SUMMARY:

Acquiring knowledge from setbacks along the path is essential for financial success.

The Cash Flow Triangle serves as a blueprint for creating a profitable company.

More than just a great business idea is needed to build a successful company.

Investing in systems rather than products is crucial for creating a long-lasting and prosperous business. Here at masterinvestor we have created the Cash Flow Triangle, which helps to illustrate why this idea is so crucial.

Master Investor made the decision to study how to build a business using the Cash Flow Triangle. Learning to build a business according to this model is high-risk, we cautioned him. Few people succeed in it, despite many attempting to do it. However, our earning potential is limitless if we can learn how to build a business in this manner following the cash flow triangle demonstrated in our content here.

Failing to achieve success

We may go through both extreme highs and lows while learning how to build a sound company that has business integrity and intrinsic value.

The journey to creating a profitable business is a path that guides us toward financial freedom, filled with obstacles like crafting ad content that never sold or having trouble raising money and managing investors' funds.

We must always be honest with the our team and customers. We must learn how to manage and communicate with others successfully. That is why improving our vocabulary daily is a must if we wish to create more wealth in our lives.

The road to success is paved with hard lessons

But despite it all, every error served as a priceless teaching moment and an opportunity to grow as a person. The risk was really significant at first as we mentioned previously. But as long as we persevere and keep learning, the benefits are genuinely limitless.

We have to look where are we weak at all three cash flow triangle levels back then, especially in cash-flow and communications management. We must learn how to do well in establishing and improving constantly the 8 component of the cash flow triangle. This businesses are doing well because he can make connections between all three Cash Flow Triangle levels.

The important thing to remember in this situation is that we must persist in learning daily despite a slow start. We are learning how to build a business and even though today is easier than before to succeed. However, not everyone can do it successfully. Many business failed within their first five years.

Anyone who want to achieve tremendous success and money in this way needs to start now, put in the necessary practice, make mistakes, learn from them, and get better.

Use the Cash Flow Triangle Shown In the Diagram Below

Give our ideas form

Many individuals believe that having a fantastic idea is all it takes to launch a successful business. There is no shortage of profitable company concepts. A business requires more than just a concept to succeed. That concept needs to be given shape by excellent teamwork, procedures, and systems.

To do this, the Cash Flow Triangle is a potent force. It gives our ideas shape. An individual can develop an asset that purchases other assets by using their understanding of the Cash Flow Triangle.

When we master the art of turning an idea into a profitable Cash Flow Triangle business, then inside investors would come running. Then, it will be true for us that money cannot be made. We will become increasingly adept at building assets that generate ever-increasing amounts of money, the the person who successfully uses the cash flow triangle to build a sound asset, he or she will be able to stop working hard for earned income (from a job) and escape the rat race to reside in total freedom. Stop working hard for money and instead work for us throughout our life.

Adopt the lifestyle of the wealthy.

We might see how the wealthiest 10 percent of Americans came to be by looking at the large businesses and wealthiest individuals in the nation.

They developed a business, discovered their calling and spirit, and let others partake in their goals, risks, and rewards. Bill Gates, Warren Buffett, Rupert Murdoch, Anita Roddick, Richard Branson, Elon Musk and other notable figures are on this list.

If anyone like, feel free to follow suit. Simply use the Cash Flow Triangle diagram, which the ultra wealthy uses to build business and expand our wealth.

True happiness is not attained through self-gratification, but through fidelity to a worthy purpose.

Discover the mission of the business we are building, use the Cash Flow Triangle to give it shape, and pick up as much knowledge as we can along the route. We can achieve both success and happiness in this way.

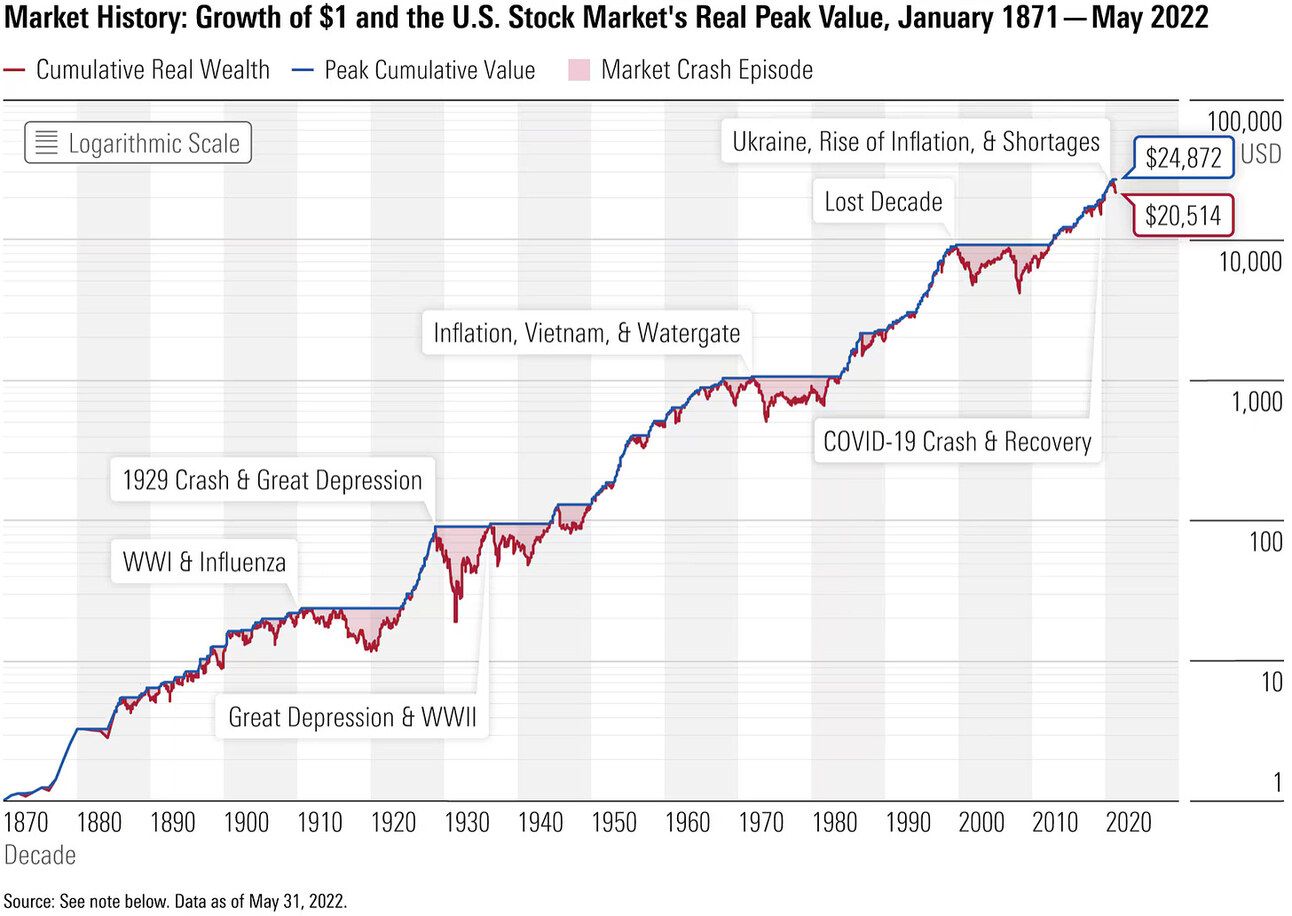

How to get ready for the next financial crisis

We've all heard a lot about the unpredictable state of the economy, and while there is a lot of conjecture floating about regarding its future, nobody can say for sure what will happen next.

Keeping in mind that markets are cyclical and that a stock market or real estate catastrophe could happen at any time, investment portfolio safeguards are crucial. Our first line of defense against market and economic downturn volatility is these measures, which make sure our investments can withstand the storm.

Even Nevertheless, those of us "in the know" understand that this may be the perfect time to find quality investments at a discount.

Naturally, this does not imply that we should immediately begin purchasing assets. Getting educated should be our first move before making any investments, be they in stocks, real estate, business, crypto, or commodities like gold and silver.

Here are some actions we can take right now to broaden our knowledge of finance:

Go through business articles. Grab a copy of any magazine that covers business and finance, such as Fortune, The Economist, or The Wall Street Journal. We can learn more even by reading the business section of our local newspaper.

Acquire the vocabulary. Look it up when we encounter terms or jargon we are not familiar with. Our learning can be greatly accelerated by simply mastering the vocabulary of investing.

Glance around and learn through practice. Even if we are not ready to buy, we can still look at assets and evaluate deals. This procedure will teach you a lot of things. We can, for instance, engage in "paper trading" or fantasy stock programs, which allow us to "invest" in the stock market using fictitious money and track the performance of our bet. Real estate research can be done online. To understand how the industry operates and how to be a wise consumer, we can visit precious metal merchants.

Take use of the abundance of knowledge available to you in today's environment.

After we have financially educated ourselves on finances, we may begin with a modest investment.

Starting small is usually a smart move since we will still make mistakes along the way as we learn, but in the long run, we will look back and realize that this was the finest time ever to invest.

Real estate investing immune to recessions

When the coronavirus epidemic was just months away, scientists were already making predictions about the next housing boom. Let's examine recent past events:

Initially, there was the savings and loan crisis in the 1980s.

Then, the stock market plummeted in 1987, resulting in a 23% loss in value for the Dow Jones index.

The dotcom bubble and its following meltdown in 1999 and 2000 was the next big event.

Following that, the collapse of the US housing bubble and the subprime mortgage crisis led to the global financial crisis of 2007–2008.

(There are a few minor ones that we're missing, but those are the genuine highlights—or lowlights, as it were.)

We should always anticipate a market crash to occur sooner rather than later because history demonstrates that markets are cyclical. Since they consistently do and always will! The truth is, though, those that are financially literate never worry about it.

We actually enjoy market crashes. Why?

To begin with, it's important to familiarize yourself with market volatility indicators, which function as warning signs that appear at each of the seven stages of a financial bubble. Gaining an understanding of these signs will set the stage for our next conversation. In our economy, booms, busts, and the different phases of financial bubbles are regular and expected patterns.

Look at this:

Okay, the response you've been waiting for is finally here:

When there is a market crash, it can be the perfect moment to buy because everyone is so desperate to sell that you can usually get a better bargain from them. Real estate is a crucial part of a well-rounded investing strategy because it frequently provides stability during turbulent times.

Amateur investors were really calling us and offering to pay us to take our homes off our hands because they are so desperate to escape their financial obligations.

Naturally, we always concurred with great pleasure and undoubtedly received the last laugh: We can generate so much money during that time that we decide to retire by understanding how to build a business that acquires other businesses using the cash flow triangle explained in detail in our books.

Keep positive or negative feedback as feedback only

While a crash is our ideal moment to buy, it's also a difficult period due to the extreme pessimism in the market. The worst news can be an investor's best ally. It enables us to purchase a portion of the future of America at a discounted cost.

We will be treated like a complete moron by our friends and family, who may even try to talk us out of "making a big mistake" by telling us that the ideal time to buy is when assets are "on sale" (during a crash, for example). After all, diversification after a crash is essential since it distributes risk and creates fresh opportunities for portfolio growth.

We narrated a tale about somebody purchasing gold in the late 1990s for $275 per ounce. Back then, the so-called experts were shunning gold in favor of dot-com and high-tech equities. But many investor were aware that they were receiving a great deal and took advantages of what other could not see due to lack of financial education.

In April 2024, when gold prices are expected to surpass $2,250 per ounce, we followed our gut and adopted the tactic that has consistently proved successful for us.

In these uncertain times, the advantages of dollar-cost averaging—where frequent investments mitigate market volatility—cannot be emphasized. People will still be queuing up, though, with warnings that "investing is risky."

They are right, too. It is crucial to remember that different people have different definitions of what constitutes "investing." When the real estate market was booming and prices were skyrocketing, a lot of novice investors made their investments with the expectation that home values would continue to rise.

Most likely, they intended to flip the house and profit quickly by $50,000. The definition of hazardous is investing for capital gains rather than cash flow, which isn't the kind of recession-proof real estate investing we're talking about. Real estate investing basics are understood by seasoned investors such as many are here at masterinvestor. Investing doesn't always require taking a risk. Developing our financial literacy for recovery and future wealth is the foundation of smart cash-flow investing because it gives us the ability to make well-informed choices.

Investing is significantly less risky when one understands and adheres to the fundamentals. There will always be some risk, but it may be significantly minimized by adhering to sensible investing principles and making plans for any losses.

We hope that all of our efforts to weather the economic storm are fruitful. Seeking expert advice on investments can offer individualized methods and insights as we adjust our strategy to the state of the market and our particular financial objectives.

We should feel more at ease knowing that we can better prepare for the next inevitable market meltdown. We can protect ourselves from future financial crises, but we might also be able to take advantage of these circumstances. This knowledge provides us a very important objective: to get ready as much as possible now to reap the financial rewards later.

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: Establishing a Profitable Business in the Cutthroat Market of Today

Comment, like, share and follow for more High Quality Financial Education Made Simple.