am I in a Ponzi scheme?" requires introspection and financial education to determine whether something is a scam.

Bonus: What are tax deductions versus tax credits?

To keep more of your hard-earned money, you must comprehend the distinction between tax credits and deductions.

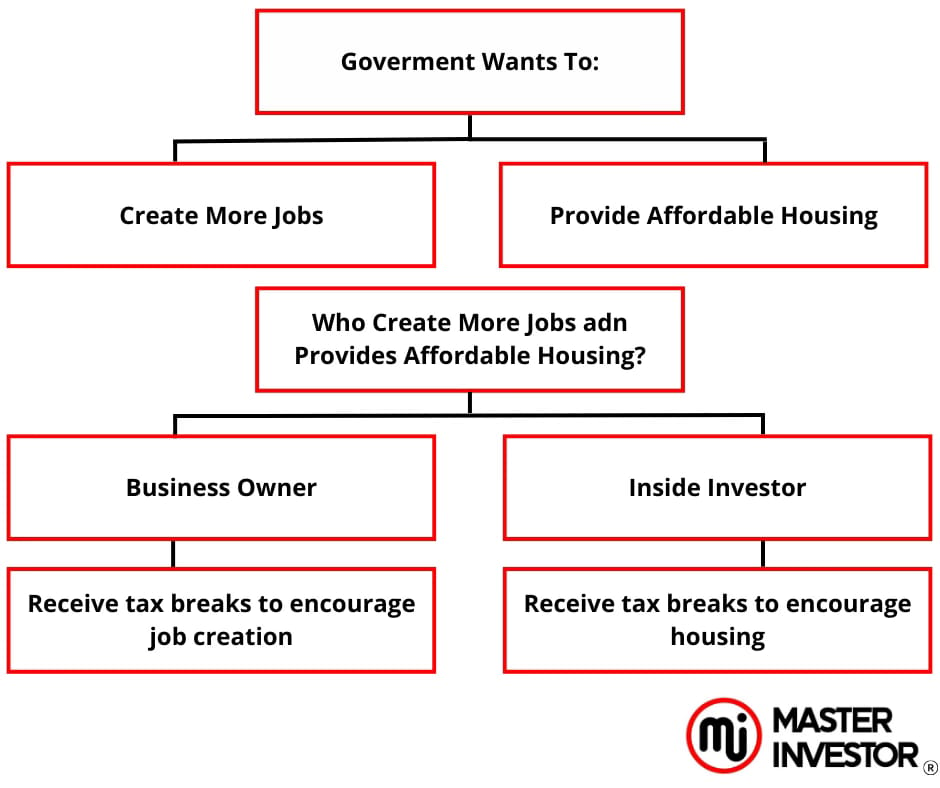

Unexpected! The tax code was created to benefit the business owner and inside investor, and not against us.

Being wealthy is more about how much we keep than how much we earn.

Anyone who is financially literate, not the affluent, wrote the tax legislation.

Anyone can make a lot of money and still not be wealthy. It all depends on how the money was truly made. Three types of income: earned income, capital gains income and passive income.

Many may have a large salary but also a lack of financial knowledge. Taxes and costly responsibilities, such as mega mansions, luxurious automobiles, and extended vacations, contribute to the financial loss of many high earners.

This information will not address the fairness of the current tax code. Regardless of how one feels about this tax code, there may be grounds for complaint. Rather than getting angry, this talk will teach us on how to lessen our tax obligation by making smart decisions. As we know the highest expense majority of humans have according to case studies are their taxes.

Learning how to minimize taxes legally by using the tax code to our advantage and following the law. When we abide by business law, and the tax code we get the government as our partner in our business. In other words, we use the government and its tools for leverage to create more wealth for us.

Here at masterinvestor, our team and tax advisor, discussed the two rules for increasing our income. All we need to do now is alter our information. Every dollar, pound, or euro we spend may decrease our taxes, and every dollar, pound, or euro we make can increase our taxes, so think about how to lower our taxes legally through business and actively investing for passive income (positive cash flow).

Our first lesson in leveraging the tax code to reduce our tax liability is provided below.

Comprehending tax credits and deductions

The secret to maximizing tax savings is understanding tax credits and deductions. Credits directly reduce the amount of tax we owe, whereas deductions can greatly decrease our tax obligation by lowering your taxable income. Knowing how to use these can help us keep more of our money.

Tax deductions

A tax deduction is a decrease in taxable income that is usually brought on by expenditures, especially those made to generate additional income. Along with credits and exemptions, tax deductions are a kind of tax incentive. The distinction between deductions, exemptions, and credits is that deductions and exemptions lower taxable income, whereas credits lower tax liability.

The Trump Tax Plan, which was implemented in 2018, nearly doubled the standard deduction for all filers, although his tax strategy for 2025 is still being finalized. Your 2018 standard deduction was $12,000 if you were a single filer or if we were married and filing separately. Heads of household received $18,000, while joint filers received $24,000. However, that tax plan did significantly alter several of the popular tax deductions from prior years.

Some common tax deductions include:

Deduction for estate taxes

Deduction for mortgage interest

Deduction for property taxes

Deduction for moving costs

Equity debt for homes

Tax credits are a direct decrease in your taxes that we receive when we be doing specific things that the government wants us to do. We just need to find out what the government wants us to do and be aware that there is a tax credit for doing it. We may even be doing these things without being aware of the available credit.

Tax credits are the pinnacle of tax savings since they reduce our tax liability dollar for dollar. Unlike a deduction, which just lowers our taxable income, it is not. It offsets our taxes directly. As a result, a $1,000 tax credit lowers our tax liability by $1,000 regardless of our tax rate.

Among the most well-known tax credits are:

Investment Tax Credits

Charity Credits

Working-Poor Credits

Education Credits

Family Credits

A direct subsidy is tax credits. The government doesn't send us a check because it's far easier for them if we submit the credit on our income tax return instead. Additionally, tax credits are never as politically acceptable as subsidies. Furthermore, the government isn't as financially burdened as it would be if it issued you a direct check because not everyone has the financial literacy to request the credits.

Common Misunderstandings

One very harmful misunderstanding about tax credits is that they are all refundable, despite their attractiveness. In practice, certain credits are non-refundable, which means they can lower our tax obligation to zero but not generate a refund.

On the other hand, many individuals err in thinking that a high income automatically makes them ineligible for certain credits or deductions.

Consulting a professional is essential when filing taxes because misunderstanding these concepts might result in missed opportunities or inaccurate tax returns.

Get professional advice.

Tax deductions and credits that we may not be aware of might be found with the help of tax professionals. Furthermore, the tax legislation is constantly changing, adding to the existing complexity and making it difficult for the average person to stay current. To ensure that our choices are well-informed and compliant, it is critical to boost our financial education while seeking individualized guidance.

Tax season shouldn't be stressful.

It's helpful to see the tax code as a tool that can greatly lower our tax liability when used correctly, rather than as a burden.

Consider how we may be someone who stimulates the economy, creates jobs, or both while doing our taxes this year. In this way, we will gain from the exact actions that the tax legislation aims to encourage. It will be better for our wallet and the economy.

Remember that it's about retaining more money rather than making more.

Get masterinvestor’s ebooks, right now to discover more about how to benefit from tax credits.

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Subscribe to our Youtube.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: How To Avoid Ponzi Schemes?

Masterinvestor’s mission is to be the global authentic brand of money, business, and investing that elevates the financial well-being of humanity through high-quality financial education made simple with lucrative opportunities to build passive income, win-win partnerships, and true wealth.

Comment, like, share and follow for more High Quality Financial Education Made Simple.