With Financial Education Anyone Can Print Money Too!

Learn to print your own money, since money is losing more and more value daily. The average wage for American workers has either decreased or remained unchanged over the past 20 years. How do the wealthy print money legally?

In the meantime, inflation has risen steadily. Simply put, this indicates that whoever works for earned income is earning less money and that it's buying them less than it formerly did. It is absurd to believe that earning at a decent job and saving money can help a person advance in today's economy. Every day, our money loses more and more value. We must learn how to print money on our own legally if we want to succeed in the new financial system.

What is an infinite return?

Having the power to print your own money is one of the finest benefits of having a financial education. This can be done legally using the financial concept of return on investment (ROI).

Most financial experts will tell others that a return on investment of between 5 and 12 percent is good; and if the people don't have financial knowledge, it is. They'll also say that the danger increases with increase in return. That applies even more if the people lack financial intelligence.

Yet, if we have a high financial Intelligence, we will understand that achieving an endless return on our investments isn't completely impossible. We should always attempt to get an infinite return.

"Money for nothing" is the definition we use for an infinite return. More exactly, an infinite return occurs when we receive a full return on our investment in a cash-flowing asset, we still own the asset, and continue to benefit from the cash flow on a month-to-month basis.

You are reading: How do the wealthy print money legally?

Printing our own money starts with being on the right side of the Cash-Flow Circle

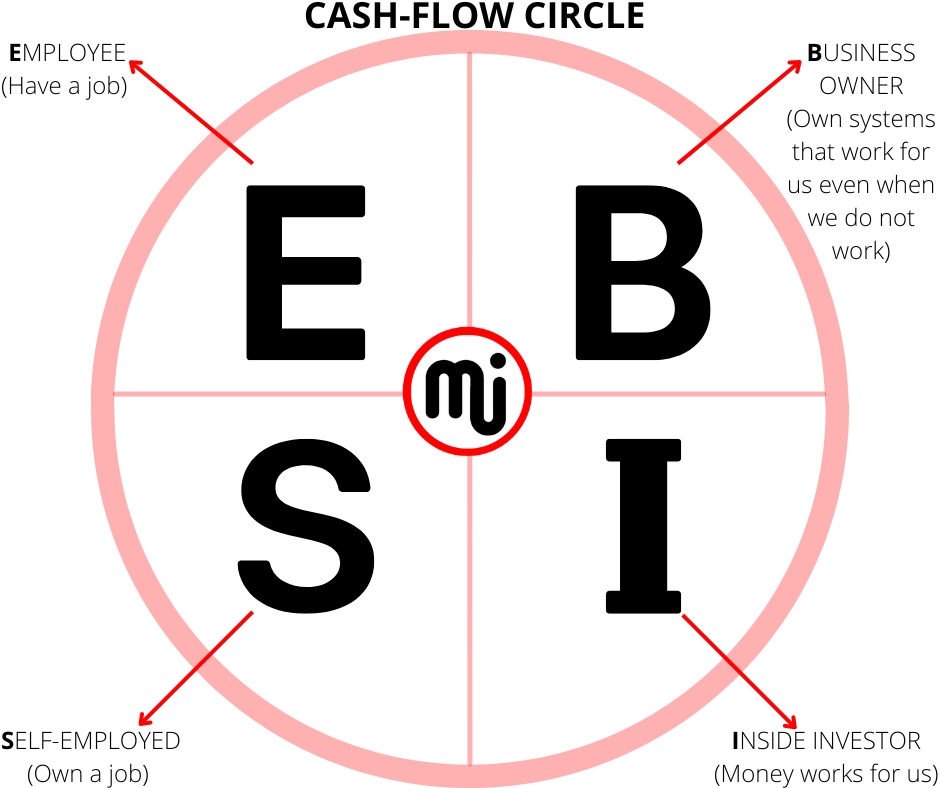

The CASH FLOW Circle is divided into four types of people, two in each category.

In a nutshell, the cash-flow circle has two sides. Employees and Self-Employed are on the left side. Business owners and inside investors are on the right side. On the left side of the cash-flow circle, people are unable to print their own money. Only if we eat, sleep, and breathe on the right side of the cash-flow circle will we be able to construct a legal money printing machine.

It is clear why this is the case. Employees do own the machine; the machine is not their property so they work for the machine. Moreover, self-employed do not own the machine. They have a business that frequently subcontracts to the money-printing apparatus. They own a job that often contracts to the money printing machine. They cannot possible reach the infininte return that come with a money printing machine since they sell their time, which is a limited resource.

You are reading: How the wealthy print money legally?

Build a money printing machine on the right side of the Cash-Flow Circle

Because they are the only ones who have found out how to legally print our own money, the ultra-wealthy only operate on the right side of the Cash-Flow Circle.

We own and control the machine, thus the explanation is also very straightforward. Business owners create businesses particularly for the aim of printing money lawfully; after we have recovered our initial investment in the business back, we may easily attain infinite return on investment. The same is true of inside investors. We are in the money printing business and making infinite returns once we recover our initial investment and still controls the asset/machine.

We can only print our own money legally if we own the machine, which means to operate on the right side of the Cash-Flow Circle.

Take a look at some examples.

How to print our own money in business

We started the Master Investor Company at my own kitchen table. Rather than use our own money, we raised funds from investors. In less than three years, thanks to the growth of the business, We have paid back our investors 100 percent plus an additional 100 percent to purchase back their shares. Today, our business puts money into our pockets even though we have none of our own money invested in it. That’s an infinite return. In other words, our business prints money for us legally. We continue to grow.

You are reading: How the wealthy print money legally?

How to print our own money with other people’s money

This brings up a crucial point: leveraging OPM (other people's money) to obtain infinite return fast.

Before getting into OPM, we should first discuss a key concept from Master Investor, the distinction between good and bad debt.

If we grew up learning the old rules of money, we have probably heard that debt is a negative thing. But it simply isn't the case.

If we want to become wealthy, we must take on debt—as long as it's good debt. That is the new rules of money.

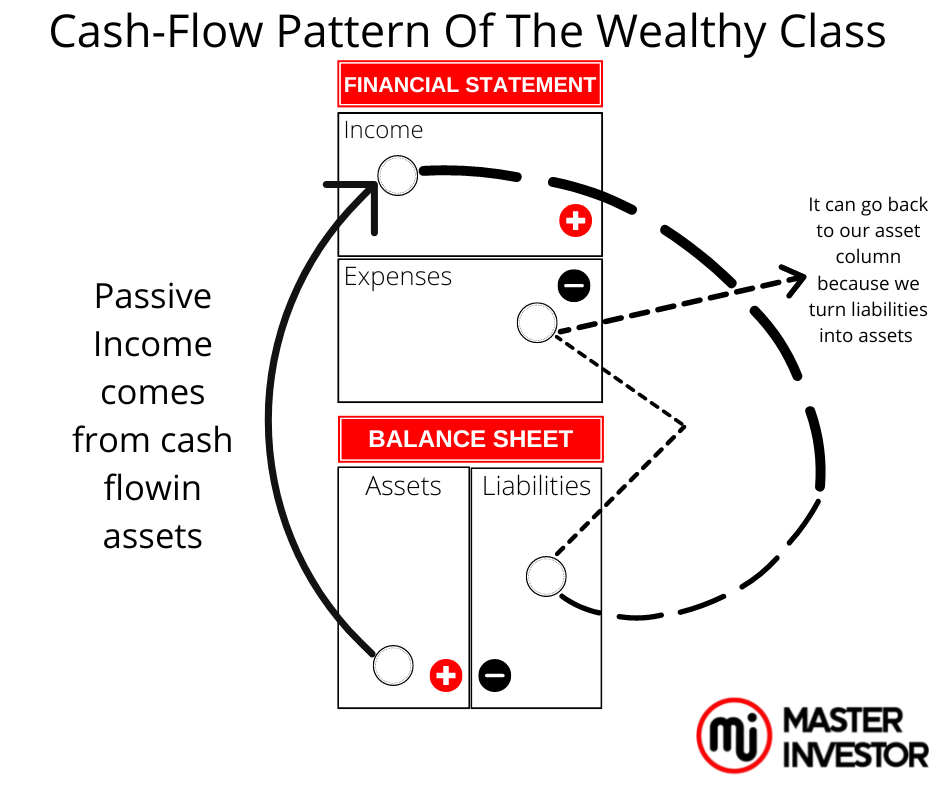

Liabilities, including goods like vehicles and trips, are financed with bad debt. Some of these are things that are unnecessary and depreciate with time. But as long as we have an asset that takes care of the payments in full, then we can acquire any liability. Liabilities, every month, they cost money and they should be pay with the passive income generated by the asset.

Good debt is used to purchase assets that put cash in our pocket each month. Good debt is things like equity partner money, a loan for an investment property, venture capital, etc.

OPM is a type of good debt. To use it effectively, we must have a high level of financial intellgence, but once we do, printing money happens far more quickly.

Here is an illustration from on OPM (other people money):

Scenario 1

$100,000 purchase price

$80,000 loan at 5% interest

$20,000 of your own money for equity

Running through a simple mortgage calculator, the annual cost for this loan would be about $8,500.

Assuming we have an income from the property of $11,000 a year, after expenses are paid, our total net income would be $2,500 ($11,000 - $8,500).

Our return on investment for this would be $2,500/$20,000 = 12.5%.

Scenario 2

$100,000 purchase price

$80,000 loan at 5% interest

$20,000 OPM (other people's money - like a credit card or credit line) at 7% interest

We get paid 50% of net operating income as the finder of the deal.

In this case, our annual loan costs would still be $8,500, but we would also have an additional cost of around $1,500 for the other people’s money we borrowed for equity based on an assumed 7%. So, total loan and OPM costs would be $10,000.

Again, assuming we have an income from the property of $11,000 a year, after expenses are paid, our total net income would be $1,000 ($11,000 - $10,000).

Our fee for putting the deal together would be 50% of the NOI, in this case $500 (50% x $1,000).

Our return on investment for this would be an infinite return because we would be making $500 without any money in the deal.

As we can see, OPM (other people's money) is a powerful money printing machine when used correctly.

You are reading: How do the wealthy print money legally?

How to print our own money in real estate

Master Investor, constantly collaborates with other real estate partners, to print money through real estate. We will locate an underperforming apartment complex, buy it with investor money (OPM), make improvements, boost the rentals, and raise the property's worth.

Then, we can refinance that property tax-free and repay the investors with the loan proceeds, all the while continuing to generate positive cash flow. With repayment of all investors, they continue to benefit from the cash flow. That too is an infinite return on investment.

These are just a few instances of how we can print our own money with the correct financial education. Furthermore, printing our own money really makes more sense than to invest our money over the long term in the stick market, working harder at a job to pay more in taxes, saving money in the bank and losing purchasing power, or working harder at a job to pay more in taxes.

Yeah, it makes more sense to build our asset column with printing money machines that work hard for us to create passive income.

Increase the financial IQ today and start printing money the legal way.

Read our ebooks to start:

You are reading: How do the wealthy print money legally?

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

You are reading: What are the simple rules for investing?

Comment, like, share and follow for more High Quality Financial Education Made Simple.