Summary:

An employee's perspective and an entrepreneur's mindset differ in a few important ways.

Entrepreneurs that are successful prioritize their company and staff over themselves.

With all that is going on in the globe, this is one of those unusual posts that is highly relevant. There are huge disparities between the mindsets of employers and employees.

People frequently claim that wealthy individuals are avaricious. However, what sort of "wealthy people" are we referring to here? Because the wealthy people we are building here in our community are those who follow the steps of the wealthiest people in the world who are very generous. The wealthy is generous and that is why we attract wealth to begin with. Since we are thinking for others and their problems, then we find a solution to serve the masses. We create jobs for others and help people’s families by creating companies that serve others in the world including those in the organization.

There could some wealthy people who are greedy since maybe they obtain their wealth by winning the lottery, or maybe they inherited but was never taught the value of a money and how it works. However, the wealthy people who have made the American Dream possible are those who have work, dedicated time and invest in their companies that sells a valuable need that is a in demand in the world.

The generosity and entrepreneurial mindset

Many entrepreneurs rank among the world's most giving people, which may surprise majority of people when they find this out. As many individuals around the world believe firmly that the wealthy are greedy. Where it could be true that there are some people that may have wealth and be greedy but if we are talking about wealthy people who build a company and brand did it by being generous.

In fact, the poor and middle class are greedier than the wealthy class due to the fact that the wealth class understands the importance of giving back. We become wealthier the more we give to others. It works that way, and it can. bring us a lot of happiness.

They have created fantastic companies and goods that improve the lives of those around them in addition to giving generously of their time and money. Some of them even go above and above the call of duty; one CEO in Seattle, for example, forgoes his own salary to provide his staff with an annual salary of $70,000.

The employees' lives are significantly improving because of his generosity:

According to the corporation, the number of children that employees were having went from zero to one per year to six to seven per year, and more than 10% of its staff made their first home purchase. According to the corporation, over 70% of employees who were overburdened with debt were able to make part of the payments towards their debt, and individual 401(k) contributions more than doubled.

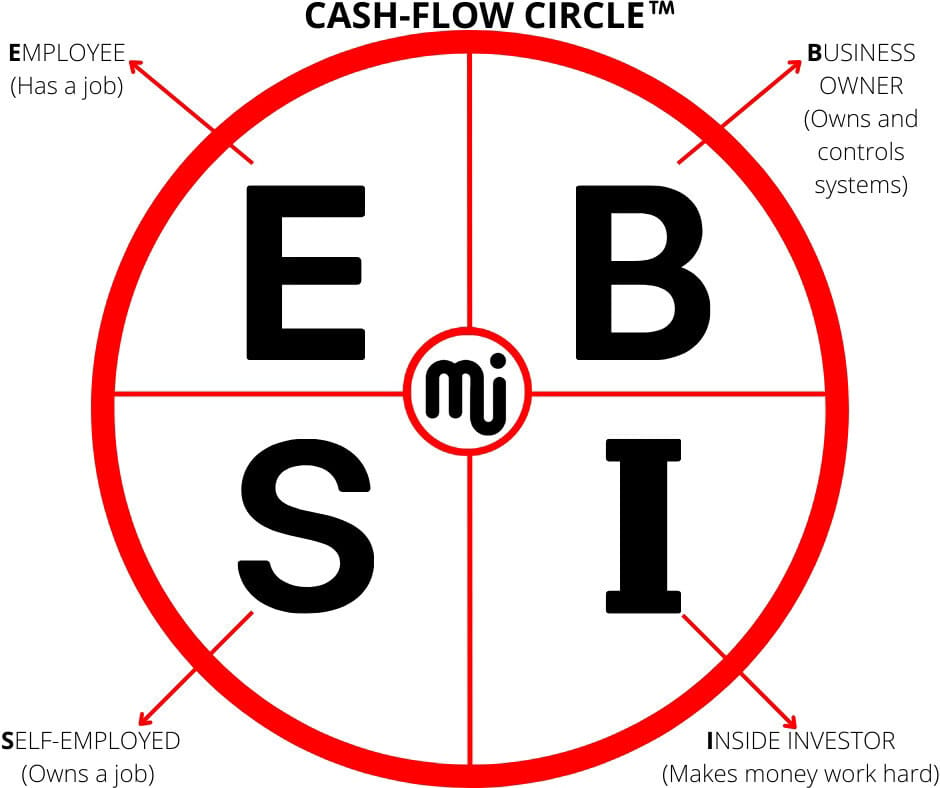

The Wealthy Uses The Right Side of The Cash Flow Circle To Create Wealth as seen in the diagram below.

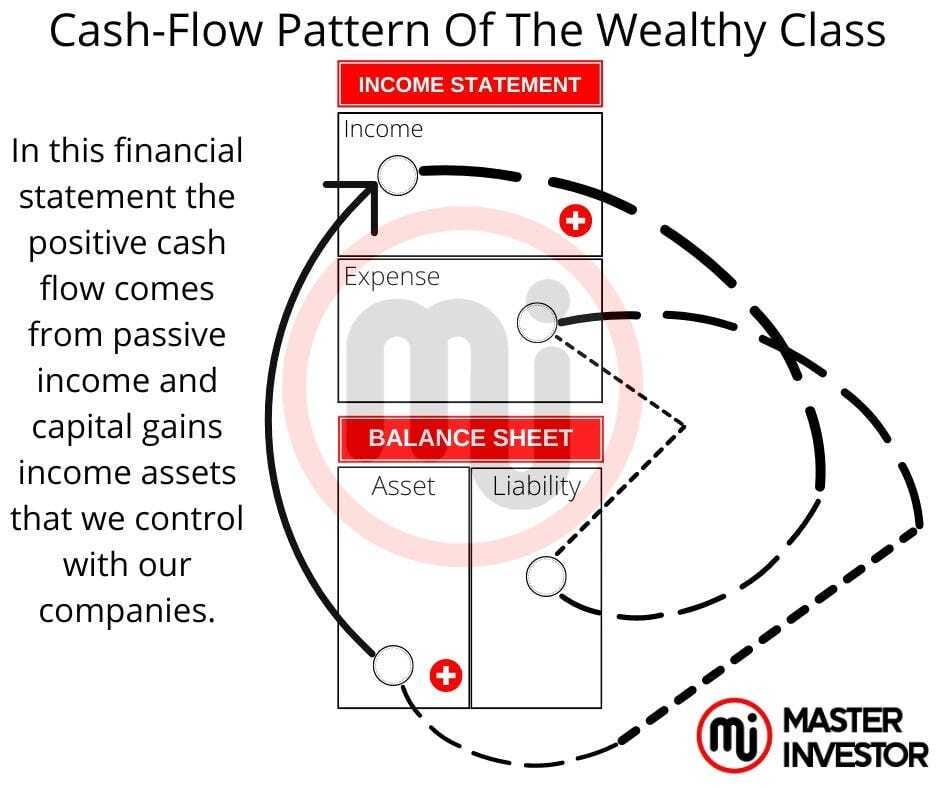

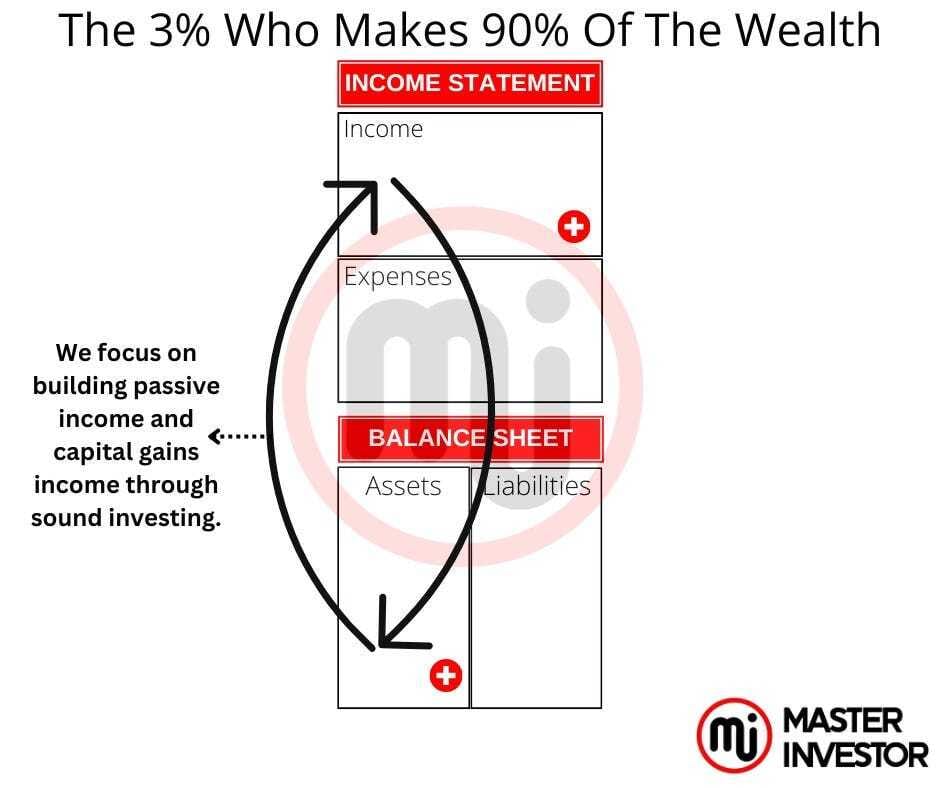

Many people live on the left side of the cash flow circle. They never get to experience total freedom. Meaning that when we build a business and solve other people’s problems with a solution as a reward of being a business person that is generous we will gain control over our time at all times due to the excess of positive cash flow and being able to live without worrying about paying for our expenses because we have cash flowing assets that are producing income for us in the form of passive income and capital gains income.

The avaricious and high-paid employee mindset

However, there is another kind of "rich" individuals: well-paid employees. Even if they could have a generous heart outside of work, highly compensated employees are frequently extremely avaricious at work. Even in bad times for the company, they will always demand more.

An excellent illustration of this was the 2017 report regarding NFL Commissioner Roger Goodell's request for a raise. While negotiating a contract extension with the NFL at the time, Goodell requested lifetime health insurance for his family, lifetime use of a private plane, and an annual salary of reportedly $49.5 million. He had amassed almost $30 million.

One anonymous NFL owner stated during the contract negotiations, "There are a number of owners in our league that don't make $40 million a year. For Roger, the amount just seems excessive. It is insulting. It is impolite.

For those who might not know, the NFL was a tax-exempt non-profit corporation until recently. Additionally, Roger Goodell has worked for the company for his entire career, rising from intern to the position of, in the opinion of many, the most powerful man in sports.

The thinking of a highly compensated worker: "They deserve a raise! (no matter what)"

The league was having financial difficulties when Goodell was negotiating his enormous raise. The ratings dropped. According to Michael McCarthy's report:

According to Nielsen data acquired by Sporting News, the league's average TV audience through Week 5 of the 2017 season decreased 7% when compared to the same period in 2016.

Even worse for the league, average game attendance has decreased by 18% from the first five weeks of the 2015 campaign.

Through Week 5 of the 2017 season, the average TV viewership of the NFL (including Sunday afternoon, Sunday night, Monday night, and Thursday night games) dropped to 15.156 million. This represents a drop of 18% from the average of 18.438 million viewers through the first five weeks of the 2015 season and a drop of 7.42 percent from the average of 16.371 million viewers over the same time of the 2016 season.

The league was also being negatively impacted by the national anthem protests, numerous other scandals, and ongoing worries about player head injuries.

Many thought it was a strange moment to request a twenty million dollar rise (he ultimately received forty million dollars, only a ten-million-dollar hike). That is, however, what Goodell did. That is avaricious.

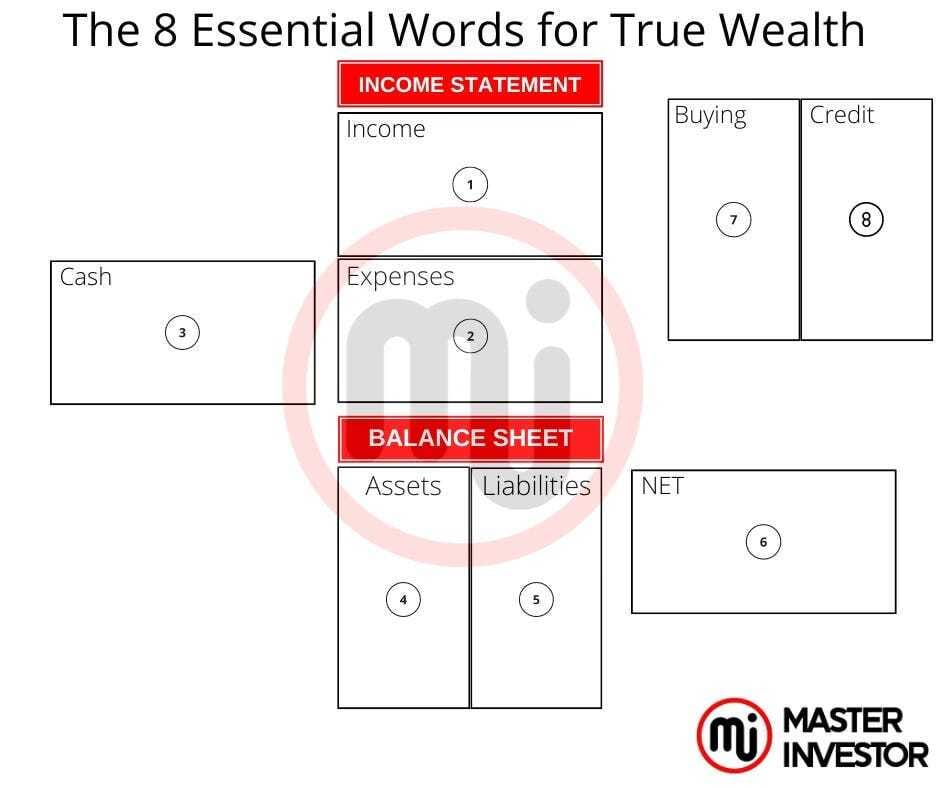

A wealthy person who operates with the wealthy context he or she understands the importance of a finical statement starting with our personal financial statement. The essential words that compose a financial statement are listed in the diagram below. Every business and investment contain a financial statement that tells us the Real story behind the operation. By reading the financial statement we can see whether such is an asset to acquire or a bad investment that we shall leave alone.

The people who operate on the left side of the cash flow circle, the employee and self employed should begin to see the importance of the financial statement. The only way for a person on the left side of cash flow circle to shift into the right side of the cash flow circle is by first shifting our beliefs about money. We have to follow the new rules of money in order to create wealth.

High-earning worker mentality: "Show me the money!"

In many ways, it appears as though the business world has gone insane, pursuing these avaricious, well-paid workers out of dread of—what exactly?

There is a clear pattern that wealthy workers, such as CEOs, continue to receive rises despite the underperformance of the companies they oversee. According to Vanessa Fuhrmans and Theo Francis' articles in "The Wall Street Journal,"

According to Journal research, the average pay for the CEOs of S&P 500 businesses increased to $12.4 million in 2018, a 6.6% increase from the previous year and the highest level since the 2008 financial crisis. However, the companies' median shareholder return was - 5.8%, which is the lowest result since the financial crisis.

97 CEOs received the highest salary possible last year, despite their shareholder returns being among the lowest in the group. These included the dialysis company DaVita Inc., which paid Kent Thiry twice as much as he did—$32 million—and Gap Inc., which gave Peck $20.8 million—the most amount he received during his four-year tenure—but generated a negative 21% return.

All of this makes it worthwhile to compare and contrast the employees versus employer mentalities.

Ownership is the thinking of the employer; ownership is the mindset of the employeePrioritizing their enterprises is one of the traits of successful business owners. They are accountable for resolving any issues that arise if the business is suffering or losing money. They must assume responsibility.

Contrarily, employees are exempt from having to make the same sacrifices that owners do. In fact, a lot of them—including Roger Goodell—demand higher compensation even during lean times in the company. They leave for another company if they don't receive their rise.

Employers should foster stability, and employees should demand it

Establishing a business carries a great deal of risk and uncertainty. Nonetheless, prosperous businesspeople have the power to take anarchy and turn it into a flourishing enterprise that offers security to many working families. The truth is that workers frequently are unaware of the lengths an employer will go to maintain their job security.Employees seek stability from their companies because they deeply dread instability. Even when the business isn't doing well, one of the reasons employees demand more and more from entrepreneurs is because they believe money brings stability. Sadly, as several tales of success from poverty may attest, it doesn't.

Working as an employee carries a great deal of danger for financial security. They pay the highest taxes and have no control over their time. Additionally, they will be the first fired if things go too badly for the company—especially if we were seeking for more money at the time.

Which frame of mind are we going for?

In the end, this is not meant as a criticism on the workforce. It's simply an admission of a distinct perspective and manner of thinking. It's alright. All that matters is that the appropriate mindset is in the proper place.

A person may decide on one course and then decide to take another. These are the staff members who run our company like business owners. They are the most important employees we have, and they frequently depart swiftly to pursue other opportunities.

While losing a fantastic employee is never fun, seeing them become into an entrepreneur and witnessing their perspective shift is a lot of joy.

Even though they have successful lives, they also add greater value to the company.

Every single one of us must choose at some point between taking the route of an employee or an entrepreneur. Which one will we select?

We must ensure that we prepare for the shift in the economy as we move forward. The only way to prepare is by studying finical education daily and applying the knowledge that we are learning from our mentors into real life.

The international economy is about to enter a crisis. It is unavoidable, but we may prepare for it by creating an investing plan.

Prepare An Investing Plan

The time to get ready is now since the next financial catastrophe is not far off. Never forget that savers are losers. Saving money does not guarantee a secure future. Getting a financial education is the best method to advance in understanding how to be an inside investor. We first need to grasp all the concepts about wealth to create wealth successfully. The first step is to start investing in our finical education and assets that we control with our companies.

Outdated School Funds

The only financial crisis advice we will receive from so-called experts is to go to school, get a job, work hard, save money, buy a house, pay off debt, and invest for the long term with a well-diversified portfolio of equities, bonds, mutual funds, and exchange-traded funds. The trouble is, this whole thing is imploding like the Hindenburg, so everybody who followed that advice is now toast.

We penned our content with the intention of educating people about the impending severe financial disaster and opportunities it brings to the financial educated investor We wish to alert people about it, show how to be ready, and help anyone make money from any type of economy we experience now and in the future.

Regretfully, he was four years off in his prediction that 2016 would see the largest crash. March 2020 saw its arrival. Furthermore, he believes that the world has changed irrevocably and that the economy is not going to recover.

The reason it took until 2020 instead of 2016 is that, due to Wall Street's, the US government and the Federal Reserve Bank's desperation. We were unaware that they might implement quantitative easing, which essentially went against the Federal Reserve Bank's economic guidelines.

Savers are losers since trillions of dollars have been printed in the last few months. Given that governments are printing money, why would we want to save money?

Because the dollar's purchasing power, or worth, is declining significantly, saving money results in financial loss.

There is no doubt that we are about to enter a deep recession, perhaps even a depression, and perhaps even an economic collapse. That is the level of danger that exists now.

It indicates that we are getting ready and building a strong foundation for ourselves to weather this financial catastrophe if we are reading this article. An outline of a true financial education—as opposed to the FAKE information they present from Wall Street—will be provided here.

Long-term stock market investing is a suicide mission, particularly since March 2020 when the largest crash occurred and is currently occurring. It continues to enlarge. The actual crash, which we most likely haven't heard about,

Commenced in September of 2019. The shadow banking system collapsed at that point.

The Shadow Banking System's Demise

What then is the system of shadow banking? In essence, it's a covert arrangement where banks lend money to one another for very brief intervals—24 to 48 hours—to maintain a clean balance sheet. It's a buddy system with extremely low interest rates and cheap loans.

However, in September of 2019, the shadow banking system collapsed, and all those massive financial organizations, including Deutsche Bank, the world's largest banks, suddenly found themselves without any money. Because there was insufficient money in the globe to pay off or conceal their obligation, the interest rates on shadow bank loans skyrocketed from incredibly low levels to 10%! an abrupt and massive inflation.

That indicates that the markets lacked faith in our financial institutions, including our banks. The financial institutions and banks had little faith or confidence in one another. That was the first indication of a weakening economy.

To add to the chaos, interest rates were falling for consumers and the public at the same time as the banks were hiking rates on their largest banks' financial entities.

Because they didn't trust their fellow banks, the big banks are now charging more for deposits, but at the same time, they were offering average citizens and peasants who weren't part of the system low interest rates on stocks and investments.

The stock market reached record highs as a result

As an example, in December 2019, the unemployment rate was at a historic low of 3% and the stock market was at an all-time high. However, as any expert investor knew, everything was set to crash and burn.

All the other common people, who never got any financial education, took advantage of the low interest rates and entered the stock market. In other words, the knowledgeable investors left, and everyone else jumped into the market.

Then suddenly, just when the Fed and other influential bankers realized the domestic banking system was about to collapse, the coronavirus panic struck. They required an excuse, a scapegoat. Let's talk about coronavirus.

The public now believes that a coronavirus crisis is the true issue. However, it served more as a smokescreen and a distraction from the current financial crisis. This isn't a controversial remark; rather, it's the idea that the virus was a front for the true collapse. How far will this collapse go is the question. We don't believe the accident is over. We believe it is only beginning.

We believe that the impending crash could be the largest in Earth's history. Right now, we are on the verge of a depression. Additionally, the last slump, which began in 1929, continued for 25 years.

How long do we believe this slump will persist, given that it is significantly larger than the Great slump? Does it still make sense to invest for the long term, as per the traditional advice?

Action plan for managing the real estate crisis

We must acknowledge that we have stepped into a fearless new world. This is unsettling. However, it's a good thing to be alarmed, as nothing is worse than a person feeling at ease during a collision.

Real estate interests a lot of us. Here are several principles that we can all use to cash flow positively and protect ourselves from down economies.

The First Real Estate Investing Rule

They have always operated on the fundamental tenet that employment drives real estate. Given the high rate of unemployment and Ken McElroy's prediction that 50% of small companies in shopping malls will fail, it's time to start considering alternative venues.

Consider Orlando, Florida, as an example. Disney World was closed. There were thousands fewer jobs. Same thing in Las Vegas. It was a town of ghosts. Consider Houston. The price of oil fell. That is a challenge because their unemployment rate will be greater than the national average.

Owner-rented properties on Airbnb and VRBO have vanished. It is really challenging to travel if we must?

So, where's the current real estate opportunity? If there is a positive aspect, what is it? Where's the chance, anyway?

Real estate is driven by employment. Therefore, when new employment sectors emerge and change in this new environment, we must closely monitor them.

The Second Real Estate Investing Rule

In summary, the first concept is that real estate is driven by employment. Investigate the real estate options in that area if we can locate a location that is crisis proof in terms of employment and jobs. We take our investment money and go to the places where people are employed. We would best move if others were moving.

The second rule is to avoid pursuing expensive houses that bring no cash flow to cover for the expenses of the property including the debt/loan service.

Avoid investing in luxury real estate since the first people to downsize after a recession or correction will be those owning expensive apartments and homes.

These affluent tenants will soon relocate into middle-class properties, or what we refer to as "B class" properties. Even though some will have to downsize, they still need a place to live.

Speaking with Ken, who oversees the Kiyosaki family's property management, it becomes clear how effective this tactic is in the current climate. We are in a very fortunate circumstance, unlike many landlords who worry about their tenants not paying their rent or, worse yet, leaving their property. Adhering to this philosophy has prevented them from losing a lot of tenants.

But it's not as simple as just making the right purchases. Tenants and us, as the landlord, are partners.

We have to recognize that they are human, and that there are a lot of people in need right now. Therefore, it's critical that we act to let tenants know that we are available and ready to support them during this difficult time.

Business and investing are a team sport. But also, it is business is all about people. We must deal with other people’s emotions. controlling our emotions will be require building true wealth.

We have a team that have been extremely intelligent. For example, tenants are receiving monthly coupons worth $100 from them. To maintain individuals in their houses even in the event of unemployment, they are also developing payment schemes. We can always opt against evicting anyone because they felt it was more important to support people through a crisis, and they chose to accomplish this by offering vouchers, payment plans, and other such solutions. At the end, when is our asset that we control, then we have a voice to improve and maintain the asset growing.

Continue to pay attention to this conversation about principles one and two if we are interested in learning more wealth. As we can see the diagram below is showing how 3% of people Makes 90% of Wealth.

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: Gambler vs. Inside Investor

Comment, like, share and follow for more High Quality Financial Education Made Simple.