Summary:

If we put ourselves out of our own way, we can develop the traits of a wealthy entrepreneur and investor.

Accept failure as a necessary part of the path but learn from them.

Breaking certain habits to become an entrepreneur is a worthwhile endeavor because it will lead to financial freedom and true wealth.

It's not like everyone else is an entrepreneur. They are individuals who chose the less-traveled path because they are motivated by something deep inside of them. Our culture is deeply ingrained with the belief that attending college will only enable one to live paycheck to paycheck for the next forty or more years while employed by a corporate. Because it's the conventional route, most people do it. It was their parents' actions. It's secure.

However, business owners are aware that it's not truly secure. To begin with, higher education is a fraud. Financial intelligence is not something that is taught in schools. They only teach you how to be a “good employee,” which will allow you to follow the other sheep into an unfulfilling retirement for the next forty years rather than teaching you how money works. Securing employment is an additional fraudulent activity; working for someone else does not provide any financial stability because you are not in charge. Employees and Self-employed people are always at the mercy of other people, who have the power to downsize, demote, fire, or even assign them to roles they don't enjoy.

Qualities of being an entrepreneur

Thus, congrats if we are considering defying the system and pursuing an entrepreneurial lifestyle! Being our own boss and setting our own hours has so many benefits. Making the move and stepping outside of our comfort zone can be very frightening.

Do we think we have what it takes? We have worked with innumerable investors and business owners over the course of the years , and we have identified some traits of entrepreneurship that are typically associated with success. Let's compare our performance and adopt these traits as we grow our business empire:

CouragePeople will think we are insane and condemn them when they announce that they are leaving their job to launch their own business. This is partly because they don't understand the reasons and, let's be honest, mostly because they're jealous that they are finally bringing their daydream to reality. It will need guts to follow our own path even when others around us disagree or express their disapproval. Because our struggles and accomplishments are unlike anybody else's, becoming an entrepreneur may be a lonely journey at times. However, when we succeed the reward is total freedom and excess of passive income.

PerseveranceEvery entrepreneur needs to possess the resilience to keep going forward in the face of setbacks. If not, we will give up the moment we encounter difficulties or make a humiliating error.Characteristic strong people always grow stronger when faced with setbacks. How? by taking what we have learned from the error and applying it to the next chance. Recall: Failure is acceptable as long as we learn from the lessons.

HonestyAn entrepreneur must always be truthful, behave honorably, and keep their word. If not for the sake of our own moral compass, then at least for the sake of our reputation: In this age of social media, consider everything you say and do to be “public record”— anything can go viral in a matter of minutes. We will get the respect of our clients and coworkers and won't have to worry about a controversy if we run our company with honesty.

Self-driveNobody is going to give you a mid-year assessment to let you know how you're doing or create a plan for the upcoming quarter when you're on your own. No one is tracking your sick days, micromanaging your tasks, or watching you clock in and out. Yes, we are responsible for our own actions. That is much easier if we are self-motivated since we don't let the absence of structure negatively affect us and we remain focused on the tasks at hand. Remember why our "why" is so crucial if we struggle with motivation—we can all do from time to time.

FervorWhy are we working at something if we don't enjoy it? Being an entrepreneur means having a strong sense of passion for our company– after all, we deliberately designed and selected it. Furthermore, passion is incredibly contagious since it helps us sell our goods and services, build relationships with clients, and inspire people to invest in our ideas.

Three self-destructive habits

These are the five entrepreneurship traits that will enable us to be successful in the business world. However, what about the other side? What about the actions that prevent we from moving forward?

This is the ideal moment to begin considering the new routines and viewpoints you want to adopt for 2021. What are some habits we could start—or quit—that are getting in the way of your success?

Many people say it starts in their own minds. To begin, consider this:

Put an end to self-sabotage caused by our own ideas and behaviors!

We restrict ourselves far too often, which keeps us from achieving our goals.

Whether our goal is to become financially independent, skydive, lose weight, launch a new brand, or make new friends, we can occasionally get in our own way, often without even realizing it. Controlling our thoughts every second and choosing the best feeling thoughts. Then, having control over our emotions will help us tremendously in our to financial freedom and true wealth.

Several methods are as follows:

Residing in our cozy surroundingsOur inner critic prefers to keep us contained and secure. This is perceived by our brains as self-preservation, as they wish to shield us from feeling exposed, committing an error, receiving criticism, or experiencing disappointment. What if they fail? Or "They aren't worthy" or "That's too much work" are some examples of what the critical inner voice might say. It's possible that they have become so accustomed to hearing that voice that they have begun to believe it.

Holding a poor opinion of oneselfWhether this stems from self-inflicted harm, a difficult childhood, a traumatic divorce, or a strict boss, We don't even stop to question our inner critic because we are so accustomed to it. Because it's what we're used to, we become mired in patterns and build our entire existence around them. The barriers we erect to keep others out only serve to restrict our lives and our possibilities.

Allowing fear to control usWe act out of fear (ego) or love in practically everything you do in life. The energy of fear is what makes us retreat, remain silent, and suffer in silence. Love is the force that heals, pushes, and frees us to be ourselves. We are frequently held back by our fears of the unknown, failure, rejection, and judgment.We won't know what's on the other side of that dread, though, if we can't overcome that same fear. We will never realize our potential. We must attack our fears and confront them. When we do we find treasures, and our dreams are there too.

The test of self-sabotage

Do any of these instances of classic self-sabotage seem familiar to you now? If yes, spend a few minutes practicing your creativity and overcoming preconceptions with this short exercise:Step 1: Split a sheet of paper into three equal sections.Step 2: Make a list of everything we would do if it were feasible and write it down in the first column.Step 3: Next, write the reason why each "want" is "impossible" next to it in the second column.Step 4: Next, make a list of potential workarounds for these barriers in the third column. While we work, keep in mind that we don't have to restrict our solutions to things we can do on our own; instead, consider how we can make the most of other people's talents!Step 5: Check our list at this point. What ideas did we generate? Do any of these circumstances seem less "impossible" now?

Character strength is important

Recall that people are tougher than we realize. Don't let our comfort zone, negative self-criticism, or personal fear to hold us back. It's possible to try something new and not succeed. However, we will only ever regret the things we never tried rather than the things we have done.

Now that we are more aware of this tendency, listen out for situations in which other people remark something like, "That's impossible," or "If only they could.", or "They are unable to because..." Consider the following when we hear remarks of this nature: "What could resolve this person's issues? How could a company be founded on helping individuals find a solution to this problem?

We might come upon a fantastic business opportunity or idea that you can use to build riches. It will, at the absolute least, train our mind to think like an entrepreneur.

In the end, it doesn't matter how large your home is or how many expensive vehicles we have stored in the garage. All that's left when all those things are taken away is our strength of character, which is what makes us unique. We will be able to achieve financial freedom if we remain loyal to ourselves.

Understanding Our Personal Financial Statement

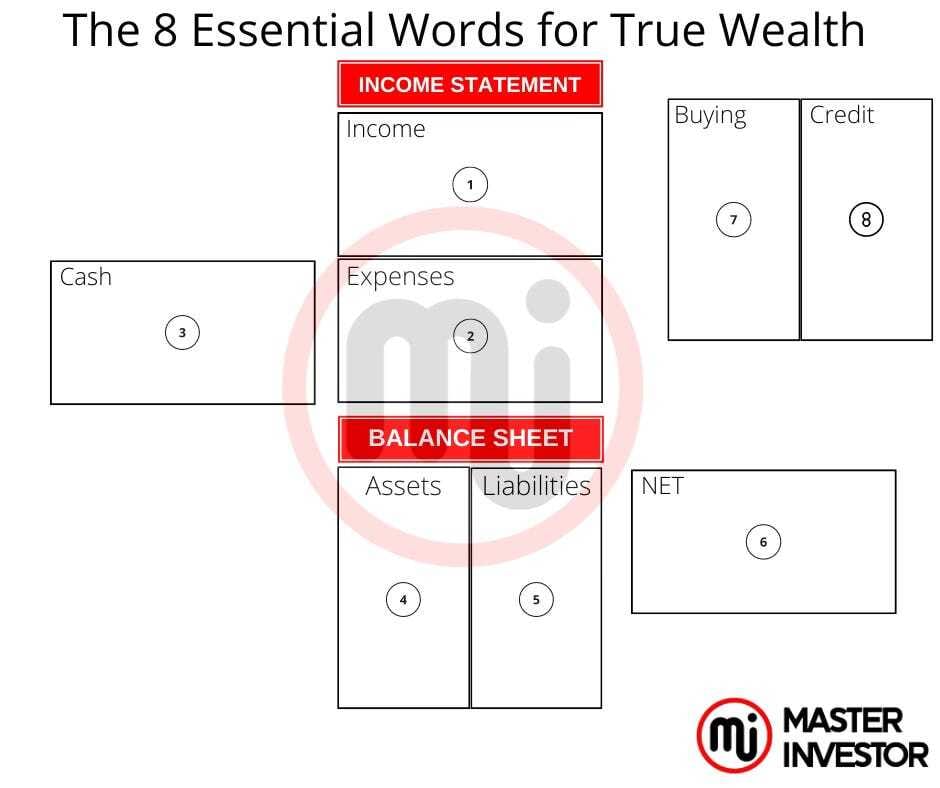

There are six basic and essential words that we must understand their relationship with one another in our personal financial statements. The following are theirs we shall master today:

Income

Expenses

Assets

Liabilities

Cash

Flow

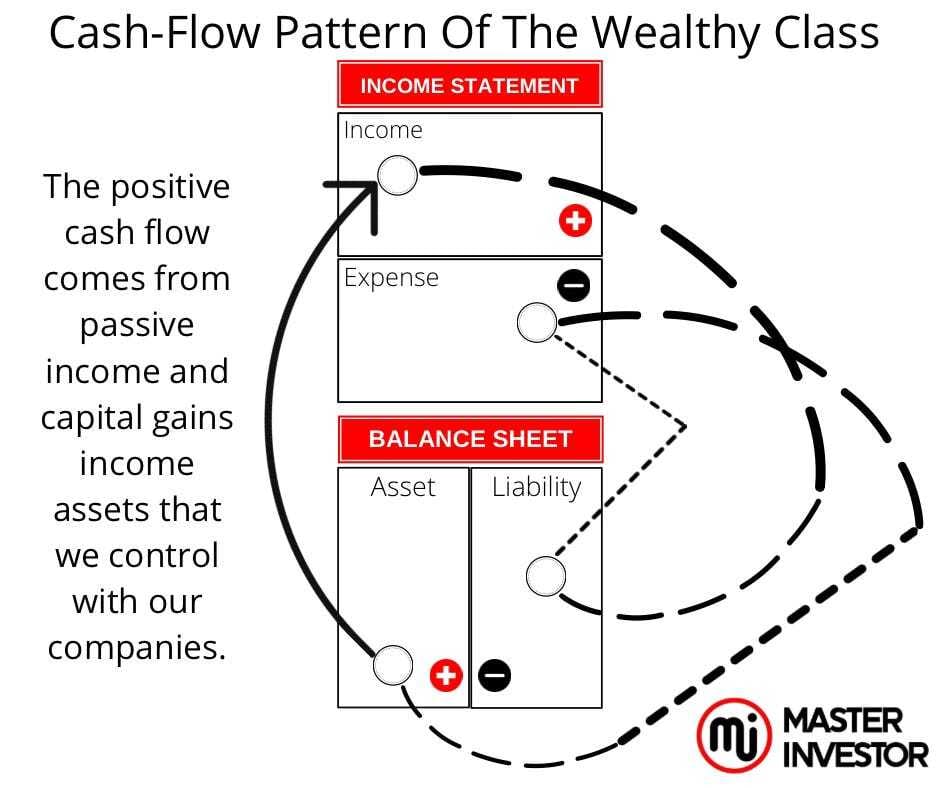

As we can observe above and below the diagrams showing us what a finical statement looks like in simplify manner. We all have a financial statement and it tells us how smart we are when it comes to making money. The financial statement shows how smart the finical IQ of the individual is. We can see how we manage our money daily. We can tell if we are a successful business owner, and inside investor.

Remember that the goal is to focus on building and acquiring cash flowing assets. In other words, our attention shall be put on the assets column primarily. Which requires us investing in financial education and actively invest daily in assets that we have full control over them.

We just gain financial experience by actively doing the real thing. This way we avoid ever giving our money away to someone else to invest it for us. The only reason why people would give their capital to brokers and other financial experts is because they themselves do not have financial education.

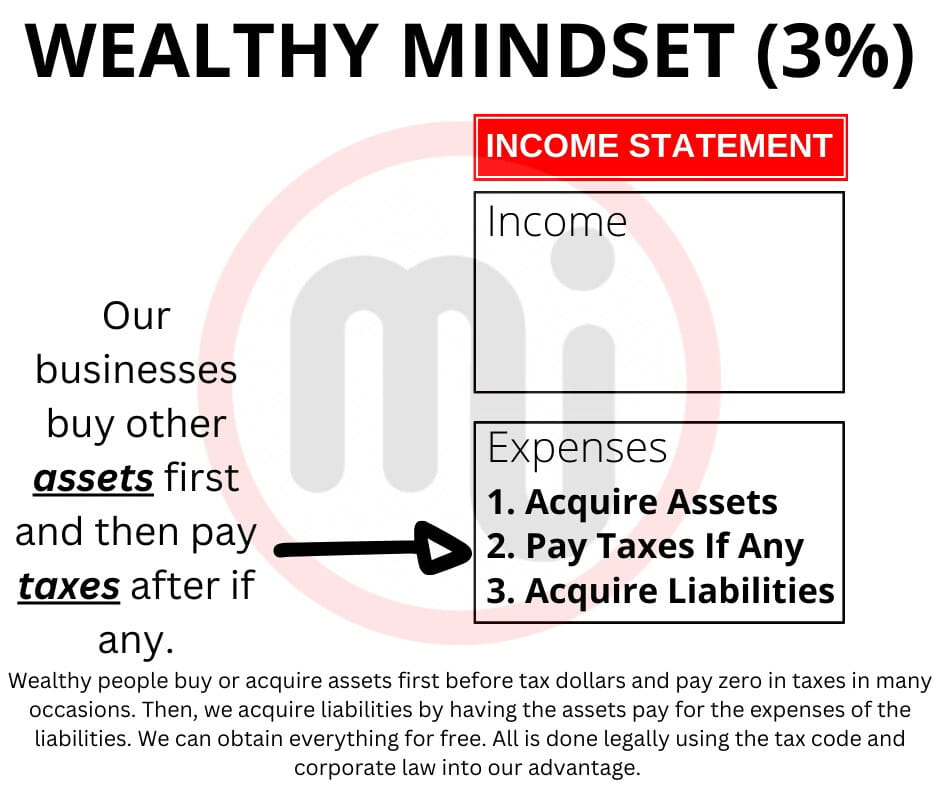

Most of the brokers and experts are not necessarily wealthy as they many of them do not have any assets and all they have are their sales jobs. As brokers make money through commissions by having financial uneducated people’s money stuck in fake assets like 401k, mutual funds, IRA, ETFs, and others alike. Fake assets that were created to serve the financial uneducated. The way we start is by taking action.

When we gain financial education daily we can definitely prepare for any economy and cash flow during any market. Becoming a successful business owner and inside investor requires daily dedication towards understanding how to build and acquire a real asset.

Is finance simple?

This is particularly valid for the financial services sector. According to VisibleThread, "a company that offers tools to analyse how well corporate websites communicate,"69 worldwide money managers' websites had some of the most confusing and technical content.They claimed, "We got poor accessibility and readability—a jargon-laden result." According to a report by VisibleThread, "Long sentences constituted 25% of the examined written material, compared with a target level of 5% of clearly written content."Columnist for "The Globe and Mail," Rob Carrick, claims that the financial business uses a lot of jargon and complex words to attract clients because, among other reasons, “A power dynamic is also at play here; the investment sector benefits from maintaining its incomprehensibility by promoting the notion that it is the only entity capable of managing our money”.

Acquire a true understanding of finance

We decided long ago to write financial books and articles as if they were written for young kids. We took this action in an effort to demystify financial education. Our goals is to make billions of people's financial life better, but we can't accomplish that by writing in an arcane manner about subjects that are actually very easy to understand.

To make it appear as though our home, automobiles, and other possessions are actually assets, for example, accountants employ intricate models. However, at Master Investor, we employ a straightforward paradigm that makes sense in practice.

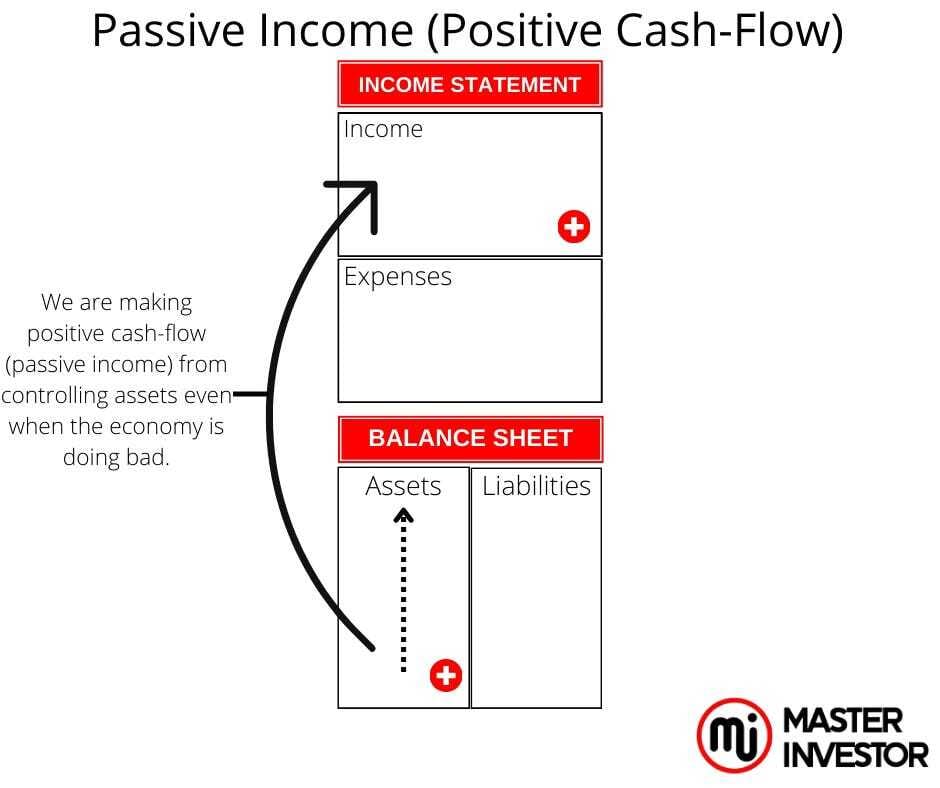

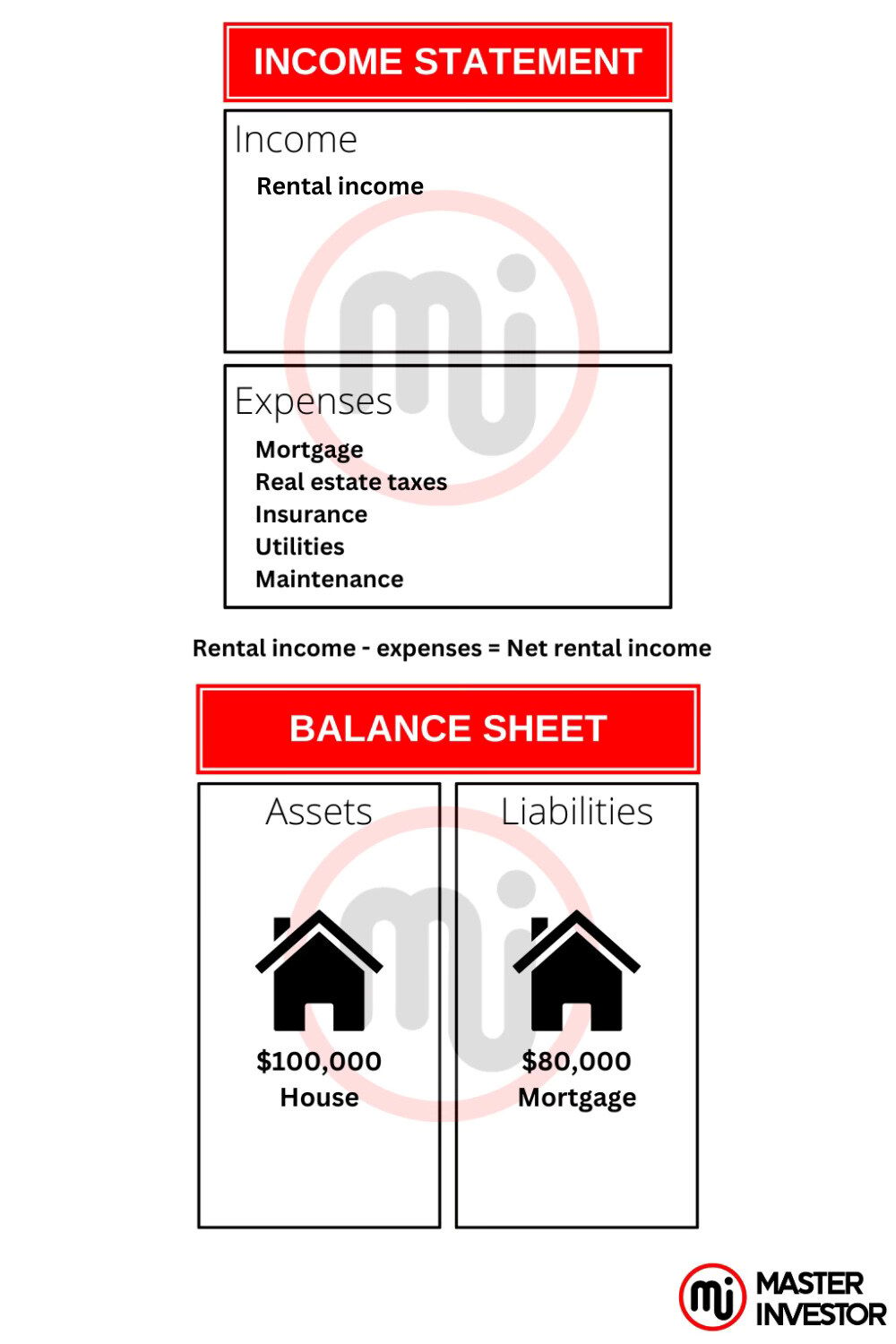

A liability is something that takes money out of our income column, whereas an asset puts money in it on autopilot without us having to work. According to those criteria, a car and a house are liabilities, not assets, unless they are rentals that generate passive income (positive cash-flow) for our companies on a monthly basis, in which case they are assets.

So, a person who uses Airbnb to rent out a home and uses the money received to pay for living expenses has an asset. Alternatively, a car rental company that uses its rental revenue to pay for its vehicles owns assets in the form of cars. However, your personal residence and upkeep are only obligations.

Then, the way the cash flow flows is what determines if something we acquire it is an asset or a liability. We said it many times before that we shall always live above our means and not below to become wealthy. Yes, we must expand and do not shrink in order to build wealth successfully.

Invest like the wealthy do. We make money from our cash flowing assets not by working selling time for money.

We must expand our mindset, assets column and any other column in our personal financial statement. Getting wealthy is not a game of saving money, actually, is the very opposite of saving money. The getting wealthy game is about mastering how to spend as much money as we can possible handle into assets that produce cash flow.

Now, we have a clear understanding how to become a wealth entrepreneur by acquiring the main characteristics we discuss here today. We have to adopt the context of the ultra wealthy mindset. Choose the type of income that we spend ur time working for wisely. There types of income we can work for to build: earned income, capital gains income and passive income. Earned income comes from job, and is the income people get when they sell their time for the money. Capital gains income and passive income comes from investing. Our rule #1 in our community is that we work to build passive income and make money multiply through sound investing. We focus on investing for passive income because it is how create true wealth with total freedom.

A career of financial education

But something isn't always easy or simple just because it's straightforward. In actuality, simplifying something is more difficult. Furthermore, applying anything we have learned in a basic method may not always be simple.

Therefore, even if it's easy to distinguish between an asset and a liability, it's not an easy task to dedicate our entire life to accumulating a portfolio of cash flowing assets that will generate income. But it is easier today than ever before due to access of information worldwide and technology. Being an expert at locating and obtaining fantastic assets is really time-intensive, but it's also very enjoyable as the reward is total freedom and excess of passive income. While it may seem easy, practice is still necessary. The best proactive is to actually do the real thing. So we must take action now in order to start building our wealth.

Master Investor promises to keep imparting this knowledge to us in the most straightforward and understandable way possible.

Getting a true financial education and dedicating our life to learning should be our commitment. That's the real way to become wealthy.

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: Characteristics Of A Wealthy Investor

Comment, like, share and follow for more High Quality Financial Education Made Simple.