Summary:

Knowing how business investing works is essential to becoming wealthy.

Losing out on investing possibilities is a consequence of being an employee.

Pro tip: Having our businesses purchase our investments is the best method to invest.

We realized the value of investing long ago. We understand that money is created with debt and because of that fact debt is tax free.

We recognized that the city's most valuable plot of properties are being acquired by the wealthy mindset.

Upon first thinking, we may wondered how can they afford such pieces of land if majority of people can barely get by each month. It is all due to lack of financial education and real life experience when it comes to investing.

Investing may sound intimidating for others at first but it’s not once we take the first step towards understanding business.

Concerning company investing, the questions are still the same

Many of the same questions about wealth are remain the same throughout history.

During investment classes, students pose questions such as these:

"If we don't have any money, how can we invest?"

"We can invest $10,000." What should we invest in, in our opinion?

"Which investments stocks, mutual funds, or real estate?”

"Can we purchase stocks or real estate without any money?"

"Isn't making money a financial requirement?"

"Investing is risky, right?"

"How do we combine low risk and such high returns?"

"May they invest alongside us?"

The effectiveness of making investments through companies

People know that the term "investing" has power, and many of them want to experience that power for themselves.

However, a lot of individuals are also wary of this power, avoid it, and some even become its victims out of fear.

We must develop an inquisitive nature as opposed to fleeing the authority or criticizing it by declaring things such, "The wealthy exploit the poor," "Investing is risky," or "I'm not interested in becoming wealthy."

Words are the most powerful tools humans have ever created, use them wisely.

Most wealthy people began our lifelong journey of research and learning about investing out of curiosity and a desire to get the power that comes with investment of total freedom.

How are we able to afford this?

Some people will wonder, "How can we afford this investments?” Our business can afford to buy real estate land, even though as individuals we may not be able too. Investing is all about mastering the use of debt through leverage and control, over ownership and our own capital. Now we are learning about true investing. Using OPM and having our businesses cash flow buys us other investments that cash flow positively.

Due-diligence are the second mot important words in the business language, and of course the first most important words are Cash-Flow.

The business of investing

We have attended and conducted courses on investments. The financial education and self development does not top ever. Often we will discussed the ins and outs of starting a business for the first fifteen minutes. Eventually, a member may raise her or his hand in exasperation and said, "we came to learn about investment! Why do we spend so much time thinking about business?

In answer, provided the man two reasons.

In the end, we make business investments. Purchasing stocks is an investment in business. Purchasing real estate, like an apartment complex, qualifies as a company. Purchasing a bond entails investing in a company. It seems to reason that having a solid understanding of and aptitude for business is a prerequisite for becoming a successful investor.

Getting our firm to purchase our investments is the finest method to invest. Investing as an individual is the worst approach. The world's wealthiest investors purchase their investments through their companies, while the truly successful ones generate investments through their companies that attract interest from other investors.

The difference between people who invest through businesses and people who don't

The ones that do understands this concept will gain power over our financial future and will tap into total freedom. We will enjoy the fast track while others will feel trapped in the rat race (slow track). Working at jobs that pays them enough so they don’t wait quit as they trade their most valuable asset we all posses which is time.

If a person wants job “security” and being comfortable first (no secure when the employer can fired you without explanation), then follow the poor mindset’s advice. However, we must heed of the wealthy context if we wish to become wealthy.

Next, let’s look at how the wealthy mindset approach to investing is different from the poor mindset.

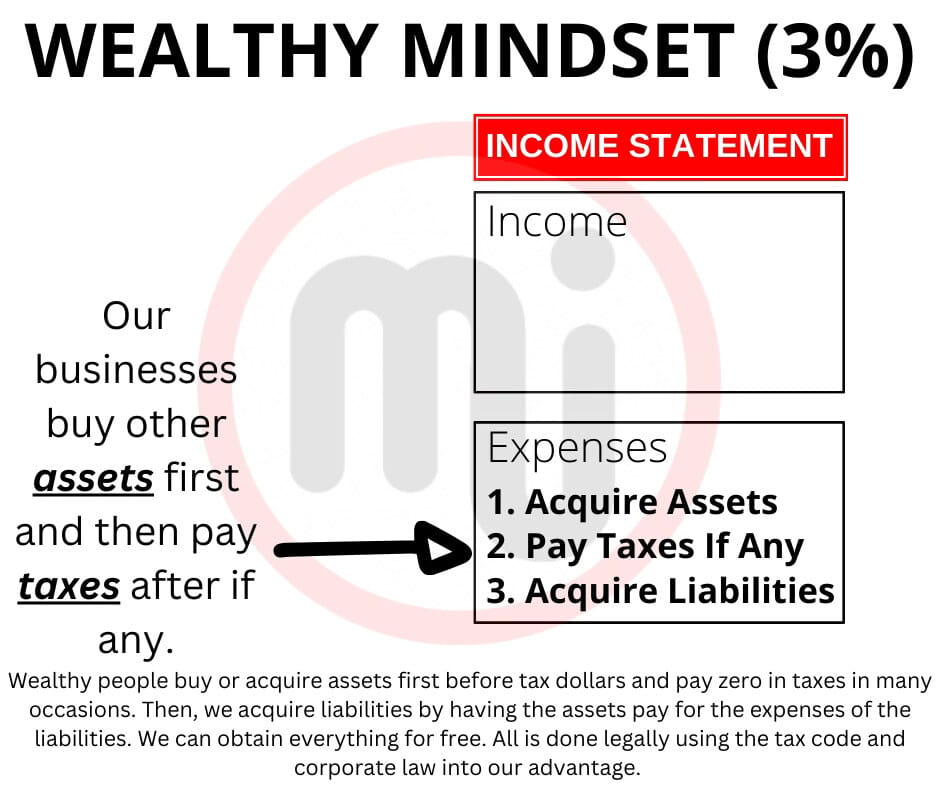

Our business purchases assets using pre-tax dollars. Look the diagram below.

Poor mindset people want to use after-tax income to purchase assets, which usually there is nothing left to eve invest. This is how his financial statement seems.

In summary, we can see from the two diagrams to emphasize the distinctions between the wealthy and poor mindset.

Investing through a business has distinct regulations that must be followed

We are attempting to get across that not everyone follows the same set of rules, even in a free country. Wealthy people can keep getting wealthier because we have our own set of laws and rules, which everyone who adopts the wealthy context can use them to become wealthy.

Majority of the people in the world are employees and they must paying taxes first from their earned income, then whatever is left into investing. This implied that before majority of people could even start investing, up to fifty percent or more of their earned income would be taken away through taxes and the remaining will be spent in their living expenses and liabilities.

Master Investor is able to purchase assets through a company and then pay taxes on the remaining revenue which when done proper and smart it will be zero in taxes for the wealthy mindset.

An inside investor acquire assets first and pay taxes after investing. We pay our taxes on net income. The poor mindset purchases assets after paying taxes on their gross income. It is extremely difficult for them to get wealthy as a result by working for earned income.

Master Investor’s points would seem as follows if we were to map this to the CASH FLOW Circle:

How the poor mindset invests?

How the wealthy mindset invests?

Always remember that the rules are different for the different sides of the cash flow circle. Make thoughtful judgments on our future. Select the rules that we wish to follow.

Naturally, this is a very different perspective on investment, which is why the Australian man first struggled so much with it. However, the way that successful investors think is what sets them apart from regular investors.

“Can we make business investments?"

The knowledge of the wealthy mindset has been relevant throughout history. Additionally, we must master how to invest through our businesses, learning from the ultra wealthy to do the same.

Every time we talk about this, people always raise their hands and say things like:

"But they don't own a business; they work as an employees."

"It takes special skills to run a business."

"Beginning a business is dangerous."

"They don't have enough money to invest, much less launch a business."

When considering claims of this nature, it's crucial to keep in mind that, little over a century ago, almost 85% of Americans operated as independent farmers or small company owners. The proportion of those who were employed was quite low.

It appears that the Industrial Age, with its guarantees of well-paying work, job stability, and pension benefits, has bred independence out of us in a matter of only a few generations.

What are our financial goals?

If we have the drive to acquire the required abilities, there's a good chance we could be a successful business owner. We can develop and rely on our business talents, just like our mentors did.

In the event that we do not currently own a business, the question is: Would we like to learn how to start a business?

The only person who can respond to that question is us. Having saying that, having a guide along the journey is usually pleasant. For this reason, we established Master Investor Coaching, enabling us to reap the rewards of having mentors like hereat masterinvestor.

Even though we all make our own decision as to what, how, how much and when to invest in, we will support all our partners at masterinvestor every step of the way while we considered and carried out own choices as everyone else does. Without financial eduction, no one would be wealthy. We must take control over our cash flow and actively invest to gain real life experience.

The 3 Es of a true Master Investor are:

Financial Education

Financial Experience

Excess of Positive Cash-Flow

So, decide now and obtain the support we require to be successful.

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Join our Discord.

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: How Investing Through Businesses Works?

Comment, like, share and follow for more High Quality Financial Education Made Simple.