Summary:

It is not how money we make, but it how much keep.

The key to being wealthy is not how much money you make, but rather how much us keep.

The way out of the rat race lies on the right side of the Cash Flow Circle®.

We need to have the correct mindset about money and excellent financial intelligence to get wealthy.

It is not only excess of money that makes us wealthy, but our financial knowledge and free time we have determines how wealthy we are.

The wealth formula is found by understanding how much time we have without working and running out of money to pay our living expenses and all other expenses we may acquire. Wealth is measure in time not only in money. Divide all money we have now by our monthly expenses. The amount of time we can have without working or worrying about running out of money is our wealth number.

First, we must lear about money and apply the simple concepts of the wealthy person.

How Money Really Works?

The concept of having a big salary is generally positive. It's horrible for the rich people. Low costs are generally seen as a positive feature. Once again, it is awful for the rich.

Money is just an idea backed u by confidence today. Once we master and grasp how the monetary systems works today, then we have the chance to become truly wealthy. As getting wealthy takes understating of how wealth is created by the ultra wealthy. There are patterns that we should have in us in order to build true wealth. Let’s talk about the financial statement’s pattern of the wealthy.

The ability to reading and improving our personal financial statements by investing in sounds assets is the foundation of true wealth. this requires finical education as we all need the data we were not taught about money.

One of the most important facts of this concept of money will become clear to us once we accept the notion that having high expenses and low income is advantageous. Many rich people become bankrupt because they fail to grasp this basic idea.

The actual functioning of money

The 97/3 rule will become clear to you as you study more about money: Three percent of the world's income is earned by 97% of the population. How do they accomplish this? by setting up a situation where they have large expenses and little income.

If we are unfamiliar with money and its operations, we may find this to be an odd statement. "How can low income and high expenses make us wealthy?" Is a question we may have. The way the wealthy entrepreneur and inside investor uses corporate and tax rules to move those costs back into the income column of our financial statement holds the key to the solution.

We simply must confer the surplus of our businesses and investment into a good expense. Meaning the positive cash flow should be invest it back into our asset column by creating a business expense for the cash flow of our assets.

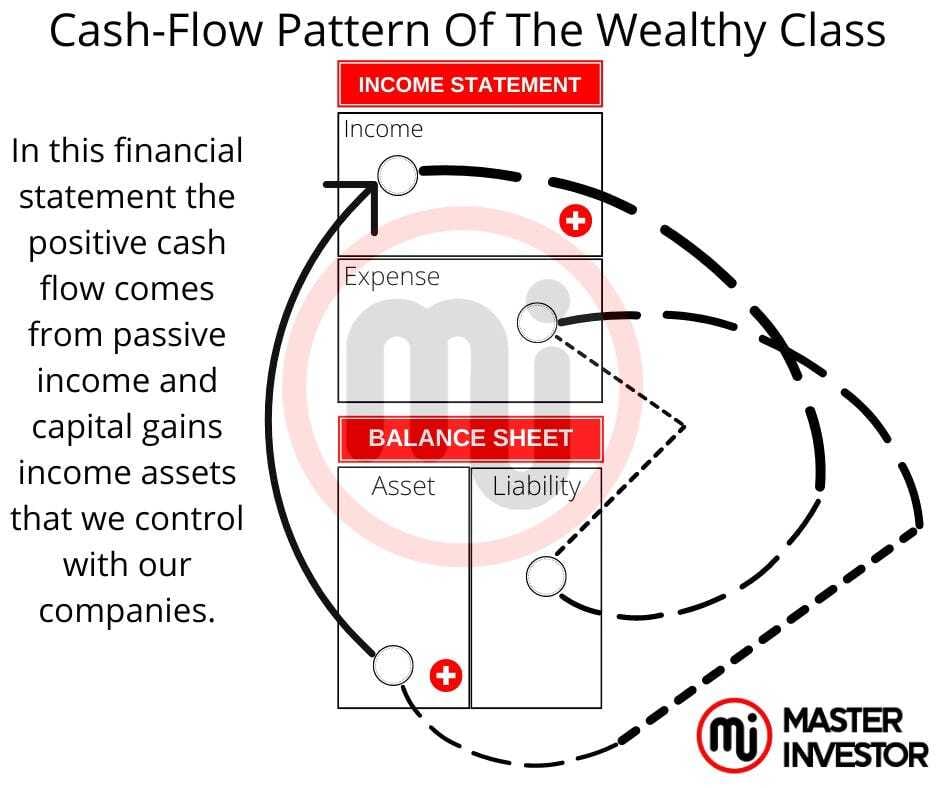

Wealthy person's financial statement

This graphic illustrates, for instance, the tasks that a knowledgeable investor works to complete.

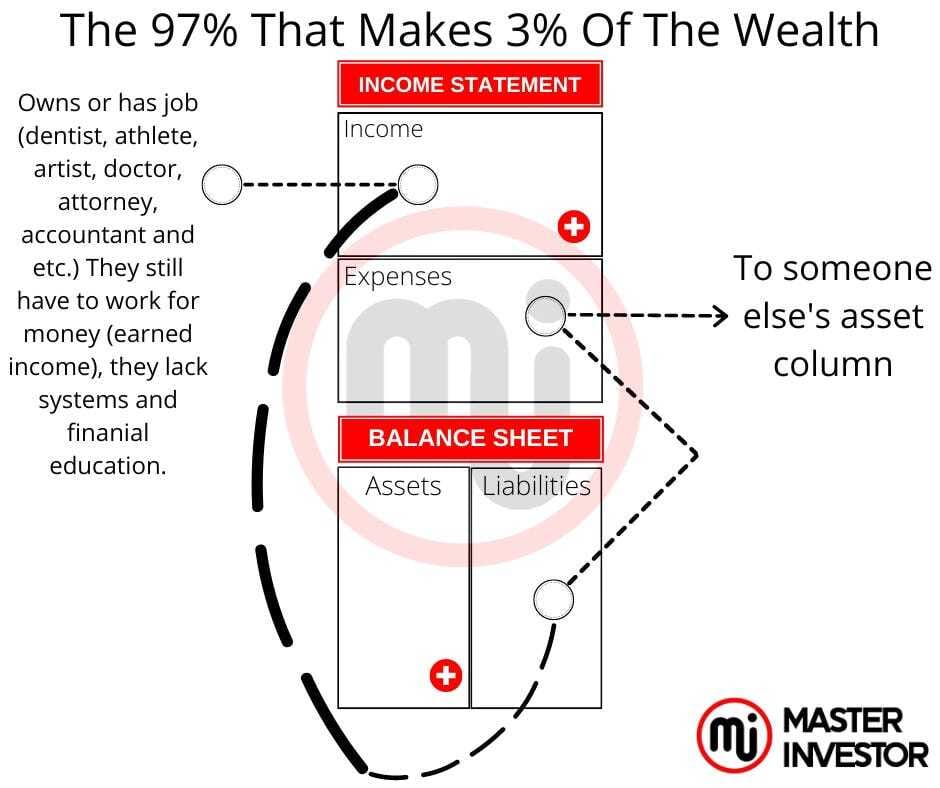

Middle class financial statement

The next diagram shows what the patter of the middle class is when it comes to money. They have high paying jobs and sometimes they are their own boss. However, they still have to show up to work to make money. Which puts them on the left side of the cash flow circle with the employees. The left side of the cash flow circle has the poor mindset. The right side of the cash flow circle has the wealthy mindset.

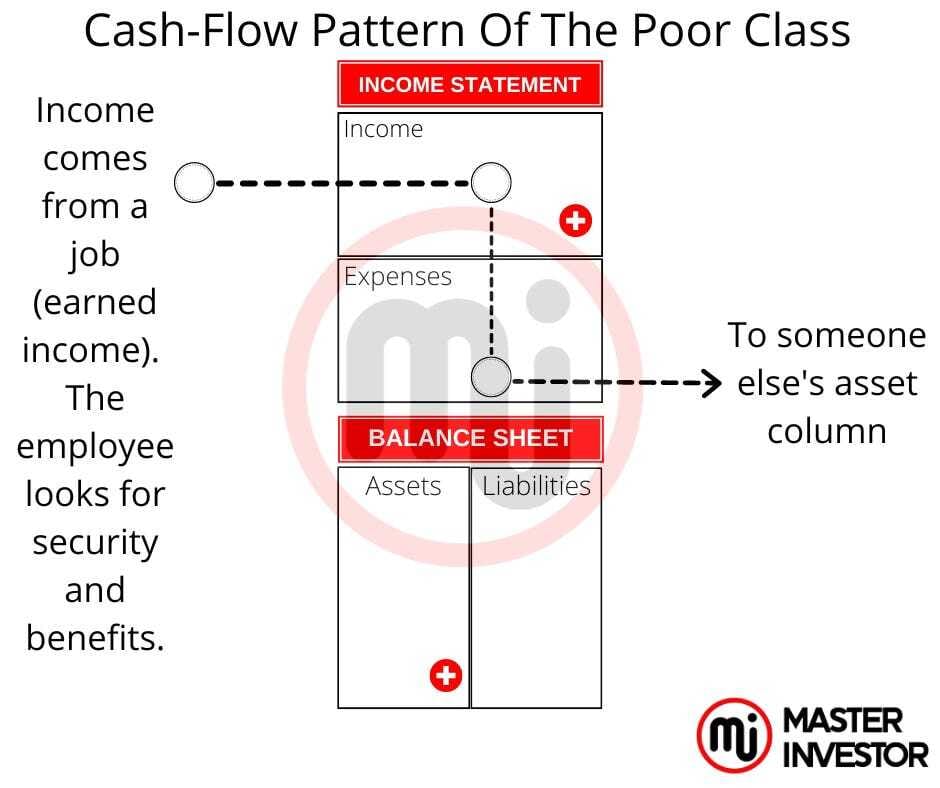

Poor class financial statement

The poor class has very similar patters as to the middle class when it comes as to how they earned income. The middle class and poor class both have low financial IQ. Although there are those on the middle class that take their hard earned income and start a business that turns into a real brand. Shifting them to the right side of the cash flow circle instead of being a high paying professional on the left side of the cash flow circle.

Two types of mindset when it comes to money

Poor Mindset: employee and self-employed operate with them context of this mindset.

Wealthy Mindset: business owner and inside investor operates this mindset.

We will witness a world of ever-increasing financial prosperity once we start to make sense of what's going on in the diagrams regarding the cash flow patterns of the different economic classes.

Our journey towards wealth starts with shifting our context with the wealthy one. We have tp adopt the new rules of money and begin to operate like the ultra wealthy do. We must duplicate the patters of the wealthy.

There are 3 Types of Income to Build

Earned Income

Capital Gains Income

Passive Income (Positive Chas Flow)

Only two of the 3 incomes come from investing. Majority of people have only been thigh to work and build earned income which is the income that comes from a job and the left side of the cash flow circle. Earned income is taxed at the highest bracket, leaving no room for the employee and self-employed to avoid paying taxes. The type of income tat we focus on will be the one that determine who we are as individuals.

The financial statement of a poor mindset individual

Compare the diagram above with the conventional framework for conceptualizing money:

This represents the majority of people on the planet's financial diagram. Stated differently, funds enter the income column and exit the spending column. It never reappears. For this reason, a lot of people attempt to make a budget in order to live within their means, save money, practice frugal living, and reduce their spending.

For this reason, even though the money leaves the property and doesn't come back—at least not right away—the majority of individuals will still claim that their home is an asset. It also clarifies why some claim that even if they are losing money every month, the government still grants them a tax credit. They state that instead of saying, "We are profitable from our investment and the government gives us tax advantages t to profit."

One of the most important controls we can have as an inside investor is found in this question: What percentage of the money going out our expense column winds up back in our income column in the same month?

We will see a whole other world one of ever-increasing wealth rather than one of declining returns that most people who work hard, earn a lot of money, and keep their costs low never see if we comprehend the other side of the coin that are speaking from.

Ask ourselves the same thing now. In a given month, what proportion of our wealth moves from our spending column to our revenue column?

We too will discover a world of wealth that never stops growing if we can figure out how this is accomplished.

If we are unable to perceive this, speak with a trustworthy person about the possibility. Reviewing the others articles we have published previously is a good place to start.

We will transition from a world of "not enough money" to one of "too much money" after we figure out the code. And nothing will ever be the same in our life again.

The four forces that can make us wealthy

Our wealth can be stolen by four things: debt, inflation, taxes, and investing. Majority of people who do not know how to actively invest their money, they end up giving their money away to financial gurus who puts their money in the worst investment vehicles that exist. Fake assets that withdraws money from the uneducated income.

These assets are those like 401k, IRA, ETFs, Mutual Funds, Bonds, CDs, Savings, etc. Because the financial uneducated investor loses so much money to those four forces, people who make a lot of money are not always prosperous. Doctors and other high-earning professionals pay some of the highest taxes in the US, lack cash flow-generating investments to protect against inflation, have excessive debt loads, and aren't prepared for retirement—that is, they depend on their income or they are impoverished.

For example, it's not implausible that two distinct individuals, each earning $100,000, may lead completely disparate financial lifestyles. One may be become wealthy and the other poor. It all depends on how each handle the money earned.

Here's an illustration. Out of the two individuals with identical incomes of $100,000, one has a mortgage that is too large to pay off, pays 20 percent in taxes, and has a 401(k) that barely keeps up with inflation.The other holds rental properties that yield inflation-adjusted passive income, pays no taxes, and intends to use that revenue to buy other passive income investments. Who is the wealthier?

Once again, it takes considerable financial intelligence to make a lot of money work in our favor when it comes to taxes, debt, inflation, and retirement.

“The rich,' high-earning employees face a basic dilemma: they bear the brunt of the tax burden, have the least control over their retirement, and can only sell their time.

Why the majority of physicians, attorneys, accountants, etc.

The distinction between individuals who earn a lot of money and those who are extremely wealthy is explained by the Cash Flow Circle®.

How to become a wealthy physician, attorney, accountant, etc?

If this sounds like anyone and they are a high-earning professional (like a doctor), the good news is that there is a way to be truly wealthy. Acquire proficiency in utilizing the right side of the CASH FLOW Circle®.

Increasing our financial intelligence and understanding how money works is something that many highly compensated professionals, such as doctors and lawyers, have made a point of doing.

They either become extremely successful investors or go on to launch companies that hire other highly compensated experts. They've made the decision to leave the rat race, paid off their debt, and start using money to their advantage. We are able to follow suit.

In addition to having control over their finances, businesses, and assets, those on the correct side might potentially reap endless rewards since they understand how to generate income through passive investing. Furthermore, they understand how to take advantage of retirement, debt, inflation, and taxes to get even richer—not poorer. We can read the our eBooks about the CASH FLOW Circle®: Master Investor’s eBooks and courses for Financial Freedom are available today to find out more about the CASHFLOW Circle®.

We require a high level of financial acumen in order to be on the correct side of the CASHFLOW Circle®. This implies that we have to keep learning more about finance. Change your perspective, read books, go to seminars, connect with like-minded people, and so on. Refuse to fall into the trap of focusing only on accumulating money from a high paying job. Boost our financial acumen to reach true wealth. We have to think about how to solve other people’s problems. The more generous we are the wealthier we become. It start we serving others and their problems. Find a need in the world, and fill it with the 8 integrates of a successful business.

Mission

Team

Leadership

Cash Flow

Communications

Systems

Legal

Product

We have created the cash flow triangle to keep in ind the 8 integrities of a success business.

Why high paying professionals are not wealthy?

Physicians are often well compensated professionals. In a year, they could earn $250,000, $500,000, or even more. However, they aren't particularly wealthy.Why?

To begin with, individuals must incur exorbitant bad debt in order to obtain their degree. Credible's statistics highlight the severity of the situation for medical students.

According to a summary of recent data, the average debt from medical school currently surpasses $200,000. Despite the fact that most medical school graduates make six figures, almost half of them want to petition for student loan forgiveness:

The mean debt from medical school is $232,300.

After medical school, the average student loan debt is $251,600.

A medical school degree typically earns a salary of $210,980.

Repaying medical school debt typically takes 13 years.

A doctor must dedicate 10 to 14 years to their education and residency program before they can even start making a significant salary.

It's normal to begin a high-earning time in the mid-thirties or perhaps forties. As they struggle year after year to make ends meet, many doctors and professionals accrue credit card debt in addition to heavy school debt. They are therefore bankrupt as soon as they do start earning money.

Furthermore, doctors are rudely awakened to the amount of taxes they must pay, the number of hours they must work in order to earn their income, and how easily they might become entangled in the rat race.

Spending in line with their income and paying off their debt as little as possible.

As a result, a large amount of money disappears as soon as it is received. Once more, having money isn't about how much we make; it's about how much we keep working hard for passive income. And for many doctors and all of those on the left side of cash flow circle, that requires financial education, which they just lack.

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: Fours Forces To Build Wealth

Comment, like, share and follow for more High Quality Financial Education Made Simple.