We can survive a financial disaster by being aware of financial bubbles.

Financial bubbles come and go, therefore we need to be able to move when and how.

To "get" financial bubbles, we must invest in our financial education.

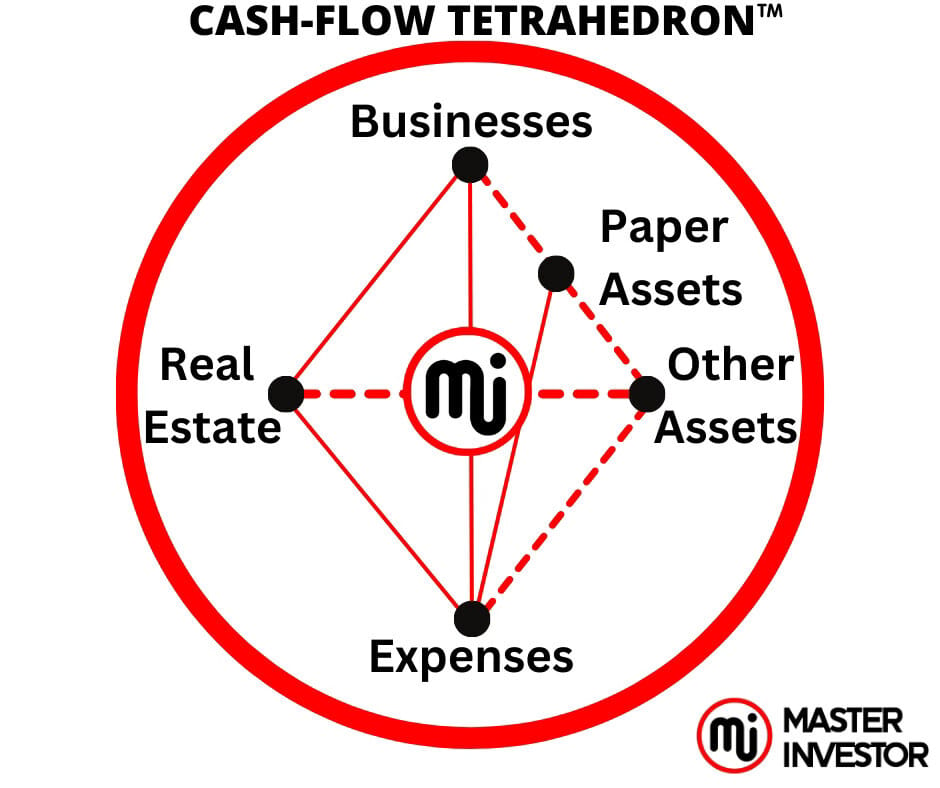

When it comes to investing, we have 5 asset classes today that we investing in. There are:

Business

Real Estate

Crypto

Paper Assets

Commodities

Having a portfolio that is diversify among these asset classes it is how we achieve true wealth. By having investments in all the asset classes it will provide us with constant positive cash flow and capital gains income. Even when the economy crashes we will still be ale to generate positive cash flow while many will suffer due to the fact that the only focus on diversifying with the same asset class.

The stock market is an example as many people tend to diversify in the stock market thinking that that will succeed when the stick market crashes, the investor looses everything.

When we look closer, we will realize that the stock market and cryptocurrency are fundamentally different from each other. It will be easier for us to manage and invest in cryptocurrencies if we are aware of these distinctions.

So let's examine in more detail the seven main differences between the two and their significance for individuals who are new to cryptocurrency but have some expertise with traditional trading.

Are we prepared to compare stocks and cryptocurrencies? Now let's get started!

Self-Custody

The main distinction between equities and cryptocurrency is self-custody. When we purchased a share of stock in the past, we would receive a tangible paper stock certificate that we could keep in a safe. This gave us the ability to keep our stock in our own hands.

Buying stock in a company these days is usually done through a broker such as Robinhood, Vanguard, or Fidelity. The stock is held in custody by the broker, and we are given "rights of ownership" that let us buy, sell, and take part in dividend payments and voting.

It can take many days to transfer our equities from one broker to another, which is a laborious process.

It might also have limitations and costs from the new brokerage company we have selected.

In the realm of cryptocurrencies, we can choose to maintain our tokens on the exchange, much like stocks, or we can transfer our cryptocurrency into a wallet where we can access and retain the keys. This is known as self-custody.

There are no outside parties engaged.

Crypto holders who decide to take their cryptocurrency off-exchange are in charge of maintaining their private keys and choosing safe storage options like hardware wallets or secure app crypto wallets, in contrast to equities maintained by banking institutions.

Swaps, Exchanges, and Peer-to-Peer

Selling the stock within the exchange is the only way we may exercise control over your ownership rights when it comes to stock exchanges. In other words, the stock market serves as a go-between for us and the buyer.

Crypto, on the other hand, provides more possibilities. Peer-to-peer networks, decentralized exchanges (DEX), and the ability to use our cryptocurrency as collateral and borrow another cryptocurrency in its stead are available options in addition to centralized exchanges that provide a more conventional trading experience.

This gives us more freedom and agency when it comes to handling and trading our cryptocurrency holdings.

Liquidity and Value

Purchasing stock entitles usto a portion of the company's earnings and physical assets. In the end, the company's ability to produce things or provide customers with services determines the stock price, as does the likelihood of future growth. Because there is now a lot more data available to influence investment decisions based on historical performance, investing in stocks is now safer.

Conversely, cryptocurrencies are digital assets that are usually backed by no tangible assets (though some, such tokens backed by gold, may). Its utility, adoption rate, liquidity, and primarily speculation determine its worth.

Cryptocurrency is a more volatile asset class since it lacks actual assets.

Trading Fees

Depending on a number of circumstances, including network congestion and the trading platform being used, the fees related to transactions in the cryptocurrency market can vary significantly.

Cryptocurrency trading fees might include extra expenses such as exchange fees, withdrawal fees, and network fees (often referred to as gas fees), in contrast to traditional stock markets where brokerage fees are typically standardized.

The real cryptocurrency must be used to pay these fees, which may have an impact on profitability. For example, we will wind up spending more money relative to the token's dollar worth if the value of well-known cryptocurrencies like ETH rises and we wish to trade a token that runs on the Ethereum network. This is because gas fees would have increased.

Trading Times

The fact that trading is allowed on the cryptocurrency market 365 days a year, 24 hours a day, is one of its primary advantages.

This sets cryptocurrency apart from conventional stock markets, which have set trading hours every day of the year.

The risk of volatility is always present with this kind of continuous trading, but cryptocurrency traders reduce this risk by putting automatic stop-losses in place that trigger token sales if prices fall below a certain threshold.

Guidelines and Policies

Although there are strict legal frameworks that must be followed for both equities and cryptocurrencies, traditional markets have more defined boundaries than cryptocurrency.

While some nations have chosen to embrace cryptocurrencies more, others have placed severe limitations or outright bans on specific cryptocurrency-related activity.

For anyone involved in the cryptocurrency market, understanding how to navigate the regulatory landscape has become crucial to maintaining compliance and managing any potential legal concerns.

The regulations governing the cryptocurrency industry are always changing and adapting to the ever-evolving sector.

Proof-of-work and proof-of-stake are two methods used by cryptocurrencies like Bitcoin and Ethereum to guarantee the authenticity of transactions and network security.

Their value is independent of a company's performance, unlike stocks. Rather, smart contracts are used, and consensus processes control the creation and allocation of these coins. These mechanisms occasionally provide cryptocurrency-based incentives to users who participate in the network by staking or mining.

The focus of digital currency is on initiatives and community interaction. This technique aims to encourage more individuals to become involved in the bitcoin ecosystem by holding tokens or mining blocks.

Crypto is the new money (currency) in town

Despite their differences, both stocks and cryptocurrency have significant places in the investment world. We strongly advise all to learn about the philosophy and background of cryptocurrencies in order to fully comprehend their purpose before we decide to take a chance on the thrilling and lucrative world of investing. Although a token's value is significant, its mission and community involvement should also be taken into account.

As we know today crypto is a currency, the new money in town. We must master it in order to become wealthy with the proper handle it of it. Last year the US Congress recognize crypto as a currency but not only here, we have seen other countries around the world doing the same in rears to the crypto being a currency just like the US dollar. Everything is going digital in this new world, and we need to make sure to make advantage of all the tools we have available to us today.

We can become wealthy faster than ever before due to technology and artificial intelligence. The person who is working at a job should only do so if he or she loves the job because we have the ability to do what we love and make a fortune with it by simply putting systems in place with a strong brand behind it that people wish to become part of it.

We can solve problems in the world by simply observing more and understanding the basics of business and investing.

Digital currencies are simpler to access and trade than stocks, but a well-diversified stock portfolio often offers greater stability than cryptocurrencies.

Meme coins are one type of digital currency that might only be valuable because people wish to possess them. If we are new to investing in cryptocurrencies, don't forget to exercise appropriate risk management and get competent financial guidance.

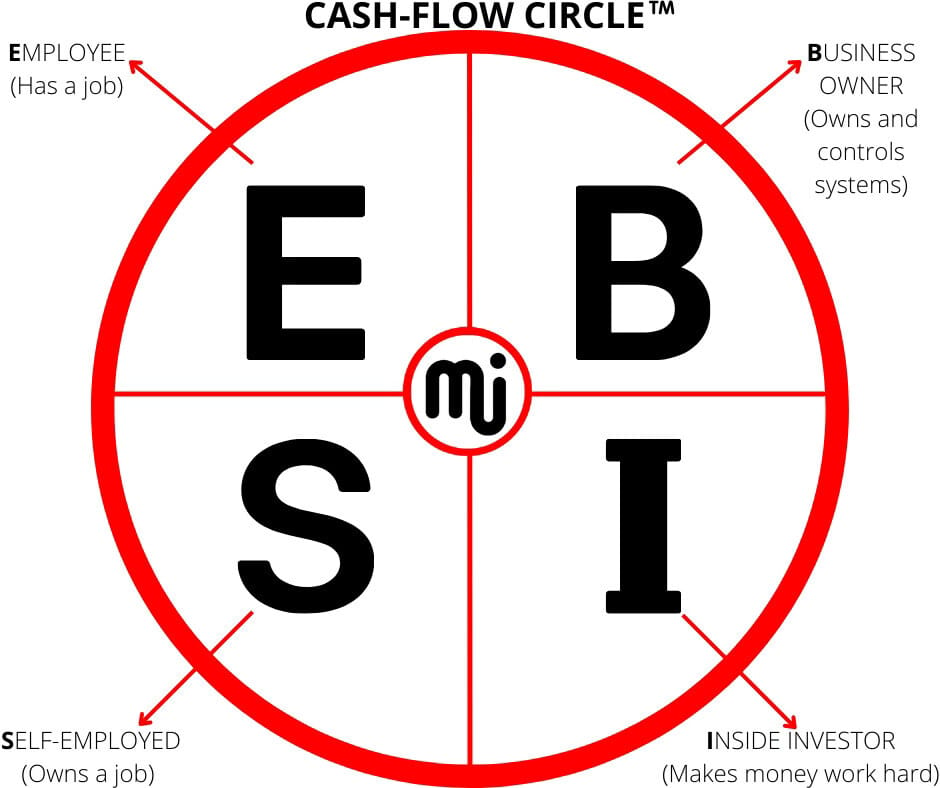

Wealth and Freedom Is Created On The Right Side of Cash Flow Circle

Our Investments and Businesses Buys Us Other Cash Flowing Investments and Pays For All Our Expenses

Use the Cash Flow Tetrahedron to bud true wealth. When we have financial education and we use the new rules of money we can obtain everything for free due to the fact that we are applying the velocity of cash flow and reaching infinite return on investments in our investments.

As true financial investors we can make money without money because we can raise capital. In addition, we can make money from thin air or money for nothing when we have recoup our initial money invested back from the investment.

Also, we can simply use 100% OPM (Other People’s Money) or debt (borrowed funds) to acquire the asset and have infinite return on investment from day 1 because we use other people’s money or good debt, to make the investment happen.

Knowledge is power and money, however, we must take action with the data we are learning daily for it to covert into knowledge for us. It doesn’t mean because it is some else’s knowledge automatically is ours knowledge, we must put it into practice in our lives in order to make it our knowledge. Then, we will collect the rewards of power, money and total freedom.

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: Main Reasons To Start A Business (Brand)

Comment, like, share and follow for more High Quality Financial Education Made Simple.