Summary:

Recall that acquiring wealth is a journey.

Action is necessary to realize financial goals.

There are no short cuts to wealth; we must put in the effort and broaden our financial knowledge.

The common Joes and Janes of the world remain after we exclude people who were wealthy by birth and lottery winners. Now, while some of these everyday Joes and Janes are struggling to make ends meet, others have succeeded in realizing their financial goals and leading fulfilling lives.

How did they accomplish it? Most likely through a series of investments, which might have been made in the stock market, real estate, their own company idea, or anything else. Did this occur over night? Very unlikely.

Let's contrast it with something that most of us have probably all experienced: the desire to shed a few pounds.

If we choose to lose weight naturally, it will require dedication and work. We don't simply go to sleep and wake up toned and lean. Rather, we engage in regular exercise. We alter our eating habits. We eventually begin to see the fruits of our labor, though.

The same applies to investing. Regretfully, there's no magic bullet for being wealthy fast except investing in our financial education and expanding our business vocabuary. Before technology was a thing, it was not possible to go to bed one night and wake up wealthy the next. Now we can wake up and be wealthy but we must have an investment strategy draw out. These approaches are rarely long-lasting, even though we may have seen promises to the contrary.

Here are some pointers to bear in mind when we start our path to financial prosperity.

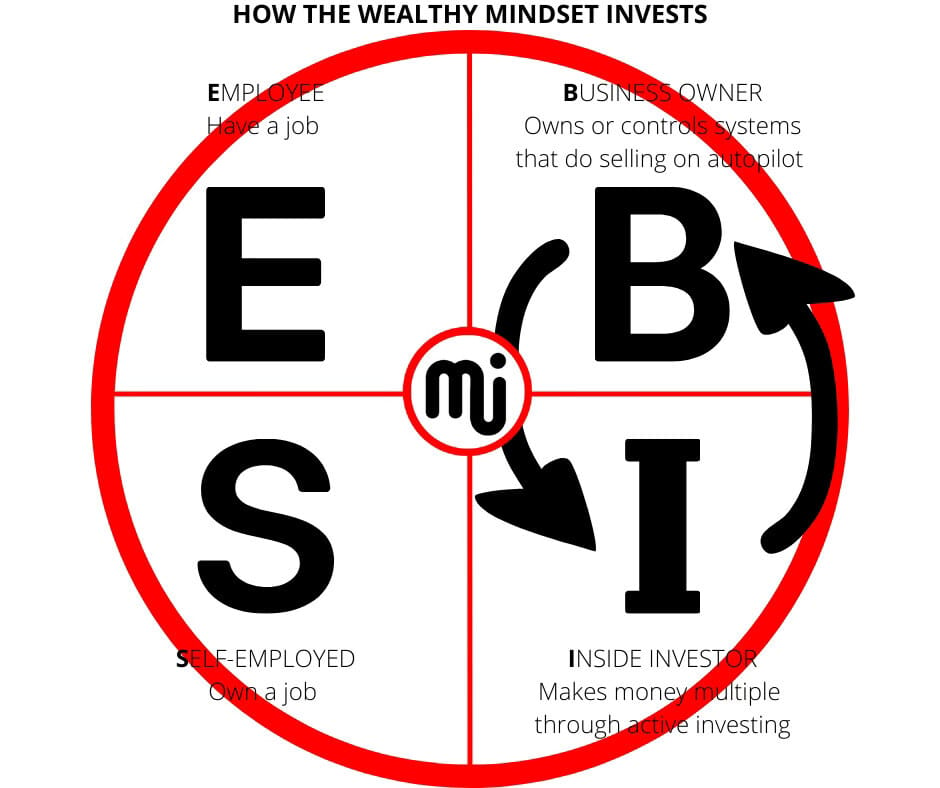

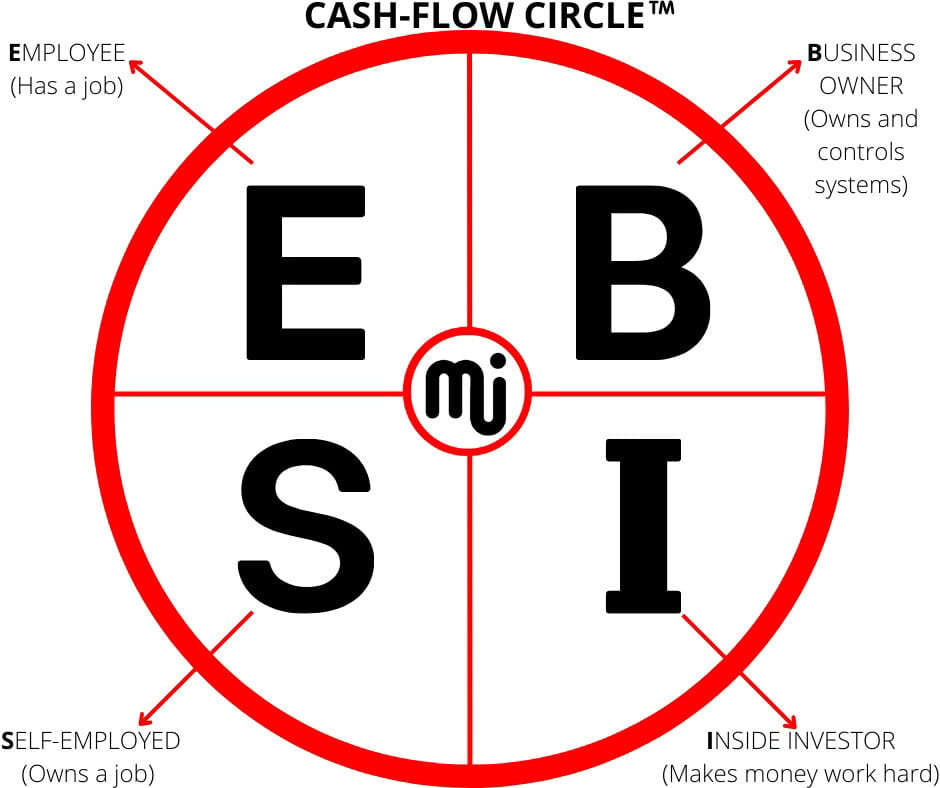

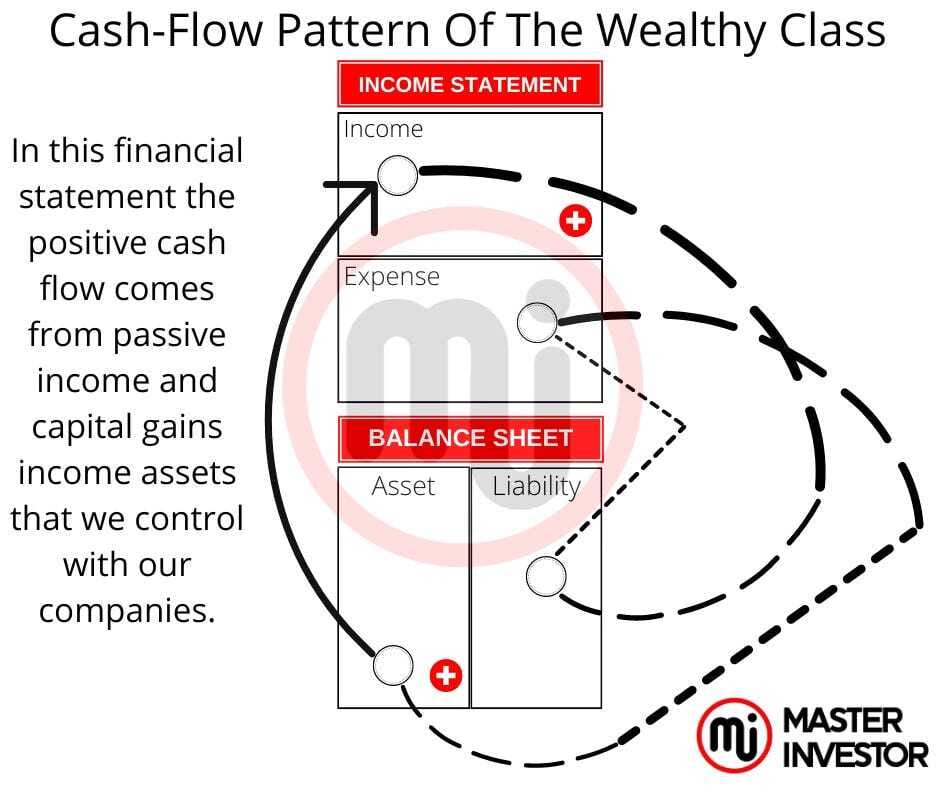

Learn to invest like the wealthy by becoming a business owner and inside investor. Operating from the right side of the cash flow circle. When an individual wants to become wealthy, then we must start minding our own business. Majority of people in the world mind other people’s businesses and in doing so those people neglect their own ability to mind their own business to change the world in a positive way. In other words, having two full times jobs or high paying job can create income for an individual but no freedom nor solution to his or her financial problem.

Therefore, having a job is the main reason people will not ever become financial free and wealthy. As having a job it hinders the ability to achieve true wealth. Having wealthy means having total freedom and not being dependent on anyone to make decisions. Control over our time, devisions, and finances.

Having wealth means no worrying about running out of money to pay our living expenses and any other bill because we are thriving with the positive cash flow and capital gains income of the assets we control with our companies. And we have an investment strategy to become wealthy. We do not save, we invest to become wealthy. We only save to invest into an asset we have done due diligence on. We are good debtors, we use debt to invest for passive income. Learning how to create wealth is a journey to appreciate as it teaches us many lesson along the way.

Lessons that are keys to living our dreams. The only shortcut in life is learning from others wisdom and knowledge, but we must apply the information into our lives in order for that knowledge to be our knowledge. We should not take for granted key relationships in our lives as they can teach us and connect us with essential moments in our path. We should make sure we only burn the appropriate bridges. Some relationships must go but some must stay. We must choose wisely our team and who gets our time.

When we have an idea, let put it in a word document or piece of paper to bring that into fruition. It becomes more vivid and powerful when we write our ideas and ideal future down. The more we write, the more we achieve in life.

Starts with knowing what we want out of life. Then, we must have investment strategy to create positive cash flow for us. That way we can provide our time to the things we truly love in this life.

The cash flow circle is key to understand to build wealth

Saving money is a fraud

Yes, it is correct. It's quite unlikely that someone we know who is financially independent acquired their wealth through saving. Saving in today’s economy is loosing money.

The main reason why this is not a good strategy to become wealthy is because savings require us to pay taxes, it can’t keep up with inflation and hinders our entrepreneurial spirit. So savings is a loosing strategy. The only reason savings should be practice is to invest. In other words, we need a down payment for a commercial real estate property and we must put the capital together to accomplish the acquisition. Then, savings would make sense because we would be saving to acquire a cash flowing asset.

When looking for financial guidance, we might have heard the following:

"Reduce our expenses!"

"Add funds to our 401(k)!"

"Live within our means!"

At best, this counsel is annoying (and blatantly misleading).

For the simple reason that they have been told to, a lot of people choose to do nothing and let others handle their finances. We can't just sit around hoping for things to change these days.

We have to be involved. We have to take action!

To begin, adopt a new way of thinking. Consider this: "Where can we get a better return on my money?" if we are only receiving 1% interest on our savings.

This is where our investment strategy's journey starts. Many people get happy when they get a new job offer, and yet I don’t see them being happy about starting their own business and brand to the world. Every second and day counts. The difference between the wealthy and the poor is the way we spend our time. The wealthy, we focus on building and working for passive income, while the poor mindset works for high earned income through jobs as employees and self employed. Surround ourselves with wealthy entrepreneurs and inside investors, to become wealthy. We can’t hang out around with those that are only speaking about working hard for earned income, saving fake money, and investing in fake assets like 401k, mutual funds, IRA, and others alike. Those who only operate on the left side of the chase flow circle will remain on the left side without the ability to experience total freedom. We must choose our partners and people we spend our time with wisely. The people we hang out with and spend our time holds our future.

Investing is an expedition

We gain knowledge while we become investors. We gain some practical experience that teaches us something we wouldn't otherwise know. We all make errors and grow from them. As we gain experience, we also make an increasing number of blunders. Our skills, abilities, and confidence all expand during this process not to mention the expansion of our bank balances.

Chasing our investing strategy is similar to life in many ways: it's a journey with ups and downs, happiness and sadness. It's always a journey worth going on in the end.

The journey itself is the prize

The journey is even more significant than the destination. That's the crucial element.

The true value is in who we become along the way, from all the mistakes and learning and experience. Consider every opportunity we have to learn more about finance as future cash in our pocket.

According to an ancient Chinese saying, "The journey is the reward." And the trip is worthwhile because of that reward.

Take charge of our own financial destiny

This brings us to our final piece of advice: Don't allow anyone else complete this task for us.

Far too many individuals depend on the gossip they hear on TV, what they read in publications, and what their friends tell them.

We have to put in the work ourselves if we want to learn the truth about money, success, or anything else in life. Nobody is going to assist us with it.

Yes, it can seem simpler to follow the herd and listen to a "credible" financial expert on television, ask our sister, best friend, or other trusted family member for guidance, or just follow the crowd. Everybody is preoccupied with work, caring for loved ones, cleaning, cooking, bills, and so on.

However, we lose control if we allow someone else to decide on important matters for us.

This implies that we are not truly aware of what is happening with our finances.

Will they receive their next paycheck in order to cover their expenses?

Are people truly using their 401(k) or IRA to help them plan for their retirement?

What occurs if the employees become ill and are unable to work?

This is a tough situation; don't they already have enough stress in their life?

It requires more work, but…

To not only survive in this day and age, but to prosper, we must become financially educated.

Gain more knowledge to take charge and lessen our stress. Cut out the justifications about not having enough money, intelligence, time, etc. All we have to do is start with these easy actions:

We should be skeptical of everything we read, hear, and see in the media as well as what "financial advisors" and gossip in our community are telling us. Investigate their claims and see whether they have any ulterior motives by conducting some investigation.

Learn what is actually happening in the world by reading media that we have never looked at before. Take a look at The Economist, The Wall Street Journal, Drudge Report, BusinessWeek, The Week, Bert Dohmen's The Wellington Letter, Master Investor’s financial education news section, and all the other news and finance sites available.We will become more receptive to various viewpoints, objectives, information, and figures.

Allocate a specific period of time every day to focus on our financial strategy. Determine our goals and a plan for achieving them in life.Next, set aside time every day to carry out our plan. Nothing happens if nothing is done.

Begin our adventure now

Today is the day to begin our journey. We will make mistakes on it, some of them very big ones. We will face difficulties. We will experience scary times. Our character will be put to the test on occasion. We won't advance, though, if we back away from the task. We are not going to learn. We also stand to lose nothing.

Thus, this is the day that our journey should begin. Always keep our hands inside the car and fasten our seatbelt. It promises to be an amazing, yet rocky, ride.

Cash Flow Triangle

The cash flow triangle is the key to building wealth with our businesses. Every successful business that exists in the world has the 8 integrities of the cash flow triangle. Start using the 8 integrities to determine the value of an existing business or investment, and help us also build a successful business form scratch by following the integrates found inside the cash flow triangle.

Every big business started small and with writing an investment strategy down. Applying the strategy requires discipline, and courage as we may encounter obstacles that can be overcome with persevere. The only we will be able to do that is if we have chosen our WHY we do things properly.

Our WHYs provide the reason and strength to keep going. Stay focus on the mission of our business and nurture our business daily. Our businesses are loyal to us and they can become angels for others lives too. When we build a business and a brand, we are doing for others and not only for us. Because if it is just for us then it is only a hobby and not a real business. A business is build to solve a problem in the world.

Finally, the question is which problems do we want to solve? Put an investment strategy down and execute. Small daily steps count tremendously after consistently doing them for long periods of time. Focus on our networks and businesses. Let’s invest today as it is easier than ever before to do it with success due to access to all the information we wish to learn.

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: An Investment Strategy is The First Step on The Path to Financial Freedom

Comment, like, share and follow for more High Quality Financial Education Made Simple.